Plug Power: Green Hydrogen Plants Are Key

Summary

- Plug Power is making strides in its ambition to become a full-fledged hydrogen ecosystem provider, with several hydrogen plants under construction and plans to produce 500 tons of green hydrogen per day by 2025.

- PLUG's growth is supported by government incentives and financing.

- Despite these positive developments, the company has struggled operationally, with negative margins, and it needs to spend a lot of many on these facilities to change its margin profile.

andreswd

Back in April, I wrote that despite big aspiration, I'd stay away from Plug Power (NASDAQ:PLUG) until it can better prove itself. Since then, the stock is down over -10%, while the S&P is up over 6%. Let's catch up on the name.

Company Profile

Currently, PLUG's main product is its GenDrive fuel cell, which is used in forklifts and other material handling equipment. These devices are typically found in high volume warehouses and distribution centers that use three shifts.

However, the company is also trying to branch out to become a full-fledge hydrogen ecosystem provider. This includes being involved in everything from hydrogen production, storage, and delivery to energy distribution. On this front, it has a number of solutions to deliver and store green hydrogen to customers, including proton exchange membrane (PEM) electrolyzers, as well as hydrogen liquefiers. The company also provides liquid hydrogen tankers for storage and transportation purposes.

PLUG has a hydrogen plant in Tennessee and several hydrogen plants being constructed. In addition, it owns a 407,000-square-foot facility in Slingerlands, New York and a 155,000-square-foot gigafactory in Rochester, New York.

New Facility Progress Continues

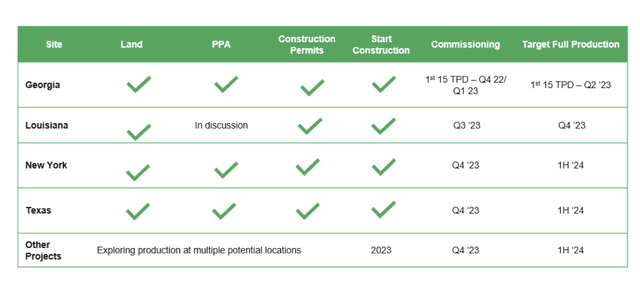

As I noted in my original article, PLUG has big ambitions, looking to create clean hydrogen hubs across the U.S. As part of this, it is building 4 new green hydrogen plants across the country in Georgia, Louisiana, New York, and Texas. It is looking to produce 500 tons per day of green hydrogen by 2025.

On that front, its Georgia plant should be set to start producing its first green hydrogen soon. At its analyst day earlier this month, the company said it expected the Georgia plant to begin production at the end of the month. There hasn't been an announcement yet, but if all is going to plan, it should start outputting some liquid soon.

PLUG's buildout should be helped by government incentives and financing, with the Department of Energy planning to invest $1.5 billion in hydrogen through the Bipartisan Infrastructure Law (BIL). The Department of Energy is offering $750 million over the next five years to help reduce clean hydrogen costs, including $300 million going towards low-cost, high throughput electrolyzer manufacturing. Meanwhile, the Inflation Reduction Act of 2022 also added additional subsidies and incentives for green hydrogen, including with the Advanced Energy Project Credit, which offers $10 billion is tax credits for advanced energy manufacturing and decarbonization projects.

While PLUG still has to invest and finance the buildout of its green hydrogen plants, the government subsidies and tax breaks are certainly a big help.

While its ambitions in the U.S. are quite large, that didn't stop the company from recently announcing that it would also invest $6 billion to build 3 green hydrogen and ammonia plants in Finland. The 3 plants would be capable of producing 850 tons of hydrogen a day. PLUG is still in talks with parties about financing the deal, and will make a final investment decision in 2025 or 2026. With 87% of Finland's grid on renewable energy, PLUG CEO Andy Marsh said it makes it much easier to generate green hydrogen.

Before the Finland announcement, PLUG was already establishing a presence in Europe, looking to build a green hydrogen plant at the Port of Antwerp. On that front, the company recently was part of consortium that won a $21.8 million grant from the European Commission.

In addition to building out hydrogen plants, PLUG has also been making inroads selling electrolyzers. It said that its sales funnel stands at $30 billion, and it has a backlog of in excess of 2GW.

Discussing its electrolyzers business at its analyst day, Marsh said:

"And I often get asked, what are these electrolyzer is going to be used for. Well, you have Ardagh, which is a glass manufacturer who I know who Ardagh was 1.5 years ago, but they have 80 facilities that make beer bottles and bottles of that nature, which people want to be green, Apex with green steel. We have Hydro Havrand, who's looking to do aluminum recycling using our electrolyzers. And of course, we had our announcement today with Avina for mobility. So not only are we building these products and I think this is probably represents about 3 continents on this. But we have good customers we can scale with, so it's really not the end. This is work we've done with McDermott on building out 1 gigawatt plant. And in reality, these plants are a combination, essentially 10x in many ways, a 100-megawatt plant we're developing with Uniper in Germany, which uses our electrolyzers and other products. And when you think about it, and I think you'll even get the feel when you're in the factory today. We really think in terms of building blocks, building blocks, building blocks. In the plant in Georgia, which is going to look a whole lot like the plant in Texas, which is going to look a whole lot like the plant in Germany, which is going to look a whole lot like the plant in Finland. But when you take a step back, not only is opportunities at Uniper, great for selling green hydrogen for industrial uses. It really helps us sell other products."

PLUG's ambitions don't end with green hydrogen plants and electrolyzers. It is looking to ship about 15 megawatts worth of stationary products, which can be used for a variety of application, including back-up power. It is also looking to build out EV charging for vehicles. It views this as a $1 billion opportunity. However, competing against Tesla (TSLA) in the space won't be easy.

Valuation

PLUG is projected to turn EBITDA positive in 2024, with the consensus call for $156.3 million in EBITDA. For 2025, it is projected to generate EBITDA of $512.2 million.

Based on the 2024 consensus, it trades at just over 31x EBITDA, while on 2025 numbers it trades at over 9.5x.

The market is attaching a healthy amount of skepticism that PLUG can hit that 2025 EBITDA number, and analysts' estimates are actually considerably lower than when I last looked at the stock.

The company failed miserably hitting its 2022 revenue guidance. PLUG originally guided for 2022 revenue of between $900-$925 million, but only generated sales of just above $700 million. For Q1, the company was able to just beat estimates by $2.5 million, producing revenue of $210.3 million, although its revenue guidance was disappointing. Its streak of missing EPS estimates also continued, with adjusted EPS of -33 cents, 9 cents below consensus. The company has generally been wishy washy about its 2023 revenue forecast, going between scenarios of $1.2 billion to $1.4 billion, with investors reacting to whichever number it plays up at the time.

PLUG doesn't have many good comps when looking at valuation. Bloom Energy (BE) may be the best. It is valued at 21.8x 2024 EBITDA and 11.9x 2025 EBITDA, and probably has slightly more predictability to future results.

Conclusion

PLUG appears to be making solid progress in transforming itself into a full-fledged hydrogen ecosystem company. However, operationally, the company doesn't have the best track record, which showed up once again in Q1, as fuel margins remained under pressure (-33% gross margins). Building its own green hydrogen plants will greatly help with its margin profile, and is what could ultimately turn it into a profitable business. However, it still needs to make a lot of progress and spend a lot of money to make this happen.

While the company has a number of exciting initiatives on the horizon, until the core business shows more progress, I continue to think that is will be best to stay on the sidelines. Building a first of its kind plant isn't easy, and I've seen many companies have issues building and ramping up different types of facilities in the past. So let's take some time and see how the Georgia plant does coming online and then ramping up production.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)