HubSpot: High Valuation With A Few Minor Cracks Showing

Summary

- I acknowledge that my previous "Sell" call on HubSpot was incorrect, as the company's stock has risen by almost 50% since then.

- HUBS's Q1 results showed a 27% growth in subscription revenue and a 23% increase in customers. However, there has been a decrease in net revenue retention, which the company expects to continue in the near term.

- Despite the company's strong performance, I maintain my "Sell" rating.

Wirestock/iStock Editorial via Getty Images

Back in February, I wrote that while I like the transformation that HubSpot (NYSE:HUBS) has undergone to transform itself from a single product company into a CRM platform, I was worried about its SMB and European exposure. My "Sell" call on those worries were clearly wrong, with the stock soaring nearly 50% since my initial article. Let's catch up on the name.

Company Profile

As a reminder, HUBS's original product was a platform for inbound marketing. Its big selling point was that customers were blocking traditional marketing and sales tactics and that its platform would "help businesses attract visitors to their websites, convert visitors into leads, close leads into customers and delight customers so that they become promoters of those businesses."

In recent years, the company began to expand its focus to become a more comprehensive platform that included marketing, sales, and customer service applications. This in turn became a CRM system that would give its clients a unified view of the customer experience and also be a system of customer engagement.

The company focuses on mid-market business-to-business companies, which it describes as companies that have between 2 and 2,000 employees. Over 40% of HUBS' business comes from outside the U.S., with Europe representing over 30% of its revenue.

Climbing The Wall of Worry

One of my biggest worries with regard to HUBS was its focus on small to medium business. These companies generally tend to struggle more during periods of economic weakness, which I thought could lead to increased churn and difficulty adding new customers. HUBS didn't have a low churn business to begin with, with churn generally 10% or more.

The company certainly didn't seem to see any impact in Q1 to its headline numbers, as subscription revenue grew 27% to $489.7 million, while customers grew 23% year over year to 177,298. The company added 9,912 net new customers in the quarter, representing 6% sequential growth. Average revenue per customer, meanwhile, rose 3% year over year.

The company said it is attracting customers at both the lower end and higher end of the market. On the low end, it said it saw a "significant" uptick in net customer additions, helped by free sign-ups and "pricing optimization" for its starter package.

At the high end, the company said it is seeing more Professional and Enterprise customers starting with multiple hubs, noting that over 45% of it installed base by ARR has three or more hubs. It said it is able to replace tools for costumers with its offerings, thus saving them money. It also noted nice progress on its Operations Hub, which was an add-on in 2/3 of the top-25 deals it did in the quarter.

Discussing adding new customers at a Bank of America conference earlier this month, CEO Yamini Rangan said:

And what you saw in terms of our Q1 results was the starter volume grew and it grew because one we are consistently optimizing the top of the funnel in terms of free sign-ups and then converting those free sign-ups into starter. We have moved a number of high-value features, including automation down into that starter tier. So customers are getting more value from the starter tier. And three, we've really continued to experiment with price points, and we moved to a $30 suite price point for starter. And the combination of all of those plays, we saw strength in terms of starter. Now Q1 is sequentially high. So I wouldn't have the expectation that we would continue to see things like what we saw in Q1 for the rest of the year. But we are excited by the progress that we have made there.

Now the second part of the question is related to our multiple front-end doors, we are definitely seeing that upmarket. Upmarket, it used to be the case where most customers with marketing, and it would take 6 months or a year for them to look at another hub. But right now, we do see more customers landing with sales hub or a combination of sales hub, Marketing Hub and Ops hub. So there's more multi-hub landing points and then kind of continued expansion from that. And that really is our product innovation over the past few years where we have continued to pour more features and more upmarket and sophisticated features, including governance, admin features, customizability and all of that drives more value."

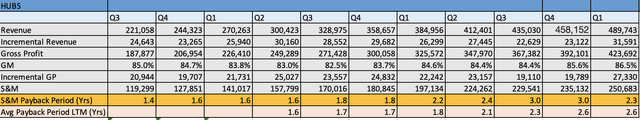

Now notably there is a big difference between a $30 a month customer and a $3,600 a month customer. So one thing I like to look at with SaaS companies is their sales and marketing efficiency. In my initial write-up, I noted that HUB's S&M efficiency was going down and that the payback on its spending was taking longer. While Q1 is typically a strong period, the company was able to stem the tide, with the payback over the LTM remaining the same as last quarter.

Now under the surface, retention was in the high 80% range, while net revenue retention was 104%. A year ago, the company said net revenue retention was well above 110%, and it was 110% in 2022 and 115% in 2021. The number is clearly coming down, and the company said it expects pressure on this number in the near term, but that it believes it can maintain it above 100%. If it can't, then it certainly puts a dent into the expand part of its land and expand strategy.

HUBS ties to Europe was also a worry I had, but its international revenue grew faster than its U.S. revenue in constant currencies. International revenue jumped 33% in constant currencies and was up 26% overall. International revenue was 46% of its total in the quarter, so it's off a similar base as North America and growing more quickly. The company said it is not seeing many difference between the U.S. and international markets. It said it is seeing longer cycles and more decision makers involved in both markets, while it continues to win in both markets because of the value it provides. So far, it does not appear that Europe is becoming a weak spot.

Valuation

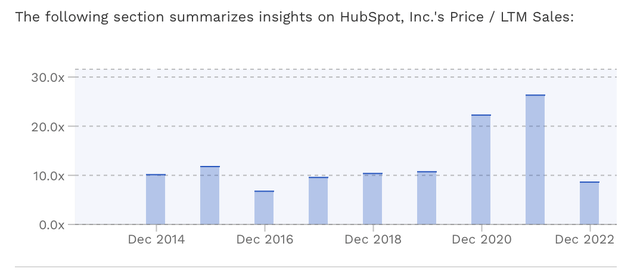

SaaS companies are generally valued on an EV/Revenue multiple. On that front, the HUBS trades at around 12.4x the 2023 revenue consensus of $2.1 billion.

That's now above where the stock has historically traded (outside of Covid), despite its lower growth rate versus years past. The company is now projected to grow revenue bin the low 20% range versus over 30% in the past.

Meanwhile, HUBS is projected to generate $344.5 million in EBITDA in 2023. That would give it an EV/EBITDA multiple of around 72x.

HUBS Historical Valuation (FinBox)

Conclusion

Clearly, I was too bearish on HUBS, as evidenced by the stock's surge. The company's Q1 results were pretty typical of the company in terms of beating headline results, and it did a nice job of stemming its weakening S&M efficiency.

That said, with the valuation up to over 12x revenue and some potential cracks showing up in net dollar retention, I'm going to hold onto my "Sell" rating a little longer. The company is clearly doing a good job, but the valuation has skyrocketed and the macro isn't out of the woods quite yet.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.