ITM Power: A Turnaround That Isn't Turning

Summary

- ITM began the year with a new management team and a new turnaround plan.

- Six months later, the company has little to show for it.

- The massive net cash balance buys ITM some time, but the runway is narrowing rapidly.

audioundwerbung/iStock via Getty Images

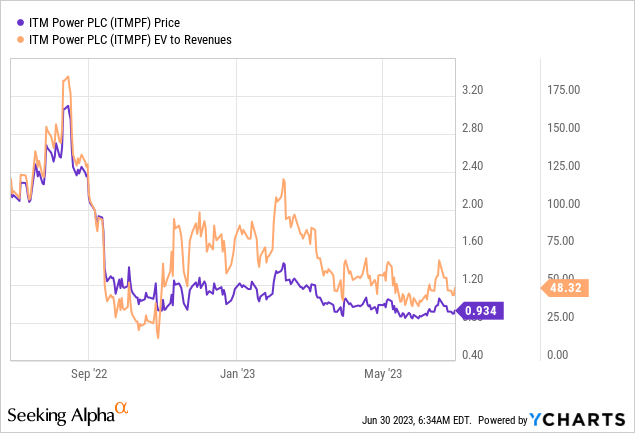

UK-based integrated hydrogen energy solutions company, ITM Power (OTCPK:ITMPF), started the year on a hopeful note, with the appointment of former Linde (LIN) executive Dennis Schulz as the new CEO. This year’s capital markets update also outlined a promising new twelve-month turnaround plan to right the issues that plagued ITM's operational and commercial performance. Yet, there has been little to indicate the promised turnaround is taking shape beyond a validation process of the electrolyzers to be delivered. Instead, the company has only announced more delays in recent months, most notably for Linde’s 24MW order for the Leuna and Yara plants into FY24. The 200MW order, also associated with Linde but operated at an RWE (OTCPK:RWEOY) site, has been pushed back even further to FY25/26 (commissioning due later in FY27). The one thing ITM has done right is to raise cash when valuations were high – as a result, the H1, FY23 net cash position is now up to ~70% of its market cap. The core business is a massive cash burner, though, and in the likely scenario that new orders remain on hold, the continued erosion of management credibility presents further downside to the stock. In line with my prior coverage, I remain sidelined.

New Management In Place; Strategic Turnaround in Progress

ITM’s initial large-scale orders (24MW for Linde's Leuna and Yara plants) have suffered numerous setbacks over the last year; even after appointing new CEO Dennis Schulz (ex-Linde Engineering) and head of engineering (also ex-Linde), however, the situation hasn’t improved. Recall that the H1 statement from Schulz indicated his intention to transition ITM away from “an R&D culture” to a “delivery organization,” while its engineering process was described as “immature” – a frank admission of the operational challenges ahead. The acknowledgment of “previous overconfidence” was also quite sobering. Yet, the fundamental nature of these issues, from engineering/manufacturing to warranty provision uncertainties, means addressing them may well take longer than the twelve-month timeline outlined.

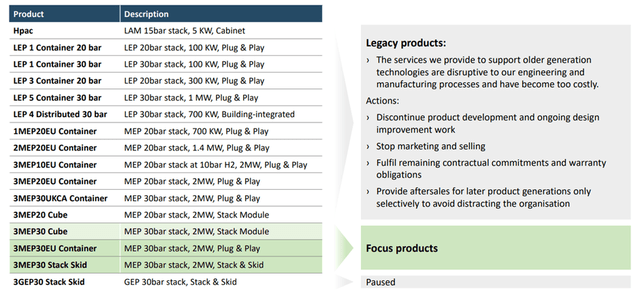

In the meantime, expected delays, pending validation of the electrolyzers to be delivered, will effectively put a stop to new orders. This leaves the ITM order book solely dependent on Linde, which most recently confirmed 200MW of electrolyzer orders to be installed at an RWE-operated site. The US, helped by ‘Inflation Reduction Act’ incentives, was singled out as the most attractive market and, therefore, ranks high on the list for ITM’s new manufacturing facility. But with the strategic review effectively halting the ITM 10MW module development path (previously cited as the next step in ITM’s product expansion), along with the rest of its product pipeline and refueling JV, there likely isn’t going to be any product traction from here.

ITM Power

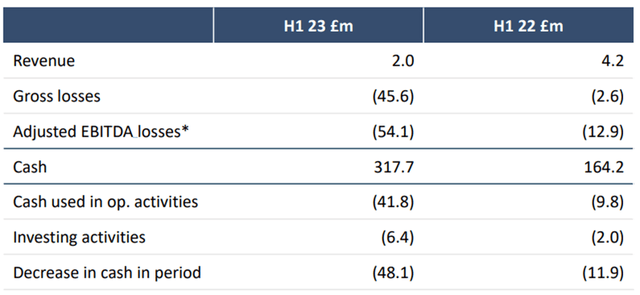

All Eyes on the Cash Burn as Revenue Generation Halted for H2

Financially, H1 results were as poor as you’d expect. Not only did ITM’s last trading update disclose revenue and EBITDA materially below prior guidance, but its full-year guidance also outlined zero revenue recognition in H2. The revenue from the Linde orders (Leuna/Yara) is only expected to flow through to the P&L in the next fiscal year, implying guided FY23 revenue of GBP2m and adj. EBITDA loss of GBP85-90m (vs. H1 EBITDA loss came of GBP54m). The latter reflects the impact of losses on customer contracts and a more prudent warranty provision policy, as well as inventory write-downs for prior product iterations on the EBITDA run rate. Most of these headwinds are non-cash, though, so the net cash balance (currently at GBP318m) should limit near-term funding risks. Meanwhile, the cash hoard also keeps a twelve-month window open for new ITM management to overhaul its operations.

ITM Power

Concerning Lack of Reporting and Progress on the Turnaround

The good news for ITM is that the prospect and viability of green hydrogen aren’t in question, with new management citing their confidence in the long-run growth potential for electrolyzers and green hydrogen. What is certain, for now, is that the new CEO is aligned with prior CEO Dr. Graham Cooley’s belief in the viability of ‘proton exchange membrane’ (PEM) technology, a more expensive but energy-efficient approach to hydrogen. But the economics today are highly unfavorable, particularly in the UK, where regulatory support is relatively lacking.

Another key obstacle has been the persistently high inflation in the UK and Europe, which has slowed customer appetite to accelerate the ‘green’ energy transition. All these factors have likely culminated in a concerning lack of progress updates by ITM - management’s last investor update was in January, with only one conference appearance before next month’s full-year update. Given ITM has made limited progress in regaining investor credibility as it moves closer to the end of its cash runway, the risk of a slower and costlier-than-expected turnaround could well accelerate its path toward insolvency.

A Turnaround That Isn’t Turning

ITM Power had a rough go of it last year, culminating in a surprise CEO departure and a massive equity de-rating amid concerns about its going concern prospects. While ITM remains a potential beneficiary of the attractive long-term hydrogen theme, the execution, even post-management reshuffle, has been poor. Recent commentary has indicated more delays to major Linde and RWE orders, as newly appointed CEO Dennis Schulz (ex-Linde) has made little progress halfway into the twelve-month turnaround plan. In the meantime, ITM will continue to burn cash and credibility with investors, limiting its runway when it ultimately runs out of funding. Even with the equity nearing its net cash ‘floor,’ I would be very hesitant to open a position pending visibility into ITM’s initial deliveries coming through.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.