Addus HomeCare: Economic Troubles Remain Well In Situ, Reiterate Hold

Summary

- Addus HomeCare Corporation's Q1 FY'23 financial results reveal an 11% YoY growth in net service revenue and a 16.2% increase in adjusted EBITDA.

- Despite this, growth comes at a cost to shareholder as the firm has a difficult time beating its capital charge[s].

- With This in mind, it is difficult to see ADUS rating higher off 18x forward earnings in my view.

Pgiam/iStock via Getty Images

Investment Summary

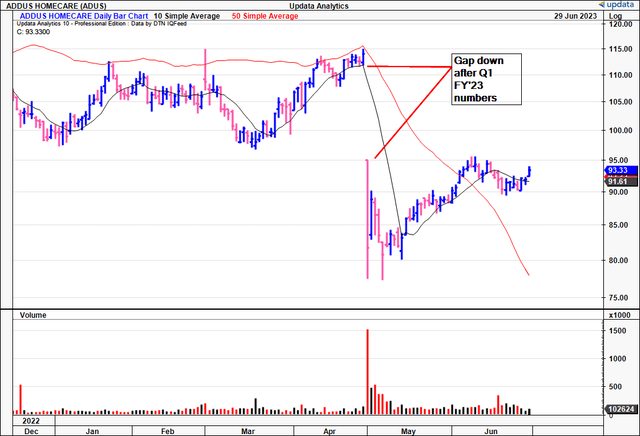

Following my April publication on Addus HomeCare Corporation (NASDAQ:ADUS) investors have exited the stock en masse with the company now trading back in early FY'22 range.

The firm's Q1 FY'23 numbers were the catalytic event for the latest repricing, implying a reduced set of expectations from the market on ADUS going forward. I had pared back my position on ADUS to hold in April, noting a series of potential headwinds, that needed more clarifications to avoid uncertainty. Specifically, the two areas identified consolidate to:

- Pressures to current operations;

- Challenges to future growth.

If a firm's value is made up of its steady-state operations plus the contribution from its growth initiatives, then ADUS hasn't passed this investment examination. Turning to the present day, not a great deal has changed on the fundamental outlook on the firm.

Net-net, based on the culmination of findings presented in this report, there is insufficient evidence to suggest that ADUS is a buy at its current levels. Not even a pullback to previous lows would have me interested, as there is nigh a reason to believe ADUS could trade above previous highs without the economic characteristics to back it up. Alas, I reiterate that ADUS is a hold.

Figure 1.

Data: Updata

Critical facts to ADUS hold thesis

Based on the latest data, there is no challenge in reiterating ADUS as a hold in my investment view. Findings from this analysis suggest there are fundamental, economic and valuation factors for consideration. Analysis of each factor is telling on what investors can expect from the company going forward.

1. Fundamental factors to the hold thesis

Close inspection of the company's unit economics and Q1 financials, presented in May, reveal plenty about the investment facts. It is important to analyse this because of the market's response afterwards [just take a look at Figure 2]. Consider these additional data points.

Unit economics

- Same-store revenue growth was up 11.4% YoY. Notably– this growth excludes the revenue generated from access to the New York CDPAP and American Rescue Plan Act ("ARPA") funds.

- Over the past 3 years, most of ADUS's same-store growth in the personal care segment has been driven by rate increases.

- Hence, the gains are largely price vs. volume (demand) related.

- Despite the above, ADUS booked gains in same-store hours per day ("HPD"). In Q1 FY'23, ADUS clipped a 5.3% gain in HPD, with the same exclusions as above. Sequentially, this was up 1.7% from Q4 FY'22.

At the conclusion of Q1, days sales outstanding ("DSOs") stood at 43.7 days, a sequential decrease from 45.1 days.

Financial results, including growth percentages

- Net service revenue came to $251.6mm in Q1, an 11% YoY growth, on adj. EBITDA of $26.1mm. The breakdown on this shows that:

- Personal care revenues contributed ~75.5% ($190mm, or $11.87/share) to the top line

- Hospice care revenues stood at $49.1mm or 19.5% of sales, and

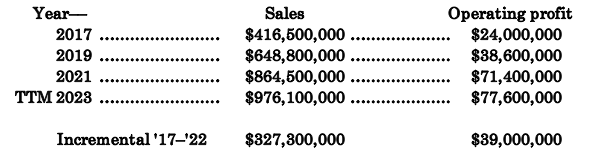

- Home health revenues amounted to $12.5mm (5% of turnover). Note the firm's long-term revenue and operational growth below.

Table 1.

Data: Author, ADUS 10-K's

- It pulled this to gross margin of 31.2%, up 20bps YoY. compared to 31% in the same quarter of the previous year. Historical gross is 29.18%, so there's upside on this at 31.2 points, however this is still well below the sector's 55.8% median gross.

- Further, this spells some troubling arithmetic for the company's business economics. Say it grows revenues by another 10% this year, the firm clips 68–70% COGS margin, meaning you're unlikely to see any of the 10% in turnover result in operating leverage. For profitability to turn off its lows going ahead, revenue costs and operating costs must be addressed in total to drive value for shareholders, in my opinion.

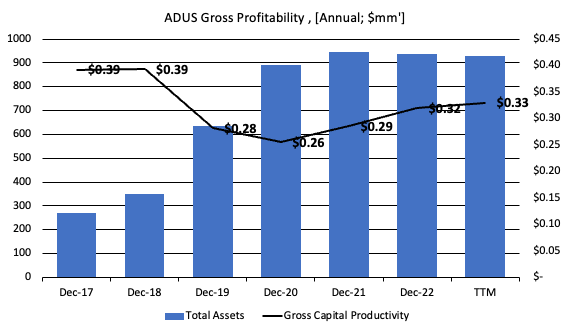

- Moreover, the company's gross profitability has wound back off 5-year range, although it has shown reasonable uptick since FY'19. Still, on absolute values, you're getting 33% gross return on assets for the capital that has been committed to and then by the business. These aren't attractive economics in my opinion, and warrants a neutral view.

Figure 2.

Data: Author, ADUS 10-K's

2. Economic factors related to ADUS' operations

The firm is driving investment into its personal care segment, the division where it sees growth potential down the line. It booked an increase in hiring in Q1, with an average of 84 new hires per business day. That's a 9.1% growth from the same period last year, and up from 77 hires in Q4.

I'd also point out the rate increases ADUS received in Illinois, its largest market. I had covered these in detail last analysis, so these were expected. It received a statewide rate increase of $0.70 per hour on January 1 of this year (again, as expected). Meanwhile, back in December, Illinois announced a further increase of $1.26 per hour– hence, the $0.70 is on top of this. Consequently, the company's Illinois state reimbursement rate now stands at $26.92 per hour. The firm believes this increase will covers upcoming wage increases on July 1.

In addition to the above, consider the following points regarding the economic characteristics of ADUS' business:

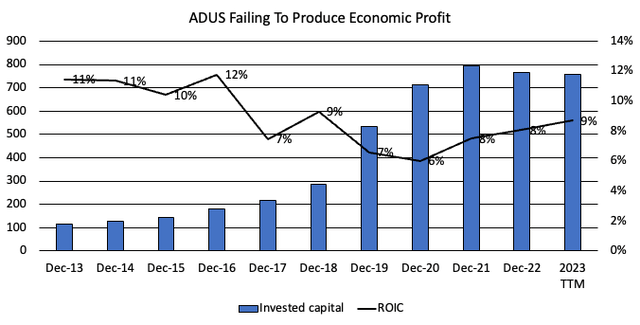

- Taking a long-term view, it's obvious ADUS has had a hard time meeting its cost of capital, and, more importantly, a hard time in beating the market return on capital.

- The annual return on ADUS' capital has tightened in to 9% in the TTM.

- You might be forgiven to think this was a pandemic–induced affair, but these trends were well in situ from 2017 at least, and thus were unlikely caused from the same.

- Most importantly to this investment thesis, is the fact none of these returns have beaten the market's hurdle rate ––12% in this analysis–– indicating there's been absolutely zero economic profit generated for ADUS shareholders over the last 5 years to date. By all means, my analysis suggests these trends will continue going forward.

These are tremendously unattractive business economics. How can you expect ADUS to compound its intrinsic valuation, when investors can ride the benchmark at a 10–12% long-term average, whilst ADUS brings home a return less than this on its own (i.e. the shareholders) capital? The simple answer is, you can't. Too many other lucrative opportunities exist, where the value of $1 is more valuable in the company's hands than in the market's hands. Consequently, this supports a neutral view for ADUS.

Figure 3

Data: Author, ADUS 10-K's

3. Valuation factors clamping future value

If it weren't enough of an ask from the data raised so far, investors are selling their ADUS stock to you at 30x forward earnings and 17.5x forward EBIT, whilst the company trades at 2.3x book value of equity.

Each of these are quite the premium to sector peers, and I just cannot get to advocating that ADUS should trade at a premium to peers, based on what's been discussed here. Predominately, it links back to the substandard returns on committed capital. The market is an accurate judge of fair value over time and will weight itself towards firms where capital is appreciating in their hands. This isn't the case for ADUS, as mentioned. It doesn't compound capital higher and faster than the market return, and so investors are unlikely ––highly, highly unlikely in my view–– to be bullish on any firm presenting with these economic characteristics.

What this says in valuation terms is telling. You're being asked to pay c.18x forward, yet the prospect of this rating higher is limited by ADUS' incapacity to produce additional profits. Hence, it is my firm opinion the company should trade back in line with the sector at ~17x forward and this gets me to $67.6 per share on my FY'23 EBIT estimates [these were presented in the last publication, with no changes to date, see: Fig 12.]. Even at 18x, you're getting to $71.30. You'll note this is well off previous estimates of mine. To this, also note 1) I am using a much higher discount rate here [12% vs. 7% previously, to account for the risk], and 2) when the data changes, so too must the analysis.

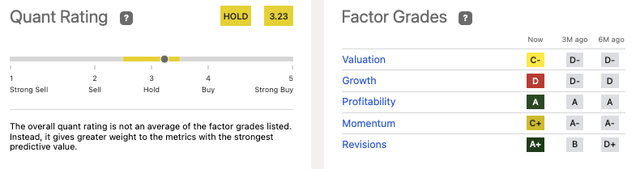

These findings are objectively supported by data shown in the quant system, also advocating ADUS as a hold. It too identifies weak points on valuation and growth, in line with my own findings. This adds a layer of confidence to the assumptions.

Figure 4.

Data: Seeking Alpha

In short

There's been no change to the investment recommendation on ADUS following the latest critical findings. Numerical and data-based evidence corroborates the firm has a gargantuan effort ahead of itself in order to reverse the sentiment picture, and attract serious investment. Without the economic characteristics though, i.e., driving higher returns on capital invested, there is difficulty seeing ADUS rate higher. In my view, this would be the critical factor clamping the company's market value at present. As was discussed in the last publication, given the way ADUS books revenues, the capital produces its profits, meaning returns on capital are absolutely integral to see it trading at higher market valuations. Alas, without any catalytic points to work from, the investment case is clamped by fundamental, economic and valuation factors. Net-net, reiterate hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.