A Less Risky And Diversified AI Play Breaking Out: AIO A Buy

Summary

- I am upgrading The Virtus Artificial Intelligence & Technology Opportunities Fund to a buy due to its decent valuation and improved technical outlook.

- The fund's portfolio is largely in the large-cap space with a significant tilt toward the growth style. It includes common stocks and convertibles, and its largest sectors are Information Technology, Consumer Discretionary, and Healthcare.

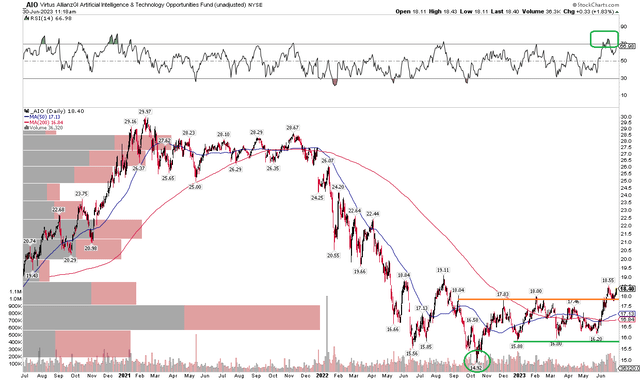

- The fund made an upside move in late May and early June, and it is expected that there could be a longer-lived bull market now that the 200-day moving average has flattened and will likely turn upward soon.

We Are

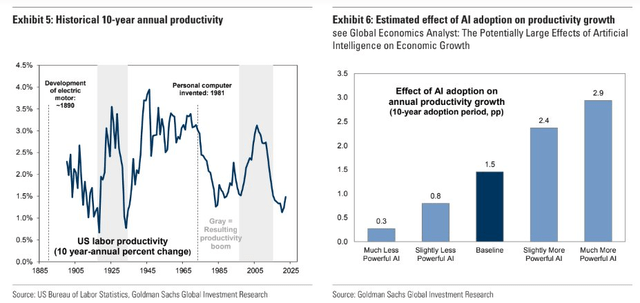

A few weeks ago, Goldman Sachs made a bold call. Its analyst team asserted that AI could raise annual US labor productivity growth by roughly 1.5 pp over a 10-year period. That would have massive implications for domestic real GDP growth and overall profitability for firms big and small. We all know how AI-related stocks have surged in the first half of this year, but one fund has not performed as well. I see better times ahead, however.

I am upgrading the Virtus Artificial Intelligence & Technology Opportunities Fund (NYSE:AIO) to a buy rating on a decent valuation and much improved technical outlook.

AI Means Big Productivity Gains - Goldman

Goldman Sachs

According to the issuer, AIO seeks to generate a stable income stream and growth of capital by focusing on one of the most significant long-term secular growth opportunities in markets today. A multi-asset approach based on fundamental research is employed, dynamically allocating to attractive segments of a company’s debt and equity in order to offer an attractive risk/reward profile. The fund normally invests at least 80% of its net assets (plus any borrowings for investment purposes) in a combination of securities issued by artificial intelligence companies and in other companies that stand to benefit from AI and other technology opportunities.

The CEF began trading in 2019 and it holds 119 individual investments (a mix of equities, convertible securities, and ordinary bonds. With net assets of $658 million as of May 31, 2023, about unchanged from the end of October last year, shares trade at a more than 8% discount to NAV. The average daily volume is not that high, though, with only 82,509 shares changing hands each day per Virtus. AIO pays distributions monthly with a market distribution rate of 10.8%. A $0.15 payout has been made each month this year.

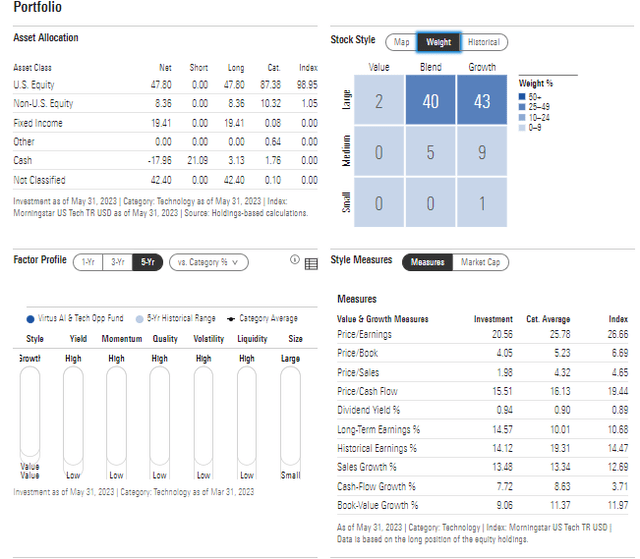

Digging into the portfolio, data from Morningstar show that the fund is very much in the large-cap space with a significant tilt to the growth style. The weighted average price-to-earnings ratio is barely above 20 – much lower than what you might expect given the fund’s name and objectives. We’ll get into the holdings next.

AIO: Large-Cap Growth With a Reasonable PEG Ratio

Morningstar

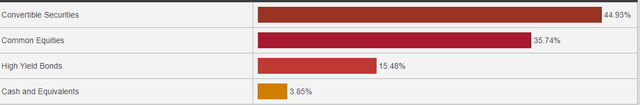

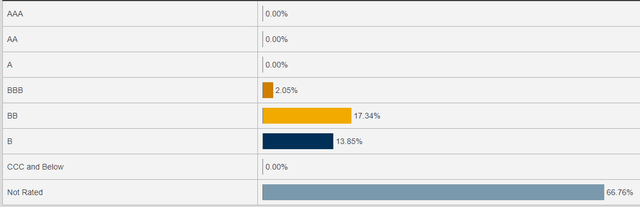

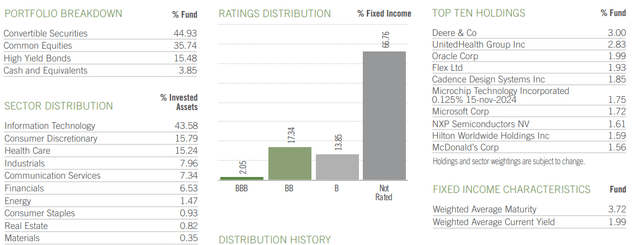

AIO can be thought of as a less risky way to access the AI industry. What’s more, the portfolio includes common stocks as well as convertibles that often trade as hybrids between equities and corporate bonds. More than one-third of the allocation is made up of individual stocks while 15% of the fund is comprised of junk bonds.

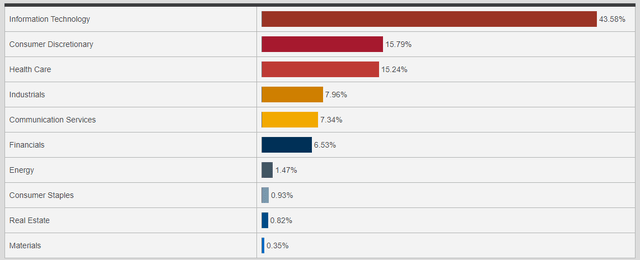

Sector-wise, the Information Technology area is the biggest portion, as you would expect. Consumer Discretionary and Health Care are also significant chunks of AIO. Interestingly, Deere (DE) and UnitedHealth Group (UNH) are the two largest equity positions – even Hilton (HLT) and McDonald’s (MCD) are in the top 10.

Portfolio Composition

Virtus Funds

Sector Breakdown

Virtus Funds

High Yield Credit Quality

Virtus Funds

AIO: Fact Sheet Summary Of Portfolio Positions & Statistics

Virtus Funds

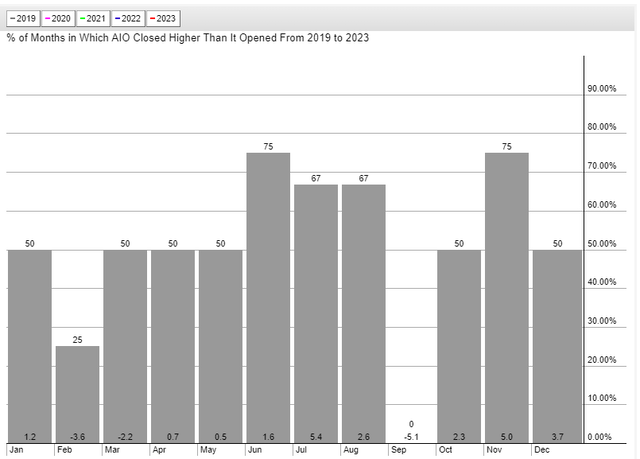

Seasonally, there isn’t a long track record, but July and August have historically been strong months while September has been a dud. Gains then picked back up during the latter part of the second half.

AIO: Bullish July-August Trends

Stockcharts.com

The Technical Take

It took a while, but the fund finally made an upside move in late May and early June. Notice in the chart below that AIO successfully tested the $17-$18 previous resistance zone earlier this month after a prolonged range between $16 and $18. Shares notched a bullish false breakdown last October, and this recent leg up is particularly encouraging. The $2 prior range implied a near-term upside target of near $20.

There could be a longer-lived bull market now that the 200-day moving average has flattened and will likely turn upward soon. From a downside risk perspective, there is a high amount of volume by price in the Q4 2022 through 1H 2023 trading range that should be supportive on pullbacks. I could see AIO ultimately climbing toward the bottom end of the 2021 range over the coming quarters – near $25.

AIO: Shares Break Out, Retest Prior Resistance

Stockcharts.com

The Bottom Line

I had a hold rating on the CEF late last year, but a reasonable valuation and better momentum today make me a buyer.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.