JinkoSolar Holding: Well Positioned For Growth In Upcoming Quarters

Summary

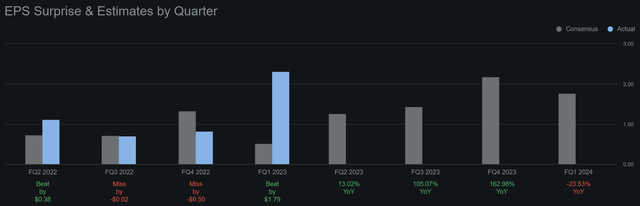

- JinkoSolar's share price has corrected by 45% from its peak, while its 1Q EPS surpassed consensus by 353%. Further EPS beats are anticipated.

- The polysilicon downcycle is expected to persist from 2H23-1H24, driven by a widening supply-demand gap. Consequently, JinkoSolar could benefit from higher unit profits for modules and increased downstream demand.

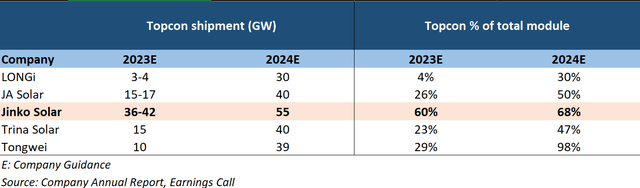

- JinkoSolar's dominant position in TOPCon technology puts it in a strong position for growth. With a projected ~40% market share by 2023, JinkoSolar has high-margin opportunities ahead.

- JKS stock appears to be a strong buy, with potential upside of 100%. The market is underestimating its profitability and competitive positioning, while concerns seem to be exaggerated.

Editor's note: Seeking Alpha is proud to welcome Oriental Alpha as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Bilanol

Overview

In 1Q23, JinkoSolar Holding (NYSE:JKS) delivered a remarkable growth in EPS, surpassing the consensus expectations by a whopping 352%. Moreover, it attained its highest global module market share. Despite such impressive achievements, the market is undervaluing JKS's profitability and overall worth. Based on my analysis, JKS's EPS is expected to continue surpassing expectations by a considerable margin. This is likely to result in a positive shift in its valuation. My target price for JKS is $83.8 within 9-12 months, suggesting a potential increase of 100% from the current price.

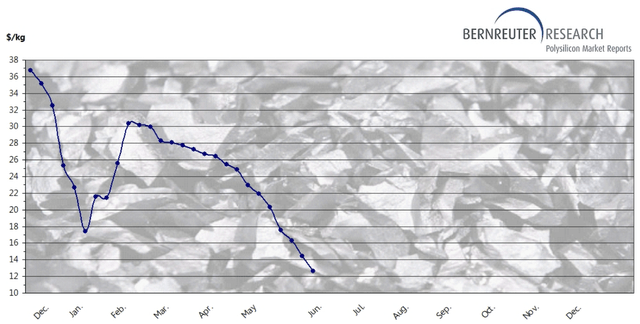

Polysilicon price has dropped more than 65% over the past 6 months. I expect the downcycle will continue in 2H23-1Q24 until reaching very low levels due to a widening supply-demand gap. A significant amount of polysilicon supply is expected to release in 2Q-3Q, and the solar wafer businesses have just started a price war and cut the factories' utilization rate, implying lower demand for polysilicon. This lower polysilicon cost will enhance JKS's unit profits as it is a major cost item for module production. Additionally, lower module prices will increase the demand for solar modules, resulting in higher demand for JKS's products.

The market undervalues JKS's competitive position, and I believe it will experience excellent profit growth in the coming quarters. JKS should remain the undisputed leader in TOPCon, which is highly underpenetrated, in the next 3-6 quarters. JKS has recently improved its vertical integration to a best-in-class level and has the highest export mix, positioning JKS to experience the greatest growth in the current landscape. Starting from 2Q23, the UFLPA-related warehouse costs in the US will decrease significantly by ~60% QoQ, leading to an expected gross margin improvement of ~1-1.5%.

Tongwei, a leading upstream player in the solar supply chain, is expanding into the module market with an aggressive sales target of 35GW by 2023. This has raised concerns about module oversupply, but these concerns may be exaggerated to JKS. While Tongwei may face challenges in competing for overseas module orders due to a lack of track record, the tier-2 or below module players in China are likely to feel the most pressure. The top 4 players - LONGi, JKS, JA, and Trina - continue to maintain their competitive positions with their overseas shipment capabilities and pricing discipline.

Company Background

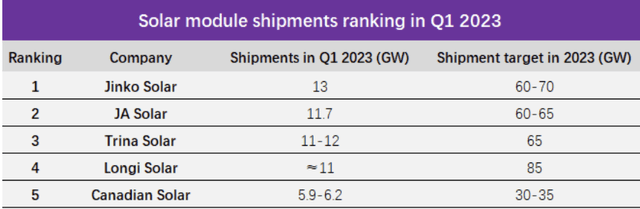

JinkoSolar is a highly respected and revered integrated photovoltaic (PV) module manufacturer headquartered in China. As one of the key players in the global market, JKS takes pride in its position among the top four PV manufacturers in the world, alongside LONGi, JA Solar, and Trina Solar, all of which are based in China. Notably, JKS ranks as the second-largest manufacturer of PV modules in the world in terms of global module shipments, having shipped an impressive volume of 46.7GW in 2022, second only to LONGi.

Furthermore, in 1Q23, Jinko has maintained its market dominance and boasts the largest market share in the world in terms of module shipments. The solar module market is characterized by a high degree of concentration, with the top four industry players accounting for 60-65% of the global market share by sales volume in 2022.

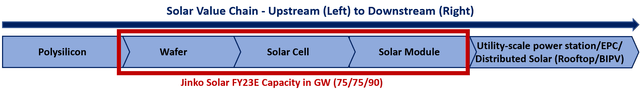

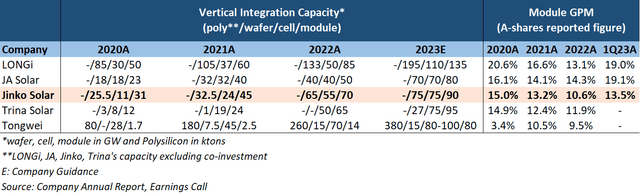

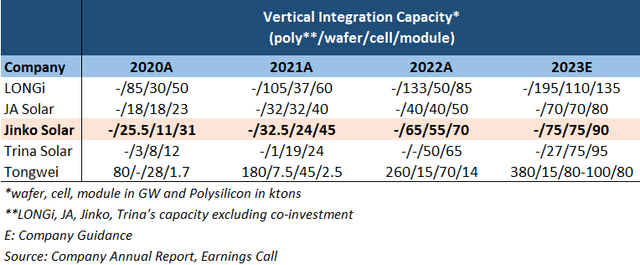

JKS is a pure-play integrated PV module maker with ~95% of revenue coming from module sales. It will have 75/75/90 GW capacity in wafer/cell/module in 2023, including 11-12GW overseas capacity which is the highest among its peers.

| JKS's Revenue Mix | 2021A | 2022A |

| PV wafers | 4.4% | 1.3% |

| PV cells | 2.0% | 1.4% |

| PV modules | 93.6% | 97.3% |

Industry Overview

Here is my summary of the five key trends across the global solar value chain and their impact on JKS.

Firstly, the upstream polysilicon downcycle is a tailwind for JKS. Polysilicon price has been rapidly falling, with a 65% correction in 6 months. I expect the decline to continue in 2H23. Polysilicon has been a major cost item for module production, accounting for 25-40% of the total production cost. Cheaper polysilicon significantly reduces the raw material costs for integrated module makers. Decline in module price triggers solar demand upcycle and integrated module players would be the key beneficiaries.

Secondly, supply chain overcapacity is a potential headwind for JKS. There are worries about overcapacity throughout the solar supply chain, from polysilicon to modules. Tongwei's recent push for aggressive expansion in solar modules has raised concerns over potential overcapacity in PV modules in the coming year, especially in the China domestic market. I remain optimistic that the top four players in the industry can mitigate the risks through their established overseas shipment capabilities.

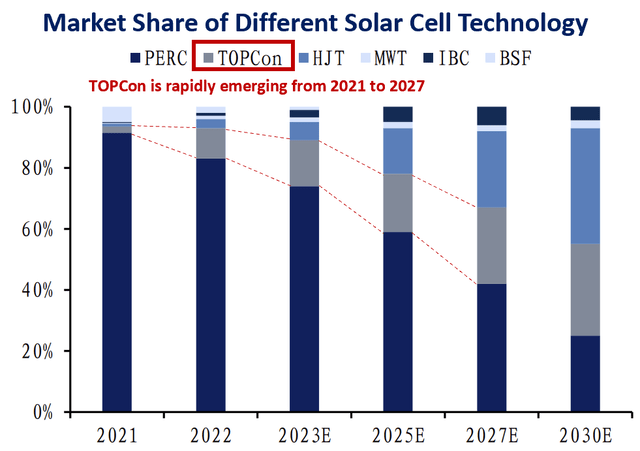

Thirdly, JKS is poised to reap the rewards of the growing popularity of TOPCon technology in the solar industry. With higher energy efficiency than the current mainstream PERC, TOPCon is projected to increase its market share from 25% to 54% by 2025. Additionally, given the limited supply, TOPCon unit profits are notably higher. As a leader and pioneer in this market, JKS is expected to contribute 35-40% of the global market share for TOPCon this year.

Fourthly, on the downstream front, solid global solar demand provides a favourable tailwind for JKS. The demand for solar modules has surged in recent years due to a combination of factors, including global initiatives to reduce carbon emissions, the high oil prices, and significant technological advancements that have reduced PV module costs and have improved IRR of solar projects. Moreover, historical data has shown that global solar installations have consistently outperformed market projections.

Fifthly, JKS faces the challenge of global trade tensions due to its export-oriented nature. The US and Europe have implemented restrictive policies such as the IRA, UFLPA, Antidumping and countervailing duties (AD/CVD), and Green Deal Industrial Plan (EU IRA). To overcome these obstacles, developing overseas capacity outside China and establishing a local supply chain in target markets are essential for meeting the necessary requirements.

Polysilicon Downcycle To Continue

The polysilicon market has undergone a significant decline in recent times, with prices plummeting by over 65%, dropping from $37 to $12 per kg since December 2022. Based on current market trends, I believe this decline will continue over the next 3-4 quarters, and we can expect prices to drop further to as low as $6.5/kg. This particular level marks the cash costs of marginal producers. This situation is mainly due to the growing gap between supply and demand.

As for the supply end, new additions in polysilicon would accelerate in the coming months. The 2Q23 polysilicon supply would increase by 20% QoQ. Notably, starting from 3Q23, several new plants will be commissioning including Daqo, Xinte, Shangji, Tongwei etc., and thus supplying a huge sum of additional polysilicon. At end-2023, the polysilicon supply volume would increase to ~1.5mtn (+70% YoY from ~900ktn).

On the demand side, wafer businesses are struggling with the continual decrease in wafer prices and are hesitant to purchase more polysilicon. To minimize their losses, some companies are shortening their order signing cycles. As a result, wafer manufacturers have begun to decrease their utilization rates. The global leader, LONGi, recently started a price war by reducing its PERC wafer price by 30% and lowering its wafer utilization rate to 85%. Production volume for the wafer industry fell 10% MoM in May 2023, and it is expected to remain low in the coming months.

In recent years, polysilicon producers have dominated the solar supply chain profits. However, in the event of a polysilicon downcycle, profits are likely to shift towards integrated module players as polysilicon accounts for a significant portion (25-40%) of module production costs. In fact, while polysilicon prices have declined more sharply this year, module prices have not fallen by the same magnitude, indicating potential gross margin expansion for module players. Furthermore, demand for downstream installations is likely to increase, as the IRR of solar farms and distributed solar installations becomes more attractive amidst the lower module prices.

Therefore, I believe the polysilicon downcycle would trigger a surge in shipment volumes and unit profits for module makers, provided they can maintain lower declines in module prices compared to polysilicon. This has already resulted in expanded margins for industry leaders in 1Q23. However, the margin expansion may slow down as module competition is also getting more intense in 2H23. Nevertheless, module players can still expect to see better profitability than they have in the past few years.

| 1Q22 | 1Q23 | |

| Average Polysilicon Market Price (RMB/t) | 239 | 206 |

| YoY % Change | -13.8% | |

| JKS Module ASP (RMB/W) | 1.79 | 1.68 |

| YoY % change | -6.4% | |

| JKS Gross Profit Margin | 15.1% | 17.3% |

| Source: PVInfolink, JKS Q1 earnings report |

According to the table above, the rate of decline in JKS module ASP is less than half of that seen in Polysilicon. Its gross profit margin expanded 2.2% YoY, even under the additional UFLPA warehouse costs of $400mn which is equivalent to a 1.5-2.0% GPM impact. I anticipate that the margin expansion will become more apparent in 2Q-3Q.

In the following, I will discuss the module's competitive landscape and JKS's competitive positioning over its close peers.

Jinko best positioned for earnings growth

I anticipate that JKS will experience the greatest growth potential in the coming 3-6 quarters for three primary reasons: Firstly, the company boasts TOPCon leadership which has a much higher margin. Secondly, JKS exhibits best-in-class integrated module capability which is conducive to margin expansion. Lastly, it stands out with the highest export mix and robust overseas capacity. I will elaborate on each point.

TOPCon pioneer with highest shipment capability

JKS recently predicted the TOPCon market share would increase from 25% in 2023 to 54% in 2025. In next few years, its market penetration will surpass PERC to become the most prevalent type of module. In a recent investor meeting, JKS discussed that their TOPCon module offers a unit profit of RMB 0.1/W more than PERC, resulting in a GPM increase of 7-9%. As TOPCon modules remain undersupplied in 2Q23-4Q23, the first movers would enjoy significant growth and margin expansion. I see that JKS would even challenge the LONGi's leader position in PV modules as LONGi's TOPCon schedule (launch in May-23) is way behind the curve. While the TOPCon market competition will become more intense in 2024 due to capacity release, the uncertainty has already been factored in with a 40-60% share price correction in recent months.

I think this concern is overdone. JKS is the pioneer and undisputed leader in TOPCon. As shown in the table below, it has the highest TOPCon sales mix of 60% of sales in 2023E, vs peers' sales mix average of 21%. JKS has a strong competitive edge thanks to its early adoption of TOPCon technology, their superior technology and cost leadership in TOPCon, and their exceptional track record in the field. It is also on track to achieve cost parity with PERC by the end of 2023, thanks to improved TOPCon energy efficiency, from 25.3% to 25.8%. This will allow them to maintain profitability even if TOPCon prices decline slightly, as production costs will also decrease due to higher energy efficiency and economy of scale. Overall, JKS's medium-term profitability outlook remains highly favourable.

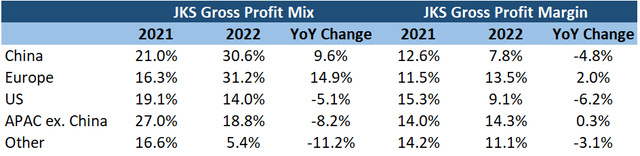

Leading vertical integration and greatest margin improvement potential

JA has been the most integrated module player, consistently having 80% self-sufficiency. Jinko has recently followed the strategy, now achieving a similar level of vertical integration. From 2020 and 2021, we can see lower vertical integration ratio tended to result in lower module GPM e.g., Trina and JKS, and vice versa for LONGi and JA.

The table above represents JKS's (688223.SH) gross margin under PRC GAAP, as its comparable peers are listed in A-shares. In gross profit calculation, the key difference between PRC GAAP and US GAAP is the classification of shipping costs, which are categorized as COGS in PRC GAAP, whereas they fall under SG&A in US GAAP.

The gross profit margins of all players have generally decreased from 2020 to 2022 due to rising freight costs caused by the Covid-19 pandemic and upstream polysilicon price hikes. However, both trends have reversed currently, leading to a positive impact on JKS as both freight costs and polysilicon prices have significantly decreased, proving to be tailwinds for the company.

JKS has historically had a lower gross margin compared to its competitors JA and LONGi. However, there are six factors that I believe will contribute to a tremendous margin improvement for JKS in the coming quarters.

- Less warehouse cost at US ports (UFLPA-related) from Rmb300-400m in 1Q23 to Rmb100-150m in 2Q23E, implying ~0.5-1% GPM QoQ expansion.

- Vertical integration improvement to best-in-class level of ~80% self-sufficiency rate this year and leads to more supply chain synergies.

- Higher TOPCon sales mix (from 50% in 1Q23 to 70% shipment in 4Q23) with higher unit profit, which is 4-6% higher GPM than non-TOPCon.

- Polysilicon price declining faster than module price as discussed above.

- Gradual improvement in US shipments in upcoming quarters, which currently has a much higher margin than the rest of the world.

- Decline in freight costs will decrease SG&A costs and improve EBIT margin in US GAAP.

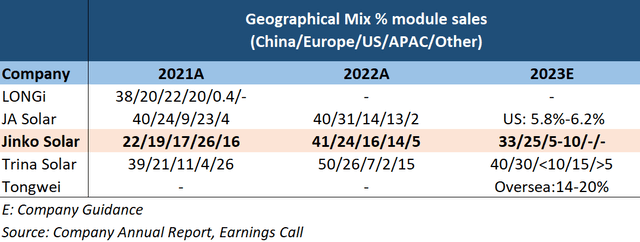

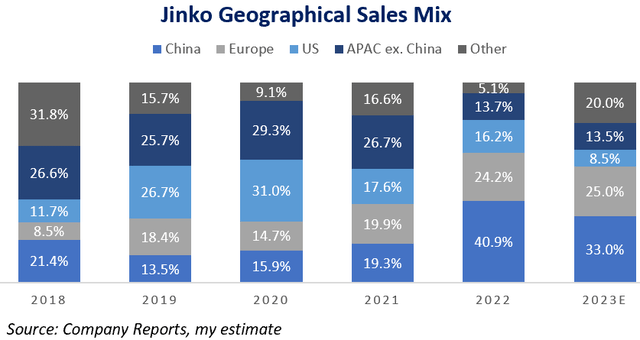

Highest export ratio and overseas production capacity

Source: Author's Compilations Source: Author's Compilations Source: Author's Compilations

JKS has a consistently higher percentage of overseas shipments compared to its peers. Currently, due to a supply shortage, selling solar modules in the US is the most profitable option compared to rest of the world. In fact, JA's management stated that unit profit for US orders in 1Q23 was more than double that of China domestic orders. This is significant as competition in the domestic module market in China has been increasingly intense due to recent capacity releases. JKS's strong export mix positions it well for the overseas opportunities with higher margins, particularly as the UFLPA demurrage costs in the US begin to decline in 2Q23.

All top players have strategically invested in building their overseas module capacity, with a specific focus on the premium US market, predominantly in South East Asia. JKS in particular has established the highest fully integrated overseas capacity of 7GW and is poised to expand to a staggering 11-12GW by the end of 2023. This solidifies JKS's position as a overseas market leader and presents a promising opportunity for the company to capitalize on the US market.

Competitive Positioning Remains Intact Despite Tongwei's Aggressive Expansion

Tongwei has been a prominent player in the upstream solar supply chain. However, it is now venturing into the module market with an ambitious sales target of 35GW by 2023 (with only 3GW reported in 1Q23) and plans to increase its production capacity to 80GW by the end of 2023, +4.7x YoY. Despite the increasing competition in 2H23, I anticipate that the competition would primarily arise in China's domestic market as Tongwei lacks track records to compete in oversea markets. In fact, Tongwei targets only 5-7GW overseas sales (~15% shipment) this year. Hence, I believe that it would not be a significant competitive threat to the top four players. Instead, tier-2 or lower module players would face the most significant pressure.

In the past few months, the pricing of Tier-1 modules has been observed to be around RMB1.65/W, which is approximately 10% higher than Tier-2 and below, priced at RMB1.5/W. This premium is now expected to widen due to the entry of Tongwei products. Tongwei has adopted a pricing strategy that falls between Tier-1 and Tier-2/3 peers, thereby posing a significant threat to the lower-tier players in the China domestic market. I believe that Tongwei's aggressive entrance could accelerate the industry consolidation and strengthen the positioning of industry leaders, with little impact on Tier-1 profitability in the short term.

Expanding Into Energy Storage Solutions

Since late-2020, JKS has been expanding into downstream Energy Storage Solutions (ESS), launching residential, commercial and industrial, and large-scale power plant ESS. Although JKS is a late entrant in this market, ESS still has the potential to be a strong growth driver for JKS in the medium term.

The global ESS market is projected to grow 15-fold from 2021 to 2030, reaching $1.7 trillion in 2032. With its strong global presence in the module market and collaborations with battery leaders like CATL, I believe JKS has a competitive edge in the ESS market. While the near-term contribution to the overall revenue is insignificant, any meaningful progress or product launches could act as catalysts for JKS's share price. For example, on Jun 14, JKS experienced an 11.8% rally after the launch of its G2 High Voltage Battery for European residential and commercial ESS, although the stock soon returned to its original level. Similar progress has been observed in other countries like China and Australia in July 2022, where the market has also reacted favorably to these developments.

In my opinion, it is too early for in-depth analysis and conclusions given the lack of information disclosure, but we should keep an eye on JKS's progress in the ESS market.

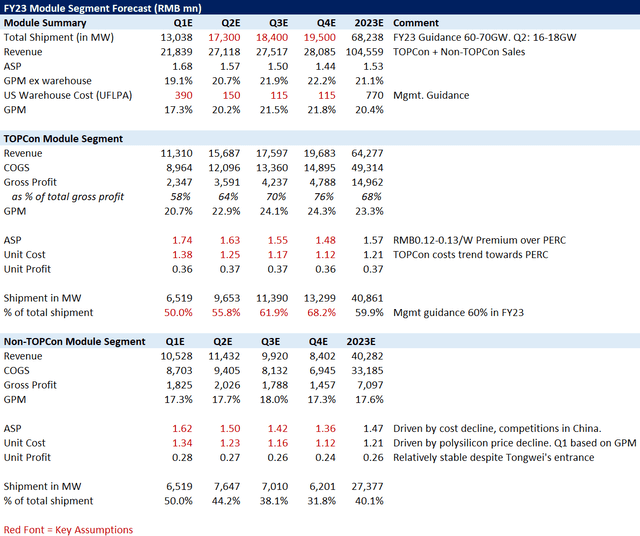

Earnings Forecast

To reflect the thesis above, I have estimated the JKS's module revenue and gross profit in a bottom-up approach. Below is the forecast for the base case.

I have summarized my FY23 EPS forecast in three scenarios and compared it to the consensus EPS.

| EPS Summary | Q1A | Q2E | Q3E | Q4E | 2023E |

| Consensus | $ 0.51 | $ 1.26 | $ 1.44 | $ 2.17 | $ 5.38 |

| Base | $ 2.18 | $ 2.64 | $ 3.24 | $ 3.46 | $ 11.61 |

| % Beat/(Miss) | 327% | 110% | 125% | 60% | 116% |

| Bull | $ 2.18 | $ 3.78 | $ 5.32 | $ 6.09 | $ 17.45 |

| % Beat/(Miss) | 327% | 200% | 269% | 181% | 224% |

| Bear | $ 2.18 | $ 1.84 | $ 1.45 | $ 1.89 | $ 7.43 |

| % Beat/(Miss) | 327% | 46% | 1% | -13% | 38% |

Valuation

JKS is trading at 6-6.5x forward P/E. All of the other top 4 global module makers are not listed in US now and are instead listed on the A-share. They have been trading at higher P/E multiples, now at 13-17x 1-year forward P/E. As the market mechanism and accounting method in A-share is quite different from the US, looking at their multiples is not very meaningful for valuing JKS.

From a valuation perspective, I think Canadian Solar (NASDAQ:CSIQ), currently the No.5 vertically integrated solar module maker in the globe, is the best comparable as both businesses are highly dependent on module revenue and are exporting to the US/EU markets. CSIQ is currently trading at 7x forward P/E.

JKS should command a slightly higher multiple compared to Canadian Solar due to its greater level of vertical integration, TOPCon leadership, and higher operating leverage to capitalize on industry trends. However, it's important to recognize that being a China-based company listed in the US does offset the multiples. Therefore, I believe that a 7-7.5x forward P/E is a fair multiple for NYSE-listed JKS.

| Scenario | 23 P/E | 23 EPS | Valuation | Weighting | Target | Current | Upside |

| Base | 7.0x | $ 11.6 | $ 81.3 | 70% | $ 83.8 | $ 42.0 | 100% |

| Bull | 7.5x | $ 17.5 | $ 130.9 | 15% | |||

| Bear | 6.5x | $ 7.4 | $ 48.3 | 15% |

Risks To Thesis

Unfavourable changes in overseas trade policy against solar exports from China might negatively impact JKS's overseas sales. However, the recent disposal plan of Xinjiang assets should be conducive to module export. There is also a risk of potential loss in profitability due to lower-than-expected polysilicon material price cuts and TOPCon price premiums, making it essential to monitor price trends across the value chain. While price competition among tier-1 module companies is unlikely, it could still result in lower module profit margins for JKS.

Investment Summary

The market is overly bearish on module makers, with share prices slumping 40-60% from recent peak. This presents attractive entry opportunities with a large margin of safety. Despite tailwinds in the industry, all tier-1 module players are undervalued according to their price-to-earnings multiples, which are currently at all-time lows.

My Stock Preference is as follows: Jinko (NYSE:JKS/688223.SH) > JA Solar (002459.SZ) > LONGi (601012.SH) > Trina (688599.SH). Among the solar module makers, JA Solar is the top pick of the street. However, I believe NYSE-traded JKS is currently the most underappreciated and overlooked player as its 1Q23 EPS of $2.31 is significantly beating the consensus of $0.51.

Expectations of increased earnings in the upcoming quarters could potentially drive a significant re-rating of the valuation of JKS. Based on these projections, I have set a target price of $83.8 within the next 9-12 months, suggesting a potential increase of 100% from the current level.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JKS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I currently have a concentrated position in JKS as a significant portion of my portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Geometric growth + oligopolic + rev/eps ratio+ low cost

170 usd will be fair value and just because is chinese if not it should be 350/400 usd.