The Great Market Miscalculation: Pfizer's True Value Remains Untapped

Summary

- Ngenla, a long-acting medicine for treating children with growth hormone deficiency, has been approved by the FDA for use in the United States, adding to its presence in over 40 countries.

- Pfizer Inc. and Opko Health have been jointly developing and commercializing Ngenla since 2014, with the goal of transitioning patients from Pfizer's Genotropin, which has been facing competition from biosimilars.

- In addition, on July 23, the FDA approved Litfulo, making it the first drug on the market to treat adults and adolescents with severe alopecia areata.

- At the end of May 2023, the FDA approved Abrysvo, the company's vaccine for preventing respiratory syncytial virus in older people.

- Despite Mr. Market's negative reaction to the news of the end of the clinical development of lotiglipron for obesity and type 2 diabetes, we continue our analytical coverage of Pfizer with an "outperform" rating for the next 12 months.

MoMo Productions

July 30 is the last day of the second quarter of 2023, which was rich in events, some significantly underestimated by market participants. Moreover, these events will positively impact Pfizer Inc.'s (NYSE:PFE) financial position in the coming decades. Gaining more than five approvals since the start of the year will minimize the damage to Pfizer's revenue growth that could come from expected losses in exclusivity for some of the company's blockbusters and reduced demand for a COVID-19 vaccine.

Since the publication of our last article, Pfizer's share price has been trying to gain a foothold above $40, but the bulls' attempts have not been successful, and it has again fallen to a strong support zone in the $36-37 range. The reason for the decrease in the price of the company's shares was a press release published on June 26 and testifying to the decision of the company's management to suspend clinical development of lotiglipron for obesity and type 2 diabetes mellitus due to elevated levels of transaminases. Despite the market backlash, Pfizer will continue to promote its clinical program for danuglipron as a potential treatment for adults with these two conditions. We believe that Pfizer's experimental drug will be able to compete with medicines from such leaders in the global diabetes treatment market as Eli Lilly (LLY) and Novo Nordisk (NVO).

In the second quarter of 2023, the company received many drug and vaccine approvals, some of which are well ahead of competitors in terms of efficacy and safety profile, thus setting the stage for increasing their share in the fast-growing pharmaceutical industry. At the end of May 2023, the FDA approved Abrysvo, the company's vaccine for preventing respiratory syncytial virus in older people. Two months later, the director of the CDC approved the ACIP recommendations for using this vaccine in the fight against the deadly virus, which opens up huge commercial opportunities for Pfizer. This decision will allow millions of older people access to the vaccine and thereby reduce the percentage of hospitalizations and deaths in anticipation of the start of a new season of respiratory diseases.

In addition, on July 23, the FDA approved Litfulo, making it the first drug on the market to treat adults and adolescents with severe alopecia areata. And after four days, Pfizer's Ngenla finally received FDA approval for its use in the treatment of children with growth hormone deficiency. The medicine is approved in more than 40 countries and has extensive long-term data demonstrating a favorable safety profile and high efficacy, which will undoubtedly minimize the impact of deteriorating sales of Genotropin.

In addition, high dividend yields well above the average for the healthcare sector and the high probability of a favorable decision by the Federal Trade Commission on the acquisition of Seagen, one of the leaders in the cancer therapy market, should continue to support Pfizer's share price.

Ngenla continues its geographical expansion

Ngenla (somatrogon-ghla) is a long-acting medicine approved for treating children with growth hormone deficiency in over 40 countries. On June 28, 2023, the United States was added to these countries after the FDA issued a positive decision on Ngenla more than a year after the issuance of the CRL.

Growth hormone deficiency (GHD) is a rare condition in which the anterior pituitary gland does not produce enough somatropin. Without timely treatment, children with these diagnoses experience significant growth retardation and delayed puberty compared to their peers, ultimately leading to various mental disorders and other complications. Given Ngenla's monthly list price of about $8,300 in the United States and that the condition affects approximately one in 4,000 to 10,000 children, we expect relatively strong sales growth and profit generation starting in 2024.

At the end of 2014, a partnership agreement was signed between Pfizer and OPKO Health, Inc. (OPK), according to which these companies began the joint development and commercialization of Ngenla. One of the main goals of this partnership is to transfer patients from Pfizer's Genotropin, whose sales have been under pressure due to competition from biosimilars. In addition, companies sought to bring to market a new generation of growth hormones, with less frequent injections, to improve the quality of life of children who experience discomfort from daily injections.

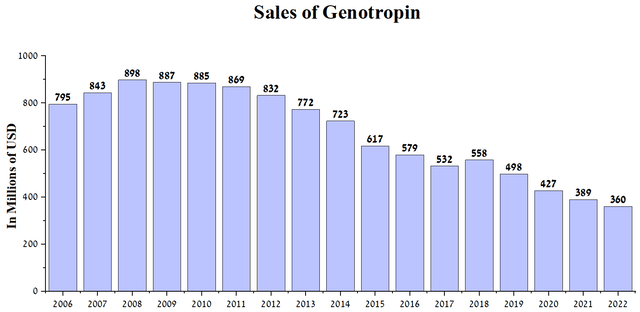

So, in 2008, sales of Genotropin amounted to $898 million but gradually began to decline and reached $360 million in 2022.

Author's elaboration, based on quarterly securities reports

We believe that with Ngenla's entry into the U.S. market and the availability of long-term data showing that it is an effective growth hormone with a favorable safety profile, Pfizer will be able to regain its share of the global human growth hormone market in a relatively short time. This is an important point for the financial position of the pharmaceutical industry mastodon, as it will diversify the sources of cash flow and partially minimize the decline in sales of the COVID-19 vaccine.

In addition, unlike its closest competitors like Ascendis Pharma's Skytrofa (ASND) and Novo Nordisk's Sogroya, Pfizer has been running an extensive Ngenla research program to collect information on the annual growth rate, growth standard deviation change, IGF-1 levels, and more for much longer. Information about the long-term effects of taking a drug is a significant advantage over competitors, as it increases patient confidence and creates a positive opinion in the medical community, ultimately leading to greater confidence in the company's drug among endocrinologists.

Moreover, Ngenla was the first to enter the markets of European and some Asian countries among long-acting growth hormones. This leads to an increase in its recognition in the industry and provides an opportunity to collect long-term information about its effectiveness and side effects. These can be an important factor in substantiating its advantages over competitors.

Conclusion

June 30 is the last day of the second quarter of 2023, which was rich in events, some significantly underestimated by market participants. Moreover, these events will positively impact Pfizer's financial position in the coming decades. Gaining more than five approvals since the start of the year should minimize the damage to Pfizer's revenue growth that could come from expected losses in exclusivity for some of the company's blockbusters and reduced demand for a COVID-19 vaccine.

In the second quarter of 2023, Pfizer received a huge number of drug and vaccine approvals, some of which are well ahead of competitors in terms of efficacy and safety profile, thereby creating the prerequisites for increasing their share in the fast-growing pharmaceutical industry. In particular, after the director of the CDC approved ACIP recommendations for using Abrysvo in the fight against the respiratory syncytial virus in older people, this will open a multi-billion dollar market for Pfizer. The world needs an effective vaccine that can reduce hospitalizations and deaths from this virus before the start of a new season of respiratory diseases.

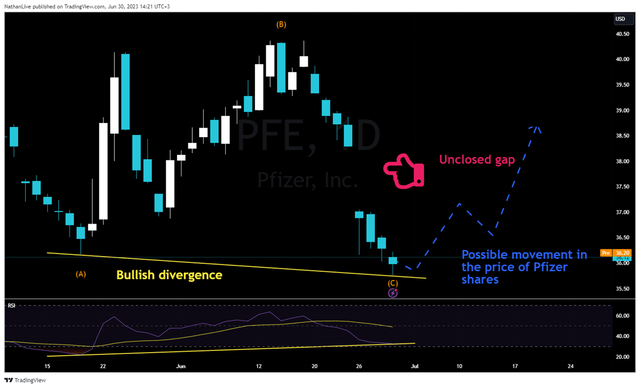

In terms of technical analysis, we believe that the corrective pattern (A)-(B)-(C) has been completed. Moreover, a bullish divergence was formed on the daily chart, signaling that Pfizer's share price is about to reverse upwards.

TradingView - Nathan Aisenstadt

Despite Mr. Market's negative reaction to the news of the end of the clinical development of lotiglipron for obesity and type 2 diabetes, we continue our analytical coverage of Pfizer with an "outperform" rating for the next 12 months.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (20)

but it appears that the more the FDA approves

the more the stock goes down!