L3Harris Technologies: A Compelling Defense Giant On Sale

Summary

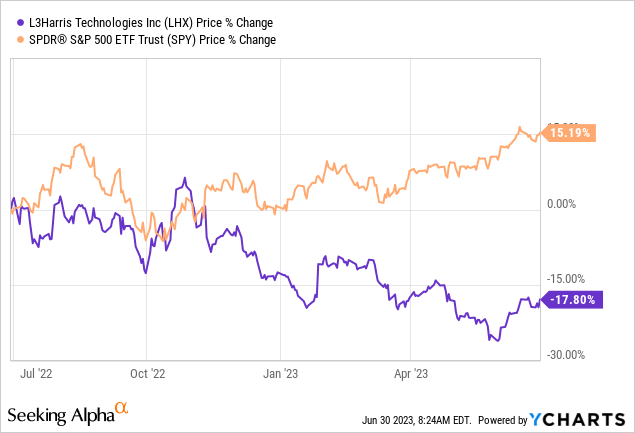

- L3Harris Technologies is down nearly 30% from its all-time high last year amid the uncertainties around the debt ceiling.

- The defense company should benefit from NATO's potential increase in defense spending requirements for its members.

- The acquisition of Aerojet Rocketdyne is expected to boost its presence in the aerospace industry and increase its financial visibility.

- The current valuation is meaningfully discounted compared to other large-cap defense companies.

Ales_Utovko

Investment Thesis

L3Harris Technologies' (NYSE:LHX) performance has been underwhelming recently, as the defense sector was being pressured by the uncertainties around the debt ceiling. With the share price now back to 2019 levels, I believe it offers a compelling buying opportunity for long-term investors.

The debt ceiling was finally raised once again and the final deal was much more favorable than expected, as defense spending is still set to increase this year. NATO is also going to discuss a potential increase in spending requirements for its members, which should present meaningful tailwinds to the company. This company is also trading at a discounted valuation compared to peers, which should offer meaningful upside potential moving forward.

The Debt Ceiling Deal

L3Harris is one of the US' leading defense and aerospace companies. The company covers a broad range of segments including integrated mission systems, space & airborne systems, and communication segments. It has an especially strong presence in ISR (intelligence, surveillance, and reconnaissance) and tactical communications, which accounts for 30% of total revenue.

The company has been weak in the past few months as the market was concerned about a potential default and a cut in defense spending. After months of drama, the debt ceiling was finally raised once again last month before the June deadline. This cleared a lot of uncertainties and the final deal is much looser than most would have expected, especially around defense spending. The new deal will maintain non-defense federal spending in 2024 at current levels, with a 1% room for increase in 2025. On the other hand, defense spending is set to increase by 3% to $886 billion this year. The increase is small but it is much better than a potential cut that some forecasted.

Potential Increase In NATO Budget

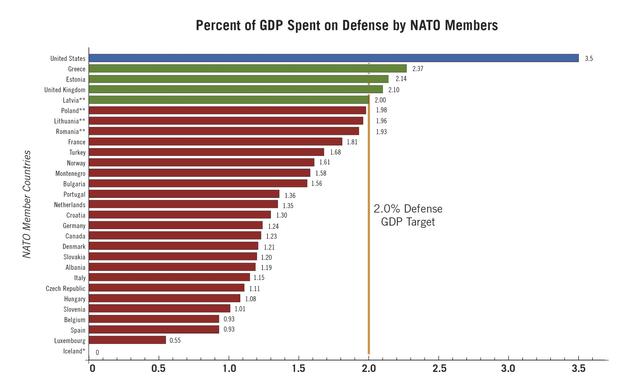

The potential increase of NATO members' defense budget should be a long-term tailwind for L3Harris moving forward. As shown in the chart below, most NATO countries have been underspending on defense and most of them do not meet the organization's spending target of 2% of GDP. As geopolitics remains highly uncertain, the organization is expected to discuss its spending target and some members are proposing to turn the 2% target to a minimum, according to NATO Secretary General Jens Stoltenberg. If this materializes, many countries will likely start ramping up their defense spending, which should benefit L3Harris.

Kathy Warden, Northrop Grumman's (NOC) CEO, on international defense budget

As we look forward, defense budgets are on the rise, and we see our global customers continuing to seek proven solutions to address rapidly evolving and increasingly sophisticated threats. We are meeting their urgent needs in areas such as air and missile defense solutions, medium and large-caliber ammunitions and armaments, advanced radar capabilities, and global surveillance to name just a few.

Aerojet Rocketdyne Acquisition

The potential $4.7 billion acquisition of Aerojet Rocketdyne (AJRD) should also improve L3Harris' fundamentals. Being one of just two suppliers of solid rocket motors, Aerojet Rocketdyne will bring extremely valuable assets to the company and help further expand its aerospace segment. Aerojet Rocketdyne's strong exposure to long-cycle programs will also further increase the company's backlog and improve financial visibility and stability.

While the acquisition will likely face antitrust investigations from the FTC (Federal Trade Commission), I am optimistic that the deal will go through eventually. Lockheed Martin (LMT) failed to acquire Aerojet Rocketdyne last year but the backdrop is quite different in this case, as L3Harris has a substantially lower presence in the aerospace industry. For instance, Lockheed Martin generates around 60% of total revenue from aeronautics and space, while L3Harris generates only 37% of total revenue from these segments. Lockheed Martin's market cap is also triple the size of L3Harris. Besides, Northrop Grumman's acquisition of Orbital ATK (another supplier of solid rocket motors) in 2018 also set a convincing precedent for this acquisition.

Discounted Valuation

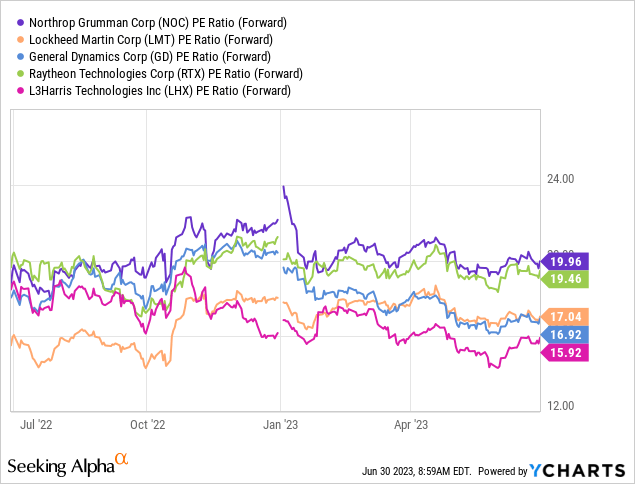

As L3Harris is now down 30% from its all-time high, its valuation has also become very compelling in my opinion. The company is currently trading at a fwd PE ratio of 15.9x, which is the cheapest among other large-cap defense companies such as Lockheed Martin, Raytheon (RTX), and General Dynamics (GD), as shown in the first chart below. The peer group has an average fwd PE ratio of 18.4x, representing a meaningful premium of 15.7% above L3Harris.

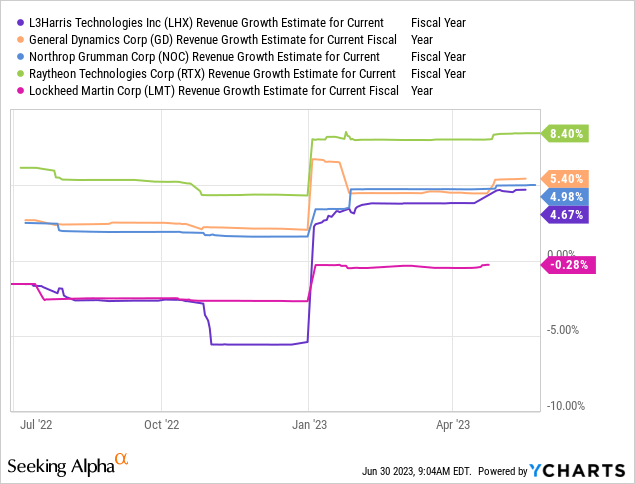

The company's financial performance is not weak by any means either. As shown in the second chart below, its estimated revenue growth of 4.7% for FY23 is pretty much in-line with peers, which averages around 5%. The growth rate may even accelerate next year, as the company's backlog grew 16% YoY (year over year) to $25 billion in the latest quarter. Considering the solid financial performance, I believe the company should be trading at peers' average valuation, which translates to decent upside potential.

Risk

The highly unpredictable political backdrop remains a notable risk for L3Harris in my opinion. For instance, while the defense budget is set to increase this year, it may still be cut next year if the government decides to further push back on spending. While the Aerojet Rocketdyne acquisition should go through based on data and past examples, it may still face unexpected roadblocks due to pressure from different parties, as Lockheed Martin and US Senator Elizabeth Warren both expressed their concern about the deal.

Investors Takeaway

L3Harris Technologies has been pressured by the uncertainties around the debt ceiling but it is now finally resolved, which should help improve investors' sentiment. NATO's potential increase in defense spending requirements for its members should also be a long-term tailwind moving forward. The acquisition of Aerojet Rocketdyne will also further expand its aerospace segment and improve its revenue visibility. While the backdrop has been improving, the current valuation remains discounted compared to peers. I believe the company has ample upside potential and I rate it as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)