Trinity Capital: 15% Yield, 9 Straight Dividend Hikes

Summary

- Trinity Capital upped its quarterly dividend for the ninth straight time in Q1.

- Its base yield is 14.06%, plus it paid a $0.05 supplemental, which brought the yield to ~15.50%.

- This article covers TRIN's earnings growth, debt leverage, portfolio health, performance and valuations vs. the BDC industry.

- Looking for more investing ideas like this one? Get them exclusively at Hidden Dividend Stocks Plus. Learn More »

8vFanI

Does your portfolio include any BDC's? Business development companies offer retail investors high yield exposure to private companies, and some of them, like Trinity Capital (NASDAQ:TRIN), focus on companies which are already backed by venture capital firms. Like certain other BDC's, TRIN benefits from rising interest rates.

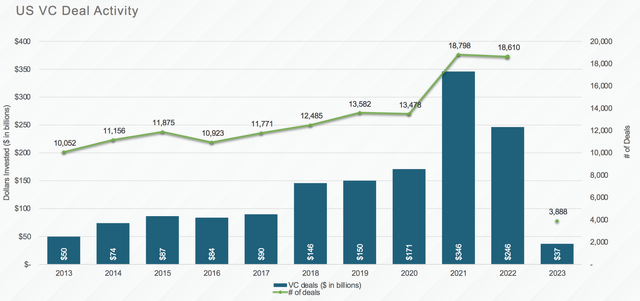

The VC market has been constrained over the past five quarters, with total VC deals dropping from $346B in 2021, to $246B in 2022. The Q1 '23 figure was $37B, which is $148B annualized, a further large drop.

TRIN site

Company Profile:

Trinity Capital Inc. is an internally-managed BDC which specializes in venture debt to growth stage companies looking for loans and/or equipment financing. Trinity Capital Inc. was founded in 2019 and is based in Phoenix, Arizona, with additional offices in Lutherville-Timonium, Maryland, San Diego, California, and Austin, Texas.

It IPOd in January 2021, but had a longer prior history dating back to ~2008 in its predecessor funds. Over the past 15 years, Trinity Capital has done $2.4B in fundings, in 287 investments, with 165 exits, and has $1.1B in Assets under management ("AUM").

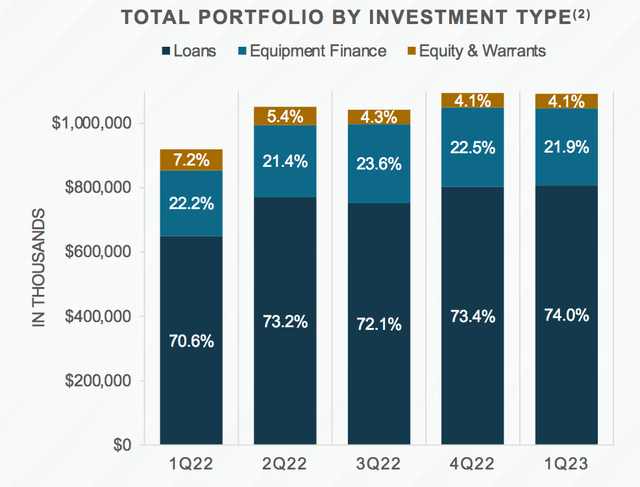

As of 3/31/23, Secured Loans made up ~74% of TRIN's portfolio, followed by Equipment Financings, at ~22%, and Equity & Warrants, at ~4%.

TRIN site

Rising Interest Rates Are Beneficial for TRIN:

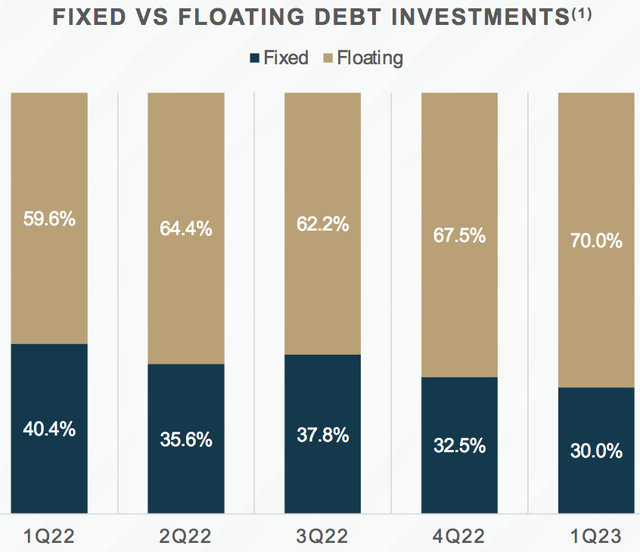

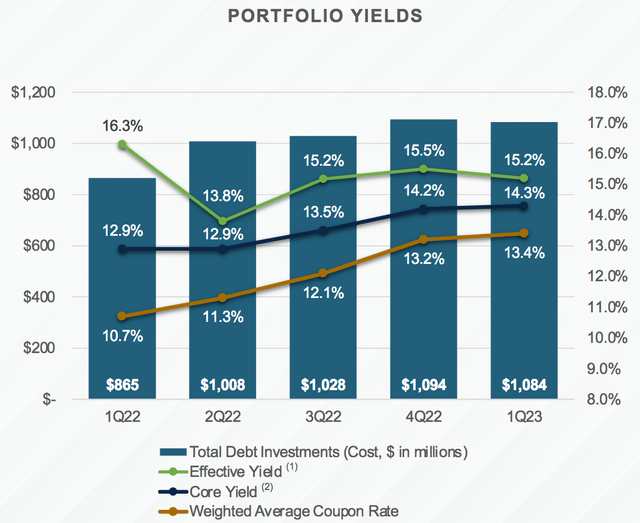

With the advent of rising interest rates, management has increased TRIN's exposure to floating rate loans over the last five quarters, from 59.6% in Q1 '22, to 70% in Q1 '23:

TRIN site

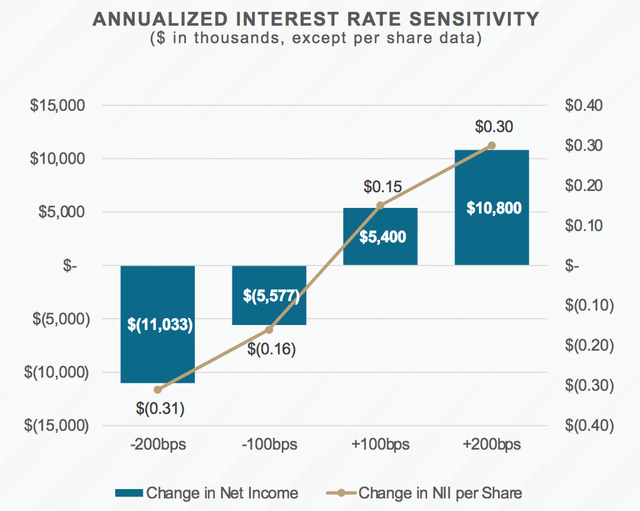

Management estimates that, for every 100 basis point increase in the prime rate adds an additional $5.4M of interest income, or $0.15/share to TRIN's annual earnings.

TRIN site

This has been evident in TRIN's core portfolio yield, which has from 12.9% in Q1 '22, to 14.3% in Q1 '23:

TRIN site

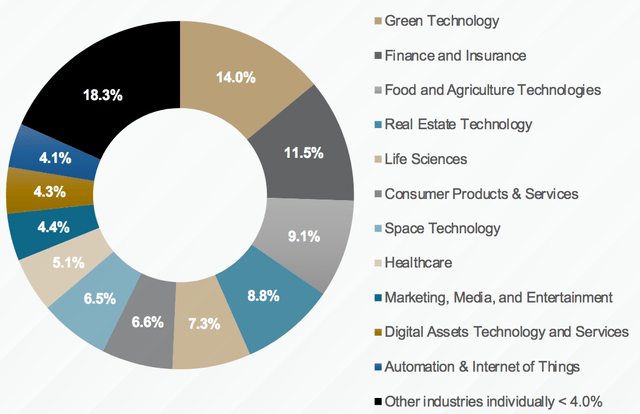

The main difference in TRIN's holdings vs. other BDCs is that it has more exposure to manufacturing, due to its equipment financing investments. Its top five industry exposures comprise ~51%% of its portfolio, with green tech, at 14%, finance/insurance, 11.5%, (up from 10.4% in Q4 '22), food and agri-tech, 9.1%, real estate tech, 8.8%, and life sciences, at 7.3%. 18% of its holdings are less than 4% of the whole:

TRIN site

Portfolio Ratings:

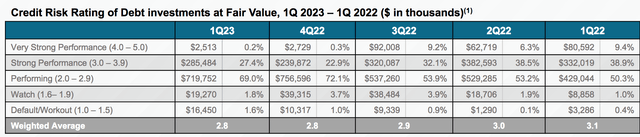

As in other BDCs, TRIN's management evaluates and rates the portfolio companies each quarter. As of 3/31/23, the top two tiers comprised 27.6% of the portfolio, down from 49.3% in Q1 '22. Conversely, the bottom two tiers rose to 3.4% in Q1 '23, vs. 1.4% in Q1 '22.

The overall weighted average was 2.8 in Q1 '23, vs. 3.1 in Q1 '22, due to a big rise in Tier 3 "performing" assets, from 50.3% in Q1 '22, to 69% in Q1 '23:

TRIN site

Earnings:

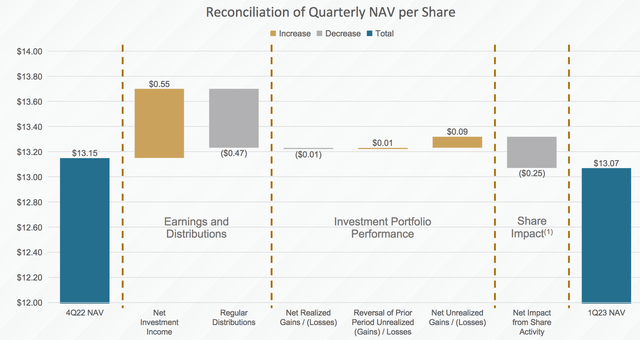

NAV/share had a slight sequential decline in Q1 '23, dropping from $13.15 in Q4 '22, to $13.07.Total NAV increased by $10M vs. Q4 '22.

Basic NII/share was $.55, more than covering the $.47/share distribution, while net unrealized gains added $.09/share, which was countered by -$.25/share in dilution.

TRIN site

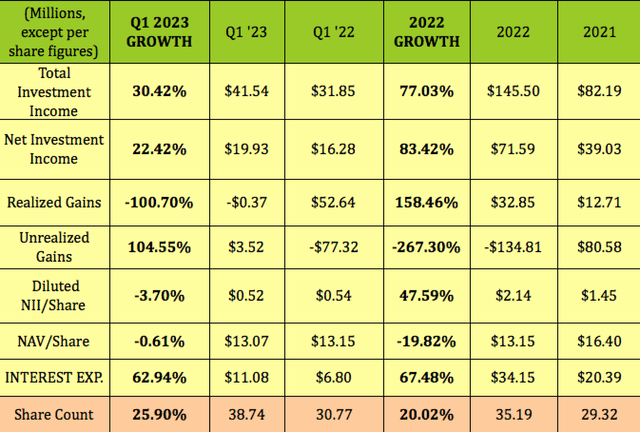

Q1 '23 - TRIN's total investment income jumped 30.4% in the quarter, with NII up 22.4%. Interest expense rose ~$4.2M, up 63%. NII/Diluted share was down -3.7%, due to a 26% increase in the share count vs. Q1 '22.

2022: Trinity Capital's earnings benefited greatly in 2022 from the rise in interest rates, and having a higher percent of its portfolio in floating rates. Interest expense rose over 67% in 2022, but was outpaced by earnings.

Net investment income, NII, rose over 83% in full year 2022, with Total Investment Income rising 77%. Diluted NII/share jumped 47.6%, even with a 20% rise in the share count.

Hidden Dividend Stocks Plus

New Business:

Q1 '23 investments funded totaled ~$70.4M, comprised of a $5M investment in one new portfolio company, a $5.2M investment in the JV and ~$60.2M of investments in 11 existing portfolio companies. Investment fundings totaled $35.9M, equipment financings totaled $31.3M and warrant and equity investments totaled $3.2M.

Proceeds received from repayments were $82.8M, which included $42.1M of investments sold to the JV, $27.6M from normal amortization, and $13.1M from early debt repayments. The investment portfolio decreased by $6.4M, 0.6%, on a cost basis.

Dividends:

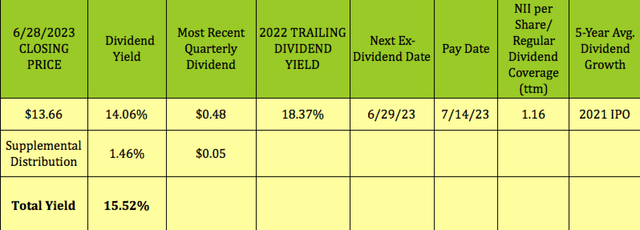

TRTN's most recent quarterly distribution rose by $.01/share to $.48, its ninth-straight quarterly hike, and management also added a $.05/share supplemental payout.

At its 6/28/23 closing price of $13.66, TRTN's base forward dividend yield is 14.06%. The $.05 adds another 1.46%, for a total yield of 15.52%.

Hidden Dividend Stocks Plus

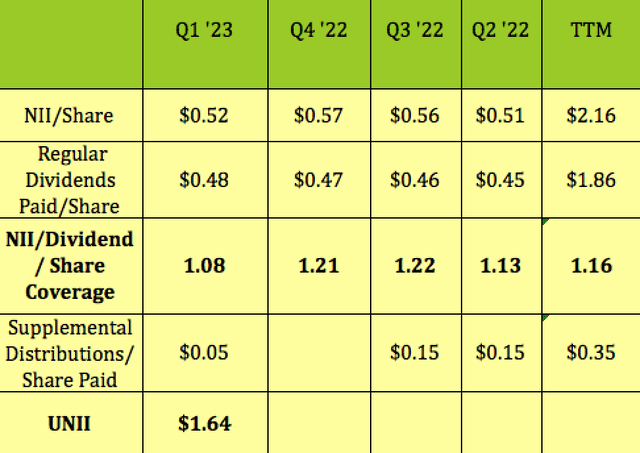

Distribution coverage was 1.08X in Q1 '23 for the regular $.52/share distribution. TRIN also had $1.64/share in Undistributed Net Investment Income, UNII.

Hidden Dividend Stocks Plus

Profitability and Leverage:

BDC's calculate Net Income as NII + Realized Gains + Unrealized Gains.

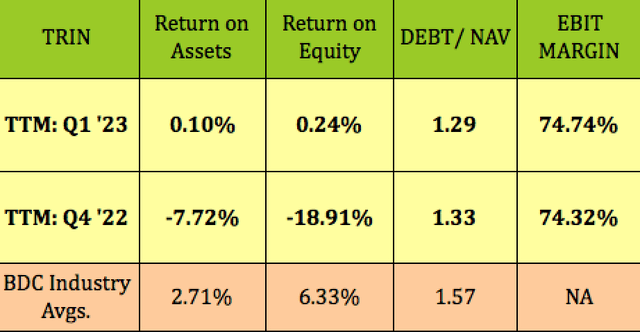

Like other BDC's, TRIN had some negative net income in 2022 due to negative, non-cash Unrealized Gains. This improved in Q1 '23, and increased ROA and ROE back into positive territory, although both figures were below BDC averages. debt/NAV was slightly better, while EBIT margin was stable.

Using net investment income, NII, TRIN's Q1 '23 trailing ROA was 6.7%, and its ROE was 16%.

Hidden Dividend Stocks Plus

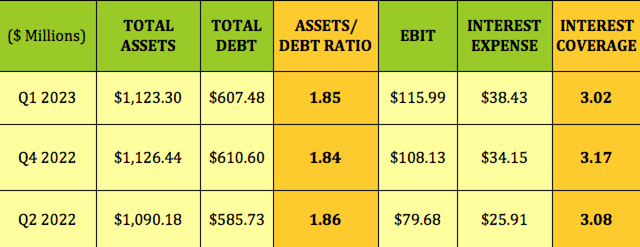

The assets/debt ratio was stable, at 1.85X in Q1 '23, whereas EBIT/interest coverage was a bit lower, at 3X:

Hidden Dividend Stocks Plus

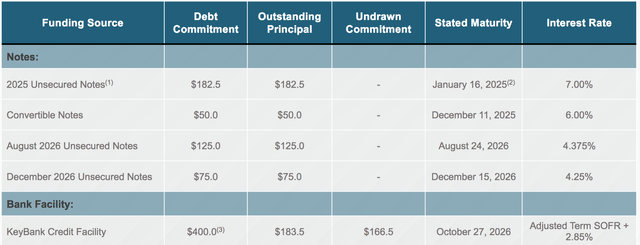

Debt and Liquidity:

TRIN has no debt maturities until January 2025, when $182.5M in unsecured notes come due. Its $400M Credit facility matures in October 2026, giving management plenty of time to refinance. TRIN has a BBB investment rating from Egan-Jones.

As of 3/31/23, it had $$174.8M in available liquidity, including $8.3 in cash, and $166.5M in available credit on its KeyBank Credit Facility.

TRIN site

Performance:

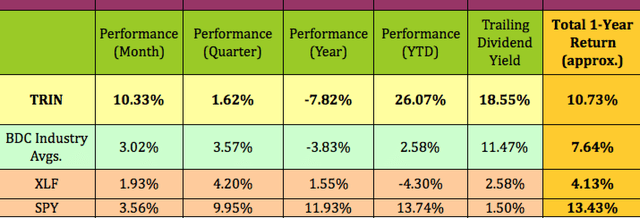

TRIN has outperformed the BDC industry, the broad financial sector, and the S&P 500 by wide margins so far in 2023, and over the past month.

Hidden Dividend Stocks Plus

Analyst Targets:

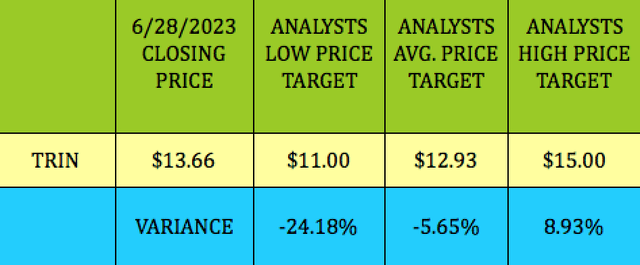

With its price surge, TRIN's share price has outrun analysts' price targets, which tend to lag. At $13.66, it was 5.65% above street analysts' average price target of $12.03, and ~9% below the $15.00 highest price target.

Hidden Dividend Stocks Plus

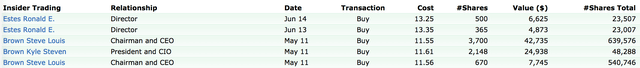

Insiders:

Insiders bought ~7400 shares in May and June '23, at prices ranging from $11.56 to $13.25. They previously bought ~3900 shares in March '23, but their biggest buys were in December '22, when they bought ~50,000 shares in the mid-$10 range.

fnvz

Valuations:

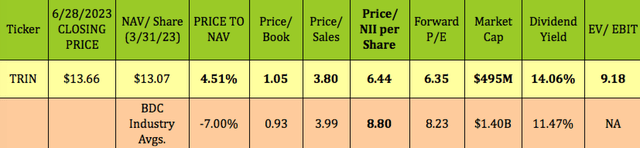

At its $13.66 6/28/23 closing price, TRIN had a 4.5% premium to its 3/31/23 NAV of $13.07/share. That's higher than the BDC industry average -7% price to NAV.

However, TRIN was selling at a cheaper earnings multiple, Price/NII, of 6.44X, vs. the 8.23X industry average. Its forward P/E of 6.35X is also lower than average, while its 14% regular dividend yield is higher than average for its industry.

Hidden Dividend Stocks Plus

Parting Thoughts:

TRIN is a good candidate for an income investor's watchlist - it's currently overbought, but, given the potential for market headwinds, you may be able to snag it at a cheaper entry price this summer, or in the typical September market swoon.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations. Our portfolio's average yield is over 9%.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of high yield income vehicles, and there's currently a 20% off sale on our service.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TRIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)