DAPP: Crypto Upside Unsustainable When Compared To Tech

Summary

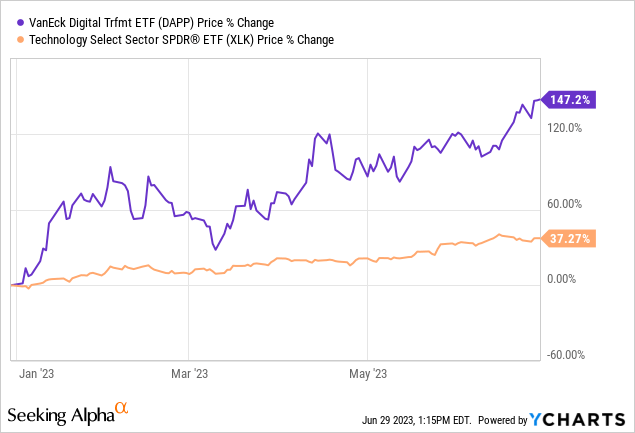

- The VanEck Digital Transformation ETF, which holds Bitcoin-related assets, has outperformed the Technology Select Sector SPDR ETF by over 100%, despite the latter benefiting from catalysts like Generative AI.

- This can be attributed to investors' preference for Bitcoin over tech, possibly due to Bitcoin's limited supply and its creation to address limitations in the financial system.

- Despite scandals and tighter regulatory scrutiny in the crypto industry, more adoption by Wall Street's big investment banks has led to a rally in the VanEck fund's share price.

- Major financial institutions in the U.S. are actively engaged in efforts to facilitate access to Bitcoin and other cryptocurrencies for their investors.

- Despite the current enthusiasm for crypto, investors should take a wait-and-see position due to potential volatility and the lack of a strong engine of growth comparable to Generative AI for tech.

iantfoto

Normally when you talk about digital transformation, names like the Technology Select Sector SPDR ETF (XLK) come to mind, which has profited from the Generative AI catalyst since the beginning of this year to gain 37%. However, as per the blue chart below, it is the VanEck Digital Transformation ETF (NASDAQ:DAPP) that holds Bitcoin (BTC-USD)-related assets which outperformed tech by more than 100%, tellingly, in a period where Sam Bankman-Fried of FTX (FTT-USD) crypto platform made headlines as regulators pounced in hard.

Thus, investors' preference for Bitcoin over tech may seem abnormal and it is precisely the objective to uncover the underlying reasons, with the ultimate intention being to assess whether investing in the VanEck fund makes sense at this stage.

For this purpose, reminding investors that for sustainable capital gains to be made, an investment has to serve an economic purpose, I compare the value creation in tech and crypto.

Comparing Value Creation for Tech and Crypto

First, Generative AI brings real benefits as seen by the speed with which one can generate reports with ChatGPT. Thus, by using simple-to-use natural language interactions instead of complex computer codes as in previous generations of machine language, this new AI flavor glitters by its simplicity while its underlying algorithms skim through the tons of data comprising the internet to extract valuable insights. In this way, it enables a high level of automation which in turn bring tangible productivity gains which can result in up to $4.4 trillion of economic benefits annually according to research firm McKinsey.

In comparison, Bitcoin which was designed as a peer-to-peer payment network in response to the Great Financial Crisis of 2008-2009 was more “anti-establishment” in the sense that the aim was to do away with the financial system prevailing at that time, mostly revolving around the U.S central bank’s printing a lot of dollar notes thereby devaluing the currency. Going deeper, with its decentralized nature, the digital asset was created to solve some of the problems inherent in our banking system, so that governments could not bring changes to supply as with bank notes. As such, the number of Bitcoins as of today is 19,415,287.5 with 1,584,712.5 remaining to be mined, or created as software codes using blockchain technology.

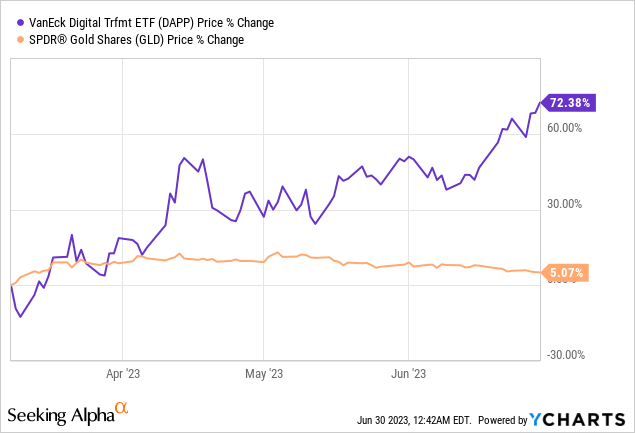

This limited supply or scarcity factor and the fact that Bitcoin was created to address limitations in the financial system may be the two reasons why DAPP did see a lot of inflows at the beginning of March this year coinciding with the turmoil impacting U.S. regional banks. Looking at portfolio protection at times of crisis, its performance even exceeded precious metals, in this case, the SPDR Gold Shares (GLD) as per the chart below. Thus, Bitcoin can be perceived as a safe haven asset class as I detailed in a thesis about the ProShares Bitcoin Strategy ETF (BITO).

Except for that bright spot, there was no Generative AI-type of catalysts for crypto, but, on the contrary, the industry was shaken up by scandals and tighter regulatory scrutiny.

It all started in November last year when Sam Bankman-Fried the CEO of FTX, was arrested after the collapse of his cryptocurrency exchange platform. At that time, the value of BTC plummeted by around 20% in only a few days. The worst was to come with other platforms like lender Genesis going down due to the contagion effect from FTX which held some of its cryptos in its custody. This is like the domino effect seen in a systemic crisis impacting stock markets as other platforms including Celsius and Voyager were plagued.

DAPP's Holdings and Big Institutions' Enthusiasm for Crypto

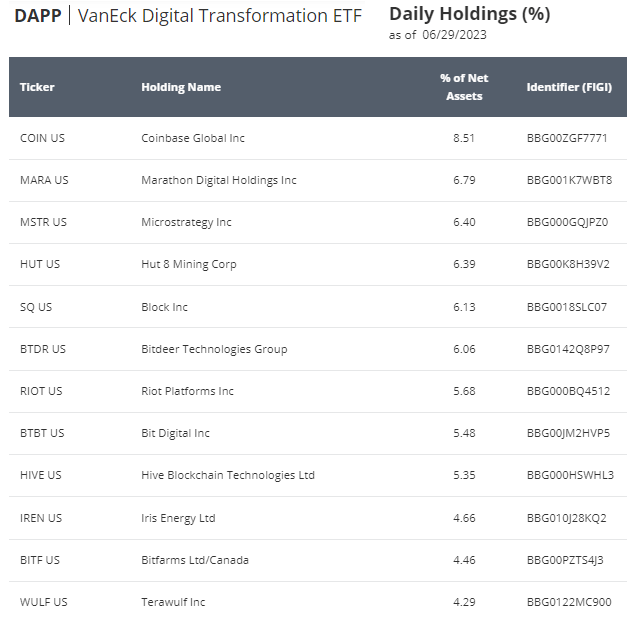

As for Coinbase, (COIN) which is the second largest exchange in the crypto ecosystem and also DAPP’s largest holding as pictured below, it was sued by the SEC (Securities and Exchange Commission) on June 6, on grounds that its asset trading platform was not properly registered. However, it is fighting back by claiming that the assets it trades do not constitute investment contracts or securities.

Largest Holdings (www.vaneck.com)

Consequently, the platform provider’s stock was hit by volatility, but, subsequently, the downside was quickly overwhelmed by more people pouring money into digital assets inducing a rally in DAPP's share price as per the above chart.

Looking for the reason, it is thanks to more adoption by Wall Street's big investment banks.

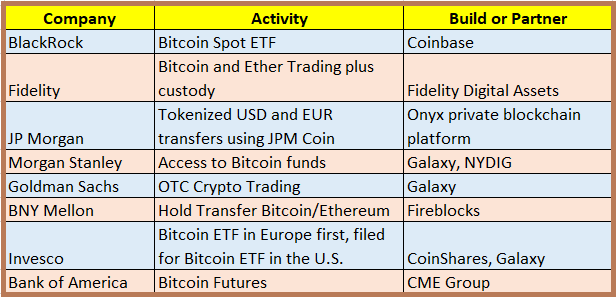

In this respect, BlackRock's (BLK) mid-June filing aimed at launching a Bitcoin ETF generated a lot of attention. Furthermore, it is not alone as many major financial institutions in the U.S. are actively engaged in efforts to facilitate access to Bitcoin and other cryptocurrencies for their investors. Mind-blowingly, these institutions collectively manage an impressive $27 trillion in client assets.

Table Built using Data from (cointelegraph.com)

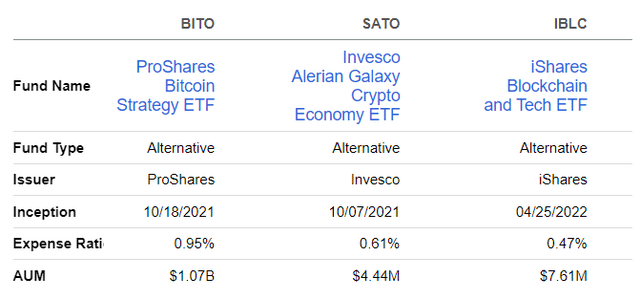

Looking in the rear mirror, initially disdained by Wall Street which was horrified at the prospect of Bitcoin becoming embedded in the mainstream financial and governmental systems, it seems that a whole different picture is emerging as seen by the interest of the top eight financial institutions. This interest comes on top of existing funds like the iShares Blockchain and Tech ETF (IBLC) as well as the Invesco Alerian Galaxy Crypto Economy ETF (SATO) as shown below.

Volatility and Lacking a Powerful Engine of Growth

However, together with BITO, these two are all classified as alternative funds, meaning that they are SEC-registered but hold "non-traditional investments or with complex trading strategies”. As such, they are flagged as having unique characteristics and are potentially riskier because they may make use of leverage.

Comparison of funds (seekingalpha.com)

It is precisely to remove these complexities that BlackRock has designed its spot Bitcoin ETF to be traded as a Commodity-Based Trust Share with Coinbase acting as the custodian of Bitcoin holdings and the Bank of New York Mellon (BK) for the fiat currency part.

Moreover, in BlackRock's proposed ETF, there can be a direct trade between two market participants (one buying and the other selling), whereas, for those trading futures contracts like BITO, the action takes place in the derivatives market. Detailing further, BITO's underlying fund holds CME futures and is regulated by the CFTC or Commodities Futures Trading Commission in the same way as a commodity such as corn or palm oil.

In case BlackRock's filing is approved it would constitute the first one of its kind by the SEC, but, given that previous applications namely by Grayscale and ARK Investments have not been successful, there are risks that the BlackRock application is rejected too, implying volatility for DAPP as well.

Thus, after an above-140% YTD upside, it is better to adopt a wait-and-see approach for the time being and, also expect some downside as a dose of realism gets injected into the system. This could take the form of heated debates between Coinbase and the SEC as part of court hearings.

To further justify my position that there is a low probability of the upside continuing, the crypto world does not have an engine of growth comparable in strength to Generative AI for tech.

Not the Right Time

Still, more institutional support for cryptocurrencies which is also exemplified by Fidelity boosting up its Digital Assets Division to provide clients with more crypto exposure shows that the demand factor is well present. Also, unlike funds holdings futures, DAPP holds crypto exchanges, miners, and FinTech companies like Block (SQ) as well as MicroStrategy (MSTR) which holds a substantial amount of digital assets in its balance sheet. For this purpose, the ETF tracks the MVIS Global Digital Assets Equity Index.

Therefore, for those looking for exposure to the crypto world, the relatively new DAPP, incepted in April 2021, with an AUM of $45.24 million and an expense ratio of 0.5% represents an appropriate choice, but not at the current share price. A better margin of entry would be around $5.9, attained before BlackRock's filing, and a level which has constituted a resistance level as represented by the blue line below. This price takes into consideration Bitcoin's value as a safe haven alongside gold for periods of uncertainty impacting the conventional banking system.

www.seekingalpha.com

In conclusion, this thesis has shown that unless you were an early investor who has already harvested incredible returns and is holding shares of DAPP, it is not time to invest as most of the market moves have been driven by institutions betting on the SEC for approval of their crypto strategy, or speculation, not concrete ingredients like Generative AI for tech. Finally, as seen during the banking turmoil, crypto could thrive again during economic uncertainty, but this will depend on liquidity flowing through the systems for digital assets to be exchanged into dollars or vice versa.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.