Canadian Natural Resources: Big Upside With Less Volatility

Summary

- We're adding Canadian Natural Resources Limited to our list of E&Ps best-positioned for higher oil prices and long-term holding.

- The shares offer a 5% dividend yield and 24% upside to our $90 price target.

- Canadian Natural Resources shares are a good alternative for investors who seek appreciation potential and income growth with less volatility.

- Looking for a portfolio of ideas like this one? Members of HFI Research Energy Income get exclusive access to our subscriber-only portfolios. Learn More »

Phototreat

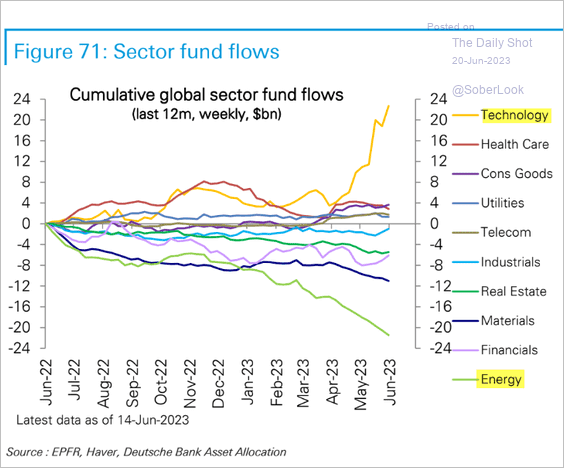

It’s still ugly in energy-stock land, even though the oil market is on the precipice of large inventory draws. Capital has abandoned the sector at a rapid rate in favor of the greener pastures of the technology sector; valuations be damned.

The chart below goes a long way toward explaining why energy stocks can’t get traction despite their improved balance sheets, attractive returns on capital, and constructive near-term fundamental outlook.

HFI Research

Source: Jesse Felder, Twitter, June 20, 2023.

Energy Aspects, a premier private oil-market consultancy, is estimating inventory draws of 2.5 million barrels per day (bpd) in the third quarter, which would be one of the largest quarterly draws in history. It attributes the draws to the seasonal increase in demand and Saudi Arabia’s voluntary 1 million bpd production cut.

Such a massive rate of inventory draws would remove the existing 150 million excess oil barrels from the market by the end of August. Steep draws would continue thereafter until either OPEC increases supply by more than 2 million bpd or prices surge to a level that reduces demand.

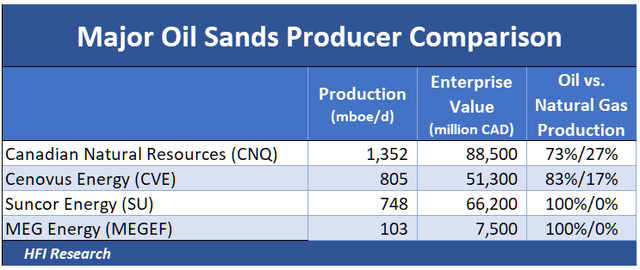

We favor Cenovus Energy (CVE), Suncor Energy (SU), and MEG Energy (OTCPK:MEGEF) as the best stocks to gain exposure to higher oil prices. These stocks feature dividend yields of 2.6%, 5.5%, and 0%, respectively. At different points over the next two years, all three companies will hit their debt targets and transition to paying out 100% of free cash flow as dividends or share repurchases. In terms of timing, we expect CVE to lead the pack, followed by SU and, lastly, MEGEF.

Based on our assessment of fundamentals and our conservative valuations, we believe that each of these stocks offers more than 50% upside if WTI heads back to $100 per barrel.

However, their returns could well exceed 50% at $100 per barrel WTI. We estimate that if these companies were to hypothetically pay out all their free cash flow as a dividend at $80 per barrel WTI, at their current stock prices they would trade at a 20% free cash flow yield. If their share prices were to increase to levels that compress their dividend yields to 10%—which reflects their risk relative to other yielding assets—they would double from current levels. These stocks’ huge appreciation and dividend potential are our main reasons for owning them.

Enter Canadian Natural Resources

Today we’re adding another Canadian E&P equity to our list: Canadian Natural Resources Limited (NYSE:CNQ). CNQ is the largest and, hands down, the best-managed of the Canadian oil sands operators. The company is unique, founded as a junior oil and gas producer in 1988 by Murray Edwards and Allan Markin. Since then, it has expanded primarily through low-risk acquisitions. It is run by a 21-member committee instead of by a singular CEO, which has worked well for shareholders. During the 2014-2020 downturn, CNQ continued to acquire attractive oil and gas properties that will benefit its shareholders over the coming years.

CNQ’s investment thesis is identical to the other oil sands operators. It possesses low-risk/low-decline assets, reserves that span several decades at current production rates, and substantial torque to higher oil prices.

The company has few negatives and many positives. The positives include the following:

- Total proved reserve volumes on a scale of international oil majors such as Shell (SHEL), BP (BP), and Chevron (CVX).

- 32 years of proved reserves at the current production rate, more than double that of CVE and SU, both of which combine probable and proved reserves in calculating their approximately 30-year reserve lives.

- The lowest corporate decline rate among the large Canadian oil sands companies.

- A presence in eight of the ten lowest-cost conventional oil and gas plays in North America.

- A dividend that has been paid annually for 23 consecutive years.

- A 25% return on capital employed in 2022, one of the highest among large-cap E&Ps.

- The highest return on capital employed over the last three years among the large Canadian oil sands companies.

- Dividends of $4.34 per share and repurchases of $4.91 per share in 2022.

- Planned 2023 production growth of 6% in 2023; 8% on a per-share basis.

Clearly, CNQ has been very well managed and owns some of the best oil-producing properties in North America.

CNQ’s stock is cheap. At C$90 per barrel WTI and $2.75 AECO, we estimate the company can generate free cash flow of approximately C$12.8 billion, or C$12.07 per share. At a 13% free cash flow yield, its shares would trade above C$90, which is our price target. CNQ shares are trading at C$72.80, so our valuation implies 23.6% upside. And for investors who seek income, the shares also offer an attractive 5.0% dividend yield.

At the moment, CNQ is returning 50% of cash flow after current dividends and capex in the form of share repurchases while using any remaining cash flow to pay down debt. Once its net debt is reduced to $10 billion, it plans to return 100% of free cash flow to shareholders as dividends and share repurchases. As of March 31, net debt stood at $12.0 billion. We expect the company to reach its $10 billion net debt target in the fourth quarter of this year. A policy of paying out 100% of free cash flow should serve as a catalyst for a higher share price.

Comparison with CVE and SU

In isolation, there’s little not to like and CNQ is an easy Buy. However, when contrasted with the other major oil sands producers, CVE and SU, it does have some negatives on a relative basis.

For one, CNQ possesses less torque to oil prices than CVE and SU. This is the case because CNQ produces the highest percentage of natural gas of the three, and it lacks refining assets to increase its netbacks. CNQ’s netback is $30.79, while CVE and SU are higher, at $36.04 and $52.40, respectively.

CNQ also trades at a higher multiple than CVE and SU. Its EV/Debt-Adjusted Cash Flow multiple is 5.3-times, versus CVE and SU, which trade at multiples of 3.5-times and 3.6-times, respectively. Clearly, investors are willing to pay up for CNQ, and rightly so. But its richer stock price means it has less upside if sector multiples re-rate higher.

While CVE, SU, and MEGEF stocks trade at prices that imply a 20% free cash flow yield at $80 per barrel WTI and $2.75 AECO, CNQ trades at a lower free cash flow yield of 13%, which reflects the company’s superior long-term track record and perceived lower risk.

CNQ has also been the go-to name for institutional investors, who tend to embrace longer-term time horizons than individual investors and impart lower volatility to the share price. The company is currently 77% institutionally owned, compared to CVE and SU, which have institutional ownership of 55% and 65%, respectively.

Even though CNQ has less than half the appreciation potential of CVE and SU, the shares could be a better choice for investors who seek more price stability and significantly lower volatility, coupled with still-attractive upside potential.

Conclusion

Ironically, the knock on Canadian Natural Resources Limited relative to our other favorite Canadian E&Ps is its high quality. CNQ is widely recognized as best-in-class among oil sands producers, but also among Canadian E&Ps in general. As a result, its stock trades at a premium multiple and is widely owned by buy-and-hold investors. Its year-to-date performance over recent months when oil-market sentiment has been bleak says it all: excluding dividends, CNQ stock is up 5.7%, whereas CVE is down 9.0% and SU is down 4.1%.

CVE and SU are lower-quality companies when compared with CNQ. But they possess more than double the upside potential amid a significant oil price rally, such as we expect later this year.

That said, CNQ is the best choice for investors who seek attractive long-term returns combined with more limited downside risk. We consider it to be one of the best “set-it-and-forget-it” alternatives among all E&Ps. We recommend that the most conservative investors who prize a relatively smooth ride higher as oil prices rise in the second half of 2023 buy CNQ today and stick with it for the long term.

Outperform!

At HFIR Energy Income, we strive to outperform with every pick recommendation. Since inception in 2021, the HFIR Energy Income Portfolio has returned ~65.5% with a return of ~35.4% YTD.

This article was written by

I have been a full-time professional energy investor since 2015, specializing in deep value opportunities and special situations. I have managed a private investment partnership since 2007 and separately managed accounts since 2020. Prior to managing the partnership, I served in various investment and research roles in the financial industry since 2000.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVE, SU, MEGEF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.