Zillow: Rebuilding Its Moat In The Real Estate Kingdom

Summary

- Zillow Group, Inc.'s core operations remain intact despite the negative investor sentiment caused by its iBuying ventures.

- Zillow has the potential to generate around $300 million in free cash flows by 2024, similar to its strong performance in 2020.

- The market has overreacted to Zillow's failed iBuying endeavors, overlooking the company's value proposition and potential for new revenue streams.

- Zillow's profitability profile, with a history of positive free cash flows, suggests the ability to stabilize operations and report strong cash flows in the future.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

SDI Productions/E+ via Getty Images

Investment Thesis

Zillow Group, Inc. (NASDAQ:Z) has lost (nearly) all its favor with investors. However, I believe that Zillow's core operations have not been permanently damaged through its iBuying escapades.

In actuality, I believe that Zillow could in 2024 return to generating around $300 million in free cash flows. A figure that in line with its last strong year, 2020, when it generated north of more than $350 million in free cash flows.

That being said, the bullish investment thesis is not without blemishes, as Zillow still has to prove it can report stable revenue growth rates. But I believe that investors are already more than pricing in that insight already.

On balance, its outlook points to a positive risk-reward profile.

Investors Are Too Eager to Push Aside Zillow's Moat

Zillow's value proposition lies in its ability to provide comprehensive real estate information and services to both home buyers and sellers. Zillow and its other websites, such as Trulia, are the default go-to destination for buyers, sellers, and renters.

Irrespective of the fact that its share price has meaningfully sold off from its all-time highs, there's still tremendous value in the company.

What's more, I believe that the market has dramatically overreacted to Zillow's failed iBuying endeavors.

More specifically, isn't a business supposed to try to develop new revenue streams? When Alphabet (GOOGL, GOOG) spends billions per year on its moonshot, investors call Alphabet disruptive and futuristic.

Whereas, when Zillow tries to embrace new ideas to generate revenues, investors positively shun its business. Even though, as we'll discuss next, Zillow is already way past that tumultuous period of 2021-2022.

Looking Ahead to 2024

Zillow has had a horrible couple of years. But this narrative is now in the rearview mirror. What matters to investors now is what will Zillow's growth rates look like in 2024 and beyond.

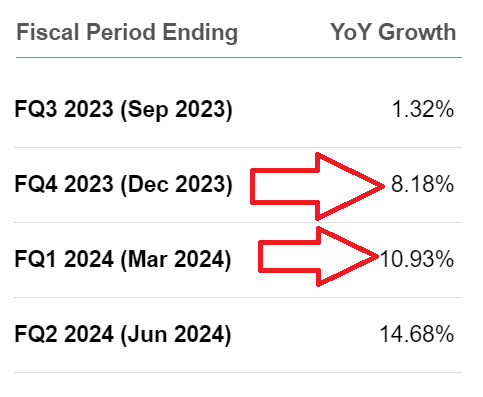

Succinctly put, can Zillow be counted on to grow by at least 10% CAGR after Q2, 2023? Recall, Q2 2023 is the last quarter where Zillow has tough comparables with the prior year, here Zillow still had its iBuying program winding up.

SA Premium

Indeed, as you see above, analysts following Zillow are expecting that as Zillow starts Q4 2023, its revenue growth rates should revert back to high single digits, before climbing higher with each sequential quarter.

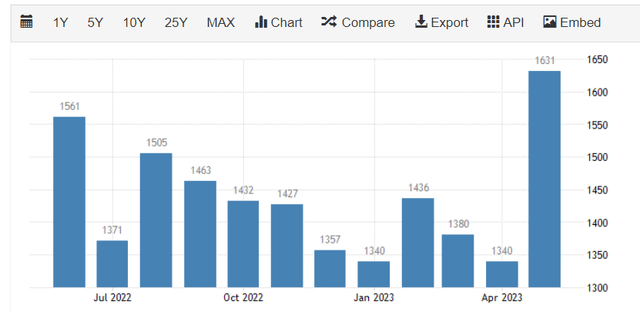

Furthermore, keep in mind that in the past few weeks we have seen housing starts jump meaningfully higher, see below.

This should be clear evidence to everyone that irrespective of the high-interest rate environment, the underlying data isn't lining up with a housing market that is on its knees. That may have been the case at the start of 2023, but what we see above is not some variability in the data.

No, it clearly shows homebuilding starts are very strong. Readers may retort that homebuilding is only indirectly relevant to Zillow's core value proposition.

However, I push back that simply because the strength in the housing market is showing up in different pockets that are different from previous housing cycles, does not mean it's insignificant.

This is my critical contention: I believe that the market is trying to sniff out the bottom of the housing cycle, and only in hindsight will it be obvious that this would have been a good time to consider Zillow.

Profitability Profile is the Crown Jewel

Zillow has a problem delivering stable revenue growth rates. However, Zillow's core business never had any problem in being highly free cash flow positive.

Even if we assume that in 2023, Zillow will only generate a small amount of free cash flow, say around $100 million, I suspect that Zillow has what it takes to return to generating more than $300 million of free cash flow in 2024, slightly lower than it yielded in 2020.

What is more, given the brutal couple of years that Zillow has had, I strongly believe that management will now be significantly more focused on stabilizing its operations and reporting strong cash flows, rather than seeking to maximize its revenue growth rates.

The Bottom Line

Zillow has lost favor with investors due to its iBuying ventures.

However, I believe that the company's core operations remain intact and can bounce back. I expect Zillow to generate around $300 million in free cash flows in 2024, similar to its strong performance in 2020.

While Zillow needs to demonstrate stable revenue growth rates, I believe investors have already factored in this concern. Overall, the outlook suggests a positive risk-reward profile.

Looking ahead to 2024, the focus is on Zillow's growth rates, and analysts anticipate a return to high single-digit revenue growth.

Zillow's profitability profile has been robust, even though revenue growth rates have been inconsistent.

In conclusion, I believe Zillow Group, Inc. has the potential to generate over $300 million in free cash flow in 2024, emphasizing management's focus on stability and strong cash flows over maximizing growth rates.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.