Global Medical: The 9.5% Yield Appears Covered Despite Pressure From Interest Rates

Summary

- Global Medical REIT's stock has been negatively impacted by rising interest rates, which have increased the company's cost of borrowing and reduced its future growth prospects.

- The stock's dividend yield has now been pushed to 9.5%, reflecting the current macro landscape and Global Medical's relatively higher-risk investment case.

- Despite these challenges, Global Medical REIT's dividend will likely remain covered by its underlying cash generation, presenting a compelling income-oriented opportunity for yield-hungry investors.

- Wheel of Fortune members get exclusive access to our real-world portfolio. See all our investments here »

JazzIRT

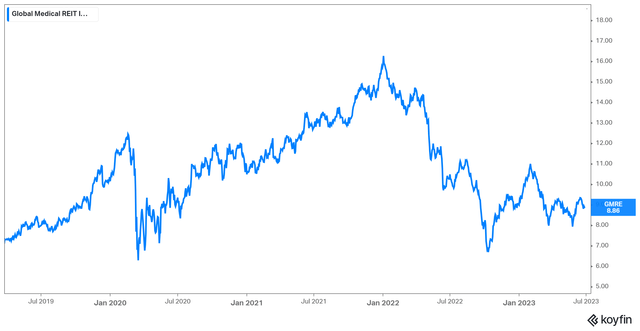

Shares of Global Medical REIT (NYSE:GMRE) have had a hard time over the past couple of years, currently exchanging hands below their pre-pandemic levels. The stock's decline during this period against Global Medical's dividend hikes has significantly boosted the dividend yield, now hovering at a substantial 9.5%.

In my view, Global Medical's stock decline is quite justified, as rising interest rates are pressuring its profitability and overall growth prospects. That said, I believe that the REIT's dividend should remain sufficiently covered. Hence, income-oriented investors may find the stock to be a compelling high-yield investment opportunity.

Let's break this down!

Is Global Medical Stock's Decline Justified?

In my view, Global Medical stock's decline is entirely justified by the recent, hasty interest hikes that have impacted its investment case in two ways: Firstly, through a valuation compression, and secondly, through a squeezing in the REIT's future growth prospects. The first is more of an industry-level impact, while the second is more of a company-level compact. To explain this further...

Impact On Valuation:

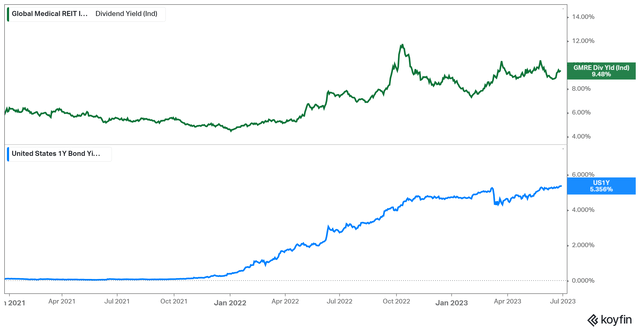

The first and most prominent reason that shares of Global Medical have struggled to find their footing in recent quarters is due to the effect of rising interest rates on the stock's valuation.

When interest rates rise, the "risk-free" rate also increases, providing investors with a higher return on low-risk investments such as government bonds. As a result, the opportunity cost of holding dividend stocks becomes more significant. Hence, investors may be less inclined to hold dividend stocks when they can earn a similar or higher income with less risk by investing in bonds or other fixed-income securities.

This concept implies that many investors have chosen to shift their capital from Global Medical's shares during the past couple of years to potentially other better-looking, income-generating opportunities on a risk-adjusted basis. For this reason, the stock's yield has now been pushed to a substantial 9.5%, supposedly reflecting the higher risk attached to it.

GMRE's Dividend Yield & US 1Y Bond Yield (Koyfin)

Impact On Profitability & Growth Prospects

The second, more company-specific impact of rising rates is its effect on Global Medical's overall profitability and growth prospects. When interest rates rise, the cost of borrowing for REITs such as Global Medical also rises. This is because REITs typically rely on the issuance of debt (and equity) to finance their real estate acquisitions and property developments. As interest rates go up, the cost of servicing their existing debt increases, and new debt becomes more expensive. This higher cost of capital can have a notable impact on a REIT's bottom line, something that was particularly evident in Global Medical's most recent Q1 results.

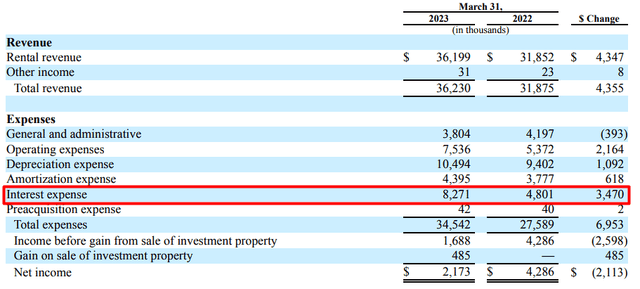

Q1-2023 Quarterly SEC filing (SEC filings)

As you can see, Global Medical's total interest expense for the quarter was $8.3 million, compared to $4.8 million in the prior-year period, an increase of roughly 73%.

While this increase was partially due to higher average borrowings, it was mainly attributable to higher interest rates between the two periods. In fact, the weighted average interest rate of Global Medical's debt for the quarter landed at 4.27% compared to 2.87% in Q1-2022. Given that changes in interest expenses can wildly swing Global Medical's profitability, you can see why some investors may feel discouraged from holding the stock in such an environment. To quantify this, the $4.3 million increase in interest expenses translates to a $4.3 million/65.5 million shares = 6.6 cents. With the company recording AFFO/share of $0.23 and the quarterly dividend standing at $0.21, it's pretty apparent how a swing of 6.6 cents can materially affect Global Medical's profitability and overall dividend coverage.

At the same time, raising funds to finance future growth has now become significantly more expensive. Even if the company chooses the equity method over debt now that rates have risen substantially, equity has also become quite expensive. If the company were to issue stock at these levels, the cost (i.e., the 9.5% dividend yield) would likely be too high, increasing the chances of a dividend cut. Hence, notable property acquisitions will likely remain off the table for the time being.

The Dividend Remains Covered, Nonetheless

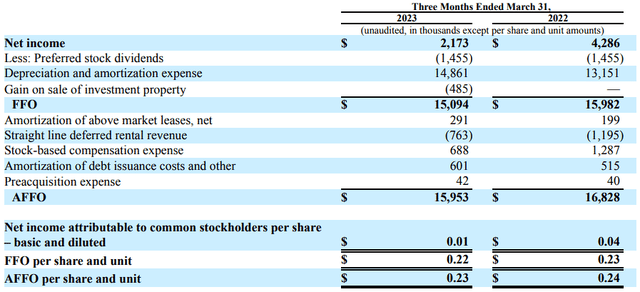

Despite the significant impact rising interest rates can have on Global Medical's profitability as well as its growth prospects, I believe that the dividend will likely remain sufficiently covered. Even with significantly higher interest expenses, which partially resulted in AFFO per share declining by one cent to $0.22, the company generated enough cash to pay the $0.21 quarterly dividend.

FFO and AFFO Reconciliation (SEC filings)

That said, the margin of error is slim. Specifically, Global Medical's quarterly dividends payable in Q1 amounted to $15.85 million, so the AFFO of $15.95 million hardly covered this amount.

Takeaway - Why GMRE Stock May Be Worth Holding

On the one hand, the decline in shares of Global Medical makes total sense given the impact of rising interest rates both in the way investors value the stock (i.e., opportunity cost against holding other assets) and with regard to its impact on profitability and further expansion prospects.

On the other hand, the stock may be worth holding, especially for investors seeking high yields. For now, the dividend remains covered by Global Medical's cash generation, while its lease profile should help management plan the costs they can control in advance to sustain payouts. Since the REIT's weighted average lease term stands at six years (including a weighted average rent escalation rate of 2.1%), management benefits from high-quality cash flow visibility prospects. Hence, with prudent cost management, they can try to ensure AFFO/share remains above the quarterly dividend moving forward.

This could last until interest rates hopefully come down in the medium term when debt refinancing and the stock's very own valuation improve, allowing the company's bottom line to breathe easier and potentially encouraging further growth developments. In the meantime, the hefty dividend yield should make for a decent catalyst to hold the stock.

Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

- WoF is 1 out-of-only 3 services with 50+ reviews that have a 5* rating.

- WoF is 1 out-of-only 7 services with 25+ reviews that have a 5* rating.

- Single, uncorrelated, trading ideas [ >250/year, on average].

- Managed portfolios, aim at outperforming SPY on a risk-adjusted basis.

Join The Wheel. Build & Protect Your Fortune.

This article was written by

Hi there!

I hold a BSc in Banking and Finance. Here, on Seeking Alpha, I cover a variety of growth stocks and income stocks, including identifying those with the highest expected return potential, and a solid margin of safety.

Currently contributing as Promoting Author to the "Wheel of Fortune" marketplace.

Feel free to contact me at any time, and follow me here on S.A. for regular content and updates!

Happy investing!

Nick

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)