HPI: 9.9% Yielding Preferred Fund

Summary

- HPI is one of the more popular closed end funds for preferred shares.

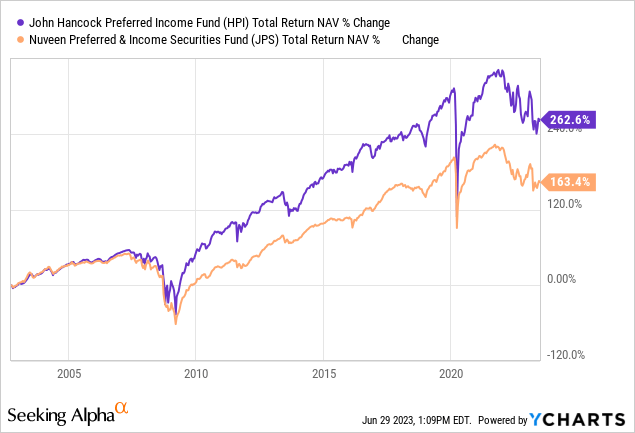

- The very long term (18 years) performance has been fantastic.

- The last 7.5 years have produced around 3% annually.

- Distribution likely gets nipped in the next 12 months and that is not the only risk.

- Looking for a helping hand in the market? Members of Conservative Income Portfolio get exclusive ideas and guidance to navigate any climate. Learn More »

Geo-grafika/iStock via Getty Images

Corporations issue various types of securities to raise capital. The type determines the return potential and risk level, with the two often being inversely proportionate to each other. Investors buying corporate debt, settle for a lower return in exchange for being higher up in the food chain in terms of return of capital if the issuer runs into liquidity issues. Those that do not care to see a ceiling to their returns, buy the common equity. The common shareholders are prepared to take it on the chin if things go wrong. Investors that want a bit of both, higher returns than debt holders and lower risk than common shareholders, buy hybrid securities. There are various types of these such as debentures, warrants, options, and preferred stock, which will be focusing on today.

The preferred stock offers a periodic and predictable dividend, with the yield being higher than that received by the debtholders. If the issuer runs has financial woes, the preferred stockholders are prioritized over the common stock in terms of dividends and return of capital. While there is no set maturity date like for bonds, the issuer can exercise its right to redeem these at par on or after a certain date, commonly known as the call date. The market price of this type of security is extremely sensitive to interest rate fluctuations, with the two generally moving in opposite directions. Corporations also tend to call the shares when the interest rates fall so that they can reduce their cost of capital with a new issuance. Investors, on the other hand, move on to higher yielding securities with the same risk profile, when interest rates rise. There is less of an exodus, if the dividends are reset periodically based on variable rate.

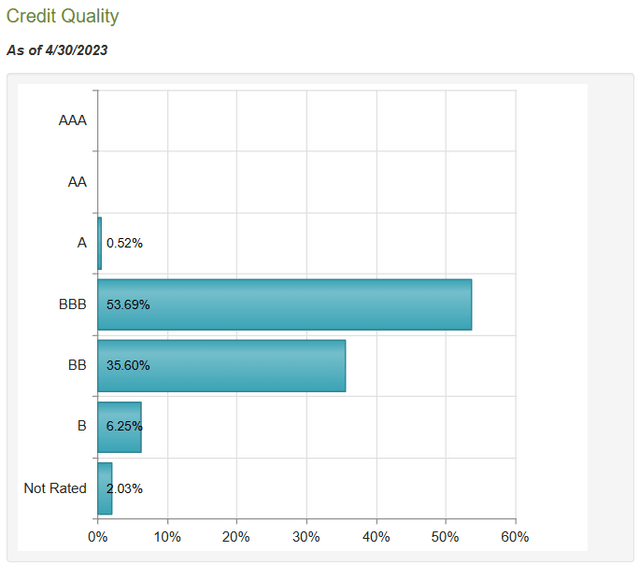

John Hancock Preferred Income Fund (NYSE:HPI) is a closed end fund, that as its name suggests, is centered around preferred securities. These could be vanilla preferred stock or convertible preferred securities, and includes a combo of both fixed and adjustable rate types. The objective of this fund is to provide a higher current income alongside preserving capital for its unitholders. HPI has one eye on the capital preservation ball with the mandate that at least 50% of the securities held have an investment grade rating. The fund was on course, two months ago at least.

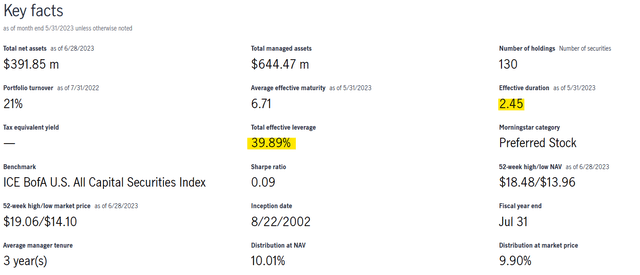

CEF Connect

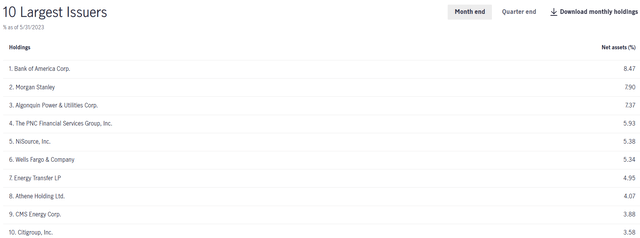

At last count, the fund held around 130 securities, with close to 60% of them from 10 issuers.

Fund Website

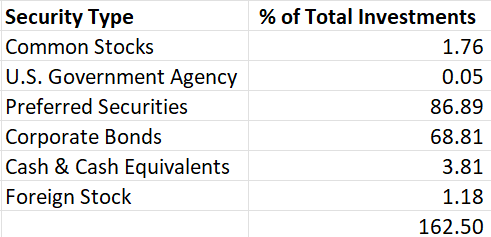

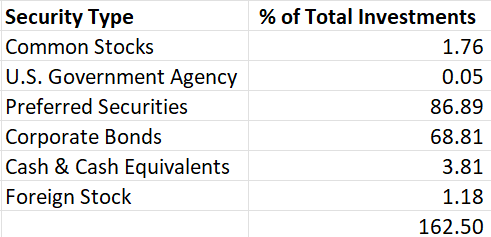

Using the holdings data available on the website, we can see that although primarily made up of preferred securities, the fund does hold a good chunk of bonds.

HPI, Compiled By Author

Performance

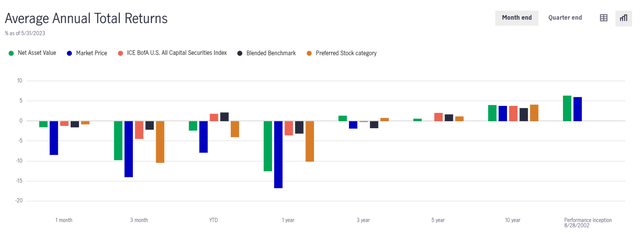

We had noted earlier that the fund aims to provide high income and preserve capital for its investors. The 2023 semi annual report makes note of a secondary objective, that is to grow capital to the extent consistent with its two primary objectives. It has not got a chance to do that in its two decade long existence.

Fund Website

We delve into the two obvious culprits. The first is what happened to the price of the underlying securities. Here the fund's website might appear confusing to some. It states an effective duration of 2.45 years, which only applies to securities which have a maturity date.

Fund Website

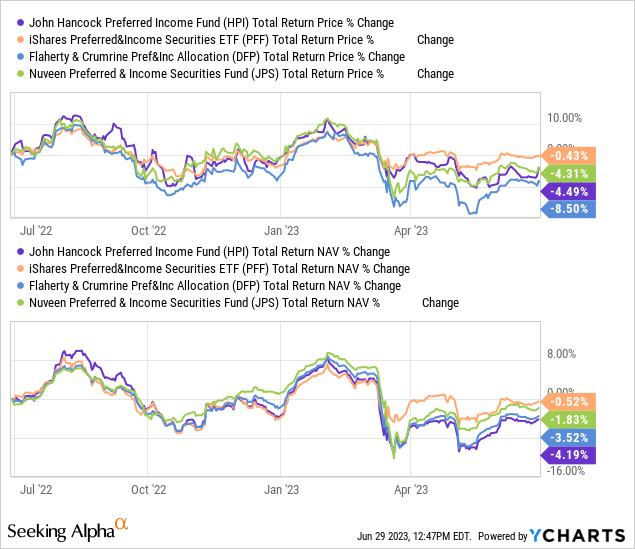

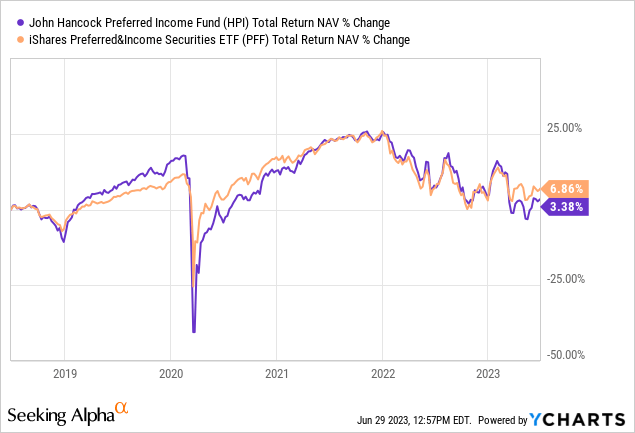

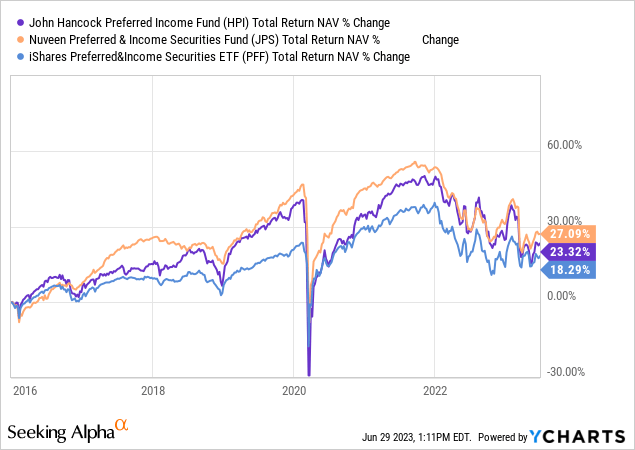

The bulk of the holdings are preferred shares and they are far more sensitive to movements in interest rates as they are perpetual securities. So HPI has suffered like other preferred share funds. We show below the comparison with iShares Preferred and Income Securities (PFF), which is an ETF and two comparable closed end funds. The returns are shown on price and on NAV. The latter differs from the former as it is unimpacted by premium/discount changes.

HPI has not done too well recently but that is to be expected from preferred shares in the face of a rapid monetary tightening cycle.

In order to meet its high income objective, it has to take leverage. This brings us to the second culprit for the underperformance and it is not insignificant at over 62%.

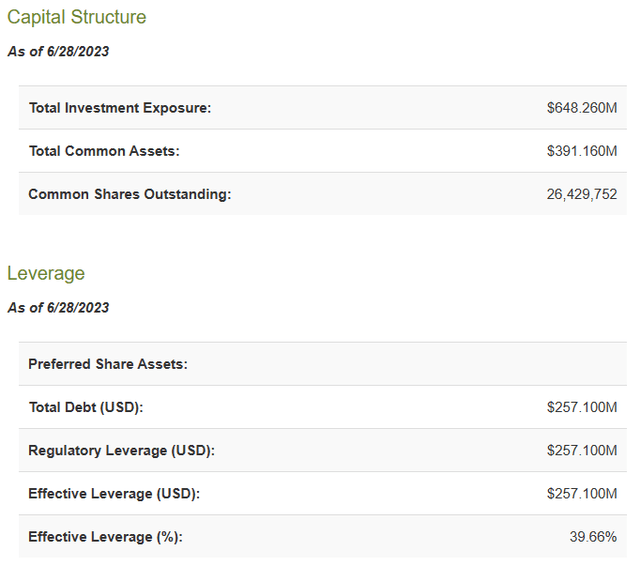

CEF Connect

Yes, we know the screenshot above states 39.66% and that is when you divide leverage by total assets. That is a dangerous way of understating risks unfortunately embraced by everyone. We prefer debt divided by common assets and that comes to 62.5%. In fact you can see this straight when you look at the data from their spreadsheet.

HPI, Compiled By Author

HPI fund invests borrowed funds to magnify the returns in order to meet the "high income" objective for its unitholders. This works like a charm if the interest paid on borrowed funds is lower than the income earned on the investments. The low or zero interest rate era we all enjoyed over the last decade or so were conducive for and generally rewarded this strategy. Times are different now.

tradingeconomics.com

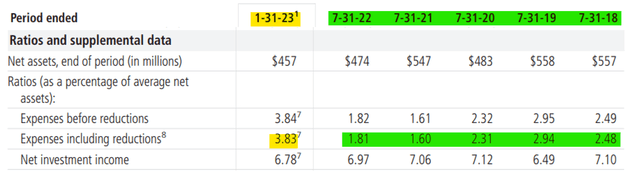

Times like these cause jump in expenses as reflected in the semi annual numbers for HPI.

Fund Semi Annual Report

The 3.83% in expenses is an annualized number of which 2.54% belongs to interest expense. In comparison, the interest expense portion for the fiscal years shown above was 0.62% (2022), 0.40% (2021), 1.07% (2020), 1.69%(2019), and 1.24% (2018). We expect that the annual report for the fiscal year ending July 31, 2023 will have an even higher interest expense, beating the annualization of the above shown six month report.

Outlook & Verdict

You can see that when times are good, HPI tends to outrun its vanilla competitors like PFF. See the pre-2020 era or the recovery from the COVID-19 lows. When times are tough the leverage bites hard. Hence over the last 5 years, investors have averaged 0.67% a year.

Currently the yield at 9.9% looks insanely high for what the fund can generate. Post leverage and management fees, we see 6-7% as the best case outcome. The asymmetric risk here is if the fund is forced to deleverage in a downturn and there you could see another 5 years with 1% annual returns. The fund is popular because of its longer term returns and we have to admit they are not too shabby.

But the golden era ended for this fund by 2016. Over the last 7.5 years annual returns have been near 3% annually.

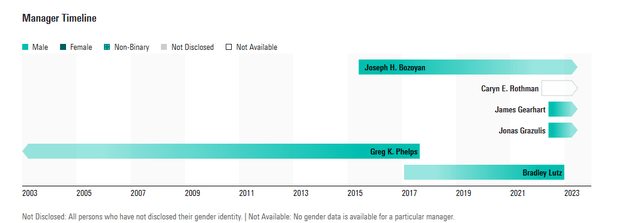

Perhaps the picture below might explain it.

Morningstar

At present with our outlook for the economy, we are overweighting fixed income. So we like preferred shares and are looking for opportunities to add. We just added one this week with a 7.5% yield. But a closed end fund with 60% effective leverage (the way we calculate it), is not one we are remotely interested in. Morningstar gives it two stars.

Morningstar

Our thinking is similar though our scale goes in the other direction. HPI gets a 7 on our potential pain scale.

Author's Pain Scale.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)