2023 Midyear Outlook: New Regime, New Opportunities

Summary

- Geopolitical fragmentation and rewiring of global supply chains are set to drive up production costs.

- Economic relationships investors have relied upon could break down in the new regime.

- Relative value opportunities from potential market mispricings are likely to be more abundant.

- AI has been turbocharged by the roll-out of ChatGPT and other consumer-friendly tools.

- Short-term bond yields have surged as central banks have raised rates.

TERADAT SANTIVIVUT

We are in a new macro regime that provides different but abundant investment opportunities. Persistent supply constraints are compelling major central banks to hold policy tight, creating greater macro and market volatility. We find opportunities by getting granular within asset classes and harnessing mega forces: structural shifts like the rise of artificial intelligence and the rewiring of Philipp Hildebrand globalization that can drive returns now and in the future.

The investment opportunities in this economic environment are different from those in the past, we think. We have updated our investment themes as a result, kicking off with holding tight. Markets have come around to the view that central banks will not quickly ease policy in a world shaped by supply constraints - notably worker shortages in the U.S. We see central banks being forced to keep policy tight to lean against inflationary pressures. This is not a friendly backdrop for broad asset class returns, marking a break from the four decades of steady growth and inflation known as the Great Moderation.

Yet we are pivoting to new opportunities - our second theme. Greater volatility has brought more divergent security performance relative to the broader market. Benefiting from this requires getting more granular and eyeing opportunities on horizons shorter than our tactical one. We go granular by tilting portfolios to areas where we think our macro view is priced in.

This leads to our third theme: harnessing mega forces. These are structural changes we think are poised to create big shifts in profitability across economies and sectors. The mega forces are not in the far future - but are playing out today. The key is to identify the catalysts that can supercharge them and the likely beneficiaries - and whether all of this is priced in today.

These mega forces are digital disruption like artificial intelligence (AI), the rewiring of globalization driven by geopolitics, the transition to a low-carbon economy, aging populations, and a fast-evolving financial system. We think granularity is key to find the sectors and companies set to benefit from mega forces.

We update our investment playbook to combine our core macro view with granular opportunities and exposure to mega forces. Slowing growth and sticky inflation in major economies underpin our preference for emerging markets (EMS) and income.

Developed market (DM) equities remain the biggest building block by far in our portfolios, especially U.S. stocks, even as we slightly underweight them. We implement an overweight AI as a mega force. Our tilt toward quality already captures AI beneficiaries. We get granular to achieve portfolio breadth: We like Japanese equities within DM stocks. We prefer EM equities and local EM bonds. For income, we prefer short-dated U.S. Treasuries, U.S. mortgage-backed securities, and high-grade credit.

On a strategic horizon of five years or longer, we like private credit as an area that may gain from the pressure on traditional banks and tighter credit conditions.

The new regime rolls on

The last six months have provided further evidence that we are in a new regime of greater macroeconomic and market volatility. To recap, this regime is the result of a range of supply constraints: They mean DMs can no longer produce as much without sparking higher inflation. We think supply constraints will be a permanent feature due to the mega forces we see shaping the outlook.

Geopolitical fragmentation and rewiring of global supply chains are set to drive up production costs. On net, we see government policies in the transition to a low-carbon economy driving up energy costs over the next decade. Aging populations mean an ever-rising share of the population is past retirement age, resulting in worker shortages. That's a key constraint fueling U.S. inflation now as a tight labor market keeps wage growth elevated. The rise of artificial intelligence (AI) could help offset some of these supply constraints thanks to productivity gains. Yet that impact will likely only be felt in decades, not years.

Central banks have a harder job in the new regime. They don't have the tools to resolve supply constraints. They face a starker trade-off between growth and inflation - and we've seen them hike interest rates at the fastest pace in decades as they lean toward controlling inflation. And yet stubborn inflation persists, even as recession hits Europe and, on some measures, the U.S. This is the new regime in action.

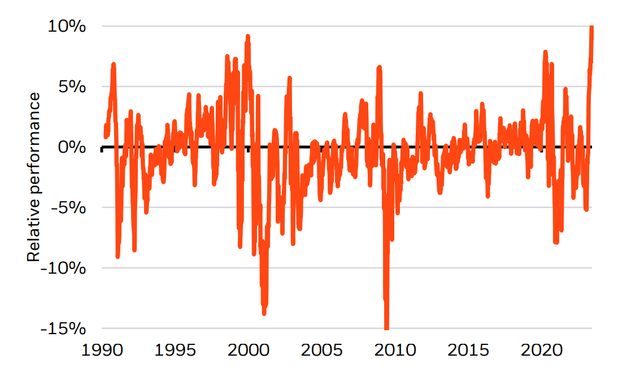

Yet equities have rebounded this year, led by tech. Those gains mask a sharp divergence in performance, with many stocks lagging the broader index. See the chart. It illustrates why getting granular in portfolios in the new regime is likely to be more important than relying on broad asset class returns. First, it means selecting segments of the market where the macro outlook is better reflected in prices. Second - as in the case of tech and AI - it means seeking opportunities to harness mega forces that not only shape the macro outlook but are set to empower and disrupt sectors and companies across the globe, too.

An unusual equity market

S&P market cap vs. equal weight index relative performance, 1990-2023

Chart takeaway: S&P 500 gains have become increasingly concentrated in a handful of tech stocks, surpassing levels seen in the 2000s tech boom. We think this unusual equity market shows a mega force like AI can be a big driver of returns even when the macro environment is not your friend.

Past performance is not a reliable indicator of current or future results, and index returns do not account for fees. It is not possible to invest directly in an index. Source: BlackRock Investment Institute, with data from Refinitiv Datastream, June 2023. Notes: The chart shows the difference between the three-month price index change of the S&P 500 Composite Index, whose performance is determined by the market capitalization of the underlying stocks, and the S&P 500 Equal Weight Index, which treats the performance of each underlying stock equally, on a rolling basis since 1990.

The new regime - shaped by persistent supply constraints - offers abundant yet different investment opportunities compared with the past.

Holding tight

We've moved from a regime where demand shocks dominated the macro environment to one where supply constraints dominate. These constraints - as discussed on the previous page - are set to stoke ongoing inflationary pressures.

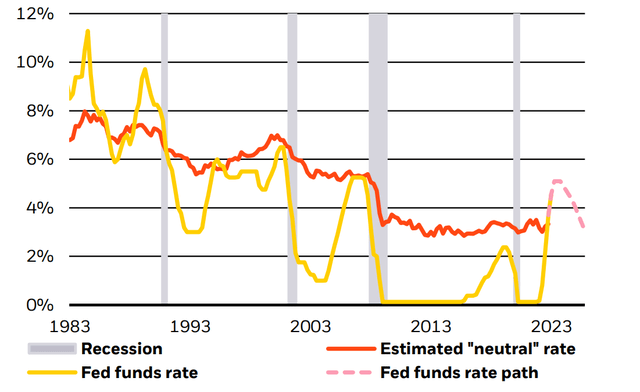

This has two implications. First, central banks will likely have to systematically hold policy tight to lean against such price pressures. That's in stark contrast to the past 30 years when broad disinflation prompted central banks to keep monetary policy easy. And in the event that rate hikes caused financial cracks - such as the collapse of a few U.S. regional banks earlier this year - or faltering economic activity, central banks would have been quick to come to the rescue with rate cuts to help stimulate activity. See the chart.

That's no longer the case. And it is a sea change from the low interest rate environment that prevailed before the pandemic. We see policy rates staying higher for longer in major economies.

The investment upshot? Income is back. That motivates our overweight to short-dated U.S. Treasuries.

The second implication is that economic relationships investors have relied upon could break down in the new regime. The shrinking supply of workers in several major economies due to aging means a low unemployment rate is no longer a sign of the cyclical health of the economy. Broad worker shortages could create incentives for companies to hold onto workers, even if sales decline, for fear of not being able to hire them back. This poses the unusual possibility of "full employment recessions" in the U.S. and Europe. That could take a bigger toll on corporate profit margins than in the past as companies maintain employment, creating a tough outlook for DM equities.

Our bottom line: We see significant investment opportunities in the new regime. They are about finding granular opportunities within asset classes, and not relying on the macro environment.

Staying restrictive

U.S. Fed policy rate and projections vs. neutral rate estimate, 1983-2025

Chart takeaway: The Federal Reserve has kept monetary policy loose since the start of the 1990s. Recent rapid rate hikes have now pushed policy into restrictive territory. We think the Fed's own plans to cut policy rates may be unrealistic.

Forward-looking estimates may not come to pass. Source: BlackRock Investment Institute, New York Fed, U.S. Bureau of Labor Statistics, with data from Haver Analytics, May 2023. Notes: The chart shows the Fed funds rate, an estimate of the Fed funds rate path, and an estimate of the nominal "neutral" rate. The nominal neutral rate is a hypothetical estimate of the central bank interest rate that will neither stimulate nor depress economic growth. The neutral rate estimate is from the Holston Laubach Williams (2017) estimate of (real) neutral rate plus an estimate of expected inflation from the model by D'Amico, Kim, and Wei (2018).

Pivoting to new opportunities

The higher macro volatility we are seeing in the new regime results in greater market volatility - conditions that don't augur well for broad asset class exposures, in our view. We think that creates other opportunities to generate returns by getting more granular with exposures and views.

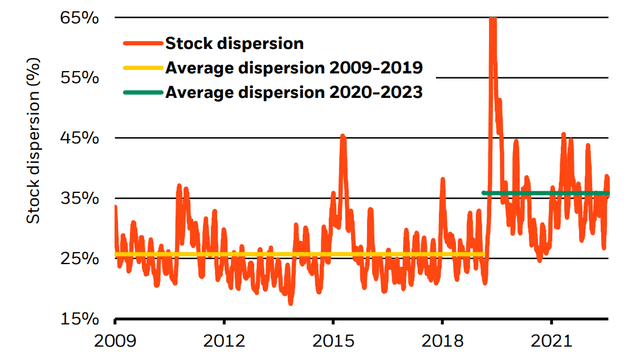

Our approach to finding such opportunities is to overlay such granularity on our macro-based asset class views. We think dispersion within and across asset classes - or the extent to which prices deviate from an index - will be higher in the new regime amid the various crosscurrents at play, allowing for granularity

The chart on the right shows dispersion within a broad U.S. equity index has ramped up as the new regime took hold. That offers more ways to build portfolio "breadth" via uncorrelated exposures, in our view.

We think it also means security selection, expertise, and skill are even more important to achieving above-benchmark returns. In the near term, finding securities where the macro outlook is already priced could yield opportunities, in our view.

Relative value opportunities from potential market mispricings are also likely to be more abundant. For example, we think the current pricing of future euro area inflation above future U.S. inflation is unlikely to pan out given more aggressive European Central Bank rate hikes.

We recognize that market narratives may switch more quickly in this new regime. So we aim to understand how market pricing is changing and take advantage of mispricings as we see them develop. See page 14.

Navigating potential returns in this new regime means eyeing opportunities on horizons shorter than our six- to 12-month tactical horizon.

Greater divergence

Range of individual stock returns vs. Russell 1000 index, 2009-2023

Chart takeaway: The performance of Russell 1000 stocks has become much more varied relative to the index after the pandemic. We think this helps create investment opportunities.

Past performance is not a reliable indicator of current or future results, and index returns do not account for fees. It is not possible to invest directly in an index. Source: BlackRock Investment Institute, with data from Refinitiv, June 2023. Notes: The chart shows the dispersion in Russell 1000 stock returns based on a 21-day moving average (dark orange line), average dispersion from July 2009 after the global financial crisis through 2019 (yellow line), and average dispersion from 2020 through June 2023 (green line).

Harnessing mega forces

We see the new macro regime - and asset returns - being shaped by big structural forces. The key, in our view, to gleaning investment opportunities is to identify catalysts that supercharge these forces and how they interact with each other. We then aim to find sectors and companies that could benefit - and track whether markets have priced this in yet.

AI has been turbocharged by the roll-out of ChatGPT and other consumer-friendly tools. We think markets are still assessing the potential effects as AI applications could disrupt entire industries. It goes beyond sectors. Increasing digitalization also brings greater cybersecurity risks across the board.

Geopolitical fragmentation, like the strategic competition between the U.S. and China, is set to rewire global supply chains, we think. We see governments reshoring operations to align production and trade more closely with allies - a potentially disruptive break from decades of globalization.

We see the low-carbon transition causing economies to decarbonize at varying speeds due to policy, tech innovation, and shifting consumer and investor preferences. Markets have historically been slow to fully price in such shifts. We see opportunities tied to the transition's large capital reallocation.

We see aging populations and shrinking workforces in DM economies as a structural drivers of the new regime.

We see profound changes in the financial system. Higher interest rates are accelerating changes in the role of banks and credit providers, shaping the future of finance.

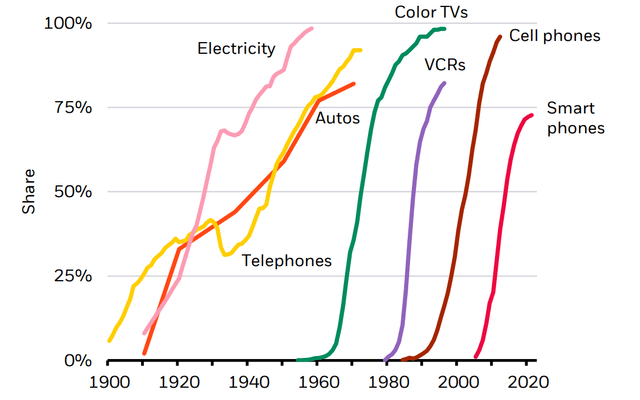

Technological innovation is fundamental to these mega forces and connects some of them. As we have seen historically, the adoption of new technology can be rapid - and transform economies. See the chart. And sometimes markets can become exuberant in extrapolating from these adoption rates. These mega forces cut across public and private markets, asset classes, and regions.

Rapid transitions

U.S. technology adoption rates, 1901-2021

Chart takeaway: Transitions can be shaped by the rapid adoption of technology. Markets can underappreciate the speed of transitions, creating investment opportunities. Conversely, exuberance over their potential can also cause temporary price spikes.

Source: BlackRock Investment Institute, with data as of 2021 from Federal Communications Commission, U.S. Census Bureau, World Bank, and Statista, June 2023. Notes: The chart shows adoption rates for various technological innovations based on household ownership, except for cell phone and smartphones data, which are based on ownership per capita.us

Evolving our playbook

Broadening our approach to tactical asset allocation

Broad and static investment solutions won't take you as far in this new regime as in the past, in our view. We think it calls for granularity and nimbleness instead. We are extending our investment playbook to broaden the range of available opportunities based on what's in the price.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds, strategy, or security in particular. Source: BlackRock Investment Institute, June 2023.

Dynamic and nimble

We think outperforming market returns in the new regime requires more dynamic and nimble strategic portfolios. Stable inflation and economic growth in the Great Moderation supported an approach that relied on static, set-and-forget allocations to public equities and bonds. Today's conditions: heightened volatility and tight monetary policy don't bode well for the static approach.

Under these new conditions, we don't see bonds offering the same diversification from equity selloffs that they used to. Instead, fixed income now offers income: Short-term bond yields have surged as central banks have raised rates. That reinforces the appeal of real income in excess of inflation in portfolios.

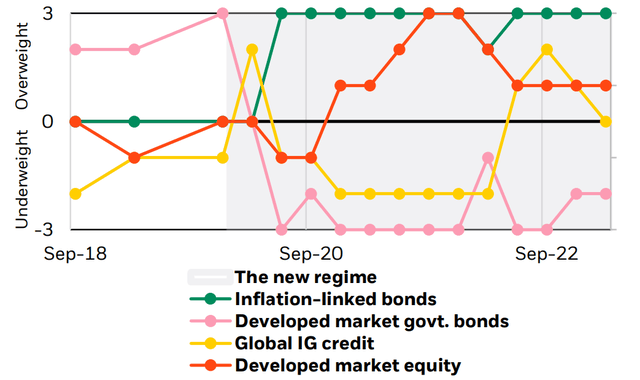

We think staying static with strategic views risks missing out on opportunities to take advantage of the market shocks that come with the volatility of the new regime. Our strategic tilts have changed more frequently as a result. See the chart.

For example, in 2020 we went from maximum overweight government bonds to maximum underweight as yields plunged from the central bank's response to the pandemic. We have stayed underweight since given the risks we have seen from inflation.

Over the past year, we cut global investment grade credit, going neutral on the banking troubles causing tighter credit conditions. We upgraded private credit to an overweight. We think private credit could fill the void left by banks curbing lending. See page 13.

We stay overweight developed market equities on a strategic horizon, seeing cumulative returns greater than bonds.

Staying nimble

Our strategic tilts to select asset classes, Sept. 2018 - March 2023

Chart takeaway: Strategic views need to change more frequently to reflect the new, more volatile regime. Investors could "set and forget" strategic allocations before. But we think being static risks missing out on the opportunities that could emerge.

This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise - or even estimate - of future performance. Source: BlackRock Investment Institute, data as of 31 March 2023. Notes: The chart shows how our strategic views for selected asset classes have changed over time. The allocation shown is hypothetical, may differ by jurisdiction, and does not represent a real portfolio. It is intended for information purposes only and does not constitute investment advice. Index proxies: Bloomberg Barclays US Government Inflation-Linked Bond Index, MSCI World US$, Bloomberg Barclays Global Credit Index, Bloomberg Barclays U.S. Credit Index, Bloomberg Barclays Global Aggregate Treasury index. We use BlackRock proxies for selected private markets due to a lack of sufficient data. These proxies represent the risk factor exposure mix we believe represents the economic sensitivity of the given asset class.

Digital disruption and AI

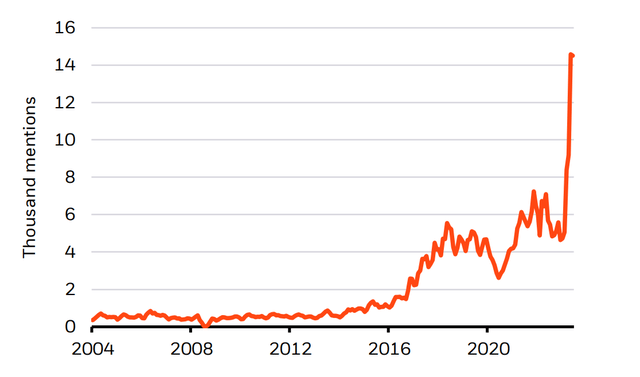

Artificial intelligence (AI) and the digital disruption of established sectors and economies are going mainstream. An explosion in computational power and data has sparked AI's ascent. Advances in machine learning have brought new AI tools to the fore. The ability of these tools to complete some tasks done by humans and analyze huge sets of data have major implications - and have sparked market euphoria. Companies are increasingly talking about AI - and seeking highly skilled workers with machine learning and AI expertise. See the chart.

The wider range of tasks that can be automated now means deploying these new innovations may boost productivity. White-collar jobs are at an increased risk of automation than before. The resulting cost savings could boost profit margins - companies with high staffing costs or a large share of tasks that could be automated stand to benefit the most. But they could also get left behind if they don't adapt.

Semiconductors are key components for AI tools and models, and market excitement over AI's potential has triggered a sector rally. More capital may flow into the production of semiconductors, especially as countries such as the U.S. provide incentives to boost domestic production.

We think the importance of data for AI and potential winners is underappreciated. Companies with vast sets of proprietary data have the ability to more quickly and easily leverage a large amount of data to create innovative models. New AI tools could analyze and unlock the value of the data gold mine some companies may be sitting on.

This year we have seen the market try to scope out the implications of AI-driven disruption. We initiate AI as a mega force view and think getting granular is a key way of expressing such views: These mega forces don't map easily to traditional portfolio building blocks and can straddle sectors and regions.

AI all the buzz

Artificial intelligence mentions on company earnings calls, 2004-2023

Chart takeaway: AI has become all the buzz. The mention of AI on company calls has skyrocketed in 2023. The popularity of ChatGPT and other large language models has stoked company and investor excitement over AI's potential.

Sources: BlackRock Investment Institute, with data from Bloomberg, June 2023. Notes: The chart shows the three-month rolling sum of mentions of the phrase "artificial intelligence" in publicly listed company earnings releases or earnings calls with analysts.

Fragmenting world

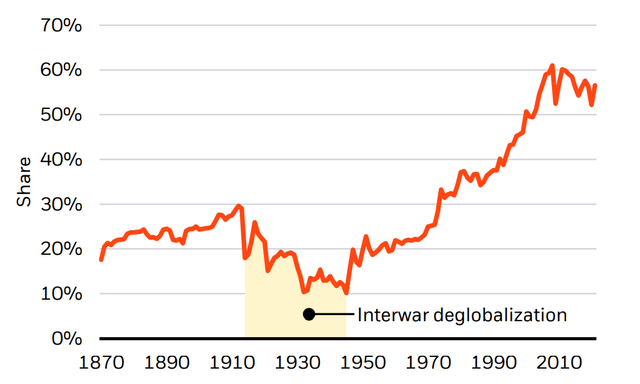

We think the Ukraine war and fraught U.S.-China relations have ushered in a new era of global fragmentation and competing defense and economic blocs - a marked departure from the globalization and geopolitical moderation of the post-Cold War period. We see a world where national security and resilience are favored over efficiency. Without significant tech-driven productivity gains, that will likely result in lower growth and higher inflation.

Industrial and protectionist policies could also spur investment in infrastructure and robotics.

As competing blocs firm up, multi-aligned countries will grow in power and influence. Countries like the Gulf oil states, India, Brazil, Vietnam, and Mexico have valuable resources and supply chain inputs.

We think they will align based on national interests - further rewiring supply chains and industrial policy. But it may also raise the risk that geopolitical confrontation plays out on land, in space, or cyberspace and drive growth in defense, aerospace, and cybersecurity industries.

A surge in investment in areas like technology, clean energy, infrastructure, and defense could create opportunities. Though economic costs could rise longer term, particularly in EMs.

We think economic growth will be more volatile and more vulnerable to shocks. Investors will need to be more cautious in targeting themes set to benefit from these trends.

Globalization rewired

World trade as a share of GDP, 1870-2021

Chart takeaway: Globalization has seen a surge in trade activity between countries, especially in the post-World War Two era. But the surge in trade as a share of global GDP has plateaued since the global financial crisis in a fragmenting world.

Source: BlackRock Investment Institute, Klasing and Milionis (2014), Penn World tables, World Bank, June 2023. Notes: The chart shows the sum of world exports plus imports, divided by world GDP. The yellow-shaded area highlights the period between the First and Second world wars when trade integration fell materially.

Tracking the low-carbon transition

We are developing the BlackRock Investment Institute Transition Scenario (BIITS) to inform an assessment, on behalf of clients, of how the low-carbon transition is most likely to play out based on what we know and expect today - and the potential portfolio impact. We aim to track its evolution over time, similar to how we plan to track other mega forces.

We believe the transition toward a decarbonized economy will involve a massive reallocation of capital as energy systems are rewired. These shifts are a result of competing economic catalysts and barriers - shaped by policy, technology and consumer and investor preferences - that determine how and when low-carbon technology will be adopted.

We expect tipping points when the relative costs of low-carbon technology fall below those of incumbent sources and when barriers to adoption are low. These tipping points arrive at different times across regions and sectors, resulting in an uneven and multispeed transition, in our view.

We see faster transitions in DMs than in EMs because of lower costs of capital, a greater share of easier-to-decarbonize sectors, and more stable total energy demand.

We see economic and investment implications. We expect inflationary pressures in coming years as higher energy prices combine with increasing capital spending - though this effect may dissipate over time as low-carbon technology costs decline. We see the growth impact dominated by physical climate damages - and expect this to bolster climate resilience to those damages as a key investment theme.

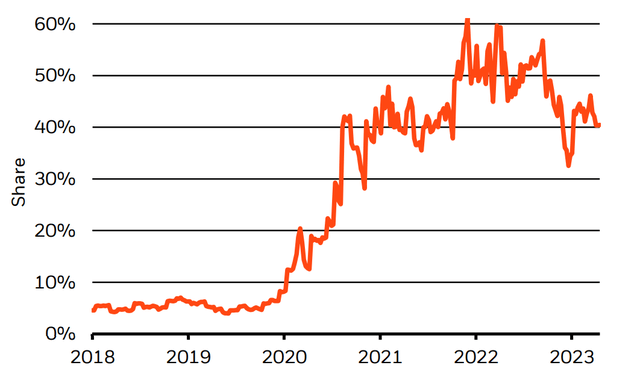

The impact on portfolios depends not only on the timing and size of these shifts but also on when markets price them in. Electric vehicles are a case in point, as the chart shows. We see opportunities across the energy system - high-carbon and low - to get in front of shifts before markets.

The BIITS offers investors a compass to help navigate the transition's risks and opportunities. It's our client's choice whether to use it in their investment processes. We recognize views on the transition differ.

Pricing in structural shifts

Electric vehicle (EV) company market cap share, 2018-2023

Chart takeaway: Valuations of electric vehicle companies surged before pulling back in the past year even as their share of overall automobile sales keeps growing, according to the latest IEA estimates.

This information is not intended as a recommendation to invest in any particular asset class or strategy. Source: BlackRock Investment Institute, with data from Refinitiv Datastream, MSCI, and IEA, July 2023. Notes: The chart shows the combined market-cap weight of pure-play EV companies - or companies that only produce EVs - within the MSCI All-Country World Automobiles Index.

Aging populations

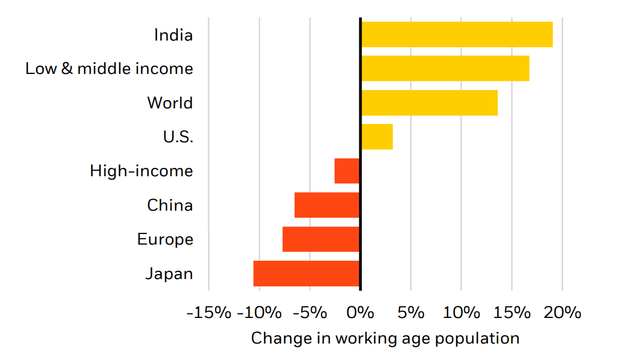

Many DMs, including the euro area and China, face a falling working-age population in coming years. See the chart. The global labor force is growing more slowly than it has since the Second World War. Reduced labor supply limits how much an economy can produce and grow - and leaves fewer workers to support a larger nonworking population. That impacts government spending and debt: per capita revenue from income tax falls, as spending on retirement-related benefits like pensions and healthcare rises. That could lead to more government borrowing, at a time when rising interest rates are already increasing debt burdens.

Aging could also prove inflationary, in our view. We don't think older populations consume less, rather the mix of demand changes. Think more healthcare. So overall spending won't automatically fall in line with lower production capacity. That's why aging contributes to the new regime and creates more difficult policy choices for central banks.

Japan offers a case study: Its working-age population has been shrinking since 1994. Japan didn't see higher inflation because economic activity was hurt by the bursting of its asset price bubble in the early 1990s. Yet it does give a glimpse of the growth effect: Since 1990, government data show that hours worked in Japan fell as the working-age population peaked and started to shrink. Japan offset some of the fall in the working-age population by growing the share of women in the workforce. Other DMs might struggle to do the same since female participation is already higher. Other options: increase immigration or raise the retirement age, each of which has political considerations. Or it can be partially offset by higher productivity, perhaps helped by AI.

Population aging is already a binding constraint on the U.S. labor supply. We see opportunities in healthcare, real estate, leisure, and companies with products and services for seniors. Investors may also consider how countries and companies are adapting differently.

Aging is mostly a DM dilemma

Projected change in the working-age population between 2020 and 2035

Chart takeaway: Aging generally poses a bigger challenge for developed markets than emerging markets. The working-age population in high-income economies is set to fall in the coming years, whereas it's poised to jump in low-income economies.

Forward-looking estimates may not come to pass. Sources: BlackRock Investment Institute, with data from United Nations, June 2023. Notes: The chart shows the percentage change in the population aged 20-64 for selected countries and regions between 2035 and 2050 based on UN data covering 237 countries or areas. Low, middle, and high-income groupings are based on the World Bank classification which uses gross national income.

Future of finance

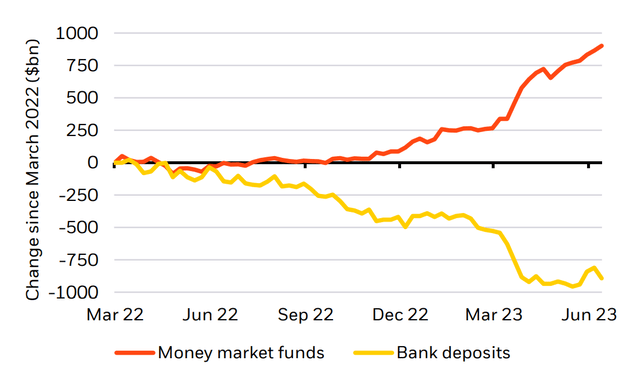

There's been a tectonic shift in the financial sector since the 2008 global financial crisis, with banks gradually losing their dominance amid new regulations, technologies, and competitors. We see this year's banking tumult as a catalyst that is likely to create opportunities for non-bank lenders.

The tumult put a spotlight on the risks of uninsured deposits, especially at U.S. regional banks, and accelerated a shift out of bank deposits and into money market mutual funds. In 15 months, about $1 trillion has left U.S. bank deposits or 6% of the total. See the chart. Why? Money market funds have been quicker to offer higher interest rates during the Fed's rapid rate hikes. Regulatory changes have made those funds competitive with banks. Digital payments mean cash can be moved in a split second. Financial plumbing changes mean funds no longer recycle cash back to deposits. We see some key changes as a result: increased consolidation among smaller banks, banks curbing lending, and more demand for non-bank lending and private credit to fill that void.

That presents opportunities in private markets, including in direct lending, or finance negotiated directly between a non-bank lender and a borrower. We expect more borrowers to turn to private credit as it becomes relatively better priced and given the certainty of execution and long-term partnership private lenders can provide. Private markets overall are complex, with high risk and volatility, and aren't suitable for all investors. Allocations also take time. So we think the recent repricing in private credit serves as an opportunity to be nimble with our strategic allocation.

Longer term, we see risks to incumbent banks. We think regulation, more concentration, competition for deposits, and disintermediation of payments all have the potential to reshape the future of banking and finance.

Seeking yield

Change in U.S. money market funds and bank deposits, March 2022-2023

Chart takeaway: Investors rattled by the banking tumult earlier this year pulled billions of dollars from bank deposits. One beneficiary: U.S. money market funds. Those funds have been seen as an important alternative thanks to higher interest rates.

Sources: BlackRock Investment Institute, ICI, and U.S. Federal Reserve, with data from Refinitiv Datastream, June 2023. Notes: The orange line shows the total U.S. money market funds. The yellow line shows domestic commercial bank deposits.

Playbook in Action

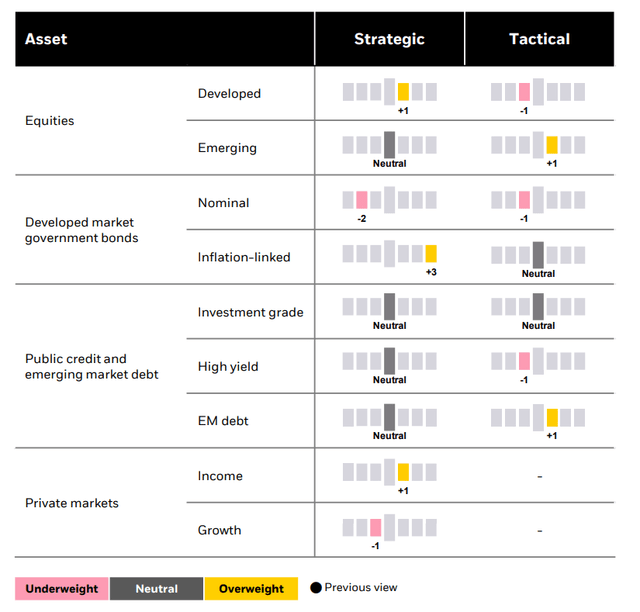

Time horizons are critical amid rapidly evolving market narratives. Our tactical and strategic views seek to capture opportunities in the near and long term.

Take equities. Our modest tactical underweight to DM equities is predicated on a view that a growth slowdown we anticipate over the next year isn't priced in. We prefer EM instead and within DM, like quality. Strategically, we are overweight DM equities. Why? A longer-term investor can look past some of the near-term pain.

In government bonds, the return of income is a core view on both horizons. Higher-for-longer policy rates have bolstered the case for short-dated government debt in portfolios on both tactical and strategic horizons. We stay underweight nominal long-dated government bonds on both horizons as we expect investors to demand more term premiums. Tactically, we have turned neutral on the euro area and UK long-term bonds where pricing better reflects our view. Our strategic views are maximum overweight DM inflation-linked bonds where we see higher inflation persisting - but we have trimmed our tactical view to neutral on current market pricing in the euro area.

On credit, we are neutral investment grade credit but see it playing an important income role in portfolios on both horizons. We upgraded private markets income to a strategic overweight. For investors with a long-term view, we see opportunities in private credit as private lenders help fill a void left by banks pulling back. Even in our underweight to growth private markets, we see areas like infrastructure equity as a relative bright spot.

Strategic vs. tactical views

Strategic (long-term) and tactical (6-12 month) views on broad asset classes, June 2023

Note: Views are from a U.S. dollar perspective, June 2023. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any particular funds, strategy, or security.

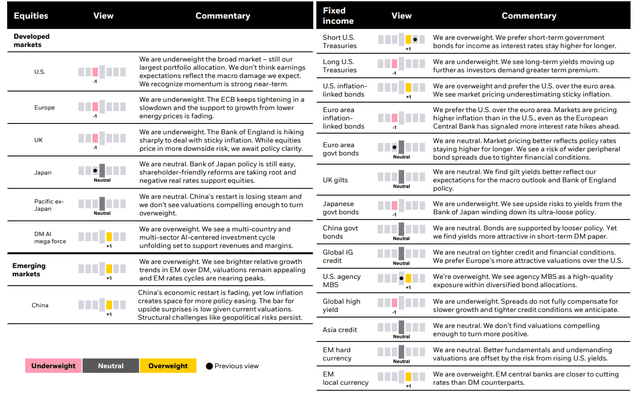

Tactical granular views

Six to 12-month tactical views on selected assets vs. broad global asset classes by the level of conviction, June 2023

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Note: Views are from a U.S. dollar perspective. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. This information should not be relied upon as investment advice regarding any particular fund, strategy, or security.

This post originally appeared on the iShares Market Insights.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by