Oracle Is The First Transformation Of The AI Era

Summary

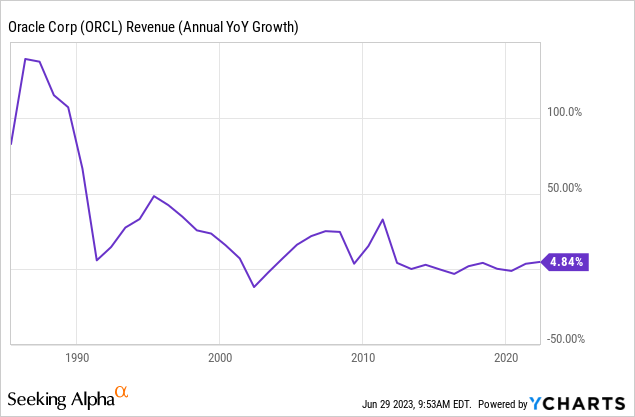

- Oracle’s legacy software business is very high margin, but has been very slow growing for over a decade now.

- But their cloud and services units are now growing very fast, and are beginning to take over the operating statement.

- There are also other considerations, like the cloud tie-in with legacy software, and their headlong push into ARM in the data center.

- I am now an Oracle shareholder for the first time since 1999.

- This idea was discussed in more depth with members of my private investing community, Long View Capital. Learn More »

Justin Sullivan

Good News/Bad News, But Mostly Good News

My big takeaway for the cloud business from all this AI frenzy is that it presents both good and bad news for the cloud providers, though it's mostly good news. They are going to see higher growth, but have to accept lower operating margin as a trade-off, because Nvidia (NVDA) is taking all the money. But that still adds up to good news, and I think this is what Oracle's (NYSE:ORCL) recently reported quarter is telling us.

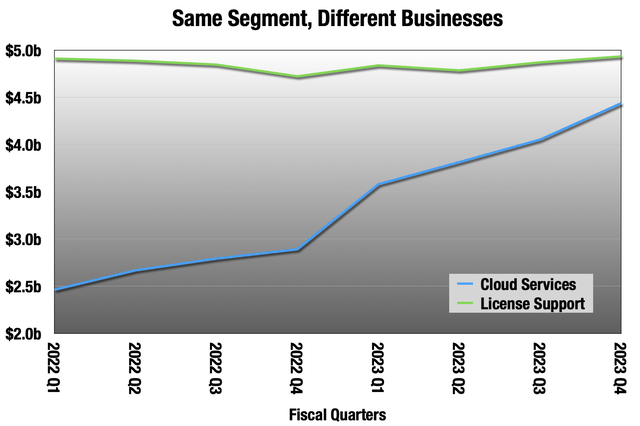

I’m hedging here, because Oracle’s reporting on cloud was very hard to parse until this fiscal year, just ended, when they added a little more texture to their "Cloud services and license support” segment. It still doesn’t give us a full view of their cloud business in isolation.

We have eight quarters of this now, accounting for about 70% of the top line:

Oracle earnings reports

In their segments, they combine their legacy database business that does not grow with cloud, which grows very fast. What’s more, the gross margin on license is something like 90%+, so they are very different growth and margin profiles.

But my best guess is that their operating margin on that fast-growing cloud portion peaked in fiscal Q3 2022 (ending February 2022). Since the cloud growth rate picked up, cloud operating margin is now down five quarters in a row, because all the cloud providers are paying the Nvidia tax now. But there is mostly good news here, in the growth part.

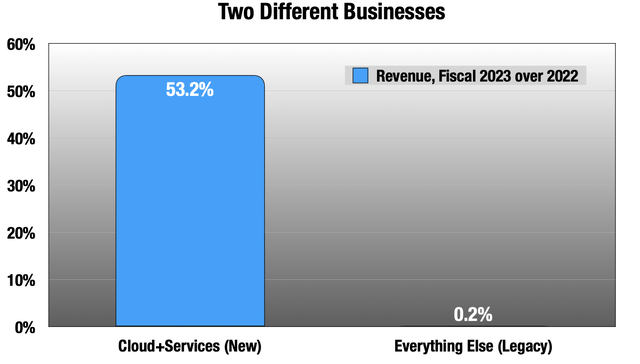

It’s not just that segment. Oracle has a weak legacy business offset by a fast-growing cloud and services part.

Oracle earnings reports

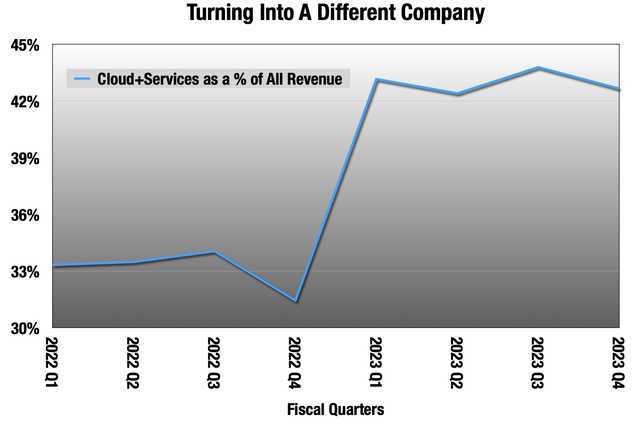

This is turning them into a different company:

Oracle earnings reports

I had stopped following Oracle. Their database business had matured 20 years ago, and pretty much stopped growing 10 years ago (chart through fiscal 2022).

They were living off that 90% gross margin on license; it was basically rent-seeking for a couple of decades. When I wrote about the cloud portion of AI, one of the comments was kind of unintentionally hilarious:

Does Oracle cloud really provide redundant cloud services/capabilities or are they just calling themselves cloud because they have datacenters?

It would be very much like legacy Oracle to do something like that, and when they changed the name of the segment to add “cloud” years ago, that is exactly what I thought was going to happen. But no, this is a real business, and it is beginning to overtake legacy Oracle with a push from AI.

Oracle looks like the first big transformation from AI, and after earnings I bought shares for the first time since 1999.

Other Considerations

Besides competing with AWS and Azure on price, Oracle’s big AI seam is that they host a ton of data in the cloud — they are the database company. AI runs on data, so the opportunity is providing add-on machine learning services using customer data in a private and secure manner. This is exactly what is happening with their deal with Cohere. Along with Nvidia and Salesforce (CRM), Oracle is an investor in Cohere.

The FTC is doing a review of competition in the cloud business, and the first step there is to solicit comments from anyone who cares to comment. Google (GOOG) used their time to complain about Oracle's and Microsoft's (MSFT) advantage in this respect:

More than anything else, Google Cloud believes customers should use our services because of the value that our services provide in supporting business objectives, not because they are locked in.

While interoperability and open source technologies are prevalent across the industry (including in response to increasing demand from customers seeking to deploy a multicloud approach), a small number of legacy on-premises software providers, such as Microsoft, Oracle, and others, are using their strong positions in non-cloud markets, such as productivity software, server operating systems and applications, and desktop operating systems, to give their own cloud products an unearned advantage and lock customers into their cloud ecosystems.

They are absolutely right about this advantage for Microsoft and Oracle. I doubt the FTC will come and save them.

I also like that Oracle is moving headlong into ARM CPUs in the data center. ARM CPUs provide much better economics in the data center versus CPUs from Intel (INTC) or AMD (AMD) because of how stingy they are with power consumption, and the much higher compute density you can build in a given space. AWS has their own, Graviton3, and Oracle uses the Altra platform from private Ampere. Oracle is also an Ampere investor, and Ampere should be going public soon.

At an Ampere event this week, Larry Ellison (Oracle's CEO) said this:

This year, Oracle will buy GPUs and CPUs from three companies. We will buy GPUs from Nvidia, and we're buying billions of dollars of those. We will spend three times that on CPUs from Ampere and AMD. We still spend more money on conventional compute.

Notice who is missing. Intel has issues.

At Long View Capital we follow the trends that are forging the future of business and society, and how investors can take advantage of those trends. Long View Capital provides deep dives written in plain English, looking into the most important issues in tech, regulation, and macroeconomics, with targeted portfolios to inform investor decision-making.

Risk is a fact of life, but not here. You can try Long View Capital free for two weeks. It’s like Costco free samples, except with deep dives and targeted portfolios instead of frozen pizza.

This article was written by

Confirmation Bias Is Your Enemy.

Tech and macro. Deep analysis of long term sectoral trends, and the opportunities arising from them. I promise not to bore you. Author of Long View Capital, a Marketplace service for long-term investors. Risk Factors: I am also wrong sometimes.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.