Seabridge Gold: An Attractive Valuation While Gold Is Weakening

Summary

- During the three months that ended March 31, 2023, Seabridge Gold Inc. posted a net loss of $7.88 million ($0.10 per share).

- On May 11, 2023, Seabridge Gold entered a royalty agreement with Sprott Resource Streaming and Royalty Corp. for $150 million.

- I recommend buying a small position in Seabridge Gold between $11 and $10.35 with possible lower support at $10.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

LifeJourneys

Introduction

Toronto-based Seabridge Gold Inc. (NYSE:SA) released its consolidated financial statements ending March 31, 2023, on May 15, 2023.

Also, on May 11, 2023, it announced that (emphasis added):

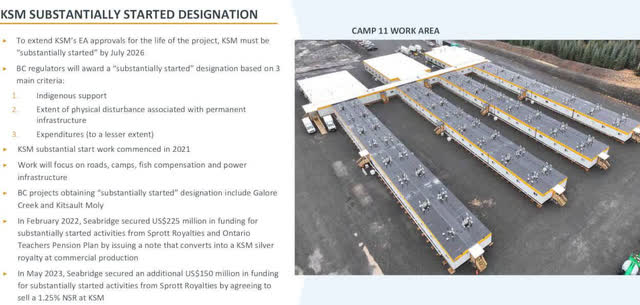

Its wholly-owned subsidiary, KSM Mining ULC, has agreed to the principal terms of a royalty agreement under which Sprott Resource Streaming and Royalty Corp. ("Sprott") pays KSMCo US$150 million (approximately C$200 million at the current exchange rate) and KSMCo grants Sprott a 1.2% net smelter royalty on its 100% owned KSM project located in northern British Columbia, Canada. The proceeds will be used to complete the physical works at KSM for which Seabridge expects to achieve a designation of 'substantially started' from the B.C. government.

SA Substantially Started Designation. KSM two financings by Sprott (SA Presentation)

Chairman and CEO Rudi Fronk said in the press release:

this is going to be a very busy and productive year as we move forward with site infrastructure at KSM and exploration drilling at three promising projects in Canada and the U.S.

Note: I used the most recent presentation published on May 2023.

This article updates my preceding article, published on February 6, 2023.

1 - Seabridge Gold's extensive portfolio

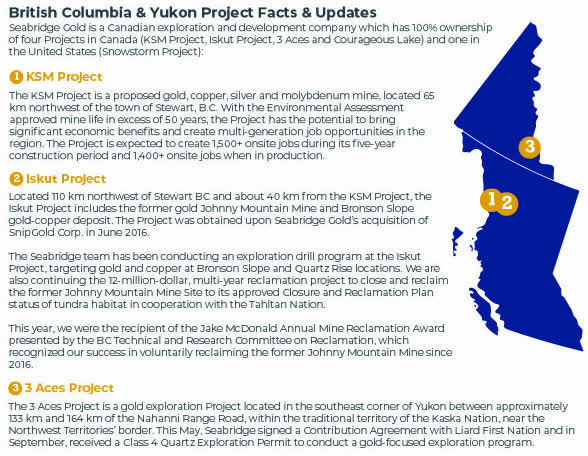

Seabridge Gold owns 100% ownership of an extensive portfolio of premium North American exploration Projects with six gold core projects and three non-core projects:

- Kerr-Sulphurets-Mitchell ("KSM") - British Columbia, Canada. The mine is the largest undeveloped copper/gold property in North America and the most valuable project for the company.

- Courageous Lake - Northern Territories, Canada.

- Iskut, which is 30 km Northwest of KSM - British Columbia, Canada.

- Snowstorm - Nevada, USA.

- 3 Aces - Yukon Territory, Canada.

- Snowfield Property acquired from Pretium Resources.

- Grassy Mountain.

- Quartz Mountain.

However, the most critical project that will make or break Seabridge Gold Inc. is the KSM project, which is the most advanced and has the potential to find an acquirer in the next few years.

SA Portfolio Premium Gold Projects in North America (SA Presentation)

2 - A look at the balance sheet

During the three months that ended March 31, 2023, Seabridge posted a net loss of $7.88 million ($0.10 per share) compared to a net loss of $4.96 million ($0.06 per share) for the same period in 2022.

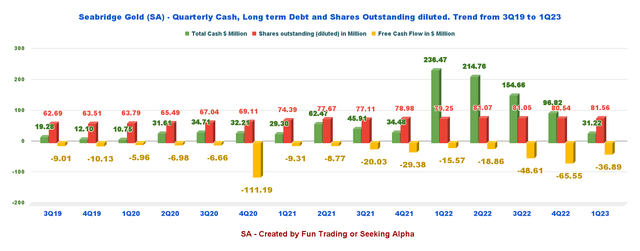

Cash on hand and cash equivalent were $31.22 million in 1Q23, down from $236.47 million in 1Q22. However, the recent transaction with Sprott will increase cash to about $180 million, again providing some leeway to Seabridge.

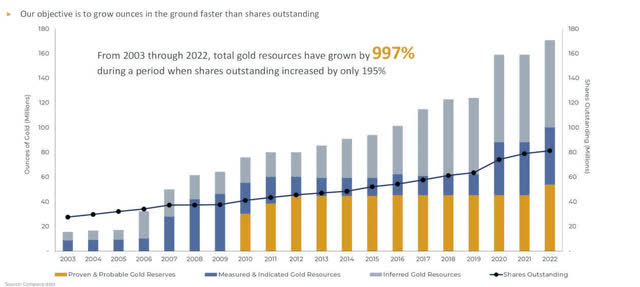

At least so far, one positive is that the company seems serious about keeping dilution in check, which is a constant danger for investors in this segment.

The outstanding diluted shares are now 81.56 million, up only 2.9% YoY. However, with dwindling cash now at $31.22 million from $236.47 million last year, I wonder about an imminent shares-bought deal that could smash the company's apparent resolution.

SA Limited dilution history (SA Presentation)

3 - Investment thesis

An important caveat emptor is that Seabridge Gold is NOT a gold or metals producer, and investing in these development-stage companies demands extreme caution. The risk of dilution and failure is very high, and completing such projects can take many years.

A mining project is a complex and expensive endeavor demanding years of preparation and a considerable amount of CapEx before getting an eventual greenlight. Hence, no fundamental reasons could justify a stock price valuation at this stage, and it is all in the eyes of the beholder.

To clarify, Seeking Alpha published my article about NovaGold Resources (NG) yesterday, which dropped nearly by half after releasing its second-quarter results. I recommend reading my article by clicking here.

The company owns about three solid projects that could produce down the road. One of the most advanced projects is the KSM/Snowfield project.

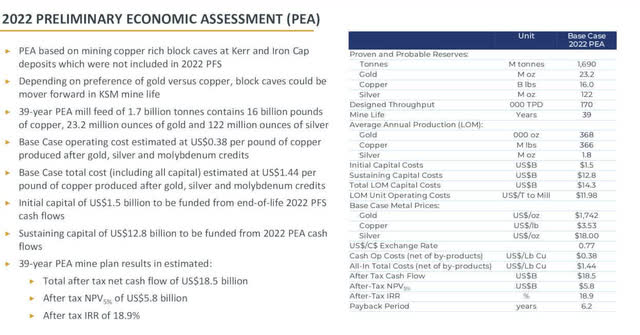

SA PEA 2022 Presentation (SA Presentation)

In 2021, Seabridge Gold started early-stage construction activities at the KSM Project to achieve the "substantially started' status by July 28, 2026, which is required to maintain the validity of the Environmental Assessment Certificate for the Project's life.

The Kerr-Sulphurets-Mitchell or KSM/Snowfield is a massive project with 59 years of project life. Total P1 and P2 reserves represent the bulk of the company's reserves, with 23.2 Moz of gold, 16 billion pounds of copper, and 122 Moz of silver, with a Mine life of 39 years.

However, the KSM copper/gold project requires $1.5 billion in Capital Costs and eventually more with the recent Snowfield acquisition. It is a large investment that could attract only a few major gold producers.

I believe the KSM mine will be segmented into several phases due to the initial CapEx required.

Therefore, I recommend trading Seabridge Gold Inc. short-term and keeping a minimal long-term bet on the back burner for the eventual final payday if the company finds a gold major willing to complete the project.

SA 3 projects in Yukon (SA Presentation)

4 - Stock Performance

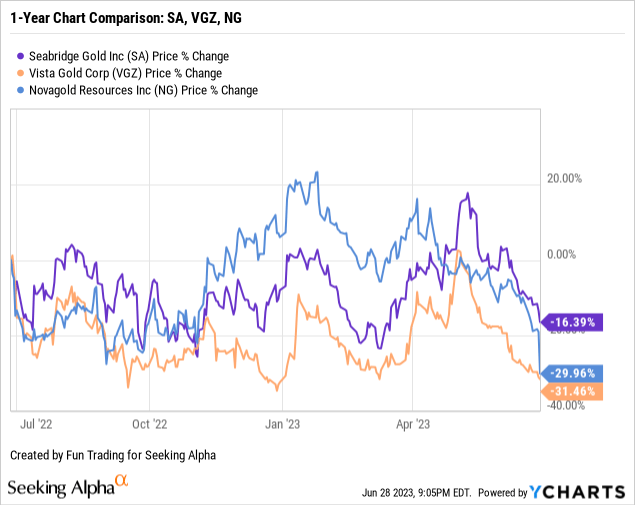

SA is down 16% on a one-year basis, performing better than a few competitors, such as Vista Gold (VGZ) and NovaGold Resources.

Seabridge Gold Balance sheet history ending 1Q23 - The raw numbers

Warning: Seabridge Gold Inc. is not generating revenues. I have converted the numbers indicated in C$ in the filing to US$.

| Seabridge Gold | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues in $ Million | 0 | 0 | 0 | 0 | 0 |

| Net Income in $ Million | -4.96 | 14.91 | 3.78 | -18.58 | -7.88 |

| EBITDA $ Million | -3.49 | 21.81 | 9.48 | -22.64 | -10.25 |

| EPS diluted in $/share | -0.06 | 0.19 | 0.05 | -0.23 | -0.10 |

| Operating Cash Flow in $ Million | -7.60 | 4.39 | 8.05 | -10.02 | -5.60 |

| CapEx in $ Million | 7.97 | 21.25 | 56.66 | 55.52 | 31.29 |

| Free Cash Flow in $ Million | -15.57 | -18.86 | -48.61 | -65.55 | -36.89 |

| Total Cash $ Million | 236.47 | 214.76 | 154.66 | 96.82 | 31.22 |

| Long-term Debt in $ Million | 222.09 | 183.00 | 165.42 | 193.99 | 206.34 |

Source: Press release.

A few historical financial data in one chart:

SA 1Q23 Balance Sheet (Fun Trading)

Trailing 12-month free cash flow ("ttm") is now a loss of $167.91 million and a $36.89 million loss in 1Q23.

Technical Analysis (short-term) and Commentary

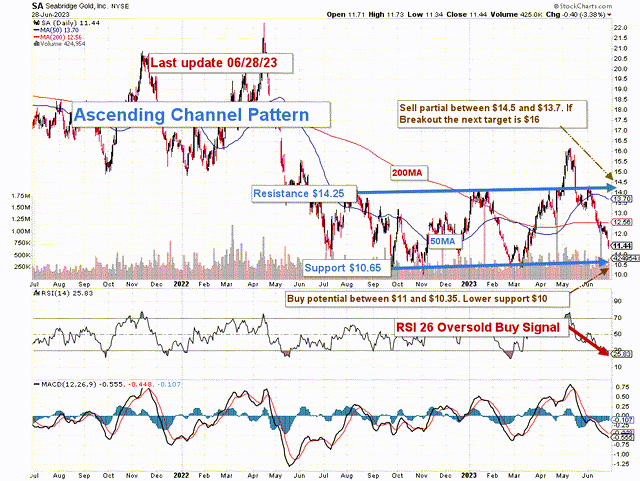

SA TA Chart Short-Term (Fun Trading StockCharts)

SA forms an ascending channel pattern with resistance at $14.25 and support at $10.65.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

The strategy here is to sell between $14.5 and $13.7 with possible higher resistance at $16 and wait for a retracement between $11 and $10.35 with possible lower support at $10.

Despite a gold price above $1,900 per ounce, the recent FED decision to hike interest twice more in 2023, despite a pause recently, had a bearish effect that may last a few more weeks. Thus, it is perhaps a good opportunity to use those oversold situations to start a small long-term position.

Gold prices are crucial for development-stage gold miners like Seabridge Gold Inc. Thus, watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I started a small position at $11.25 to follow the stock, but will accumulate only below $11.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)