SFL Corporation: Buy The 10.5% Yield Before A Potential Rebound

Summary

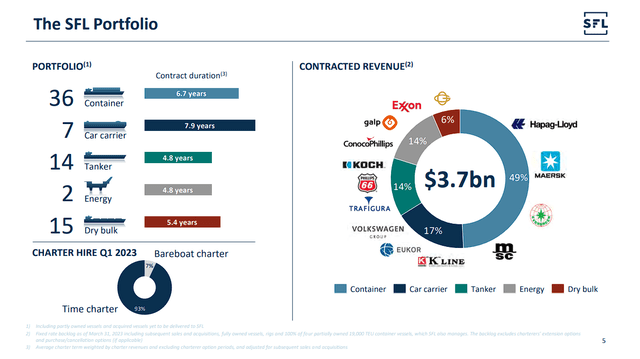

- SFL's diversified fleet and multi-year backlog differentiate the company from its more volatile peers.

- SFL's most recent results were seemingly underwhelming profits-wise, but this was due to one-off items. Earnings should rebound with Hercules' re-deployment.

- SFL's 10.5% dividend yield is highly attractive and well-covered by operating cash flows.

- The announcement of a $100 million share buyback program should contribute to investors' total return prospects. It also signals heavy undervaluation in SFL stock.

- Wheel of Fortune members get exclusive access to our real-world portfolio. See all our investments here »

HeliRy

SFL Corporation's (NYSE:SFL) stock performance has been rather underwhelming recently. Shares have traded mostly sideways over the past year, with periodic dips pushing them below $9.00. I took this opportunity several times during this time to accumulate shares and build my position, resulting in SFL now being one of the most substantial holdings in my portfolio.

SFL Stock's price chart (Koyfin)

My high conviction towards SFL's bullish case is due to a multitude of compelling factors. Firstly, the company's profitability remains exceptional, despite it taking a hit in its most recent results due to one-off items. Further, SFL boasts a well-covered massive dividend yield, which has been further enhanced by multiple dividend hikes following the post-pandemic period. Additionally, the exceptional stability of cash flows directly results from management's astute chartering strategy, providing reassurance and predictability when it comes to SFL's future performance. Lastly, SFL's optimally diversified fleet adds another layer of strength and resilience to its overall portfolio.

However, one of the most compelling factors that prompted me to fully commit to SFL was when management unveiled their plan to repurchase up to $100 million worth of stock. This announcement not only solidified SFL's undervaluation but also presented an opportunity for the creation of shareholder value through accretion. Moreover, it established a substantial safety net, effectively safeguarding against potential further downside risks.

Let's go through each one of these topics.

What Sets SFL Apart Within The Shipping Industry

SFL sets itself apart within the shipping industry through its exceptional capacity to consistently generate stable results. This is achieved through the synergistic combination of two fundamental elements: the remarkable diversity of its fleet and a prudent, forward-thinking approach to long-term charters. These integral components not only ensure SFL's ability to cover substantial dividends but also position the company as a true standout amidst the turbulence of the industry.

Fleet Diversity: Setting Sail on Multiple Horizons

While most shipping companies concentrate on a specific vessel type, such as containerships or oil tankers, SFL has wisely ventured into various asset classes. Their fleet comprises an impressive mix of multiple asset classes, which comes with multiple advantages. While spot-market-sensitive single-class vessel owners (e.g., Star Bulk Carriers (SBLK) in dry bulk or DHT Holdings (DHT) in oil tankers) are at the mercy of market volatility, SFL's exposure to multiple asset classes acts as a safeguard. For instance, in the face of a slump in demand for dry bulk vessels with below-average rates, container vessels may experience a surge in demand with above-average rates. By effectively balancing these fluctuations whenever SFL has to re-chart its assets, its diversified fleet helps minimize the erratic swings plaguing its competitors.

Chartering Strategy: Navigating the Seas of Consistency

Building upon SFL's extensively diversified fleet, the company's chartering strategy adds an extra layer of flexibility, further minimizing the volatility effects inherent to the shipping industry.

Specifically, SFL adopts a unique chartering strategy that sets it on a course toward consistent and predictable cash flows. Unlike many shipping companies that operate their own vessels, SFL opts to charter (lease) them out for extended periods. The company's charter backlog currently features a weighted average term of 6.6 years, shielding itself from the volatile spot rates that often rock the shipping industry. Regardless of how drastically rates for various asset classes may fluctuate, SFL can rest assured of a steady stream of revenue.

Of course, as is the case with all things business, SFL's multi-year chartering strategy comes with an opportunity cost. For instance, during the period of soaring containership rates in the midst of the pandemic, SFL's containerships were committed to long-term leases, missing out on the potential windfall. Similarly, the current surge in the spot market for tankers is another instance where SFL's fixed-rate charters may limit immediate gains. Yet, it is this very approach that provides stability and consistency to SFL's performance, making it a reliable player in the industry. While charters eventually need to be renewed, SFL's long-term industry trends tend to align with its results, creating a harmonious balance.

Recent Results Impacted By One-Off Items, Not Market Volatility

SFL's most recent results might have put off some investors, as the company's profitability was compressed quite significantly. However, this was due to one-off items in the income statement that hardly reflect the core business's performance. In fact, despite the volatile fluctuations experienced by each individual asset class, SFL's multi-year charter backlog remained steadfast in generating consistent cash flows that aligned with the agreed rates of each contract. Accordingly, SFL posted chartering revenues of $182.4 million for Q1.

Note that this result implies a decline from the previous quarter's $197.8 million, but this is attributable to one rig being out of service and lower dry bulk rates in the first quarter. The latter reason is, in turn, due to about 14% of SFL's fleet being employed on short-term charters in the spot market, despite the company's otherwise long-term strategy.

Profitability-wise, net income landed at just $6.3 million, or $0.05 per share, compared to the previous quarter's $48.5 million or $0.38. The massive decline is what most likely disturbed the market and what has likely been the reason shares have struggled to build some momentum since. However, it's important to highlight that this decline was primarily driven by a one-off event. Specifically, the decrease in net income was primarily due to the drilling rig Hercules, which recorded no revenues during the quarter but incurred full operating expenses as it underwent a scheduled comprehensive special survey and upgrades. Additionally, there were some one-off mark-to-market effects relating to interest and currency swaps following the refinancing of bonds during the quarter.

Looking ahead, there is no cause for significant concern as Hercules is scheduled to undergo its survey and proceed to Canada to begin working in a contract with ExxonMobil Canada to drill one well. The estimated duration of this contract, including mobilization, is approximately 135 days, with an estimated value of around $50 million. Subsequently, the rig will move to Namibia to initiate a contract with a subsidiary of Galp Energia for two wells. Once again, we are looking at another contract value of over $50 million. Afterward, the rig will be available for new contracts from the second quarter of 2024 onwards. Consequently, Hercules is expected to resume contributing to net income, presenting significant potential for high employment rates after Q2-2024, considering the growing demand in the rig market.

The 10.5% Yield Is Highly Attractive, Covered

SFL's dividend yield of 10.5% remains exceptionally attractive, even in a market with rising interest rates. Considering the current dividend per share run rate of $0.96 and FY2022's earnings-per-share of $1.60 as a benchmark for "normal conditions," we find that the payout ratio stands at a comfortable 60%. This conservative ratio indicates that SFL is well-positioned to sustain its dividend payouts.

Although the GAAP basis suggests the dividend may not be fully covered this year due to significant losses incurred in Q1, SFL is expected to have no trouble covering its payouts from operating cash flows. Notably, even during Q1, the company generated operating cash flows amounting to $81.1 million, surpassing the $30.4 million used for the quarterly dividend.

Furthermore, an important aspect to consider regarding dividend safety is that SFL increased its dividend by 4.3% back in February, marking the fifth dividend hike within a span of just two years. This consistent upward trajectory in dividend payments, despite the already high yield, should provide reassurance to investors regarding the sustainability of payouts. It also demonstrates management's confidence in the company's future earnings prospects.

The $100M Buyback Program Exposes SFL's Undervaluation

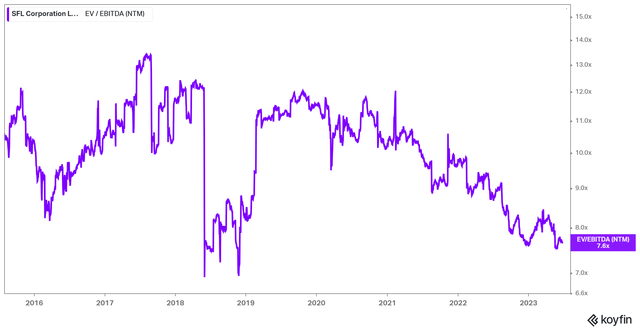

SFL appears significantly undervalued from multiple points of view. For starters, the stock trades at a forward EV/EBITDA of just 7.6X, which is at the very low end of its historical range. I also believe this is a cheap multiple given the significant $3.7 billion in backlog, which makes for one juiciest backlog-to-assets setups I have encountered in shipping.

SFL's Forward EV/EBITDA (Koyfin)

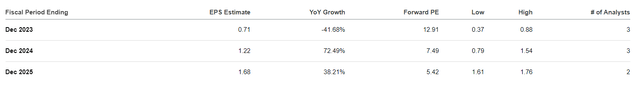

Even on a GAAP basis (including non-cash items such as depreciation and amortization), Wall Street sees FY2024 EPS (absent of one-off abnormalities such as in Q1-2023) of $1.22, implying a P/E of just 7.5 under "normal conditions".

SFL's Forward Valuation (Seeking Alpha)

To build this case further, along with its Q1 results, SFL announced a $100 million share repurchase program. This move carries significant implications, suggesting that the shares are undervalued for several compelling reasons. Notably, the fact that the management is willing to allocate such a substantial amount towards buybacks rather than other options like debt repayment indicates their belief in the higher accretive potential for investors. In a rising-rates environment, deleveraging emerges as an appealing avenue, making the decision to repurchase shares all the more compelling evidence of their undervaluation.

Moreover, it is worth highlighting that this marks the first time in SFL's history that the company is engaging in share repurchases. This fact alone underscores that the level of undervaluation has surpassed the stage of relying on market forces to rectify it.

On a lighter note, in Marine Money 2023, held in New York a few days ago, Ole Hjertaker, SFL's CEO, jokingly stated the following:

All management teams say their share is undervalued, and we believe we are 'particularly' undervalued.

Conclusion

With its robust multi-year charter backlog, ensuring excellent cash flow visibility, coupled with a well-diversified fleet, SFL undeniably stands out as a compelling investment opportunity for those seeking exposure to the shipping industry while mitigating much of its inherent volatility. Moreover, the company's enticing 10.5% yield, complemented by an ongoing $100 million buyback program, promises substantial capital returns, fostering a potential resurgence in the stock price and reducing potential downside risks. Hence I will continue accumulating shares at these levels, especially below $9.00.

Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

- WoF is 1 out-of-only 3 services with 50+ reviews that have a 5* rating.

- WoF is 1 out-of-only 7 services with 25+ reviews that have a 5* rating.

- Single, uncorrelated, trading ideas [ >250/year, on average].

- Managed portfolios, aim at outperforming SPY on a risk-adjusted basis.

Join The Wheel. Build & Protect Your Fortune.

This article was written by

Hi there!

I hold a BSc in Banking and Finance. Here, on Seeking Alpha, I cover a variety of growth stocks and income stocks, including identifying those with the highest expected return potential, and a solid margin of safety.

Currently contributing as Promoting Author to the "Wheel of Fortune" marketplace.

Feel free to contact me at any time, and follow me here on S.A. for regular content and updates!

Happy investing!

Nick

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SFL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.