FTAI Aviation: ESG, Scaling Opportunities, And Still Undervalued

Summary

- TAI Aviation is focusing on scaling its Module Factory business and enhancing its ESG initiatives, which could lead to increased efficiency and reduced maintenance costs.

- The company's recent termination of all lease agreements with Russian airlines due to sanctions has led to an impairment of assets.

- I provide an updated financial model with an implied share price of around $43.76.

Pavel Muravev

FTAI Aviation Ltd. (NASDAQ:FTAI) recently noted initiatives for scaling the Module Factory business, which may bring lower turnover and less maintenance. Besides, management continues to explain how ESG efforts could minimize the carbon footprint through sustainable jet engine maintenance, which may bring further interest from investors. Taking into account the current net debt/EBITDA ratio and lower market guidance among some risks, I lowered my price target, but I continue to believe that FTAI is undervalued.

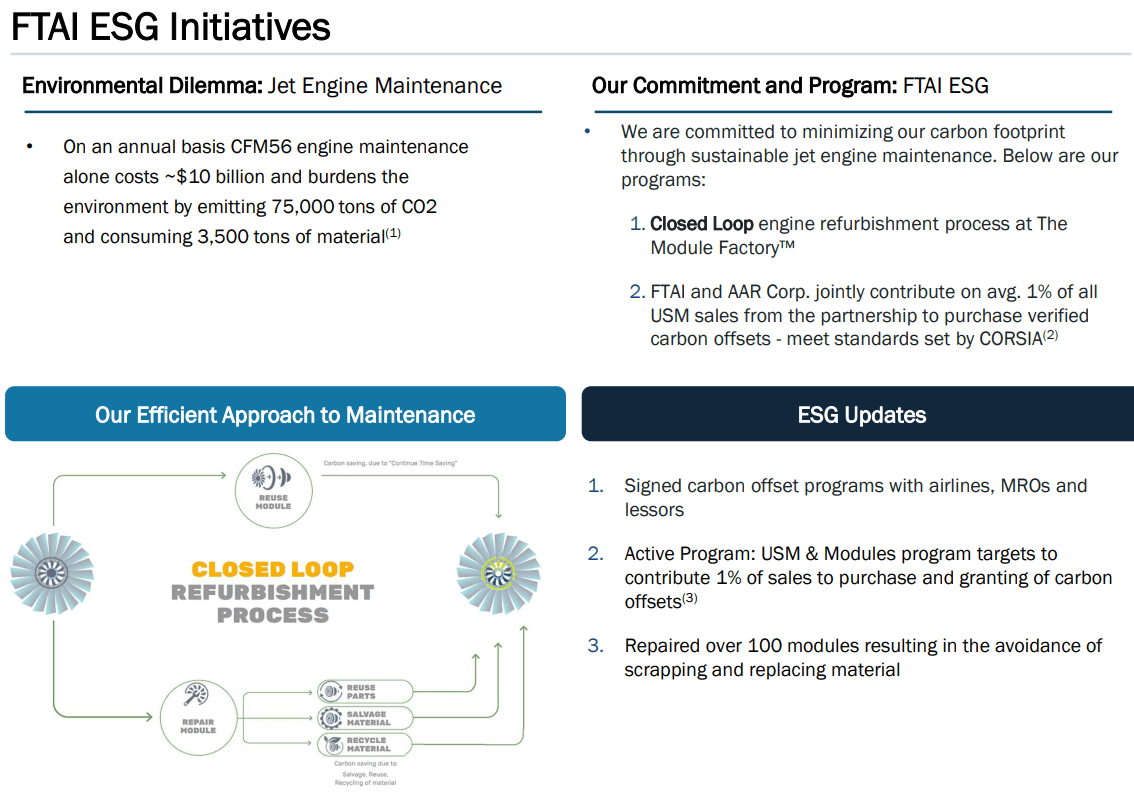

FTAI: Further Scaling Of The Module Factory Business And More ESG Initiatives

FTAI Aviation owns a portfolio of 93 aircraft and 241 standalone engines, including 336 CFM56 engines, which the company owns, leases, and sells.

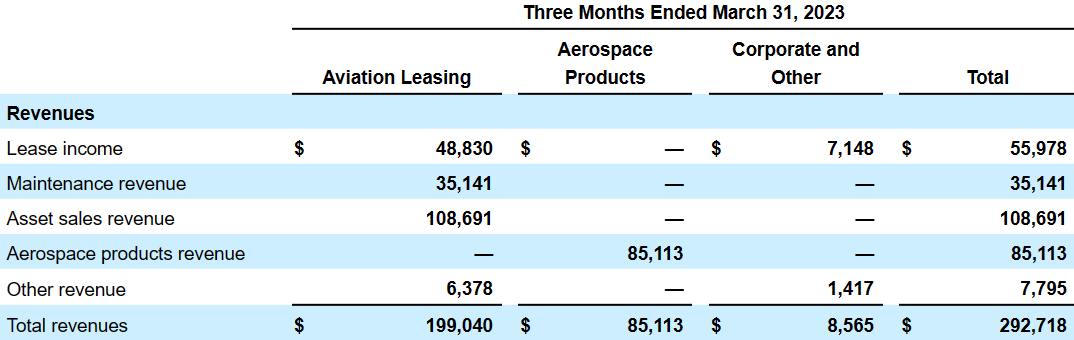

The most relevant activities as reported in the last quarterly report include aviation leasing, which accounted for $199 million including lease, maintenance, and asset sale, and aerospace products with $85 million.

Source: Quarterly Report

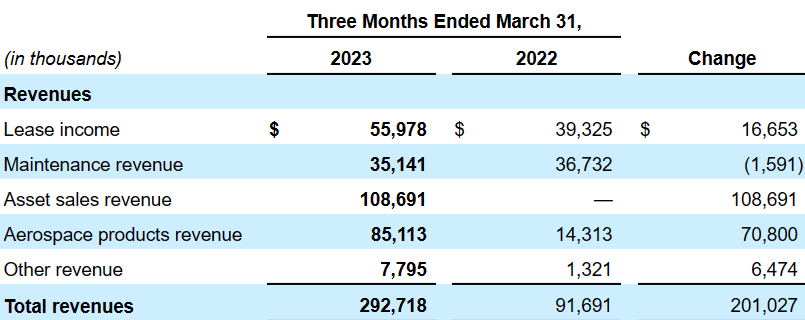

As I noted in my most recent article, and many other analysts noted a few months ago, total revenue increased in 2023 as compared to that in 2022. In the quarter ended March 31, 2023, the company reported close to $201 million more in total revenue driven by increases in asset sales revenue and lease income. I believe that investors would most likely appreciate having a look at FTAI because most market participants out there are expecting net revenue growth.

Source: Quarterly Report

I believe that a new article was necessary taking into account the results of the quarter and the new information about the scaling of the Module Factory business, a commercial maintenance program run by FTAI.

Our engine and module sales are facilitated through The Module Factory, a dedicated commercial maintenance program, designed to focus on modular repair and refurbishment of CFM56-7B and CFM56-5B engines, performed by a third party. Source: Quarterly Report

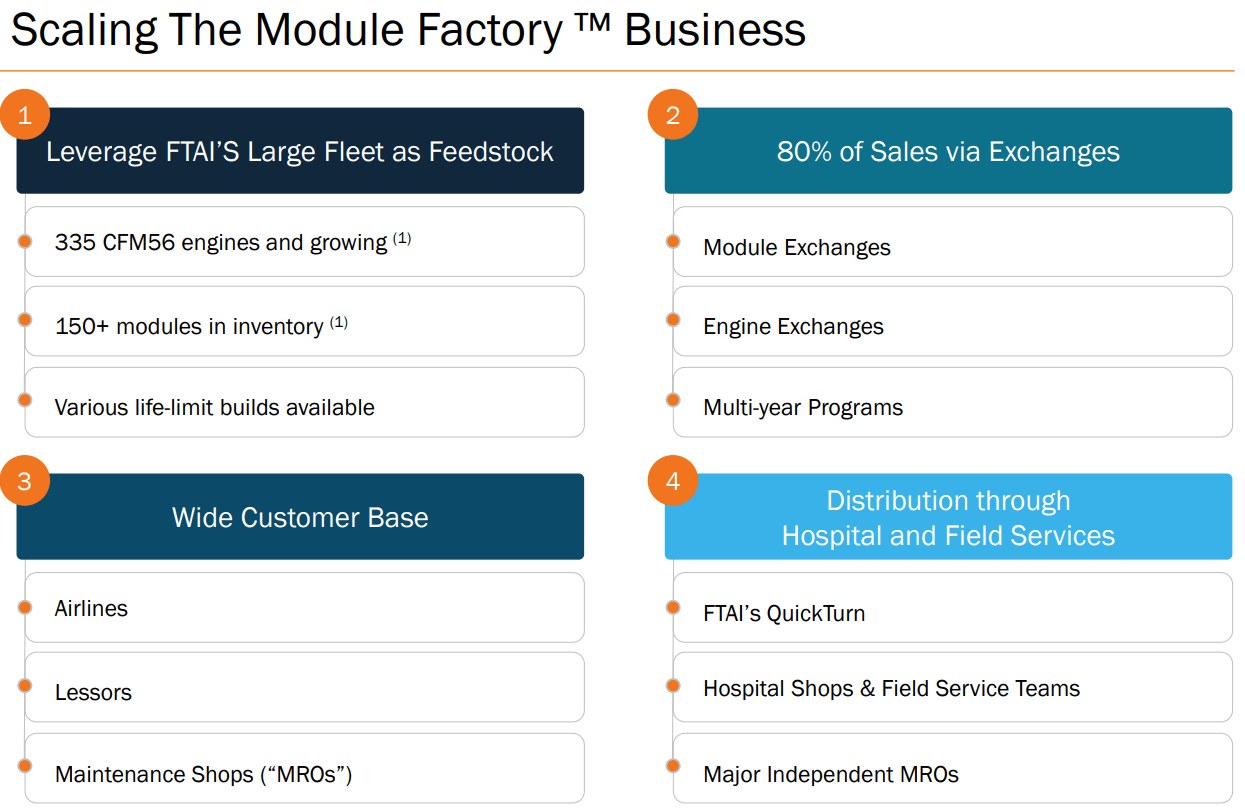

In a recent presentation, FTAI noted that scaling The Module Factory business will most likely leverage FTAI's fleet including the 335 CFM56 engines. Scaling this program may also enhance revenue growth thanks to FTAI's access to a wide customer base and net revenue obtained from sales via exchanges.

Source: June Presentation

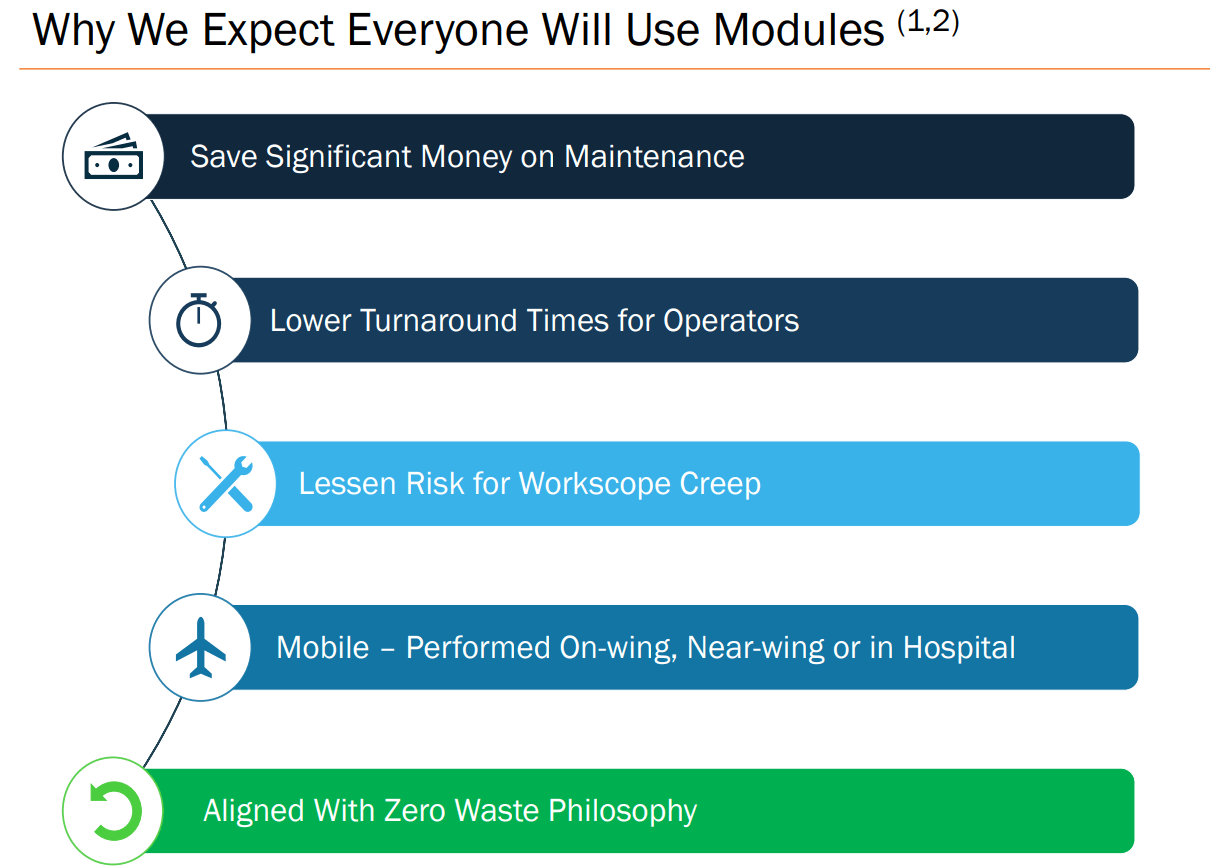

Management provided a full explanation about why the use of modules makes sense, however I believe that the most relevant are two main points. First, FTAI will most likely lower turnaround times for operations, which may bring larger efficiency, and may enlarge the FCF margins. Besides, it is quite beneficial that the strategy is aligned with zero waste philosophy. In my view, it may bring significant attention from investors looking for companies showing ESG initiatives.

Source: June Presentation

The company mentioned initiatives to minimize the carbon footprint through sustainable jet engine maintenance. Besides, the company noted active programs including the USM & Modules program to contribute 1% of net sales to purchase and grant carbon offsets.

Source: June Presentation

Market Analysts Lowered Their Expectations

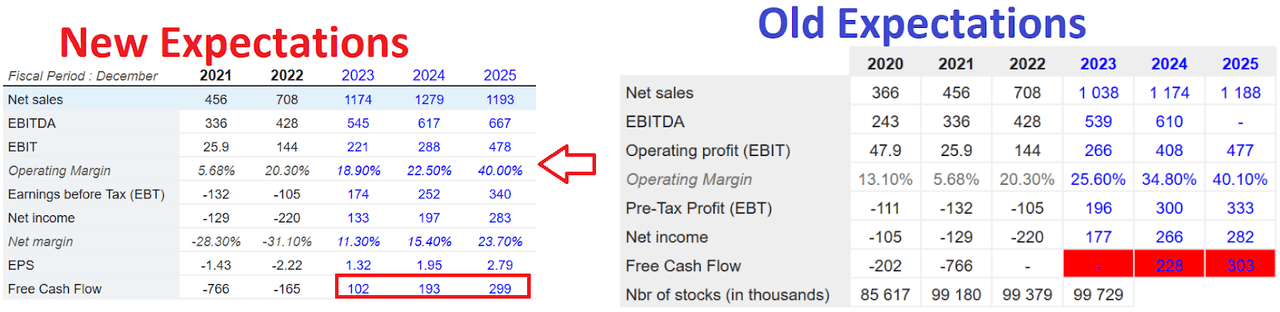

I believe that having a look at the expectations of other market analysts is always beneficial. Market estimates include 2025 net sales of $1.193 billion, 2025 EBITDA close to $667 million, and 2025 EBIT worth $478 million. Besides, 2025 net income is expected to be close to $283 million, with 2025 FCF of about $299 million. 2024 net sales would be close to $1.279 billion, with 2025 EBITDA of $617 million and 2024 net income of $197 million. Finally, 2025 FCF would be close to $193 million. It is worth noting that the expectations for 2024 and 2025 were lowered recently, which did not seem to have an effect on the stock price of FTAI.

Balance Sheet

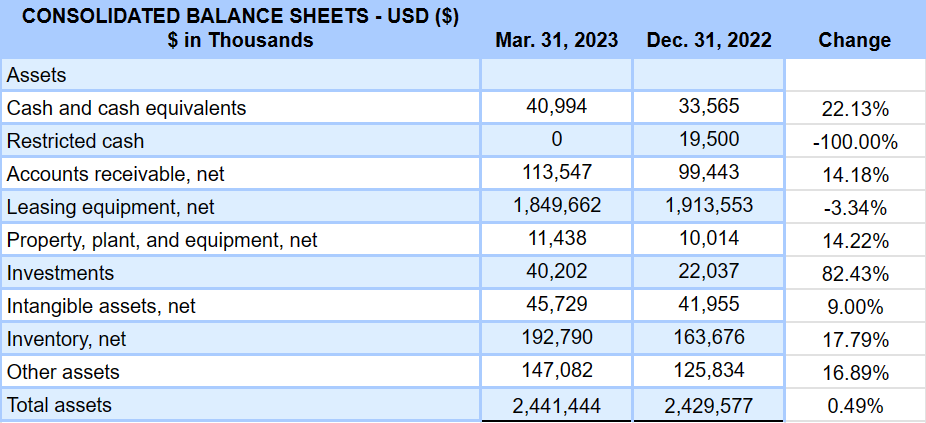

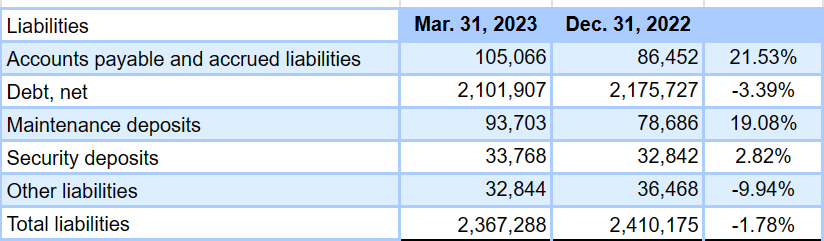

The last quarterly report included a 22% increase in cash, 82% increase in investments, and increases in inventories and total assets. In the same time period, the total amount of liabilities decreased by close to 1.78% driven by decreases in the total amount of debt. I believe that the evolution of the balance sheet would most likely be appreciated by investment professionals.

As of March 31, 2023, the company reported cash and cash equivalents of about $40 million, accounts receivable close to $113 million, leasing equipment close to $1.849 billion, property, plant, and equipment, net worth $11 million, investments worth $40 million, intangible assets, net worth $45 million, inventory, net of $192 million, other assets of $147 million, and total assets worth $2441 million.

Source: Quarterly Report

The list of liabilities included accounts payable and accrued liabilities worth $105 million, debt of about $2.101 billion, maintenance deposits close to $93 million, and security deposits of about $33 million. Finally, total liabilities stood at $2.367 billion.

Source: Quarterly Report

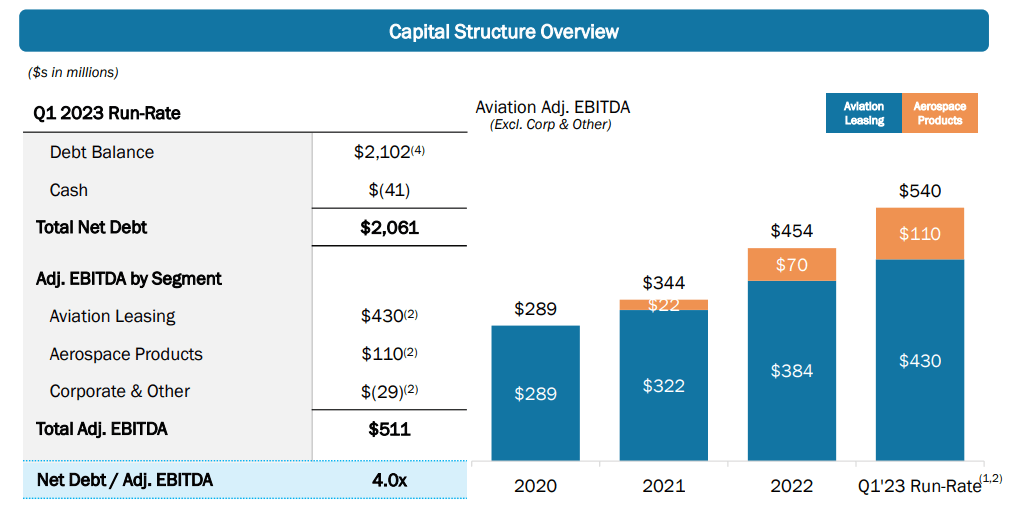

In my view, for some investors the total amount of debt of close to $2.06 billion may be too much. The company reported an adjusted EBITDA of close to $511 million, so the net debt/EBITDA stands at close to 4x.

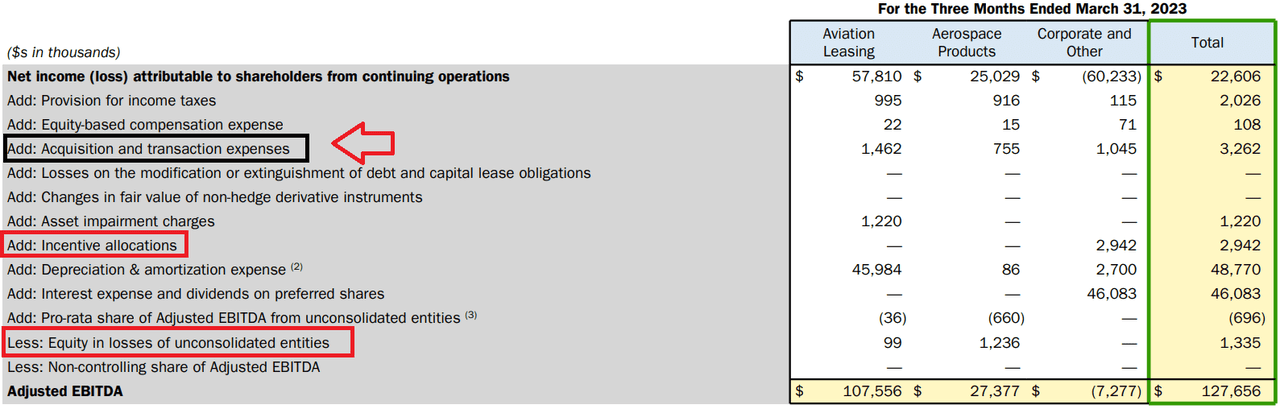

Source: Quarterly Earnings Presentation

With that, the calculation of the quarter adjusted EBITDA management included incentive allocations, equity in losses of unconsolidated entities, and acquisition and transaction expenses, which some analysts may decide not to include. The net debt/EBITDA ratio may be a bit lower than the net debt/adjusted EBITDA. With that all being said, I believe that future EBITDA growth and FCF growth expected would most likely lower the net debt/EBITDA ratio. And as a result, I believe that more investors may have a look at FTAI.

My New Financial Model

As a result of the sanctions imposed on Russian airlines, FTAI terminated all lease agreements with Russian airlines. In the last quarterly report, management noted an impairment of assets because of the sanctions. The company does not expect to recover the lease equipment assets. I cannot say whether new sanctions, the outcome of the war, or new restrictions would impact FTAI. In my view, supply chain issues in the region may impact the transportation of assets, or may push the costs up. Management offered certain commentary in this regard.

We determined that it is unlikely that we will regain possession of the aircraft and engines that had not yet been recovered from Ukraine and Russia. As a result, during the three months ended March 31, 2022, we recognized an impairment charge totaling $122.8 million, net of maintenance deposits, to write-off the entire carrying value of leasing equipment assets that we did not expect to recover from Ukraine and Russia. Source: Quarterly Report

The extent of the impact of Russia's invasion of Ukraine and the related sanctions on our operational and financial performance, including the ability for us to recover our leasing equipment in the region, will depend on future developments, including the duration of the conflict, sanctions and restrictions imposed by Russian and international governments, all of which remain uncertain. Source: Quarterly Report

I believe that further scaling of the Module Factory business may bring an eventual increase in efficiency because of lower turnaround. Besides, lower maintenance may be needed, which may lead to larger FCF margins. If a sufficient number of investors anticipate the increase in FCF margins, they may buy shares. As a result, I believe that we may see an increase in the stock price.

I think that sufficient ESG initiatives and advertisement for these initiatives could bring stock demand and more visibility in the stock markets. In this regard, I invite investors to have a look at the number of institutional investors trying to purchase ESG-related assets and the expected growth of this market out there.

Asset managers globally are expected to increase their ESG-related assets under management to US$33.9tn by 2026, from US$18.4tn in 2021. With a projected compound annual growth rate of 12.9%, ESG assets are on pace to constitute 21.5% of total global AUM in less than 5 years. Source: PWC

I also assumed that management will continue to reduce its debt outstanding as we saw in the last quarter. As a result, shareholders may receive a bit more net income as interest expenses would decline. In the last quarterly release, management noted how interest expenses decreased.

Interest expense decreased $4.8 million which reflects a decrease in the average outstanding debt of approximately $426.0 million due to decreases in the 2021 Bridge Loans of $260.0 million and the Senior Notes due 2025 of $199.2 million, which were partially redeemed in August 2022, partially offset by an increase in the Revolving Credit Facility of $33.2 million. Source: Quarterly Report

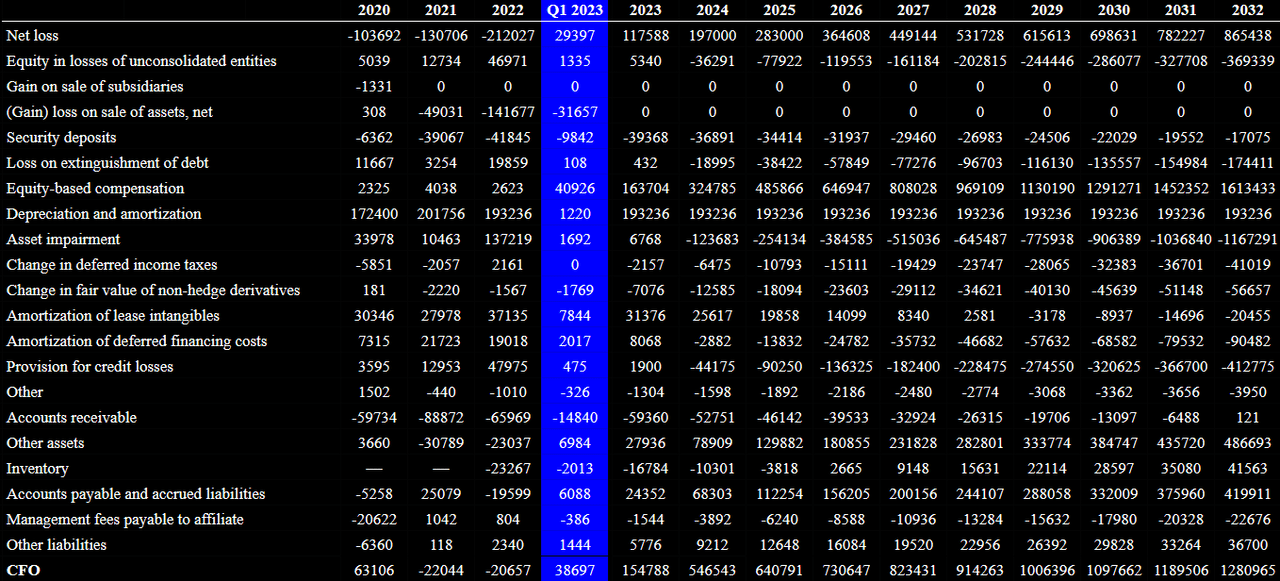

Considering my new assumptions, I assumed 2032 net income close to $865 million, with equity in losses of unconsolidated entities worth -$370 million, equity-based compensation worth $1.613 billion, and 2032 depreciation and amortization of $193 million. Besides, I also assumed changes in deferred income taxes worth -$42 million, changes in fair value of non-hedge derivatives of -$57 million, amortization of lease intangibles close to -$21 million, and changes in inventories of $41 million. Besides, with accounts payable and accrued liabilities worth $419 million, I obtained 2032 CFO of $1.280 billion. If we also assume capex of -$192 million, 2032 FCF would be close to $1.089 billion.

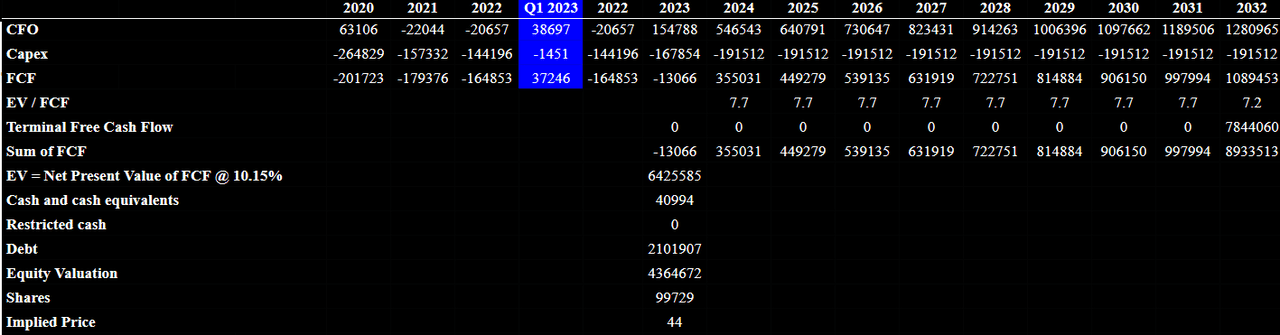

With an EV/FCF of 7.2x, which is a bit lower than that in my previous article, and a WACC of 10.15%, the implied enterprise value would be $6.42 billion. Adding cash and cash equivalents worth $40.994 million, and subtracting debt of $2.1 billion, the implied equity would be $4.36 billion. Finally, the implied price would be close to $43.76 per share.

Risks

I continue to see certain problems from the fact that an affiliate of Fortress, FIG LLC, receives a fee from offering services to FTAI. In my view, if FTAI successfully hires personnel and remains independent, more shareholders will most likely acquire stock. I am not in a position to judge whether the fees paid by FTAI are fair, or they are too expensive.

We are externally managed by FIG LLC, an affiliate of Fortress Investment Group LLC, which has a dedicated team of experienced professionals focused on the acquisition of transportation assets since 2002. As of March 31, 2023, we had total consolidated assets of $2.4 billion and total equity of $74.2 million.

Source: Quarterly Report

Besides, I believe that FTAI would suffer significantly from oversupply of assets in the aviation industry. As a result, prices in the aviation market may lower, which would put pressure on the FCF margins, and may bring lower demand for the stock. Interestingly, the company noted that oversupply occurs when there are economic downturns. In this regard, investors may want to read the following lines from the last quarterly report.

The oversupply of a specific asset is likely to depress the lease or charter rates for and the value of that type of asset and result in decreased utilization of our assets, and the industries in which we operate have experienced periods of oversupply during which rates and asset values have declined, particularly during the most recent economic downturn. Source: Quarterly Report

I also believe that the further increase in the total amount of debt, or lower EBITDA or FCF than expected could increase the net debt/EBITDA ratio. If this happens I believe that many investors may decide to sell their shares, which could push the price of the stock down. Taking into account the current amount of debt, this risk is overall quite significant.

Conclusion

FTAI Aviation recently delivered interesting initiatives for scaling the Module Factory business and ESG initiatives, which may bring further efficiency, less maintenance costs, and more demand from investors. I would understand that most investors out there do not appreciate the current net debt/EBITDA levels, however I believe that FTAI continues to trade undervalued. I lowered my price target, but the stock price is still too low.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FTAI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)