UPS Stock Is Not Undervalued Versus Its Peers

Summary

- UPS, a global leader in supply chain management, has experienced fluctuations in its stock price and revenues due to the COVID-19 pandemic, economic uncertainties, and reduced consumer spending.

- The company's financial analysis shows that despite a decrease in revenue and profit in the most recent quarter, UPS has sufficient cash balance and free cash flow to meet its short-term obligations and dividend payments.

- However, the company's valuation metrics indicate that its stock price is not undervalued.

Juanmonino

Introduction

As a global leader in supply chain management, United Parcel Service, Inc. (NYSE:UPS) offers a wide range of products and services across approximately 220 countries and territories. Their comprehensive offerings include transportation and delivery, distribution, contract logistics, ocean freight, airfreight, and insurance. To ensure reliability and accessibility, UPS operates one of the largest airlines and maintains an extensive fleet of alternative fuel vehicles under the global UPS brand. However, the COVID-19 pandemic and subsequent lockdowns have presented challenges for UPS. The company has experienced fluctuations in its stock price and revenues due to economic uncertainties and reduced consumer spending. In this analysis, I have thoroughly examined UPS's financial performance in comparison to its industry peers. Ultimately, based on my findings, I have formed an investment opinion regarding UPS stock.

UPS business and financials

One of UPS's crucial strengths is their extensive global network, which spans both air and ground logistics. This network is unparalleled in the packaging and logistics industry, providing a significant advantage. However, it also exposes the company to vulnerabilities during international outbreaks such as the COVID-19 pandemic or broader economic uncertainties. Furthermore, on June 16th, 2023, UPS employees were granted strike authorization. These ongoing labor negotiations have the potential to adversely impact the company's operations as a majority of their 330,000 workers have expressed dissatisfaction with their contracts and conveyed negative sentiments.

Another significant factor that has had a negative impact on UPS is the decrease in consumer spending. Specifically, during the first quarter of 2023, the company experienced a decline in the number of deliveries due to lower retail sales in the United States. This decrease in demand was not limited to the United States alone, as it was also observed in Asia. It is expected that this low demand will persist under current macroeconomic conditions. In terms of financials, UPS recorded a total revenue of $14.98 billion in the United States segment during 1Q 2023, compared to $15.12 billion during the same period in 2022, representing a 0.9% decrease primarily driven by a 5.4% decline in average daily volume.

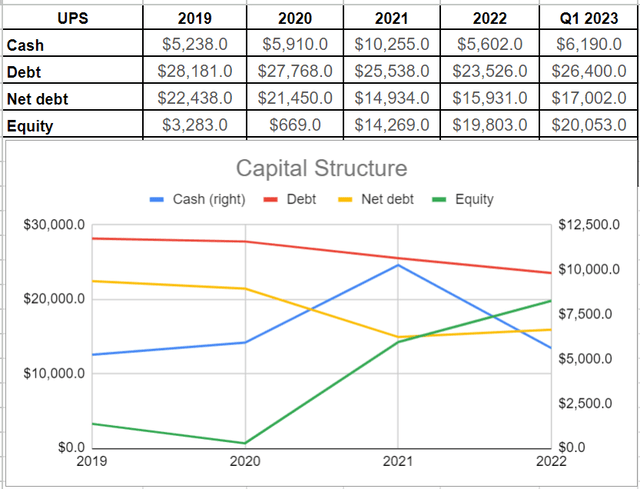

As shown in Figure 1, UPS experienced a significant increase in cash generation, nearly doubling to over $10.2 billion in 2021 compared to $5.9 billion in 2020. This surge can be attributed to the notable shift in consumer behavior due to the COVID outbreak and subsequent lockdowns, with more individuals opting for online grocery shopping rather than traditional in-store purchases. However, there was a decline in cash generation, dropping back to $5.6 billion in 2022 before reaching $6.2 billion by the end of the third quarter of 2023. During this period, UPS's debt level also saw an increase of 12%, rising to $26.4 billion in the first quarter of 2023 from $23.5 billion at the end of 2022. Despite this rise, it is important to note that the net debt sat at $17 billion, which thankfully is below the equity level, which is a positive aspect for the company. Additionally, it is worth highlighting that after experiencing a significant drop to $669 million in 2020, equity level has steadily improved and surpassed $20 billion in the most recent quarter.

Figure 1 – UPS’s capital structure (in millions)

Author

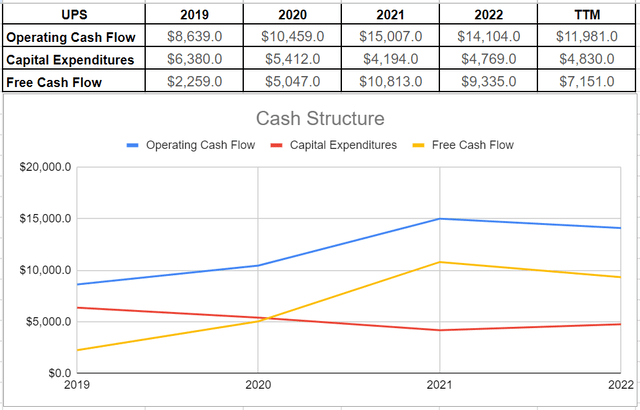

Furthermore, the company's operating cash flow was approximately $12 billion in the trailing twelve months (TTM), representing a 15% decrease from the end of 2022 when it stood at around $14 billion. Despite this decline, capital expenditures remained relatively stable, leading to a free cash flow of $7.15 billion in TTM, which was 23% lower than the end of 2022. However, despite the decrease in free cash flow due to lower volume, UPS is still able to cover its planned dividend payment of $5.4 billion by the end of 2023. This is a positive outcome as management anticipates that lower volume will persist due to global economic slowdowns. Fortunately, UPS's cash and capital structures are robust and capable of fulfilling their obligations and providing returns to shareholders (see Figure 2).

Figure 2– UPS’s cash structure (in millions)

Author

Valuation

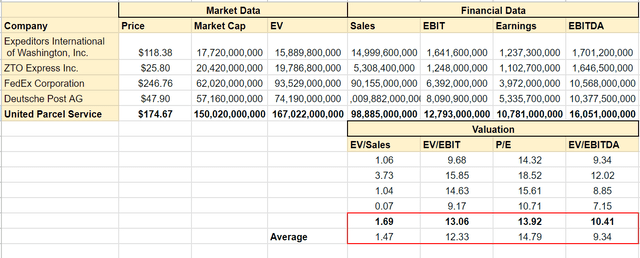

In this section, I have analyzed UPS's financial metrics and compared them with those of its peers. According to Table 1, UPS's EV-to-sales ratio is 1.69x, slightly higher than the average of its peers at 1.47x. Additionally, UPS's EV-to-EBITDA is 10.41x, while the peer group's average is 9.34x. Meanwhile, the company's P/E ratio stands at 13.92x, which is 5% lower than the peers' average of 14.79x.It is worth noting that FedEx (FDX), as UPS's most significant competitor, has an EV-to-sales ratio of 1.04x, which is 29% lower than the peers' average. Furthermore, Deutsche Post AG (OTCPK:DPSGY) provides the lowest P/E ratio among the peers at 10.71x.Overall, UPS demonstrates healthy fundamentals as its cash and equity are sufficient to cover short-term obligations, and it generates enough free cash flow to meet anticipated dividend payments. However, in order to improve its valuation metrics in comparison to its peers, UPS should focus on deleveraging further. Given the upcoming economic uncertainties, changes in consumer behavior, and potential employee strikes, it may not be an opportune time for investors to enter into UPS positions. These factors could lead to volatility in UPS's financials and performance.

Table 1 – UPS’s valuation metrics vs. peers

Author's calculations

Conclusion

UPS, a leading global packaging and logistics company, operates in over 220 countries and territories. Recent analysis of its performance suggests that the company could benefit significantly from the COVID-19 lockdowns in 2021, as there was a substantial increase in volumes worldwide. However, the economic slowdown and decrease in consumer spending have resulted in a decline in revenue and profit for UPS in the most recent quarter. This downward trend is expected to continue until the end of 2023. While UPS has sufficient cash balance and free cash flow to meet its short-term obligations and dividend payments, valuation metrics indicate that its stock price is not undervalued. Therefore, the current price does not present an appropriate entry point for investors.

As always, I welcome your opinions.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

www.cnn.com/...