Chewy: Bullish On The Leadership Position In The Lucrative Pet Product Industry

Summary

- Chewy is diversifying its offerings by expanding into health services such as pharmacy, telehealth, and insurance.

- The COVID-19 pandemic has accelerated pet ownership and e-commerce, boosting Chewy's sales.

- CHWY's long-term sales and earnings growth prospects remain strong as it attracts pet owners with a wide assortment of goods and services and reliable automated shipments.

- I have a buy rating on the stock with an end-of-year price target of $51.

Group4 Studio/E+ via Getty Images

Thesis

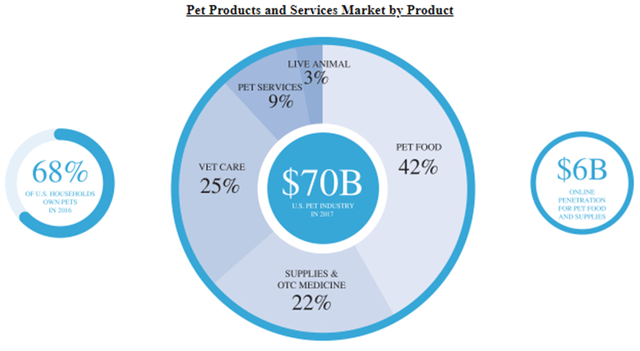

I am bullish on Chewy, Inc. (NYSE:CHWY), given my view that the pet product and care industry offers an appealing and resilient market characterized by continuous growth as pet owners increasingly consider their pets as family members. The online penetration of this market is still in its early stages, with only about 20% of the U.S. pet product market currently transitioning to online platforms. CHWY has effectively utilized the unique characteristics of the pet product market, executed its strategies well, and provided exceptional customer service, positioning itself as a leader in the online pet product retail sector. I anticipate that the company will maintain and expand its leadership position in the coming years. My end-of-year price target of $51 is based on 1.7x EV/Sales and consensus revenue 2024 estimate.

Company Description

Chewy strives to be a one-stop destination for all pet-related needs with one of the largest assortment of pet products compared to other pure-play competitors. The company sells food and supplies and is expanding into healthcare and other services, such as medications and other pet-health products. Chewy has gained significant market share by expanding its sales assortment, with food & supply SKU's doubling over the past 2-3 years.

Q1 Review and Outlook

CHWY exceeded revenue expectations and achieved higher profit margins in the first quarter of 2023. Unlike many other consumer companies, CHWY is confident in its sales and earnings guidance for the year, as the pet ownership rate remains stable, promotional activities are reasonable, and the company's autoship program, which accounts for 75% of sales, is performing exceptionally well. CHWY's strong visibility is attributed to the growing popularity of autoship. Despite the current economic climate, consumers are not seen as compromising on quality for lower prices, which is advantageous for CHWY as it is not a price leader.

Chewy's long-term sales and earnings-growth prospects remain strong as it attracts pet owners with a wide assortment of goods and services and reliable automated shipments -- which is now 75% of revenue. As rising numbers of active users place larger orders, I believe annual revenue could reach $11-$11.5 billion for fiscal 2023. Increased sales enable Chewy to wrest concessions from suppliers, keeping it price-competitive with e-tailing nemesis Amazon.com, Inc. (AMZN) and providing the opportunity to highlight strong service and a broad selection.

Expansion Can Spark Sales Growth

Chewy's expansion into businesses such as pet health care (including services, pharmacy and insurance) and private-label products is the right call, as I see it, because it increases the potential market and supports growth in net sales per active consumer. The company expanded its Chewy Health platform to include prescriptions and telehealth services -- a $31.4 billion market -- for all its members. "Connect with a Vet" allows access to a doctor 365 days a year, as late as 11 p.m. New York time. Its private-label program (with mid- to high-single-digit penetration) aims to fill needs unmet by branded offerings in consumable items and pursue greater penetration in hard goods, which tend to be less competitive.

Chewy's high double-digit sales growth will continue in the medium term driven by relatively low penetration, expansion into new product and service lines -- such as pet health care, insurance and private label -- and a rising number of long-term users who tend to increase spending over time are catalysts. These factors could drive an annual low- to mid-single-digit increase in active consumers and a high-single-digit jump in net sales per active consumer (NSPAC).

E-Commerce Penetration to Boost Sales

The COVID-19 pandemic has accelerated the ongoing trend of increased pet ownership in the United States, which has had a positive impact on suppliers like Chewy. In 2020, there was a significant surge in adoption rates, resulting in the addition of over 11 million pets. Presently, approximately 70% of households in the US own at least one pet, compared to 56% at the end of 2011. The total annual market size for pets in the country is estimated to be $123.6 billion, with around 65% of that dedicated to food, treats, supplies, and over-the-counter medication, according to the American Pet Product Association.

Chewy, recognizing the potential in the expanding pet market, is diversifying its offerings by venturing into health services such as pharmacy, telehealth, and insurance. This expansion has the potential to increase Chewy's target market by 30%. Additionally, the various subsegments within the health services sector are expected to experience growth in the mid- to high-single digits over the next few years.

Not only did the pandemic accelerate gains in pet ownership, but it also lifted e-commerce, with more customers getting used to the convenience of doing business online. Pet e-commerce penetration increased to as much as 30% in 2020 from 20% before the virus, according to Packaged Facts, yet I believe industry growth remains in the early stages. The online pet-supplies sector may expand in the low- to mid-teens for the next several years, chipping away at other formats, particularly pet-specialty and grocery brick-and-mortar retailers. Amazon.com tops pet e-commerce with 46% of the market, followed by Chewy (35%) and Walmart (WMT) (8%). Brick-and-mortar pet-specialty retailers trail at 2% for Petsmart and 1.2% for Petco.

Valuation & Financial Outlook

Chewy's net-revenue increases could accelerate to at least the low teens over the next couple of years, as significant expansion in net sales per active consumer outpaces gains in customers. Short-term, greater churn from shoppers obtained during the pandemic may weigh on sales growth, but that will subside over the next couple of quarters. Operating efficiencies such as automation in fulfillment centers are starting to take hold, offsetting pressures from product and labor costs. This will allow EBITDA margin to expand closer to its long-term goal.

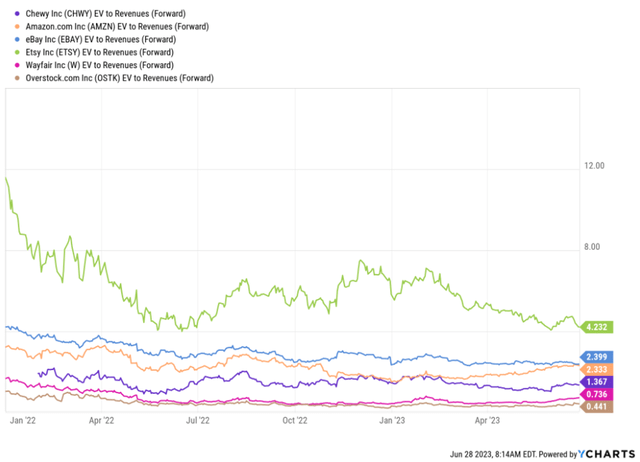

The stock is currently trading at 1.3x EV/Sales. I believe the stock is inexpensive for a double-digit top-line grower with margin expansion. My end-of-year price target of $51 is based on 1.7x EV/Sales and consensus revenue 2024 estimate. I believe CHWY merits a premium to online retailer peers, given its highly visible and recurring revenue stream.

Risk

Chewy has witnessed a significant surge in its active customer base, growing over 50% since FY 2019, which coincided with the start of the pandemic. This growth was fueled by people spending more time at home and having increased availability to care for their pets. However, as the world gradually recovers from the pandemic and individuals return to offices, there is an expectation of a slower rate of customer acquisition on the Chewy platform. This projection is driven by the anticipation of higher customer churn as people have less time to dedicate to their pets. Any unforeseen loss of customers could have a negative impact on the company's stock price.

Furthermore, Chewy faces heightened competition from Amazon, which has been increasingly focusing on the pet category in recent years. Amazon has introduced features like pet profiles in late 2017 and launched its private-label brand, Wag, in May 2018. Additionally, Amazon offers subscribe & save discounts, creating additional competitive pressure. It is estimated that Amazon holds the second position in the online pet market, making it more challenging for Chewy to further expand its approximately 33% share of the online market. Moreover, Amazon could employ price strategies, such as promotions during events like Prime Day, to gain market share.

Conclusion

The pet industry is considered defensive, as it has historically demonstrated resilience and outperformed during economic downturns. The demand for pet-related products and services is relatively insensitive to price changes, particularly in essential categories like Consumables. This means that cost increases can be passed on to consumers without a significant impact on demand. Additionally, the challenges faced in the supply chain and labor market last year have subsided, creating a favourable environment for the pet industry. Moreover, there is still room for increased spending per pet, as newer millennial cohorts tend to spend more on their pets compared to previous generations. I have a buy rating on the stock with an end-of-year price target of $51.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.