Honeywell Or General Electric? A Very Difficult Choice

Summary

- Today, I'll be comparing 2 major conglomerates, Honeywell International Inc. and General Electric Company, which exhibit several similarities.

- The 2 companies will most likely grow based on different growth drivers.

- GE's EPS has greater growth potential in the next two years due to its lower bottom-line base resulting from recent challenges.

- But GE, with a less diversified business structure than HON, is unlikely to have the valuation premium that Mr. Market is currently pricing in.

- I'm choosing HON instead of GE this time around.

- I do much more than just articles at Beyond the Wall Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Wirestock/iStock via Getty Images

Introduction

I continue the comparison of industrial conglomerates that I began with Johnson Controls (JCI) and Carrier Global (CARR), but this time I take on two larger and more diversified companies - Honeywell International Inc. (NASDAQ:HON) and General Electric Company (NYSE:GE), which share many similarities.

Firstly, both HON and GE are multinational conglomerates operating in the industrial sector with diverse business segments spanning multiple industries. Secondly, they both have a significant presence in the aerospace industry, with HON involved in aerospace systems, avionics, and aircraft engines, while GE manufactures aircraft engines through its GE Aviation division. Thirdly, HON and GE emphasize technological innovation, investing in research and development to develop advanced solutions. Fourthly, they have a strong global presence, serving customers worldwide and operating in multiple countries. Lastly, both companies provide safety and productivity solutions, with HON offering safety equipment and automation solutions, and GE providing safety systems for power generation and healthcare.

I propose to compare the various characteristics of these two companies and try to choose "the stronger horse" in the medium term based on business prospects and valuation.

Business Models And Financials

To be fair, I should list some differences in the business focuses of the selected companies:

| Area / Firm | HON | GE |

| Main industries of focus | aerospace, building technologies, performance materials, safety, and productivity solutions | power, renewable energy, aviation, and healthcare; historically been more heavily involved in the energy sector. |

| Industrial automation space | a broad range of industrial automation solutions | has expertise in areas like power generation, grid solutions, and digital industrial automation. |

Source: Author's compilation

The different specification levels of the companies become even more apparent in the breakdown of revenue streams:

Author's compilation [based on 10-Qs]![Author's compilation [based on 10-Qs]](https://static.seekingalpha.com/uploads/2023/6/28/49513514-1687926018259498.png)

The identified difference in specification and expertise means that the two companies will most likely grow based on different growth drivers.

Honeywell has strong growth potential, driven by the increasing demand for warehouse automation solutions, digital offerings, and a broader commercial aerospace recovery, according to Morningstar's analyst Joshua Aguilar [proprietary source]. The company's presence in the e-commerce and carbon capture markets further enhances its growth prospects. In contrast, GE's growth lies in its focus on renewable energy and digitalization. GE is expanding its renewable energy portfolio, particularly in wind and hydropower, to align with the global shift towards sustainable energy sources. Additionally, GE's digital solutions empower customers to optimize operations and increase productivity, positioning the company for growth in the renewable energy and digital industries.

Goldman Sachs' investment research team adds in its most recent research [June 21, 2023 - proprietary source], that General Electric has a significant backlog of engine orders and expects a robust growth trajectory for its installed base. The recovery of air traffic, particularly in narrowbody and widebody segments, is expected to drive the ramp-up of services revenue. GE is also focusing on the LEAP engine, with internal shop visits projected to begin in 2023. The company aims to achieve OE break-even and program profitability for LEAP by 2025. General Electric expects organic growth in the mid-to-high teens for Aerospace in 2023, with operating profit and strong free cash flow conversion. GE's commercial services division is expected to experience strong demand, with a mid-20s CAGR projected for OE deliveries from 2022 to 2025. Looking ahead to 2025, GE anticipates organic sales growth, operating margins of around 20%, and mitigating headwinds through volume, price, and productivity improvements.

Now let's take a look at a comparison of the latest financial and corporate results:

| Criteria [Q1 Data] | Honeywell | General Electric |

|---|---|---|

| Stock Performance | Underperformed S&P 500 YTD: +59.75% vs. +14.99% | Outperformed the market YTD: -5.47% vs. +14.99% |

| Revenue Growth | 8% YoY organic [to $8.9 billion]. | 16% YoY organic [to $13.7 billion] |

| Segment Margins | Widened by 50 basis points to 22.0%. | Improved by 330 basis points to 6.4%. |

| Adjusted EPS | $2.07 (above the consensus estimate of $1.93; a beat of 7.3%). | $0.27 (above the consensus of $0.14; a beat of 93%). |

| Guidance for FY2023 |

|

|

| Recent Acquisition | Acquired Compressor Controls for $670 million (15-times 2023E EBITDA on a tax-adjusted basis) | N/A |

| Segment Outlook |

|

|

| Shareholders return |

|

|

Source: Author's compilation, based on Seeking Alpha and Argus Research

To be honest, I like both companies. Honeywell seems more stable to me than General Electric, but in many ways, I judge by "old memory". The perception that GE has had a lot of problems in the past overrides my perception and clouds the potential growth prospects for the business. And GE definitely has prospects. But HON also looks promising as far as I can see, albeit without the rapid growth rate of recovery as GE.

Ultimately, it all boils down to a comparison of the companies' valuations - let us get to that now.

Valuations

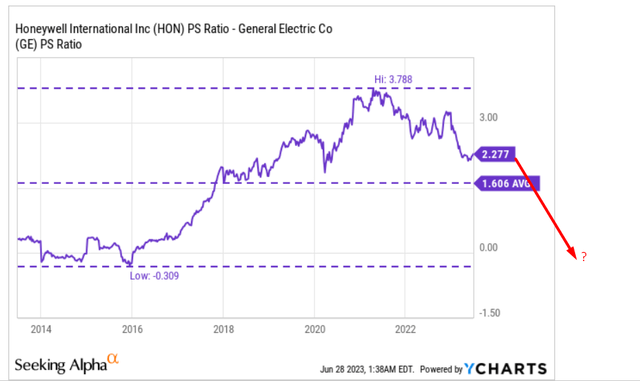

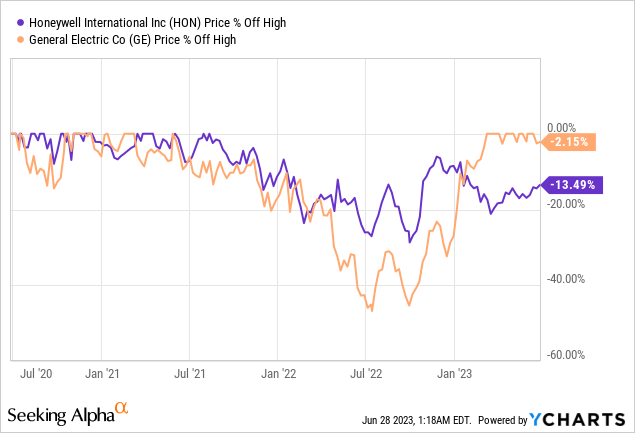

As you can see from the table above, GE has significantly outperformed not only HON but also the broader market. Looking at the off-highs dynamics, GE is trading near its 3-year highs, while HON is trying to slowly recover from its recent dip:

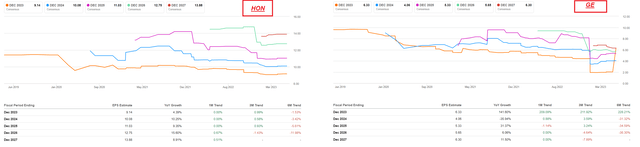

In terms of momentum, GE is far superior to HON. But why? I suspect there are several reasons for this. First, GE's FY2023 EPS revisions have skyrocketed recently - Wall Street has obviously become much more positive about the company's prospects in its segments. But the same thing didn't happen to HON.

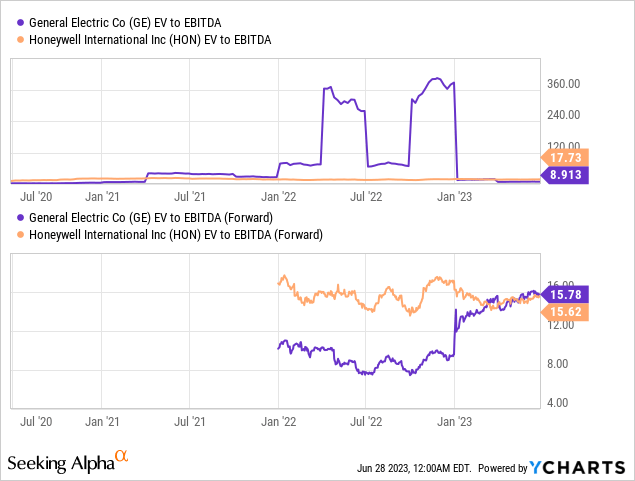

Second, the valuation multiples of GE started to catch up with other competitors, which we can clearly see in the EV/EBITDAs of HON and GE. The market simply began to value GE at the level of HON [based on the nearest future]:

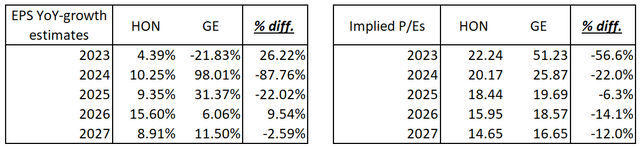

The third point is that the growth of GE should exceed that of HON many times over in the foreseeable future if we look at the EPS figures. In any case, this follows from the consensus forecasts of both companies:

Seeking Alpha data, author's work

But as you can see from the implied P/E ratios, the valuation of GE is not shrinking as companies achieve relatively equal growth rates through 2026-2027. Why GE has to be at a premium to HON is not entirely clear to me. Apparently, the market believes we will see the following dynamics in the next 2-3 years:

In my opinion, GE has absorbed too much positive at the moment and has become more expensive than it should be. The upward trend seems limited from here.

My view is supported by Morningstar Premium's "Price vs. Fair Value" system and by Argus Equity Research analysts:

| Analysts' upside targets | HON | GE |

| Morningstar | 11.07% | 7.70% |

| Argus Equity Research | 13.53% | 6.75% |

Argus Equity Research [proprietary source]![Argus Equity Research [proprietary source]](https://static.seekingalpha.com/uploads/2023/6/28/49513514-16879311861042979.png)

Risk Factors To Consider

It's impossible to ignore the risk factors surrounding both GE and HON. For your convenience, I have decided to present them in tabular form, following the chosen comparative format.

| Honeywell | General Electric |

|

|

Source: Author's work

Also, note that both companies' performance is closely tied to global economic conditions. Weak economic growth, recessions, or industry-specific downturns can impact demand for Honeywell's and General Electric's products and services, affecting their revenues and profitability.

Concluding Thoughts

Although GE has grown significantly faster than HON in recent months, I like the latter stock better today because it is relatively moderately valued and, historically, has had poor institutional positioning recently [so it's not as overcrowded as GE might be today]:

BofA [June 15, 2023 - proprietary source]![BofA [June 15, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/28/49513514-16879315584816906.png)

I acknowledge some analysts' perspectives that GE may have higher growth potential for its EPS over the next two years, as the company is starting from a lower EPS basis due to recent challenges. But that does not change the fact that GE, with a less diversified business structure, is unlikely to have the premium that Mr. Market is currently pricing in.

So I'm choosing HON instead of GE this time around.

Thanks for reading!

Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.