3 Dividend Growth Stocks With Yields Over 6%

Summary

- The article discusses the potential of high-yield dividend growth stocks, particularly in sectors like pipelines and banking.

- Banking stocks often offer high yield and growth together.

- The same is true of pipeline stocks.

- Sometimes high-yield dividend growth stocks have high payout ratios, but that isn't always the case.

- I share one bank stock and two pipeline stocks that have high yield and dividend growth.

Pipeline stocks often have high yield and dividend growth. pandemin

Yield and growth.

In the world of dividend investing, they're often regarded as polar opposites.

On the one hand, you have steady dividend growers like Apple (NASDAQ:AAPL) whose yields are paltry.

On the other hand, you have preferred shares, which often yield 6% but usually never grow.

The difference between dividend yield and dividend growth is so stark that many dividend investors put themselves in one camp or the other. Some are high yield people, others are dividend growth people. It seems logical, as yield today is not the same as yield in the future. But in fact, you do not need to choose between the two. There are many stocks out there that offer yield and growth in the same package. Often found in sectors like pipelines and banking, these stocks have rewarded investors handsomely over the years. To be sure, high yield dividend growth stocks aren't risk-free. In many cases they are subject to the same risks that stagnant high yielders are. But they are very much worth looking into. In this article I will explore three dividend growth stocks with yields above 6%.

Bank of Nova Scotia

The Bank of Nova Scotia (BNS) (BNS:CA) is a Canadian bank stock with a 6.4% dividend yield at today's prices. If you are American and you hold it in a taxable account, the 15% withholding tax reduces the yield to 5.4%. If you hold the stock in a 401k, then the dividend withholding tax is not taken out. So, it is possible for an American investor to enjoy the full dividend on BNS shares within a tax deferred account.

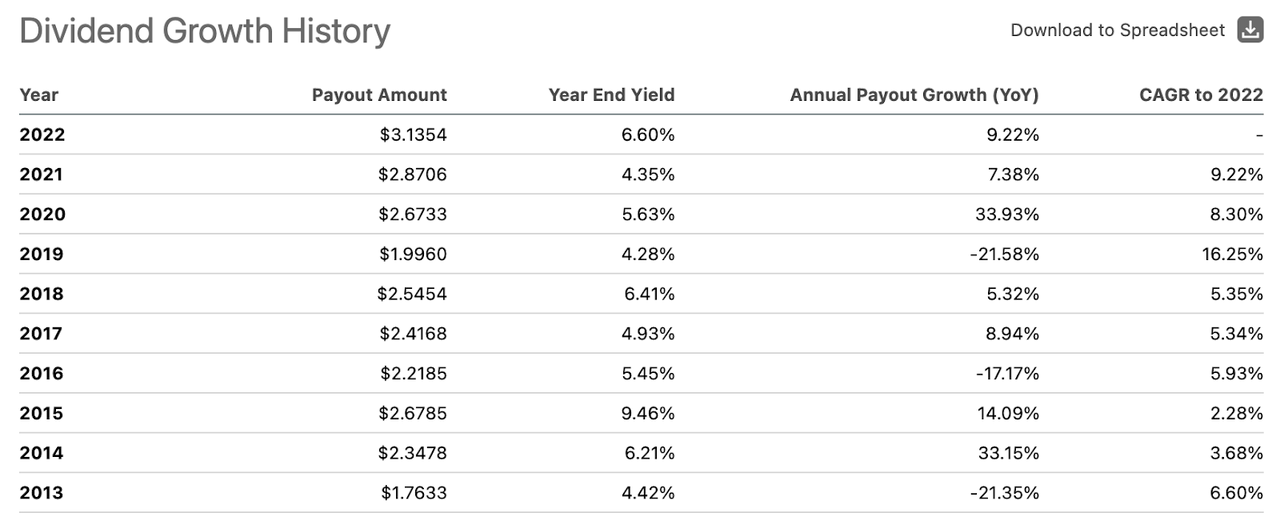

For a stock that has high yield and growth in one package, Bank of Nova Scotia has an admirably low payout ratio. According to Seeking Alpha Quant, BNS pays out 53% of its earnings as dividends, which is not very high at all for a high yield stock. It also has a 5.43% average dividend growth rate over the last five years. As the chart below shows, the growth is much better than that over a longer term timeframe.

BNS dividend growth (Seeking Alpha Quant)

So, BNS is a high yield stock with some dividend growth. What's not to love?

One thing worth noting is that BNS's dividend growth has not been well supported by earnings growth. According to Seeking Alpha Quant, Scotiabank's earnings have grown at just 2.42% CAGR over the last 10 years. This would suggest that the dividend growth is outpacing the growth in earnings. Unlike other Canadian banks, BNS went with Latin America and Asia for international expansion, rather than the United States. Some of BNS's foreign markets face political challenges that sometimes negatively impact economic growth. For example, the Borgen Project estimates that Columbia loses 1% of its potential GDP each year to corruption. This may be holding back Scotiabank's growth abroad, but on the flipside, the bank's 6.4% yield is enticing enough already even if growth is slow going forward.

Kinder Morgan

Kinder Morgan (KMI) is a pipeline stock that has a sky-high 6.83% dividend yield, and a track record of 14% dividend growth over the last five years. This is among the best combinations of yield and growth I've ever seen. If the company keeps it up, the yield-on-cost could rapidly hit double digits. Additionally, the company's payout ratio-98%--is within the realm of reason. Pipelines often have payout ratios above 100%, as they like to reward their investors with large dividends. So while KMI's payout ratio is high compared to all stocks, it is not high on a sector relative basis.

KMI has a very diverse mix of operations. It transports crude, gasoline, natural gas, diesel and jet fuel. It also operates a number of storage terminals. It transports 40% of the natural gas consumed in the United States. In its most recent quarter, earnings declined 8%, which isn't a positive, though it's less bad than the earnings decline seen at E&Ps in the same period. As a pipeline company, KMI is less sensitive to oil prices than E&Ps are. Pipelines lease out pipeline space, which is a business that can do well even when the price of oil is relatively low.

Kinder Morgan has a fairly modest valuation at today's prices, trading at 14.5 times earnings, 1.98 times sales, 1.2 times book value and seven times operating cash flow. Overall, it's a high yield dividend growth stock with a lot of potential.

Enbridge

Last but not least we have Enbridge Inc (ENB) (ENB:CA). This is another pipeline company with a high dividend yield and strong dividend growth. At today's prices, ENB yields 7.14%, and has a 5.45% CAGR dividend growth rate.

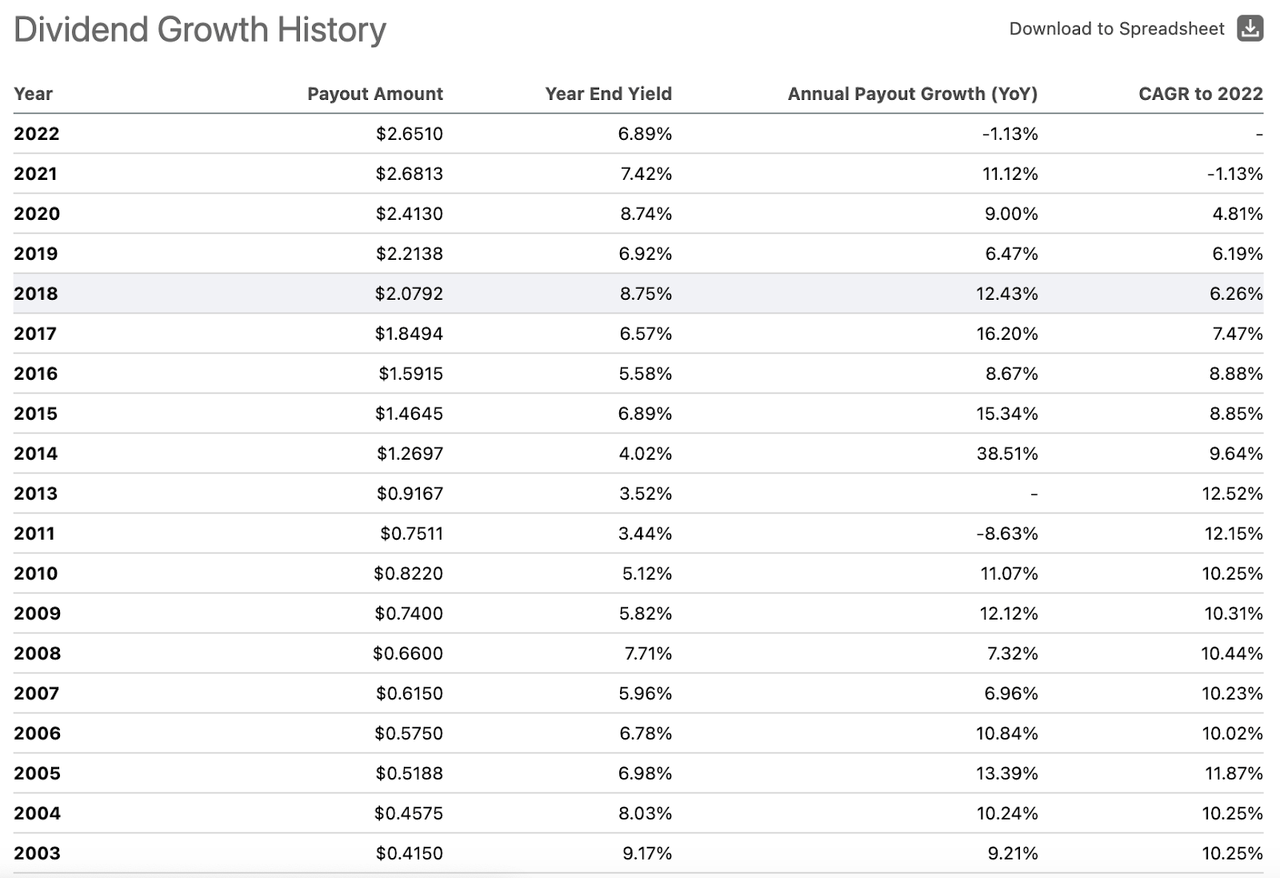

As you can see in the table below, ENB's dividend has grown dramatically over the years.

Enbridge dividend growth (Seeking Alpha Quant)

Enbridge's revenue has been remarkably steady over time. Even in 2020, when oil prices went negative, Enbridge's revenue only declined 20%. Apart from that one year, Enbridge's revenue has been growing consistently. One of the reasons for this is that Enbridge locks its clients into long term contracts, typically for at least eight years. This means that the company's revenue keeps coming in even during periods of weak oil prices.

One potential risk with Enbridge is its payout ratio. Currently the earnings based payout ratio is at 120%, and the free cash flow payout ratio is above 100% too. This situation could jeopardize ENB's dividend growth going forward. On the other hand, the reason why Enbridge's payout ratios are high is arguably a positive. Enbridge's free cash flow is currently being suppressed by high capital expenditures, particularly on projects like the Line 3 replacement, which will widen that line's pipes and add extra transportation capacity.

Enbridge is not as cheap as Kinder Morgan, trading at 17.5 times earnings and 1.8 times book value. On the flipside, its dividend yield is considerably higher. If Enbridge's expansion and replacement projects pay off, then those investing in the company today may enjoy higher yields in the future.

The Bottom Line

The bottom line on dividends is this:

You do not have to choose between yield and growth. To the contrary, it's quite possible to find both in the same stock. Stocks that offer high yield and growth are rare, but they are often great opportunities. As the three stocks reviewed in this article show, they're often fine companies as well.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.