Rio Tinto: Balancing Cyclical Payouts With Commodity Market Remaining Volatile

Summary

- RIO's stock prices have moderated in line with the iron ore spot prices since the commodity comprises a large part of its EBITDA thus far.

- For now, the long-term contracts suggest a new normal in iron ore prices through 2024, potentially lifting its top and bottom line, with China's import YTD looking promising as well.

- However, China's commitment to expand steel scrap usage may potentially erode the long-term demand for the commodity.

- Then again, RIO is also diversifying into copper and lithium carbonate production, capitalizing on the global electrification trend through 2050.

- In any case, the commodity market's cyclical nature and the stock's semi-annual variable dividends may not suit all income investors.

PM Images

This Highly Cyclical Commodity Investment Thesis May Not Be Suitable For Everyone

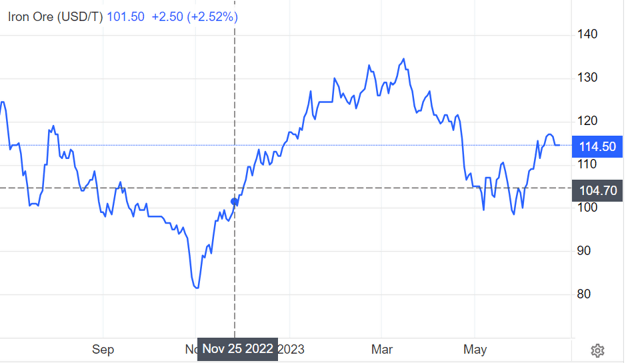

We previously covered Rio Tinto (NYSE:RIO) in November 2022, suggesting that the cooling property market in the US and China's Zero Covid Policy might be headwinds to the recovery of iron ore prices then.

Iron Ore Spot Prices

Trading Economics

While iron ore spot prices might have rallied upon China's unexpected reopening by the end of 2022, it appeared that demand remained sluggish, naturally triggering the moderation of spot prices by April 2023. This had also impacted RIO's stock prices since the commodity comprised 68.7% (-2.8 points YoY) of its EBITDA in 2022.

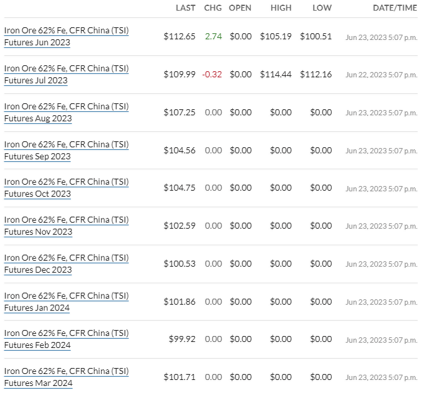

Recent Contract Rates For Iron Ores

Market Watch

The same pessimism is also reflected in the commodity's contracted rates in China, ranging between $112.65 for June 2023 contracts to $101.71 for March 2024 contracts. These numbers contrast sharply against the March 2023 peak of $134.50 and July 2021 peak of $222.50 indeed.

Given that the country accounted for 71.3% of the global iron ore demand in 2022, we suppose that the normalization in spot prices may trigger a similar moderation in RIO's top and bottom line ahead. This is especially since Greater China comprised 54.3% (-5.4 points YoY) or $30.17B (-20.3% YoY) of the producer's revenue in 2022.

Then again, while things appear to be on the downward trend, these contracted prices suggest a new normal compared to the 2019 average of $95. This cadence is made more optimistic with China's higher iron ore imports of 481M metric ton (+7.6% YoY) between January to May 2023, with steel exports also growing to 36.37M metric ton (+40.9% YoY) at the same time.

In addition, China's steel mills reported improved profit margins of 34.2% in May 2023, compared to 26.41% in April 2023, suggesting that the increased iron ore imports may continue for a little longer. The country's iron ore inventory of 127.95M metric ton by June 22, 2023, remains near its 1Y lows as well, suggesting potential restocking ahead.

Nonetheless, we must also warn RIO investors that it remains to be seen if this optimistic cadence may be sustained in the long-term, since China has also committed to expand its use of scrap-to-steel usage to 380M metric ton by 2030, expanding at a CAGR of +7.69% from 210M MT in 2022.

With 590M metric ton of iron ore likely to be displaced per annum by the increased steel scrap usage by 2030, we may see the country's effort in achieving its peak carbon intensity by 2030, with a net zero goal by 2060, potentially erode the demand for the commodity over time.

While RIO had also been diversifying its operations to copper, due to the global electrification cadence through 2050, the commodity only comprised a minority of its EBITDA at 8.7% (-1.5 points YoY) in 2022, suggesting its long way to go in being a top and bottom line driver.

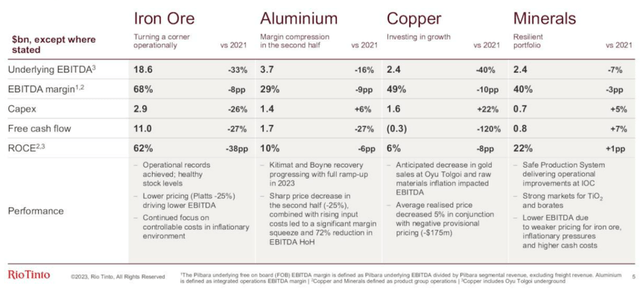

RIO's Segment Performance In 2022

This is on top of the commodity's unimpressive Return Of Capital Employed [ROCE] of 6% in 2022, against iron ore at 62%, despite the higher average spot price for copper at $8.22K (-11.7% YoY) per metric ton compared to $6.01K in 2019.

Then again, while there may be a temporal major supply additions from the Kamoa-Kakula mine in the Congo, the Quellaveco mine in Peru, the expansion of the Quebrada Blanca II, and the Spence-SGO mines in Chile, market analysts believe that much of these may be digested by 2026.

In addition, copper spot prices are expected to remain above $8K per metric ton through 2024, before hitting over $10K per metric ton by 2027 "when market deficits begin to appear."

RIO has already guided up to ~500K ton per annum of additional copper output by 2028, on top of its annualized copper output of 580K ton by FQ1'23 (-5% QoQ/ inline YoY) and a maximum existing capacity of up to 710K ton per annum.

This cadence suggests that the producer's expansion in Oyu Tolgoi in Mongolia/ La Granja in Peru for copper remains highly strategic to its relevance and top/ bottom line expansion over the next decade.

This is on top of RIO's lithium carbonate plans through Rincon in Argentina, with an estimated capacity of 3K metric ton per annum. The global lithium market size is also expected to grow to $89.9B by 2030, expanding at a CAGR of +22.1%, with demand similarly expanding to 2.1M metric ton at a CAGR of +16.95% at the same time.

So, Is RIO Stock A Buy, Sell, or Hold?

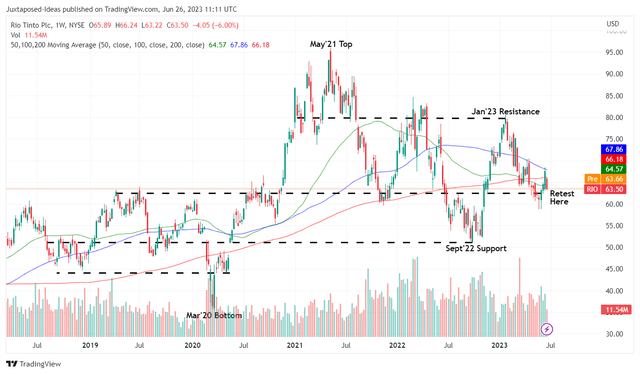

RIO 5Y Stock Price

For now, RIO has already retraced tremendously from its previous peaks to retest the previous support at $60s.

Assuming that these levels hold, we may see the stock offer improved forward dividend yields of 7.08%, based on its annualized dividend of $2.25 in the latest payout. These numbers are much improved compared to the 5.2% average yield and the $3.31 paid out in 2019, barring the bonus dividends.

Then again, we must also warn prospective investors that the commodity producer offers variable semi-annual dividends, a cadence that may not suit those who rely on stable payouts.

As a result, we are cautiously rating the RIO stock as a Buy for long-term investors, if the portfolio remains well-balanced afterward. The commodity market remains highly cyclical, with the peak already moderated due to the peak recessionary fears. With the Fed guiding two more hikes in 2023, it remains to be seen when the macroeconomic sentiments may lift as well.

Therefore, investors may also want to moderate their expectations accordingly, since we are unlikely to see the repeat of hyper-pandemic payouts ahead.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)