Performance Shipping: Great Fundamentals Held Down By Shareholder Dilution

Summary

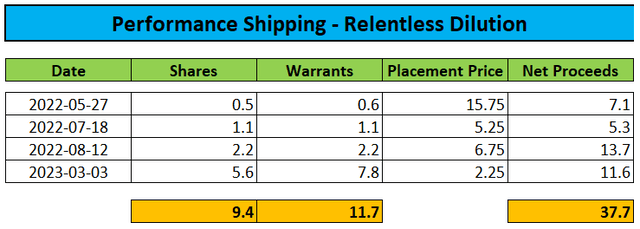

- Greece-based tanker operator has raised $37.7 million over the past 13 months from relentlessly diluting common shareholders well below net asset value ("NAV").

- Like other tanker companies with a focus on the spot- and short-term time charter markets, Performance Shipping has benefited heavily from elevated charter rates caused by recent geopolitical events.

- Last week, the company reported highly profitable Q1/2023 results with $18.7 million in cash generated from operating activities as compared to $33.8 million for all of 2022.

- Current discount to NAV calculates to an eye-watering 97% as investors remain wary of potential dilution from outstanding warrants and convertible preferred stock.

- I am assigning a "Speculative Buy" rating to the shares based on my expectations for additional near-term share buybacks and management to abstain from further dilution for the time being.

HeliRy

Note:

I have covered Performance Shipping (NASDAQ:PSHG) previously, so investors should view this as an update to my earlier articles on the company.

Last year, small Greece-based tanker operator Performance Shipping joined peer Imperial Petroleum (IMPP, IMPPP) and sister company OceanPal (OP) in relentlessly diluting common shareholders at a tiny fraction of net asset value for the sole purpose of growing their respective fleets.

Over the past 13 months, Performance Shipping has raised approximately $37.7 million in net proceeds from additional equity offerings including warrant sweeteners:

Please note that common shareholders suffered additional dilution (albeit to a lesser extent) from share sales executed under two recent at-the-market offerings.

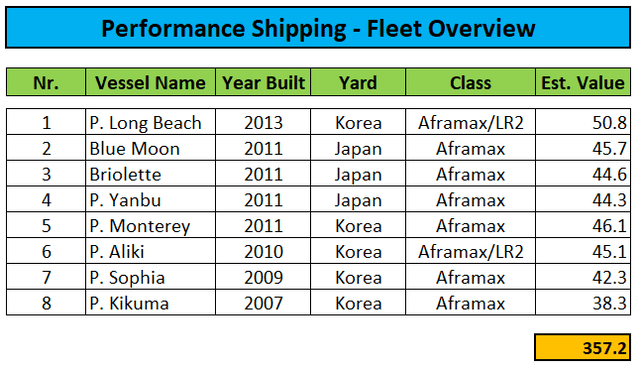

The company has used the funds to expand its tanker fleet to eight vessels with an estimated market value of more than $350 million:

Company Presentation / MarineTraffic.com

In addition, Performance Shipping has ordered a newbuild Aframax/LR2 tanker for a purchase price of $62.2 million with delivery expected in Q4/2025. In April, the company paid the first installment of $9.5 million.

Like other tanker companies with a focus on the spot- and short-term time charter markets, Performance Shipping has benefited heavily from elevated charter rates caused by recent geopolitical events.

Last week, the company reported highly profitable Q1/2023 results with $18.7 million in cash generated from operating activities as compared to $33.8 million for all of 2022. Please note that both earnings and cash generation were negatively impacted by the 15-year special periodic survey and installation of a ballast water treatment system on the vessel P. Kikuma.

Moreover, in a surprise twist of fate, the company has recently started to repurchase common shares:

Despite what we consider to be sustainably strong fundamentals for our sector, we believe the value of our common shares is extremely low when compared with our quarterly earnings and cash on hand. In light of that, we commenced a $2.0 million share buyback program in April, which we believe is in the best interests of both our Company and our shareholders. Pursuant to this program, we have repurchased 1,518,113 shares of our common stock to date at an average price of $0.84 per share.

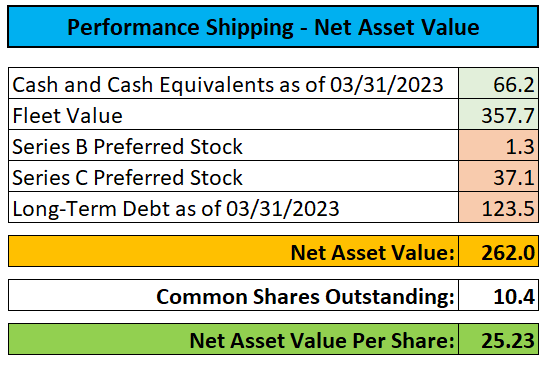

Indeed, the company is trading at an eye-watering 97% discount to net asset value ("NAV"):

Press Releases and Regulatory Filings / MarineTraffic.com

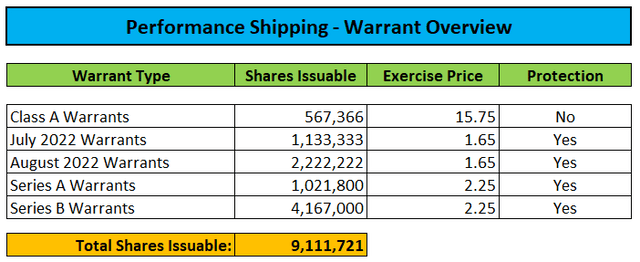

Unfortunately, Performance Shipping has issued plenty of potentially dilutive warrants in recent years with the overwhelming majority being subject to exercise price adjustments should the company sell additional equity going forward:

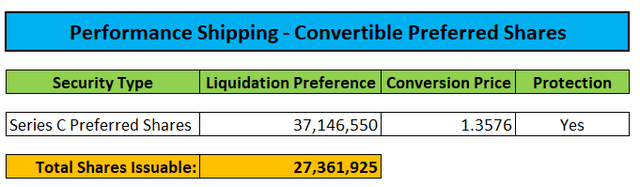

In addition, Performance Shipping has issued approximately 1.5 million dilution-protected Series C Convertible Preferred Shares with a liquidation preference of $37.1 million and a current conversion price of $1.3576:

Please note that further downward adjustments to the conversion price are subject to a floor of $0.50 per share.

Not surprisingly, Chairwoman Aliki Paliou and her spouse, CEO Andreas Michalopoulos control approximately 90% of the Series C Convertible Preferred Shares.

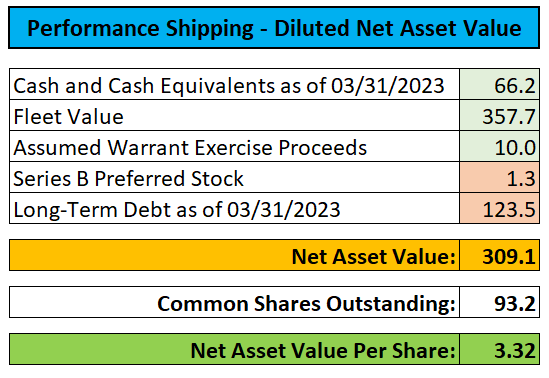

Assuming conversion of all outstanding Series C Convertible Preferred Stock at the floor conversion price of $0.50 and full exercise of all dilution-protected warrants for aggregate cash proceeds of $10 million, fully-diluted NAV would calculate to approximately $3.32 per share thus reducing the discount to slightly below 80%:

Regulatory Filings / Author's Assumptions

Please note that further dilutive equity and warrant offerings will be required to reduce warrant exercise and preferred stock conversion prices to the levels assumed in my example. Consequently, the diluted NAV of $3.32 per share calculated in the table above might still be too high.

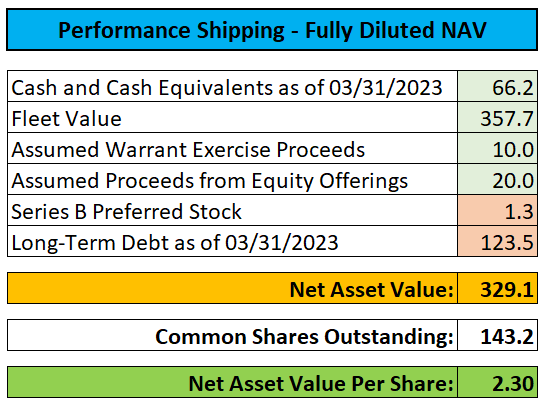

Assuming the company issues another 50 million shares at an average price of $0.40 in future equity offerings, fully-diluted NAV per share would decrease to $2.30:

Regulatory Filings / Author's Assumptions

While charter rates have retreated from record levels achieved in Q4/2022, current spot rates of around $45,000 for Aframax tankers remain highly profitable.

As a result, Q2 will be another quarter with strong cash generation for Performance Shipping thus, at least in theory, eliminating the need for further dilutive equity offerings in the near- to medium term.

At this point, the company has approximately $0.73 million remaining under its recently announced $2 million share repurchase program, sufficient to buy back another 9% of outstanding common shares.

But even if management keeps a more shareholder-friendly stance going forward, market participants are likely to remain wary of the fact that controlling shareholders would actually benefit from additional dilution as the conversion price of their Series C Convertible Preferred Shares would be adjusted downwards closer to the $0.50 floor price.

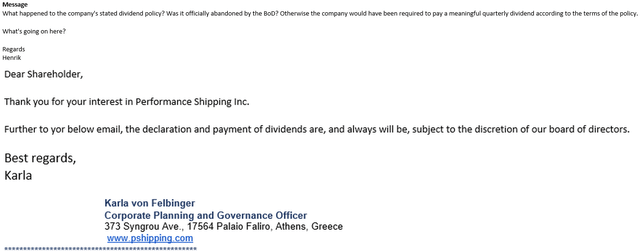

In order to substantially narrow the discount to NAV in the short-term, Performance Shipping will have to be more aggressive on common share buybacks and introduce additional shareholder-friendly measures like the initiation of a quarterly dividend.

At least the latter appears highly unlikely given the fact that the company started to ignore its stated dividend policy in Q3/2022 after cash flows vastly exceeded required thresholds.

I actually took the time to ask the company about the issue and even got an answer:

So much for the value of a stated dividend policy.

The company's highly questionable course of action actually ruined my trading call on Performance Shipping's common shares at that time.

Lastly, investors should note that the company remains out of compliance with the Nasdaq's $1 minimum bid price requirement but has been provided the usual 180-day grace period until October 16.

Bottom Line

Despite the company's strong balance sheet and substantial cash flow generation, Performance Shipping's common shares continue to trade at a massive discount to NAV as market participants remain wary of the overhang from outstanding warrants and convertible preferred shares as well as the likelihood of further dilutive equity offerings going forward.

On the flip side, the company recently reversed course and repurchased more than 10% of outstanding shares over the past two months.

While my perception of Performance Shipping hasn't changed by any means, I am assigning a "Speculative Buy" rating to the shares based on my expectations for the company to buy back additional shares and abstain from further dilutive offerings in the near- to medium-term.

Please note that only the most speculative investors should consider getting involved with trading bottom-of-the barrel shipping stocks from the likes of Performance Shipping, Imperial Petroleum, OceanPal and Castor Maritime (CTRM) given poor corporate governance and associated risk of further, outsized dilution.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PSHG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Interesting but management are too scammy. Best!