Google: Not Hyped, But Not Cheap Either

Summary

- Alphabet reported still solid quarterly results, but growth rates slowed down and operating income as well as earnings per share declined.

- The AI battle seems to be heating up, but Alphabet has been spending and focusing on artificial intelligence for about 10 years and should be well positioned.

- Additionally, the economic moat remains intact and is making it challenging for competitors to attack Alphabet’s business and market share.

- While I don’t want to make the argument that Alphabet is extremely overvalued, I don’t see it as a good investment either.

400tmax

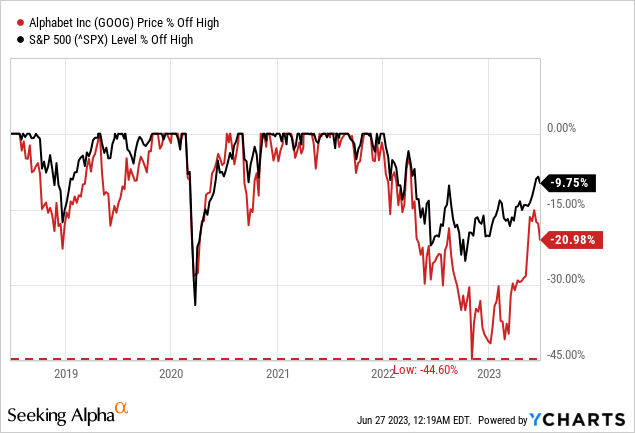

Similar to many other major technology companies, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) started declining in late 2021 and during 2022 it lost about 45% of its previous value. And while Alphabet is still underperforming the S&P 500 (SPY), which is trading only about 10% below its previous all-time high, Alphabet also gained in value again in the last few months but is still about 21% below its previous all-time high.

One of the major discussions right now is if the stock market is actually heading towards a recession and if a bear market is imminent. And it seems like investors and analysts are split – we have several world-class investors expecting a severe recession and hard landing (including Stan Druckenmiller) but we also have several investors and analysts seeing us at the beginning of a new bull market with October 2022 being the bottom. And often these bullish expectations are fueled by technology and especially the potential of artificial intelligence.

As Alphabet is certainly one of the leaders when talking about AI, we can ask the question if Alphabet is a great investment right now as it will profit from participating in the AI-fueled boom or if it is rather the time to be cautious due to the recession on the horizon. In trying to answer that question we start by looking at the last quarterly results.

Results

For the first quarter of fiscal 2023, Alphabet reported solid results – the numbers were not great, but considering the challenging macro environment, we shouldn’t be too disappointed. And Alphabet did beat revenue expectations (by $950 million) as well as earnings per share expectations (by $0.10).

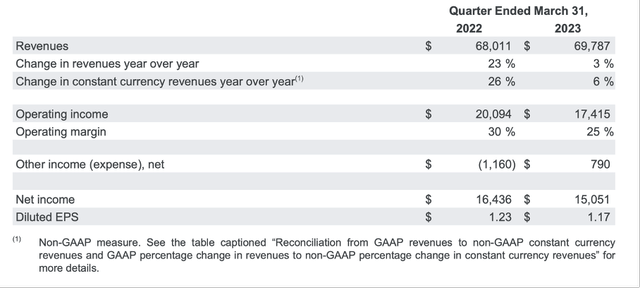

The top line grew slightly from $68,011 million in Q1/22 to $69,787 million in Q1/23 – resulting in 2.6% year-over-year growth. In constant currency, Alphabet grew its top line even 6% YoY. But while the top line was still growing, operating income declined 13.3% YoY from $20,094 million in the same quarter last year to $17,415 million this quarter resulting also in a declining operating margin (25% compared to 30% one year earlier). Diluted earnings per share also declined 4.9% YoY from $1.23 in Q1/22 to $1.17 in Q1/23.

Alphabet Highlights Income Statement (Alphabet Q1/23 Earnings Release)

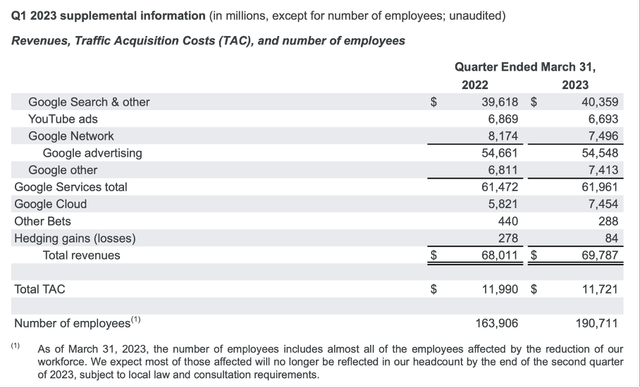

When looking at the different segments, revenue growth was mostly driven by Google Cloud with sales for the segment increasing from $5,821 million in Q1/22 to $7,454 million in Q1/23 (28.1% YoY growth). The segment was also profitable for the first time and generated an operating income of $191 million (compared to an operating loss of $706 million one year earlier). The biggest part of revenue stemmed from “Google Services” which increased revenue slightly from $61,472 million in the same quarter last year to $61,961 million this quarter (0.8% YoY growth). Despite Google Cloud being profitable, the biggest part of operating income stemmed from “Google Services” – but operating income declined 1.1% to $21,737 million.

Alphabet Supplemental Information (Alphabet Q1/23 Earnings Release)

Within Google Services, Google Search reported growing revenue, while YouTube ads and the Google Network had to report slightly declining revenue. Especially worth mentioning is “Google Other” which saw revenue increase 9% YoY – being led by strong growth in YouTube subscriptions (both in YouTube Music Premium and YouTube TV).

Operating income mostly declined year-over-year due to $3,288 million in corporate costs, which primarily include AI-focused shared R&D activities and corporate shared costs such as finance, certain human resource costs as well as fines and settlements. In the first quarter, these costs also included charges associated with reductions in the workforce and office space.

AI Battle

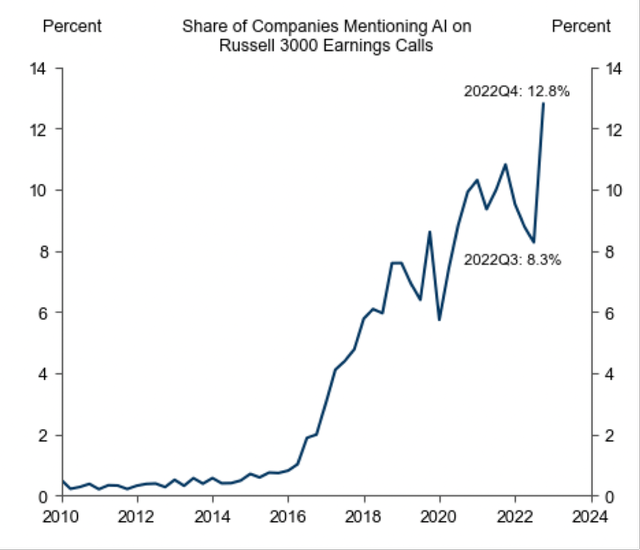

One of the major topics that is hard to ignore right now is “artificial intelligence”. Especially since the launch of ChatGPT in November 2022, the topic seems to be trending and getting more and more coverage. According to a study by Goldman Sachs, the number of companies mentioning AI during the earnings call constantly increased since 2016, but especially between Q3/22 and Q4/22 the number jumped as many companies seemed to follow the trend and current hype.

Alphabet is certainly a company that was focusing on artificial intelligence for several years (at a time when most other businesses did not care about the topic) and with the recent developments it is not surprising that management is talking a lot about AI during the earnings call.

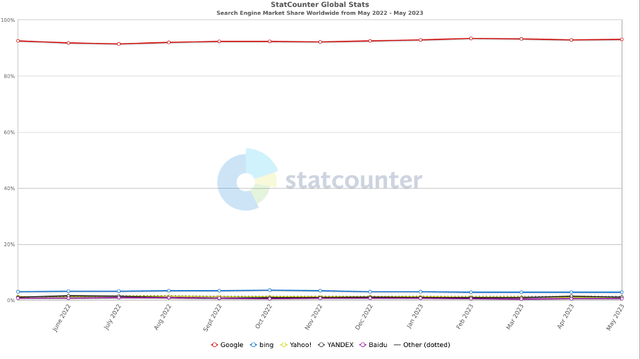

One of the major worries was Microsoft (MSFT) including OpenAI’s software and ChatGPT into Bing to gain market share (from competitors and especially Google). It is hardly visible in the chart above as Google’s market share is so impressive, but in the United States, Bing hasn't really gained any market share so far.

In May 2023, Bing’s market share was 6.36% and between June 2022 and November 2022, Bing’s market share was even above 7% and so far, we can’t conclude that Bing is gaining market share. Of course, we are only looking at a few short months of data and drawing conclusion might be a bit too early.

Famous is also the leaked “We have no moat, and neither does OpenAI” internal document and it seems to be a legitimate question if ChatGPT and other companies focusing on large language models and generative AI might be able to challenge Google’s moat. In a previous article, I already explained why I don’t think Google (or Alphabet) should panic and the wide economic moat is still in place and hard to overcome:

However, instead of panicking, Alphabet should reflect on its strengths and when asking the question if ChatGPT could be a threat for Google (and Alphabet) we also must keep in mind that ChatGPT can’t really replace Google. While ChatGPT seems to be better in generating ideas, longer texts or construct arguments, Google is much better is finding information. Especially accurate and current data can’t be found by ChatGPT. And Google is much better in presenting information in a more appealing way, while ChatGPT will offer only text. And of course, Google is offering many different services – we can search for pictures, watch videos on YouTube or use Google Maps.

Returning on Path of Growth

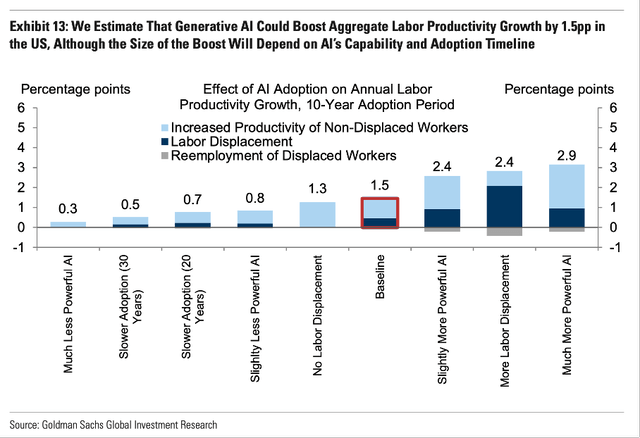

In the above-mentioned study by Goldman Sachs, the authors are also suggesting that artificial intelligence might lead to a productivity boost and contribute to economic growth in the years to come. Not only could investments in AI reach about 1% of total GDP by 2030, AI could also contribute about 7% to economic growth over the next ten years and might increase productivity growth by 1.5pp in the next ten years.

However, the authors are also pointing out that timing is difficult, and it is hard to predict when such a productivity boom triggered by AI might set in.

And while Alphabet might profit from a productivity boost by AI, it is certainly not the only way for the business to grow in the years to come, but artificial intelligence was one of the two major themes set by Pichai during the earnings call. Pichai compared the AI opportunity to the shift from desktop to mobile about a decade ago and pointed out that Alphabet is well positioned due to countless investments the company has made in AI over the last ten years.

Aside from artificial intelligence, the restructuring of the business was the second major topic. Alphabet was sometime criticized in the past that it did not have cost control and was spending too much and was not efficient enough. During the earnings call, CEO Sundar Pichai called out these two major themes and was addressing Alphabet’s focus on efficiency:

We have significant multiyear efforts underway to create savings, such as improving machine utilization and finding more scalable and efficient ways to train and serve machine learning models. We are making our data centers more efficient, redistributing workloads and equipment where servers aren’t being fully used.

(…)

And we are taking concrete steps to manage our real estate portfolio to ensure it meets our current and future needs. We’ll continue to use data to determine additional areas for durable savings.

And restructuring the business, cutting costs, and making Alphabet more efficient will certainly have an impact on the bottom line and lead to better margins. And while headcount still rose 16% year-over-year to about 190.7k employees, Alphabet announced already in January 2023 it will cut about 12,000 jobs, which won’t be reflected in the headcount at the end of the second quarter anymore.

Top Line Growth

Making Alphabet more efficient will certainly contribute to bottom line growth. But growth must also stem from top line growth – and top line growth will not just occur due to artificial intelligence. During the earnings call, chief business officer Philipp Schindler once again outlined 3 areas of potential long-term growth – Google AI, Retail and YouTube.

YouTube

And while YouTube is still struggling, YouTube Shorts are continuing to perform well and the number of channels that uploaded to Shorts daily grew over 80% and those posting at least weekly to Shorts saw the majority of new channel subscribers coming from Shorts. Schindler also pointed out the watch time growth Alphabet is seeing and monetization is also progressing. Additionally, the YouTube subscription business is also performing well. Pichai was outlining the updates YouTube made to its subscription business:

On our subscription business, we rolled out several new updates to YouTube Premium. Premium subscribers can now queue videos on phones and tablets, stream continuously while switching between devices and auto download recommended videos for off-line viewing. And we have great momentum around YouTube TV and YouTube Primetime channels. We have announced pricing for the NFL Sunday Ticket offering, which will help to drive subscriptions, bring new viewers to YouTube’s paid and ad-supported experiences and create new opportunities for Creators.

Alphabet’s goal is for YouTube to become a one-stop shop for multiple types of video content – both ad-supported and Premium services. Investors should also expect more updates over the coming quarters.

Retail

As already mentioned in previous articles, Alphabet wants to focus more on retail. This is including Alphabet’s ambitions to include shopping on YouTube (by partnering with commerce platforms like Shopify). So far, more than 100,000 creators, artists and brands have connected their own stores to their YouTube channels, but Alphabet sees itself still in a very early stage in that process.

Cloud

And of course, one of the drivers of growth for Alphabet is its Cloud business. I already mentioned above that Cloud turned profitable, and it is probably one of the segments with the biggest growth potential for Alphabet in the years to come. During the last earnings call, CEO Pichai commented on the cloud business:

Over the past 3 years, GCP’s annual deal volume has grown nearly 500%, with large deals over $250 million growing more than 300%. Nearly 60% of the world’s 1,000 largest companies are Google Cloud customers, and many leading start-ups and millions of small and medium enterprises use Google Cloud.

We have also built a strong partner ecosystem. Over the last 4 years, the number of Google Cloud Partner certified practitioners around the world has increased more than 15x. The largest global system integrators have built 13 dedicated practices with Google Cloud compared to zero when we started. And today, more than 100,000 companies are part of our Google Cloud Partner Advantage program.

Share Buyback

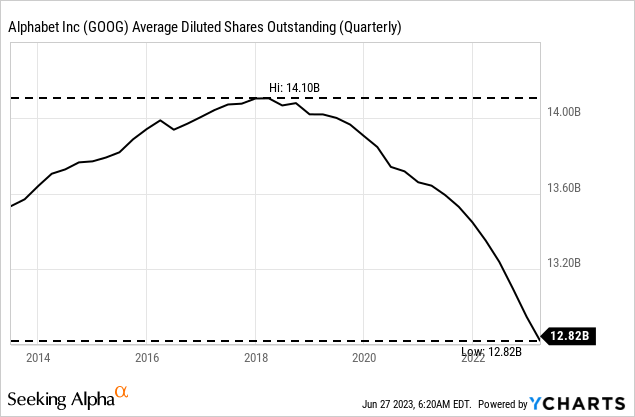

Aside from growing the top line – by focusing on YouTube, the retail business or cloud business – Alphabet can also grow its bottom line by using share buybacks. And in the last few years, Alphabet lowered the number of outstanding shares constantly and decreased the number of outstanding shares from 14.10 billion in 2018 to 12.82 billion right now – a decline of 9%. And on April 19, 2023, the Board of Directors authorized the company to repurchase up to an additional $70 billion of its shares (class A and class C shares).

And we should not forget that Alphabet is able to generate more than $60 billion in free cash flow annually. And with no dividend payments, it could spend that amount mostly on share buybacks and can repurchase about 4% of its outstanding shares. Additionally, Alphabet has about $115 billion in very liquid assets that could also be used to repurchase shares (enough for almost 8% of outstanding shares).

Intrinsic Value Calculation

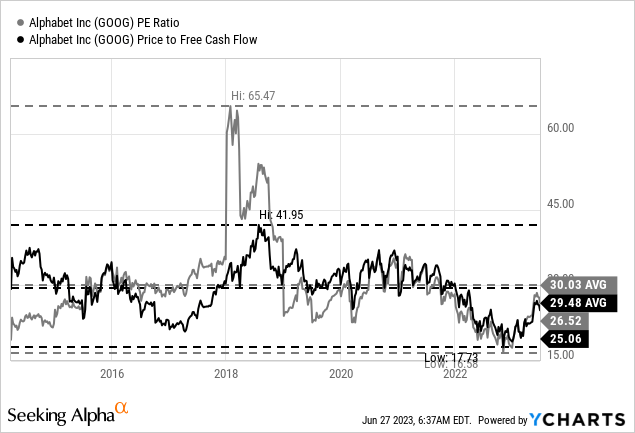

Right now, Alphabet is trading for 26.5 times earnings and for 25 times free cash flow. And while this is much higher than 16-17 times earnings/free cash flow a few months ago, Alphabet is still trading below the average of the last nine years (since Google was renamed to Alphabet). During that period, Alphabet was trading for an average P/E and P/FCF ratio of 30.

Despite the high growth rates Alphabet could report in the past, I would not make the argument that Alphabet is cheap right now. With the major risk of a recession, I would not buy Alphabet at this point. And we should differentiate between short-term troubles (next one or two years) and long-term potential. Long-term, Alphabet is certainly a great business and can most likely continue to grow with a high pace. And in the next few years, artificial intelligence might also contribute to growth. But over the next few quarters, with the risk of a recession being rather high, I would be cautious. A shrinking economy will probably have an impact on advertisement spending again and companies like Meta Platforms (META) or Alphabet will see an impact on its top line again.

When comparing Alphabet to other companies closely associated with AI like NVIDIA (NVDA), Alphabet’s valuation seems to be much more reasonable, and the stock is not really participating in the hype we can see right now.

Conclusion

I don’t think one might regret buying Alphabet at this point as a long-term investment. With a time horizon of at least 10 years, the investment will most likely be profitable. Nevertheless, I see Alphabet trading for lower stock prices in the coming quarters and I would not really talk about a bargain. And while many AI-related companies and stocks can’t be bought right now due to (in some cases) triple-digit valuation multiples, Alphabet might be a solid pick if you must buy right now and want to participate in the AI-fueled hype. But for me, the stock is still a “Hold”.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.