Legal & General: Under-Appreciated Insurance Titan With Solid 8.6% Dividend Yield

Summary

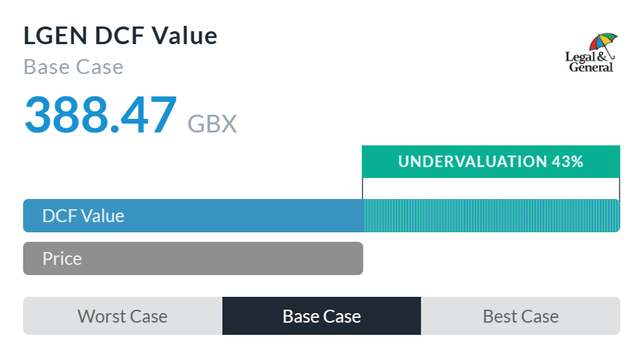

- Legal & General is undervalued, trading at a 27.7% discount to fair value based on DCF analysis, with a PE of 6.6 and an 8.6% dividend yield covered twice by earnings.

- The company has sustained an 11% CAGR in earnings and dividends for over 10 years, but concerns over new leadership and macroeconomic factors may be affecting its stock price.

- Two suggested investment strategies include outright purchase of the equity or buying an equity position and systematically covering it when the stock is below the 185-day moving average.

NicoElNino/iStock via Getty Images

The UK has not exactly been the poster child for stability. Since Brexit in 2016 roiled the financial markets and disturbed the place that Britain once held as the financial capital of Europe, it's been a difficult period of governance marked by multiple prime ministers and even a pension and banking crisis to boot.

That being said, many of the best bargains come out of a combination of investor apathy and disregard. Legal & General (OTCPK:LGGNY) (OTCPK:LGGNF) is a market leader in the insurance sector, with a market cap of £13.2 billion. The UK insurance industry is actually still the largest in Europe, and Legal & General holds a market-leading position in life insurance.

Rising interest rates are generally good for insurance businesses, as they can generally respond to rising rates by holding short- and medium-term fixed income and debt, which benefits from and gets rolled into higher yields. The market appears to be undervaluing this at present.

Legal & General

The business has been operating since 1836 and has deep experience of delivering cross-sector services. It's split into four large segments:

1. Institutional retirement services - LGRI

- Retirement solutions - roughly 43% of group profit

- They operate £6 trillion worth of pension fund liabilities

- They secure and safeguard customers' pensions through an annuities business that managed £9.5bn in new premiums at the end of 2022

- £32bn in new direct investments

- £1.3bn in clean energy investment

2. Capital Investment - LGC

- This is in turn split into four areas: real estate, clean energy, financing operations, and housing

- The unit is 17% of the group's profit

3. Investment Management - LGIM

- LGIM is a recognisable brand in the pension industry

- They manage £1.2 trillion

- This is a slightly lower margin and contributes under 12% of group-wide profit

4. Retail

- Last year they merged Insurance and Retail Retirement into one division

- They had 6.3mn UK life assurance customers in 2022

- Individual annuity sales flat-lined at £954mn in 22 and have been decent given the turbulence in 2022

- Insurance gross written premiums surged 8% to £3.1bn

- Profit jumped a colossal 33% to £825mn, driven mainly by the US insurance business

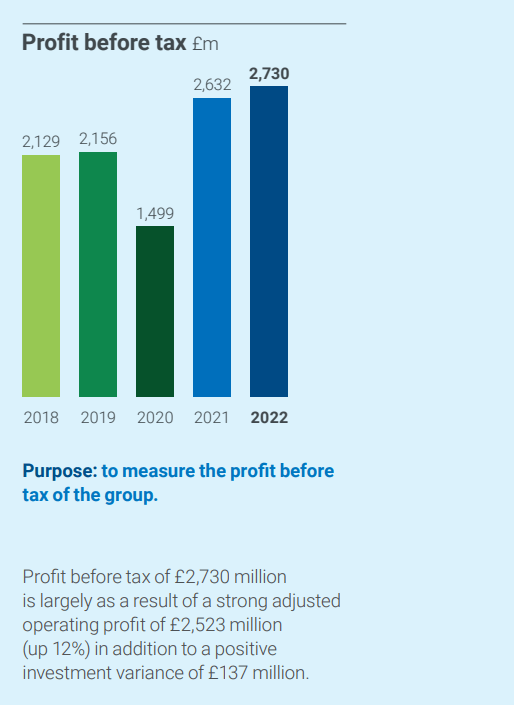

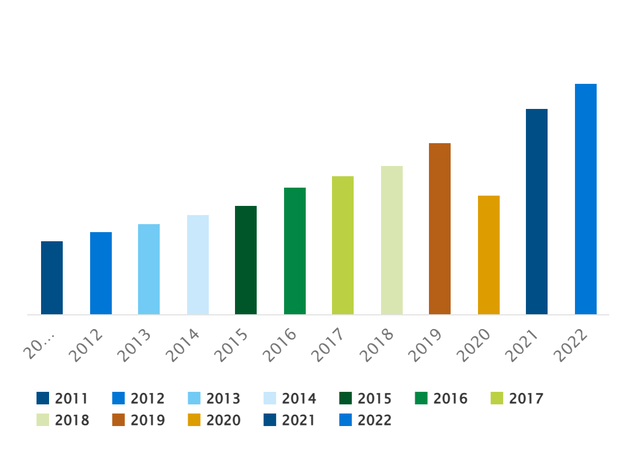

Profit before tax and revenue growth has been decent across the business:

Legal & General annual report 2022

Apart from challenges in 2020, the company has managed to maintain and push increased profitability and to continue to grow the dividend while building solvency II surplus and coverage ratios.

The Investment management arm experienced a 19.5% drawdown in adjusted operating profit in 2022, while Retail and Capital Investment stormed ahead with topline growth. Institutional Retirement hit £1.257bn in adjusted operating profit, which was strong year-on-year but flat over the 3 and 5-year time horizon.

Retail is punching well above its weight with a 33% jump in adjusted operating profit.

Clearly, there have been challenges, though, as the shares are down -5.51% over the past twelve months and 10.62% year to date in 2023 - significantly underperforming the FTSE 100 Index.

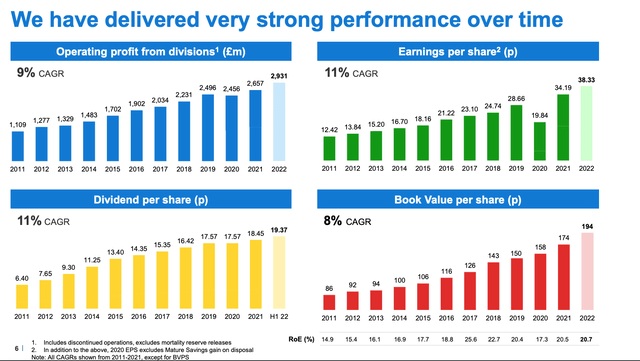

If we zoom out and really think about the long-term trend, Legal & General is a fundamentally sound business that has grown both the top and bottom lines over time:

Legal & General Annual Report 2022

If we take the existing dividend, the company currently yields 8.6% and has a healthy dividend cover of 2.

Looking at valuation, it's useful to see what a Discounted Cash Flow analysis reveals about the future value of the cash flows and the present value of the business. According to Alpha Spread, LGEN has a significant 43% discount to DCF with a base case valuation of 388.47p versus the current stock price of 223p. The same holds true for the American ADR stock LGGNY:

DCFs depend a great deal on their inputs, so it is important not to take the outputs at face value. Running a proprietary version for DCF modelling that uses an 8% discount rate and 10-year time horizon, gives LGEN a fair value of 308.4p, which represents a 27.7% discount to fair value and a wide margin of safety. For me - having two separate analyses of value and taking either the lowest of the two or an average is prudent.

Delving Deeper - The Issues

Legal & General is fundamentally undervalued. However, it's important that we delve deeper and explore whether the market is right in whatever assessment it has collectively made.

There are two issues at play and we'll cover them in turn.

The first seems to be concerns about the leadership at LGEN. Legal & General recently announced that it has appointed António Simões as CEO and that he joins from Banco Santander, where he has been regional head of Europe since September 2020. There are concerns that Simões doesn't have direct experience of running an insurance company. He also has big shoes to fill as LGEN has been winning in life assurance and destroying the competition - chiefly in Aviva and Prudential - with higher returns and more market share.

I believe that this is an over-reaction. Sir Nigel Wilson will be staying on for the remainder of the year to ensure a smooth handover, and further, he's retiring from the role having successfully led the business for a considerable length of time rather than stepping down suddenly. Simões has an impressive track record of delivery at McKinsey, Goldman Sachs, HSBC, and Banco Santander. He was the CEO of HSBC UK, and therefore, has experience of running a scaled business with multiple departments and stakeholders.

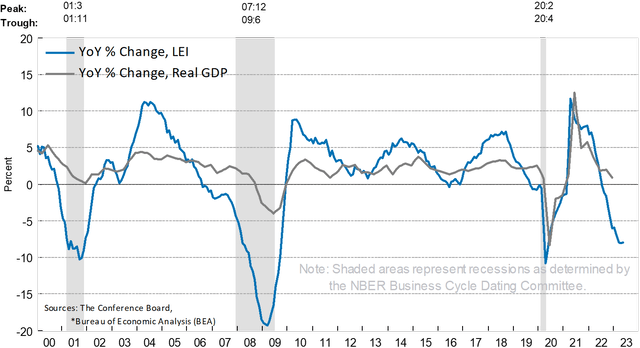

The second issue appears to be linked to the macroeconomy and fears that there could be continued weakness in the Investment management arm or an under-performance in Retail due to the exceptionally strong year they had in 2022. This is not completely unfounded: LGIM took a bit of a bath in net profit in 2022 and the macroeconomy isn't out of the woods yet. Take a look at the Leading Indicator Index that suggests a recession could still be on the cards for next year:

The Conference Board LEI Index, 2023

To this, I suggest we zoom out and look at the strong performance of the group over a period longer than the past decade:

Legal & General Annual Report 2022

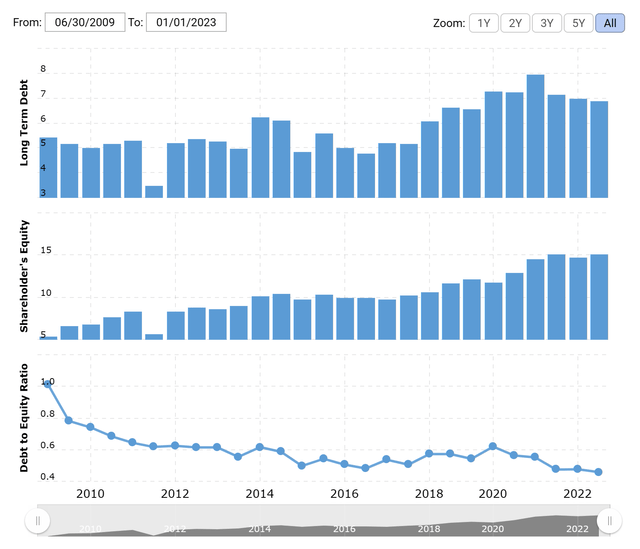

Another issue is that LGEN supposedly carries a lot of debt. With a debt to equity ratio of 0.46 and a rising trend of shareholder equity against long-term debt held, though, this is a tough position to defend:

With total debt of £5.5bn in 2022, and net income from continuing operations of £2.29bn, the company could in theory pay off that debt within two years of net income.

Returning to the threat of macroeconomic headwinds or weak performance, it looks less likely from these levels, but it's a risk. Indeed, if we do get a hard landing, like we did in 2001 and 2008 then you could expect LGEN to continue to struggle. In 1998-2003 it took a 61.8% drawdown and again in 2008-9 it took a 71% drubbing. It's this fear that's weighing on the stock.

Investment Strategy

There are two good ways to invest in LGGNY

The first is an outright purchase of the equity, either in the UK (LGEN.L) or the US (LGGNY).

We prefer to be buyers when LGGNY shows a bit more upward momentum. Wait for a cross above $14.60 (64-day moving average) and for a green distribution day in terms of volume. Right now we have had 5 red distribution days which could signal capitulation as large volumes of shares are trading the stock down. Better to wait for the recovery and to see the stock start to outperform its benchmark. On balance, volume is looking constructive, but let's see what next week brings.

The second option favours either buying an equity position (option 1) and then systematically covering your position anytime the stock is below the brown 185-day moving average. Based on the chart above, investors have significantly benefitted from following the trend, and a strategy based on this approach would have achieved a CAGR of >16%. The easiest way to achieve this would be to own the LGEN.L shares and then be prepared to buy monthly Puts when the position is below the 185-day moving average. Alternatively, investors could consider exiting their positions if options are not available to them. Remember, you collect income (in the dividend) that compensates you for some lost premium.

Final Thoughts

I think it's worth keeping in mind Peter Lynch's sage advice on the subject of weighing your investments based on the possibility of future corrections:

Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.

I remember in One Up on Wall Street, Lynch went a step further and pointed out how his average annual return - by the numbers - was a staggering 29.2% as he moved the fund from $20 million to over $14 billion in assets under management. Yet he said that few investors actually saw that rate of return, because what he watched was that they would sell and panic at the bottom and withdrawal funds during the bad times; then steamroll into the fund at the top during the good times, only to repeat the cycle ad infinitum.

It's really key to identify great businesses that are fundamentally mispriced by the market and to allocate capital to them until they get re-rated in the future. Legal & General trades at a historic discount to intrinsic value and offers a very attractive and well-covered dividend yield of 8.6%, trading on a PE of 6.6.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you'd like to learn more - take advantage of our 14-day free trial (new subscribers only) and stay on the right side of the market and Away From the Herd

This article was written by

David works in a senior management position within the professional services sector and has extensive experience helping FTSE 100 and Fortune 500 businesses to improve their efficiency, quality and speed of delivery.

Over that same timeframe he has built up and manages an extensive portfolio of stock, bond and derivative positions that has beaten the S&P 500 for the past 5 years. He is a member nominated pension director and has acted in several Trustee positions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LGGNY, LGEN.L either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)