SSR Mining: Disciplined M&A Allows For Continued Reserve Per Share Growth

Summary

- SSR Mining is on track to continue growing its reserves per share since 2019, despite the inflationary environment that has made reserve replacement more difficult.

- The company's disciplined M&A strategy should push its reserve base among 9.0 million gold-equivalent ounces at a time when the company continues to repurchase shares opportunistically.

- That said, while SSRM continues to be one of the more disciplined & better-run miners sector-wide, I don't see enough margin of safety in the stock just yet at US$14.00.

Juan Jose Napuri

Investors in the precious metals sector have had to endure a rollercoaster ride in 2023, with the index starting the year off with a double-digit gain only to find itself back near flat year-to-date and massively underperforming the overall market. We can attribute the poor performance for most miners to declining margins year-over-year and flat production/sales and what have been underwhelming year-end FY2022 reserve statements on balance. In fact, less than one-third of large producers successfully replaced mineral reserves. And given the steadily rising share counts for many producers, this means that investors hoping for leverage to metals prices by owning producers have been getting the opposite, with share counts rising faster than gold reserves. The result is that an investor in most producers needs to buy more shares to get the same amount of gold production and gold reserves as they did several years ago.

Fortunately, while SSR Mining (NASDAQ:SSRM) was one producer that saw declining reserves year-over-year, this trend is likely to change. This is because the company continues to repurchase shares to reduce its share count, it's done an excellent job with bolt-on acquisitions in core jurisdictions in a counter-cyclical manner to reduce share dilution/proceeds paid, and the company should see reserve growth at Copler this year from C2. Finally, at Puna where it has one of its smaller reserve bases, we should see a turnaround and a reversal to reserve growth as SSR Mining accelerates near-mine exploration after years of underinvestment in the Argentinian asset.

SSR Mining Operations (Company Website)

Just over six weeks ago, I covered SSR Mining, noting that while the addition of Hod Maden was an upgrade to the investment thesis, I saw better reward/risk bets elsewhere. Since then, the stock has declined 17% despite the gold price spending a record fifteen weeks above the $1,900/oz level, and despite continued softness in oil prices. In this update, we'll take a look at the company's reserves and resources to see how they stack up against its peers, and whether investors can look forward to the same long mine lives at Hod Maden (~13 years) as it does at its current operating gold assets (Copler, Marigold, and Seabee). A strong and diversified reserve base is important given that it provides visibility into future cash flow generation and whether further M&A is needed to maintain current output levels. Let's take a closer look below:

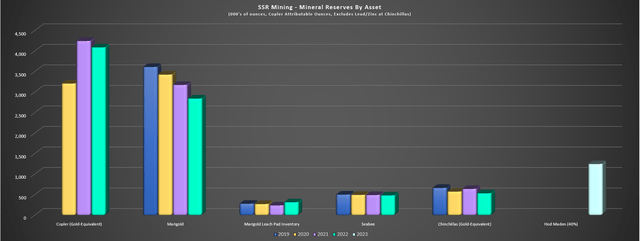

2022 Reserves

SSR Mining released its FY2022 Reserve/Resource update earlier this year, reporting mineral reserves of ~8.3 million gold-equivalent ounces [GEOs], a 6% decline from the year-ago period. Meanwhile, the company reported inferred and measured & indicated [M&I] GEOs of ~5.8 million and ~7.3 million ounces, respectively, translating to a 6% decline in its inferred GEOs and a 56% decline in M&I GEOs. However, while the decline in M&I resource ounces that back up reserves might appear alarming, this was primarily related to the sale of Pitarilla at a very attractive price to Endeavour Silver (EXK), with its non-core asset sales translating to ~$240 million in value, double the net asset value ascribed to these assets. And, while reserves were down year-over-year, SSR Mining noted new drill results or resource modeling changes were not incorporated, with the drop in reserves solely reflecting mining depletion through 2022.

SSR Mining - Attributable Gold-Equivalent Mineral Reserves by Asset (Company Filings, Author's Chart)

As the chart above shows, SSR Mining's two largest assets from a reserve standpoint continue to be Copler and Marigold in Turkiye and Nevada, respectively, with a combined attributable reserve base of ~7.2 million GEOs. And while Marigold saw its reserves decline for another consecutive year in 2022, the current mine plan does not incorporate upside from the New Millennium target, which should make its way into an updated mine plan in the next 18 months. In addition, there looks to be long-term upside from Trenton Canyon Oxides and Buffalo Valley Oxides further to the south, as well as Trenton Canyon Sulfides (assuming the company can secure a way of processing this sulfide material). So, while we could see some pressure on reserves from higher cut-off grades because of higher operating costs (inflationary pressures), I remain optimistic about reserve growth at Marigold.

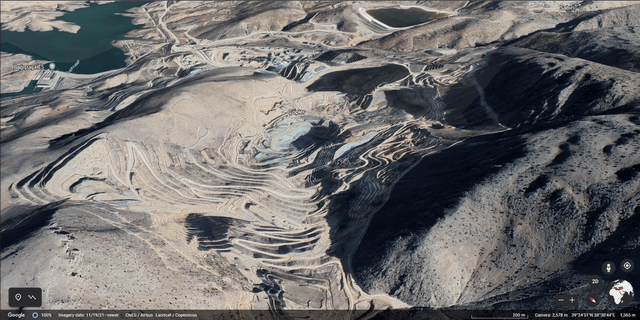

Moving over to Copler in Turkiye, SSR Mining may have seen a slight dip in mineral reserves last year to ~4.1 million GEOs, but its reserve base is backed up by over ~2.4 million ounces of gold in the M&I category, and there is no contribution in this reserve figure from C2 (Copler Expansion), with SSR Mining noting that a Pre-Feasibility Study would be completed later this year, resulting in the declaration of maiden reserves. Besides, while Copler may have seen its reserves decline, it still has an enviable reserve base of 4.0+ million GEOs and over 9.0 million ounces of gold across all resource categories. So, with its flagship asset having a 20+ year mine life at industry-leading operating costs, any minor dip in reserves on a year-over-year is hardly material, with this being one of the longest-life precious metals assets not held by a gold major.

Copler Mine (Google Earth Pro)

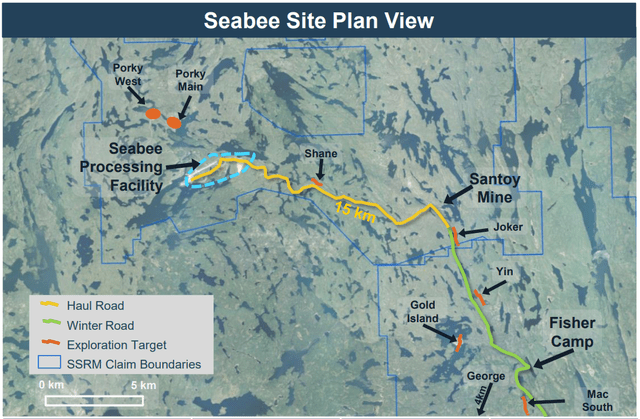

Finally, looking at its smallest gold asset, Seabee, the Saskatchewan (Canada) mine continues to have a short mine life with just 481,000 ounces of gold reserves, down from 490,000 ounces in the prior-year period. However, the reserve base is backed up by 2.75 million tonnes at higher grades (11.49 grams per tonne of gold) or 319,000 M&I resource ounces, as well as an inferred resource base of 536,000 ounces at 6.05 grams per tonne of gold. Plus, the company appears optimistic that two targets north of the Seabee Mine (Porky and Porky West, a past producer) could provide longer-term production opportunities, and the company is planning to drill deep extension targets this year hoping to uncover new mining opportunities at depth. So, while Seabee has a short reserve life that might concern some investors as it's one of only two Tier-1 jurisdiction assets with Marigold, I am optimistic about extending the mine life at this asset as well, especially with the significant land package increase with the low-cost Taiga Gold acquisition.

Seabee Site Plan View (Company Presentation)

Reserves Per Share

As I've noted in past updates, reserve growth is important, but far more important is reserve growth per share. This is because reserve growth that comes at the expense of significant share dilution means that investors are getting exposure to fewer ounces per share held, which makes owning an ounce of gold more attractive, given that an investor is getting negative leverage to gold if reserves per share and or production per share is declining. Obviously, this is not ideal, since it makes no sense to own a more volatile and riskier gold producer (relative to the gold price) if it is not offering the leverage that one should get for taking on this added risk. Some examples of companies with the worst track records of reserve growth per share are Coeur Mining (CDE), Americas Gold and Silver (USAS), McEwen Mining (MUX), and Kinross (KGC), which is why I continue to see these names as names to avoid.

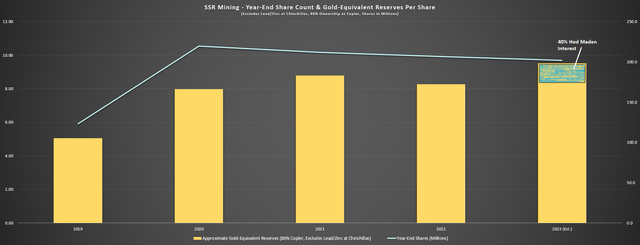

Fortunately, SSR Mining is one of the few companies that has maintained its reserve per share since 2019, with the Alacer Gold merger (~95.7 million shares issued) being done at a very reasonable price, and subsequent bolt-on acquisitions being completed for cash, with no drain on the treasury as the company has balanced this with the timely sale of a royalty portfolio and its sale of Pitarilla, and in a period where it's continued to buy back its shares when they've been on sale. Plus, SSR Mining has continued this track record of disciplined M&A, with it recently announcing an option agreement to acquire up to a 40% interest in the ultra-high-grade Hod Maden Project in Turkiye, with a reserve base of ~3.11 million gold-equivalent ounces at an industry-leading reserve grade of 11.1 grams per tonne gold-equivalent.

SSR Mining - Attributable Gold-Equivalent Ounces Per Share (Excludes Lead/Zinc) (Company Filings, Author's Chart & FY2023 Estimates)

Looking at the chart above, we can see that assuming a year-end share count of ~203 million shares, and accounting for its future 40% interest in Hod Maden, and assuming flat reserves year-over-year at existing assets (~8.3 million GEOs), the company's reserve base would grow to ~9.5 million GEOs, giving it a larger reserve base than million-ounce producer B2Gold (BTG) and a similar reserve base to ~700,000-ounce producer, Evolution Mining (OTCPK:CAHPF). Just as importantly, it would materially increase SSR Mining's reserve grade, it would be highly margin accretive with expected AISC of sub $700/oz on a co-product basis, and it would lead to further growth in reserves per share. Hence, I see this as a brilliant move by the company to fortify its position in a jurisdiction where it's already present, especially given the untapped exploration upside at Hod Maden.

SSR Mining - Year-End Share Count & Gold-Equivalent Reserves Per Share (Excludes Lead/Zinc, Copler Attributable Ounces) (Company Filings, Author's Chart)

So, while investors must be careful of many producers that grow at any price with undisciplined M&A and must also be careful of producers that have seen a sharp decline in reserves because of rising cut-off grades (inflationary pressures) that could cause them to do semi-desperate M&A in the future, SSR Mining is not in this category. In fact, the company is not only growing reserves but also reserves per share and I would expect any future M&A to be at an accretive price given the discipline the SSR Mining team has shown under new Chief Execution Officer Rod Antal to focus on per share growth and capital discipline in jurisdictions it's familiar with, all while returning meaningful capital to shareholders through dividends and buybacks. To summarize, at least among the mid-tier and intermediate producers, SSR Mining is one of the safer bets.

So, is the stock a Buy?

While SSR Mining continues to be one of the better-run producers sector-wide, I still don't see quite enough margin of safety in the stock just yet at US$14.00, with it trading at over 7.7x conservative FY2024 cash flow per share estimates ($1.80) vs. a historical multiple of ~11.3x cash flow (10-year average). This is because I prefer at least a 35% discount to estimated fair value, and assuming a fair value of US$20.40, the stock's ideal buy zone would come in at US$13.25 or lower. So, while I see SSR Mining as a name worth keeping an eye on if we see further weakness, I remain on the sidelines for now and see better opportunities elsewhere in the sector.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

https://imgur.com/a/rBZmvuMSubscription Link:

buy.stripe.com/...