AMCON: Lack Of Organic Growth And Interest Rates Are Starting To Bite (Rating Downgrade)

Summary

- The company’s Q2 FY23 revenues soared 49.3% year on year to $585 million but this was mainly thanks to acquisitions.

- Henry’s Foods is in the red and interest expenses increased by over 8 times to $2.2 million due to high interest rates.

- In my view, AMCON’s net income for FY23 could drop below $10 million, and I think this could be a good time for investors to trim or close positions.

- Microcap Review members get exclusive access to our real-world portfolio. See all our investments here »

da-kuk

Introduction

In February, I wrote an article on SA about US convenience store distributor AMCON Distributing Company (NYSE:DIT) in which I said that an annual net income of at least $15 million per year seemed sustainable and the company should be trading at above 8x P/E, which translated into $213.40 per share.

Well, I think that the Q2 FY23 financial results were underwhelming, and considering the share price has surpassed my target, I no longer feel comfortable with a buy rating on the stock. In my view, AMCON is likely to struggle to surpass $10 million in net income in FY23 and I’m changing my stance on the stock to neutral. Let’s review.

Overview of the Q2 FY23 financial results

In case you're not familiar with AMCON or my earlier coverage, here's a short description of the business. It’s an Omaha-based company that specializes in the wholesale distribution of consumer products and it currently sells over 17,000 items, including cigarettes and tobacco products, candy and other confectionery products, beverages, groceries, paper products, health and beauty care products, frozen and refrigerated products and institutional foodservice products. AMCON is among the largest wholesale distributors in the USA with annual revenues of over $2 billion and it serves about 6,800 retail outlets including convenience stores, grocery stores, liquor stores, drug stores, and tobacco shops. It operates a total of eight distribution centers across Illinois, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Tennessee, and West Virginia that have some 1.1 million square feet of permanent floor space. In addition, the company has a retail segment that includes health food firm Healthy Edge Retail Group. The latter sells natural and organic groceries and dietary supplements and has a network of 18 stores under the Chamberlin’s Natural Foods, Akin’s Natural Foods, and Earth Origins Market brands.

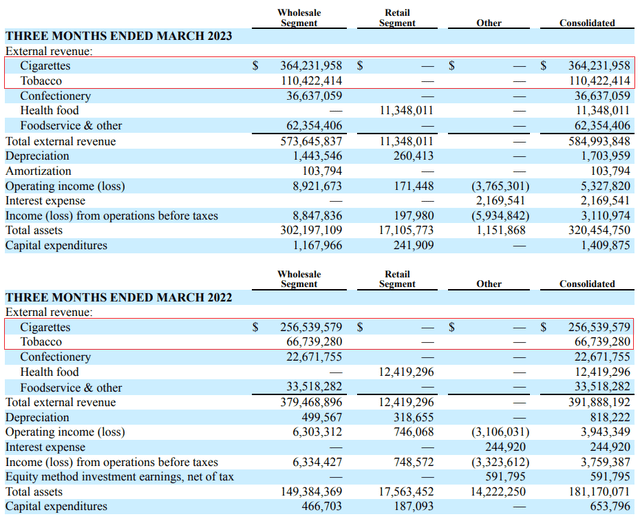

Turning our attention to the Q2 FY23 financial results, we can see that revenues soared by 49.3% year on year to $585 million. As you can see from the tables below, all of the increase came from the wholesale segment and cigarettes and tobacco now account for over 80% of this unit’s revenues. The decrease in sales of Healthy Edge Retail Group was to be expected considering it had two more stores a year earlier.

AMCON Distributing Company

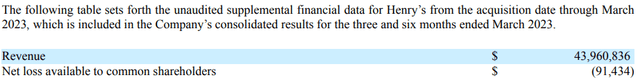

About $152.2 million of the increase in sales in the wholesale segment in Q2 FY23 came from Team Sledd, which AMCON acquired in Q3 2022. In my view, this figure is disappointing considering Team Sledd added a total of $159.9 million to AMCON’s sales in Q1 FY23. Another $21 million of the increase in sales came from price increases implemented by cigarette manufacturers while Henry's Foods added sales of $44 million. The latter is the largest convenience store supplier based in Minnesota and was bought by AMCON on February 3 for $55 million. In my previous article, I said that this purchase was likely to improve the company’s net income but it seems I was wrong as Henry's was in the red from the acquisition date through March 2023. Its operating income for the period was just $0.3 million (see page 22 here) while the net loss stood at $0.1 million.

AMCON Distributing Company

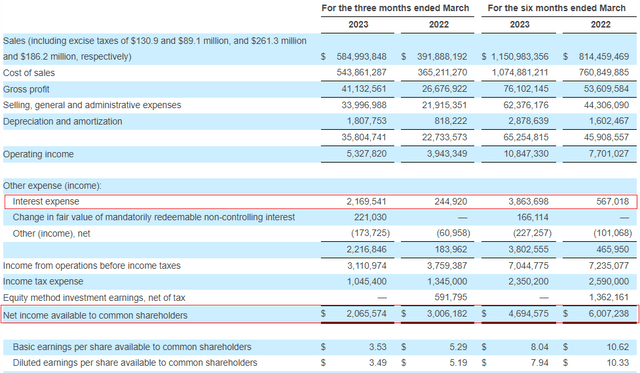

Overall, I’m disappointed by AMCON’s lack of organic growth in Q2 FY23 as well as Henry’s weak margins, and looking at the income statement, I’m concerned by the rapidly rising interest expenses due to higher interest rates. AMCON has three credit facilities with a combined borrowing capacity of $290 million and they bear interest at either the bank’s prime rate, the Secured Overnight Financing Rate (SOFR), or the London Interbank Offered Rate (LIBOR). The average interest rate of the company's credit facilities was 6.49% at the end of March (see page 23 here). In my view, net income for FY23 is likely to drop below $10 million unless interest rates start declining soon.

AMCON Distributing Company

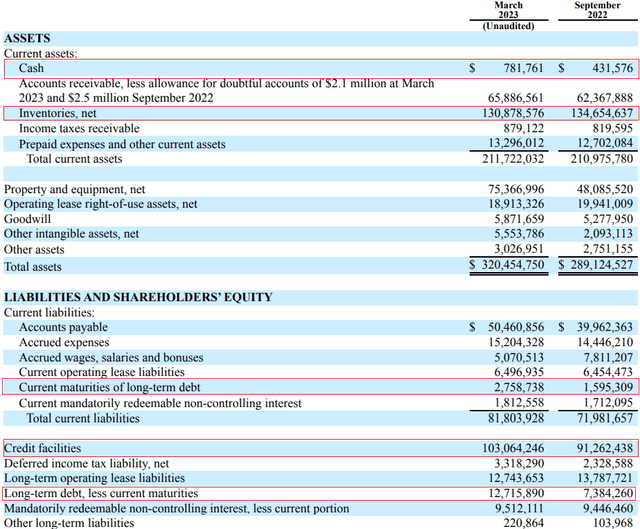

Turning our attention to the balance sheet, I think it’s a positive development that inventories dropped to $130.9 million in March from $185.2 million in December. This level is close to the one from September and enabled AMCON to decrease its net debt to $117.8 million from $149.8 million in December despite funding the acquisition of Henry’s with loans. Unfortunately, further opportunities for reducing the debt burden seem limited.

AMCON Distributing Company

AMCON has a quarterly dividend of $0.18 per share and it has also distributed three $5.00 per share special dividends over the past three years, giving the company a dividend yield of 2.65% as of the time of writing. In my view, the decreasing net income due to high interest rates could lead to the company scrapping its next special dividend (likely scheduled for December 2023 or January 2024) which would drop the dividend yield to just 0.3% based on the quarterly dividends.

Turning our attention to the valuation, AMCON has a TTM net income of $15.4 million which puts its TTM P/E ratio at 8.6x. While this level doesn’t look high, the ratio would increase to 13.2x if net income drops to $10 million. Considering that AMCON has been struggling with organic growth lately, interest rates around the world are still rising, and Henry’s is loss-making, I don’t think that the company should be valued at more than 10x P/E. This leaves a small margin of safety here which could disappear over the coming quarters.

Investor takeaway

In my view, AMCON had a weak start to 2023 with Q2 FY23 results pressured by the lack of organic growth, high interest rates, and underwhelming margins at Henry’s. With central banks around the world still raising interest rates, I doubt that the company’s financial performance will improve over the second half of FY23, and I expect net income for the fiscal year to drop below $10 million. Considering the market capitalization of AMCON has grown by 23.5% since my previous article, I think that this could be a good time for investors to trim or close their positions and take profits. At this share price level, my rating on the stock is neutral.

If you like this article, consider joining Microcap Review. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys.

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.