Delta Air Lines Stock Surges On Future Supercycle Growth

Summary

- The Delta Air Lines Investor Day presentation lifted the stock and the industry.

- Delta continues to see a positive growth path ahead for its business, growing more diverse and more efficient.

- Delta's diversified business strategy is unmatched in the industry.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

viper-zero

Delta Air Lines, Inc. (NYSE:DAL) hosted its Investor Day on the 27th of June, and it was one that appealed to not only shareholders of Delta Air Lines, who sent the stock nearly 7% higher, but also lifted the industry, with the U.S. Global Jets ETF (JETS) gaining more than 4%. In this report, I will be highlighting the most interesting parts of the Investor Day, but before I will do that I will also highlight why the projections and the positive stock price response are not a major surprise to me.

Delta Air Lines: The Supercycle

One reason why the Delta stock price response to the event is not a big surprise to me is because Delta already pointed at a supercycle in its strategic guidance late last year. Back then, there were some investors saying that with a recession upcoming, airlines wouldn’t be preferred investments, ignoring Delta’s view that the demand strength would remain robust even through a recession if one were to hit. Since then, DAL stock has gained 37%, outperforming the 10.6% of the broader market. So, I think overall that negative viewpoint was not quite correct, and the 2023 Investor Day actually to a major degree was not different from the story we saw late last year.

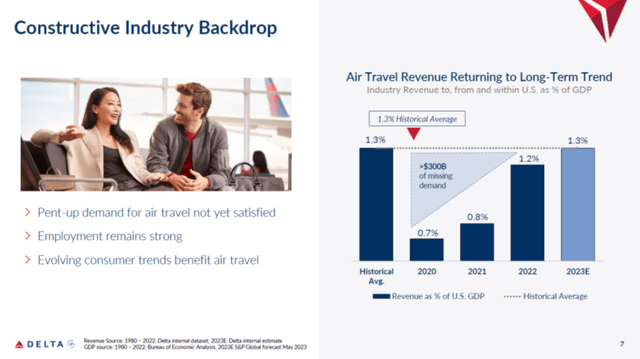

A Continued Bullish Super Cycle Story For Delta Air Lines

That the story is not much different from the prior strategic update becomes clear from the slide above. The right side of the slide was shown previously as well, and it tells the story of around $300 billion in missing demand. While the market and airlines generally speak about a release of pent-up demand to the market, Delta’s viewpoint is that 2023 will actually be a return to the historical average of air travel revenues being 1.3% of U.S. GDP. What does this mean? It means that the $300 billion in missing demand has yet to be released to the market, and the strong surge we saw in 2022 and the growth in 2023 will just be a move to return to the historical average. Whether that $300 billion will in full return to air travel revenues and at what time frame is unknown, but it certainly is a big positive for airlines.

Furthermore, the company highlighted that spending on services is still not recovered and is in fact significantly below the trendline, but consumers are swapping spending for goods for spending for experiences such as travel, which can be considered a sign of some part of that $300 billion in missing revenues actually being returned to airlines, as services spent recaptures the trendline driven by the swap between goods and services.

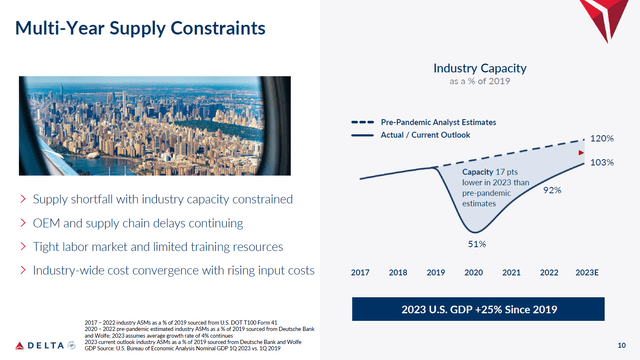

The company also supplied the slide above, which I find interesting as it shows that for 2023 the industry capacity remains 17 pts below what was previously expected. This is driven by a pilot shortages, which should be a lesser problem for Delta Air Lines, but overall airlines scaled down fleets early on in the pandemic. With some expertise in the OEM supply chain being lost as well as the situation with Russia, it has been challenging or OEMs to increase production rates. Combined, the first slide and the second slide show the supercycle: there is demand that has been released to the market and still has to be released, while the ability to supply remains limited and below pre-pandemic forecasts. It could somewhat suggest that higher unit revenues are here to stay for the foreseeable future.

Delta Air Lines: A Prudent Business Approach

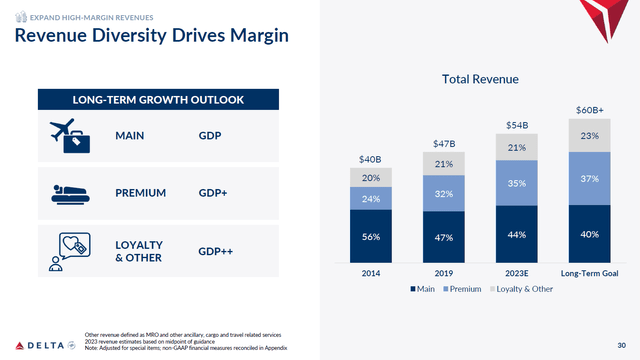

Overall, Delta Air Lines is also executing a prudent business strategy. The company is seeing strong demand for its premium cabin product, and then we are not talking about Emirates-style luxury, but things like premium economy and business class. Delta recognizes that once guests have a taste of that, they will stick in the premium segment. Furthermore, its cobranding with American Express (AXP) is expected to add $10 billion in revenues over the long term, which falls into the loyalty and other segment.

The fleet strategy is also noteworthy. Delta Air Lines is known for their extremely diligent fleet decision strategy. The airline will not always buy the most fuel-efficient airplanes, but it will make the fleet decision that is most cost efficient and beneficial to its entire business. The replacement of the Boeing (BA) 757 by the Airbus (OTCPK:EADSF) A321neo drives seat costs down by 10%, while premium seats are increased by 13%, increasing margins by 10 to 12 points on lower seat counts. This is not necessarily an example of Delta doing a thorough cost efficiency analysis and select end-of-production-life airplanes, but it does show how technological advancement and cabin segmentation add profits.

Similarly, the replacement of the Boeing 767 by the A330-900neo provides a strong up-gauge and drives down unit costs by 7.5%, and again, higher premium seat counts add to the margins, which expand by 10 pts.

Besides the operational profits that these airplanes bring, MRO capabilities have played a major role as well and provide some way to reduce cyclicality and add strong long-term non-airline growth. Delta Air Lines always explores adding MRO capabilities to its portfolio when ordering new airplane types, and that multi-focus aircraft procurement strategy should help MRO revenues grow from $0.8 billion this year to $2 billion by 2026 and eventually to $5 billion by 2030+.

Delta Air Lines Guidance Update

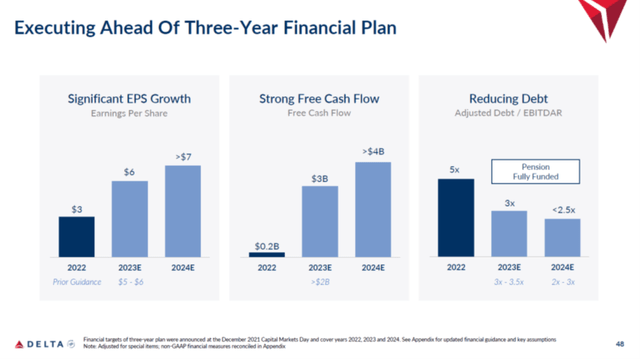

Delta Air Lines has not updated its 2024 targets much, but will detail those in the future. For 2023, the company now expects $6 in earnings per share compared to $5 to $6 guided for earlier. The >$2 free cash flow target has been detailed at $3 billion, while its deleveraging target is now 3x from 3x-3.5x previously guided and less than 2.5x for 2024, compared to the previous guide of 2x-3x. For Q2 2023, the company sees year-over-year non-fuel unit cost growth tapering compared to the Q1 2023 growth rate, while in the second half unit costs should be down year-over-year, and the same holds for 2024.

Conclusion: DAL Stock Remains A Buy

The market has reacted positively to the Investor Day presentation by Delta Air Lines, and I also see the positives on how the airline creates a strong brand with various revenues streams while its premium cabin mix also adds to the margins. I like listening to Investor Day presentations, as they really do give a good sense on how airlines are approaching their business, not just for a quarter or two ahead but for the mid-to-longer term. Delta’s business strategy has always looked strong to me.

At the same time, I have to say that to me the overall story did not sound different to what made me mark Delta Air Lines a strong buy. I did not see anything that was extremely unexpected. The company is basically tracking well on its targets, and for this year it should be better than guided for. So, I don’t see any reason to change my strong buy rating other than a significant portion of the upside to Wall Street targets having been filled since the last strategic update I covered.

However, I do think that Delta is a business that has such a strong execution and vision that it can revisit it pre-pandemic all-time highs. The business remains cyclical, which is an obvious risk, but if there is one airline I would invest in, it would be Delta Air Lines, Inc.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.