XYLD Keeps Grinding Higher In 2023, Delivering 11% Plus Yields

Summary

- The Global X S&P 500 Covered Call ETF is an attractive option for income investors, as it has consistently generated a large income stream and currently yields over 10%.

- The ETF uses a covered-call strategy, selling monthly covered calls against its portfolio to generate immediate income for its distributions.

- Comparing XYLD to the Nasdaq 100 Covered Call ETF and the Russell 2000 Covered Call ETF, XYLD has shown the lowest percentage loss on original capital and the largest total ROI over the past 2.5 years - also, the largest yield by a small fraction.

- However, investing in XYLD is not without risks. The covered-call strategy caps potential upside returns and investors should fully understand how call options work before investing.

- I recommend XYLD as a component of an income portfolio but advise potential investors to conduct their own research and due diligence.

Sakorn Sukkasemsakorn

If you're not an income investor, the Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) probably wouldn't be that appealing. Today, income investors have risk-free alternatives to taking on equity risks that generate attractive yields. There are many CDs that offer in the mid to high 4% levels and several that meet or exceed a 5% yield. A money market from Schwab with a $0 minimum investment will generate 4.93%, and parking money in a 10-year T-bill will generate a yield of 3.76%. Having several non-risk assets generating more than 3.5% has created an environment where traditional equities that yield between 2-3% are significantly less appealing. During the 2022 decline, XYLD fell from $50.75 on 1/4/22 to $38.33 on 10/14/22. YTD, XYLD has grinded higher, appreciating by 3.12%, and has been establishing a new base above the $40 level. XYLD has never missed a monthly distribution throughout the decline and continuously generated a large income stream. Its covered-call strategy isn't for everyone, but it's far from a gimmick, as the options market provides ongoing premiums to be distributed to investors. I am still a fan of XYLD and feel shares will grind higher as the market rebounds.

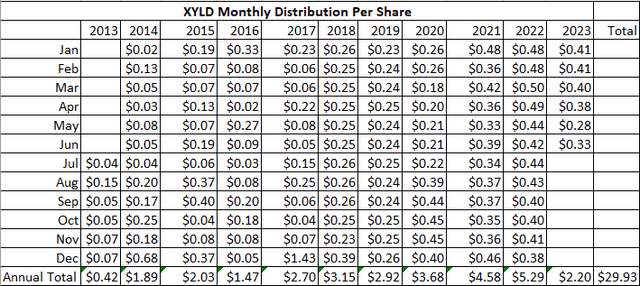

XYLD has never missed a monthly distribution and has generated 74.83% of its initial share price through its distributions

When it comes to income, there are generally two thought processes. Some investors favor investing in assets that have the potential to generate larger amounts of capital appreciation and then sell shares when income is needed. Others would rather invest in income-producing assets and collect the distributable income without touching the original base. Different investors have different needs, and while one method may work for a specific methodology, it may not be the best fit for another.

When it comes to income, I would rather invest capital in an income-producing asset, and generate a continuous stream of income without selling shares. Hypothetically, if you were to purchase 100 shares of the SPDR S&P 500 ETF (SPY), it would cost $43,662. SPY generates a dividend of $6.52, so in the first year, you would generate $652 in dividend income. If you were to take that same $43,662 and allocate it toward XYLD, you could purchase 1,073 shares, which has a TTM distribution of $4.67, which is $5,012.33 in annualized distributions.

Since I can't predict the future, I am going to make some general assumptions to establish my point. The assumptions are that XYLD keeps the distribution stagnant while SPY keeps the dividend stagnant and appreciates by 8.5% annually. After the $652 is deducted, you would need to sell off enough shares to cover the $4,360.33 gap between the dividend income from SPY and the distribution income from XYLD. At the end of the first year, you would need to sell 10 shares to cover the difference. Markets don't go up in a straight line, so accounting for fluctuations in the market and downtrends, my assumptions are that based on an average annualized rate of return of 8.5%, it would take between 15-18 years to sell off your entire base of SPY before the investment was depleted to generate $5,012.33 of income annually.

This is why I prefer investing in income-producing assets, and I feel XYLD is very interesting from a dividend farming perspective. Regardless of what the market does, XYLD will generate monthly income without touching the principle.

Since its IPO, if you had purchased 1,000 at $40, you would have collected $29,930.70 in distribution income without touching a single share. While XYLD has fluctuated and recently traded downward, XYLD has distributed 74.83% of its original IPO price throughout 120 monthly distributions. I am willing to put the price fluctuations aside and not look at the day-to-day pricing of the underlying asset in XYLDs case because of the track record it has established with the monthly distribution. My preference is to generate income from the asset base without drawing down from the principle, because, in this case, I will always have the same XYLD asset base generating an ongoing stream of income. The capital appreciation would have been 1.7% over the past decade, but those 1,000 shares would have brought in 29,930.70 of income, and based on the TTM distribution, would be on track to deliver an additional $5,012.33 of income in 2023, while having a base value of $40,680.

Both methods can be effective, and if you're able to invest in a stock that outperforms the S&P 500, you will extend the number of years it would take to draw down your entire asset base. Investing in XYLD isn't going to generate market-beating capital appreciation, but the results over the past decade indicate that the stream of income will continue to be delivered monthly without selling off a portion of the asset base.

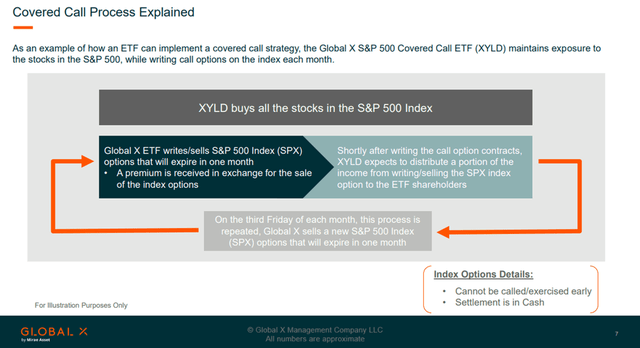

How XYLD delivers double-digit yields

XYLD can deliver double-digit yields by sacrificing capital appreciation or upfront income. This is where the methodology comes into play, and why XYLD isn't a good ETF for investors looking for capital appreciation. XYLD caps the upside potential by selling monthly covered calls against its portfolio and distributes the income received to its investors. Some investors still feel XYLD is a gimmick, and implementing an overlay call strategy adds risk. All investments contain an element of risk, and proper due diligence should be taken prior to allocating capital toward any investment type, and understanding how call options work is critical before investing in XYLD.

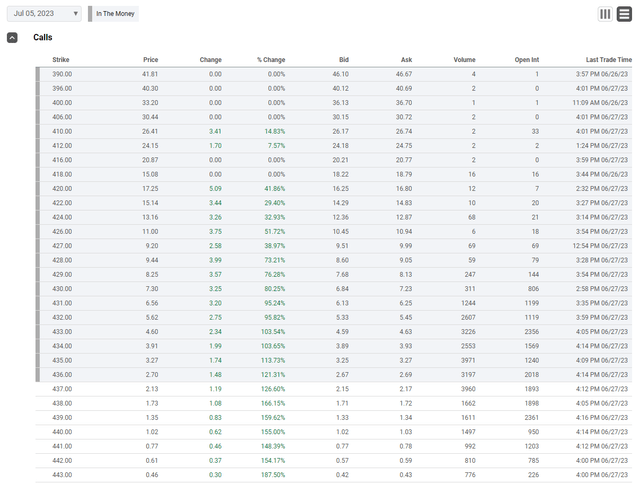

Utilizing a covered-call strategy doesn't increase the risk to the downside, it just caps your potential upside returns. Each call contract is the equivalent of 100 shares. If I own 100 shares of SPY, I can write 1 contract on my shares. Below is a snapshot of the Jul 5th, 2023 options chain found on Seeking Alpha. The critical components of an option are the strike, price, and expiration date. If I write 1 contract against my 100 shares of SPY, I am selling someone the right to purchase my shares on a specific date for a specific price, and they are paying me a premium today for that right. If I was to sell a covered call on the July 5th, 2023 chain, July 5th is the expiration date. If I am selling the contract at a strike price of $443, SPY has to be above $443 at the close of trading on July 5th for the contract to be executable. I would be paid $0.46 per share or $46 today for the right to purchase my 100 shares on July 5th at a share price of $443. If SPY doesn't reach $443, the contract expires worthless, and I keep my shares and the contracted premium I was paid. If SPY exceeds $443, no matter the price, the order will be executed, and I will be paid $44,300 for my 100 shares. Selling covered calls does not add downside risk. The risk that selling covered calls adds is losing out on capital appreciation.

XYLD utilizes a buy-write strategy and invests in all of the companies within the S&P 500, just like a traditional index fund on the buy side. XYLD then implements a sell-side where it writes or sells corresponding call options on the S&P 500. The options are written at the money on a monthly basis, and the premiums collected are used to fund its monthly distributions to shareholders. Covered Calls are written on 100% of the portfolio, which is how XYLD is able to pay a monthly dividend that currently has a double-digit yield base on the trailing twelve months [TTM]. All XYLD is doing is selling the right to purchase their shares at a future date at a specified price and collecting income through the option premium upfront. The only additional risk outside of the equities falling in value is that the upside is capped due to the covered calls, but you are getting paid upfront for the upside to be capped.

How XYLD has done compared to QYLD and RYLD since 2021

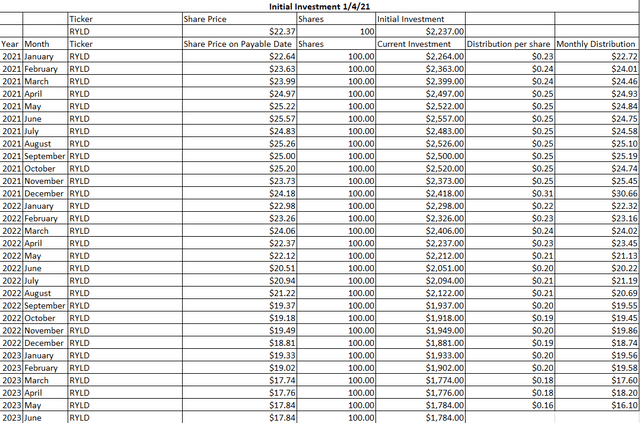

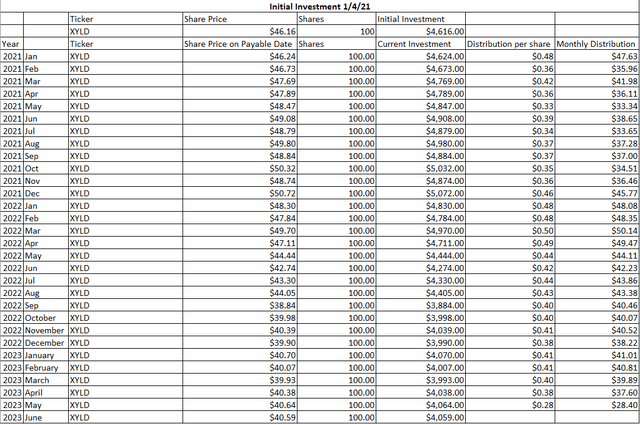

Global X has 3 main covered call ETFs. Including XYLD, Global X also has the Nasdaq 100 Covered Call ETF (QYLD) and the Russell 2000 Covered Call ETF (RYLD). I have calculated how these funds would have performed based on an investment of 100 shares and taking the income as distributions rather than reinvesting the income.

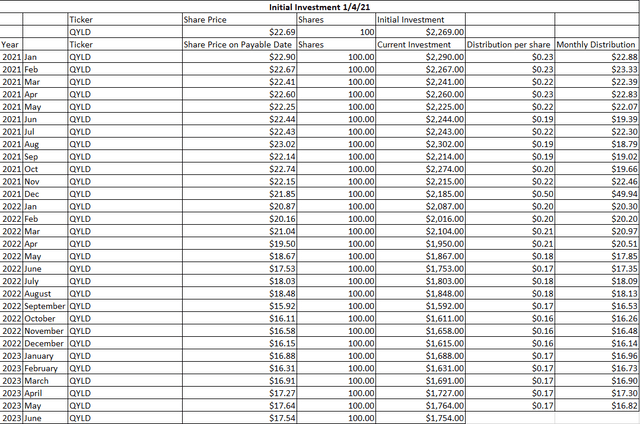

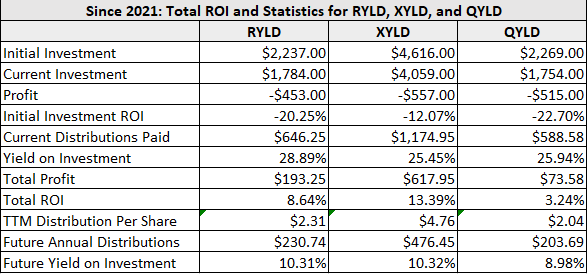

An initial investment in QYLD would have cost $2,269 and would be worth $1,754 today. Off the top, the asset base would have declined -22.70% or by -$515. QYLD has generated $588.58 in income since January 2021, which is a 25.94% yield on invested capital. When the distributions are netted out from the losses, the total profit would be $73.58 for a total ROI of 3.24%. In the TTM, QYLD has produced $2.04 in distributions per share, placing its future annualized distribution at $203.69 or 8.98% on invested capital.

Steven Fiorillo, Seeking Alpha, Global X

An investment in RYLD would have cost $2,237 at the beginning of 2021 and since then would have declined by -20.25% or -$453. It has paid $646.25 in distributions generating a 28.89% yield on invested capital. After the distributions are netted against the investment losses, the total investment is in the black by $193.25 for a total ROI of 8.64%. In the TTM, RYLD has generated $2.31 per share of distributions placing its future annual distributions at $230.74, which is a future yield on invested capital of 10.31%.

Steven Fiorillo, Seeking Alpha, Global X

Over the past 2.5 years, XYLD has been the clear winner. An original investment at the beginning of 2021 would have cost $4,616 and would be worth $4,059 now. This is a loss of -$557 or -12.07%. XYLD has paid $1,174.95 in distributions over this period which is a 25.45% yield on investment. When the distributions are netted against the losses, the total ROI is $617.95 or 13.39%. XYLD has paid $4.76 in TTM distributions which would place its future annualized distributions at $476.45 or 10.32%.

Steven Fiorillo, Seeking Alpha, Global X

XYLD has the lowest percentage loss on original capital with the largest total ROI from the 3 funds. XYLD also has the largest yield by a small fraction. Overall, XYLD has the lowest yield on invested capital, but has generated the best returns for investors compared to RYLD and QYLD.

Steven Fiorillo, Seeking Alpha, Global X

Conclusion

Every investment has a level of risk, and if you're interested in XYLD, you should research call options and the implications of implementing an overlay covered call strategy. I like XYLD as a component of my income portfolio because the income isn't predicated on generating EPS and paying a dividend. XYLD is investing in companies that are part of the S&P 500 and selling covered calls against its portfolio monthly to generate immediate income to fund its distributions. Regardless if the market goes up or down, XYLD will continue to write covered calls and generate income. My preference on the income side is to invest in income-producing assets and never draw down from the asset base unless I absolutely need to. XYLD has continuously generated a large income stream and is currently yielding over 10%. Just because XYLD fits within my risk profile doesn't mean that it will fit in yours, so please read the ETF documents before investing.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XYLD, QYLD, RYLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.