Palantir: 3 Reasons To Buy (Rating Upgrade)

Summary

- I missed the initial move on Palantir as I had a 'neutral/hold' rating. But after reviewing Q1 FY23 and the company's AIPCon, I am changing my stance to a 'buy'.

- Palantir is poised to benefit from accelerated US Commercial adoption as customer counts and average pricing per customer metrics show sharp improvement.

- 2 more quarters of GAAP net income profitability can unlock institutional and passive investor flows.

- Management has a track record of beating expectations, consistently surprising on revenue guidance as well as actual revenue and margin prints.

- Palantir is at a slight valuation premium relative to its historical multiples. But so long as the operating momentum and positive surprises continue, I think the stock will do well.

Dr Alexander Karp, CEO of Palantir Drew Angerer

Thesis review and update

In my last article on Palantir (NYSE:PLTR), I had a 'neutral/hold' stance as the leading indicators of revenue were pointing to a slowdown. Since publication, the stock has gone up 66.15% against the S&P500's 5.35%, leading to a large alpha of 60.8%. Clearly, this has been a missed opportunity.

Now, as I review my thesis after Q1 FY23 and AIPCon, I am upgrading my view to a 'buy' due to 3 key reasons:

- Palantir is set to benefit from accelerated US Commercial adoption

- GAAP profitability can unlock institutional and passive flows

- Management has a track record of beating expectations

Palantir is set to benefit from accelerated US Commercial adoption

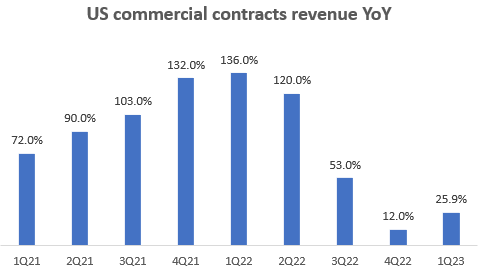

US Commercial Contracts Revenue YoY (Company Filings, Author's Analysis)

The last quarter saw an acceleration of the YoY growth trend in US commercial contract revenues to 25.9% from 12.0% in Q4 FY22. An even better sign is that excluding the revenue from their invested companies, CFO David Glazer noted that the YoY growth was more than 45% YoY. Since getting business from non-investee customers is a relatively more difficult sales challenge, I view this as a more reliable indicator of true business momentum. Looking at the composition of this growth, I gain further confidence of continued momentum ahead:

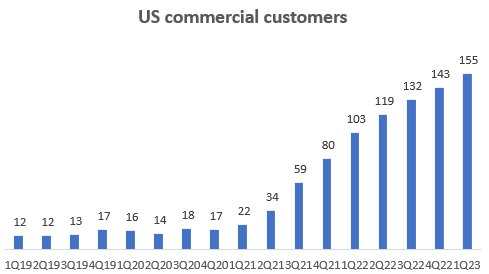

Palantir continues to add US commercial customers at an accelerating pace (+12 last quarter vs + 11 in the quarter before that):

US Commercial Customers (Company Filings, Author's Analysis)

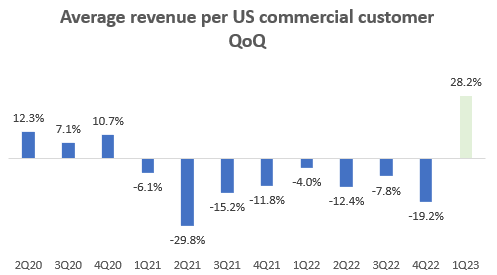

The average revenue from these 155 customers jumped 28.2% to $0.7 million, breaking a long spell of declines:

Average revenue per US commercial customer QoQ (Company Filings, Author's Analysis)

The numbers speak for themselves in showing evidence of a meaningful rev up among US enterprises. Management's narrative in the call supported the bullish trends as they broad set of drivers:

We continue to see robust pilot starts and promising conversions, and we're also beginning to see the realization of our expansion strategy, meaning we're beginning to see meaningful growth and upsell opportunities with our newer customer base. Some notable examples include the expansion of our work with Hertz (HTZ), who is using Foundry to more efficiently manage and operate its fleet of nearly 500,000 vehicles; and Jacobs Engineering (J), who is doubling down on our partnership to reduce costs and improve performance across plants.

- Chief Revenue and Chief Legal Officer Ryan Taylor in the Q1 FY23 earnings call, Author's bolded highlights for emphasis on broad-based growth drivers

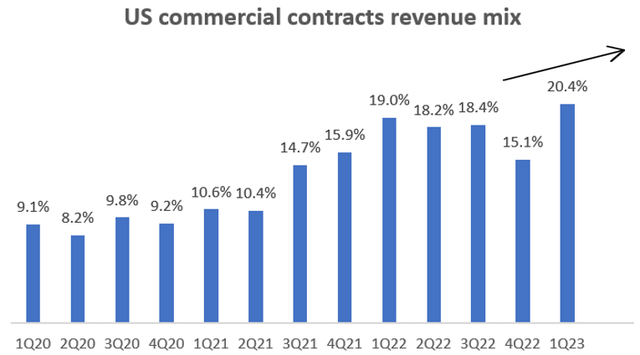

US Commercial Contracts Revenue Mix (Company Filings, Author's Analysis)

The current mix of US commercial contract revenues has increased to all-time highs of 20.4%. I anticipate this trend to continue since management does not have much visibility of growth in the international business, and US government contracts are described as having "timing uncertainties".

CEO Alexander Karp noted a key change in the nature of conversations with potential customers:

...the quality of the questions has shifted from why would we need this to how would I use it?

- CEO Alexander Karp in the Q1 FY23 earnings call

I believe this is a signal of a potential beginning in large-scale enterprise adoption. Palantir's recent showcasing of their AIP for Business platform likely spurred the enthusiasm even further. Personally, I was mind-blown when I watched their demo.

GAAP profitability can unlock institutional and passive flows

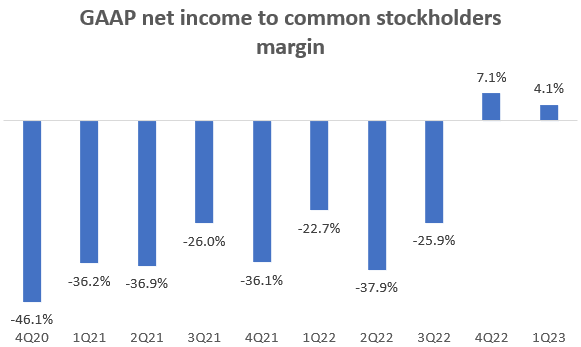

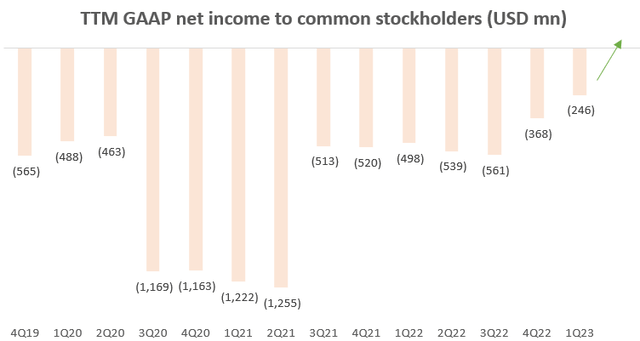

Palantir has printed positive GAAP earnings for the second time in Q1 FY23:

GAAP net income to common stockholders margin (Company Filings, Author's Analysis)

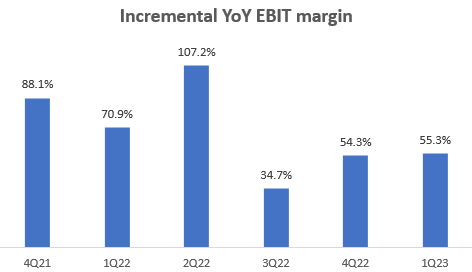

Importantly, management expects to be profitable for each of the subsequent quarters in FY23. In all likelihood, I believe the profitability profile will increase dramatically as its high incremental YoY EBIT margins of over 50% drives powerful operating leverage effects:

Incremental YoY EBIT Margin (Company Filings, Author's Analysis)

This will make Palantir eligible for inclusion in the S&P 500 (SPY) (SPX) by the end of Q3 FY23 as it would meet the following 2 criteria:

- It must report positive earnings in the most recent quarter.

- The sum of its earnings in the previous four quarters must be positive.

This catalyst can unlock a greater flux of institutional and passive investor flows for Palantir, which would be constructive for the stock.

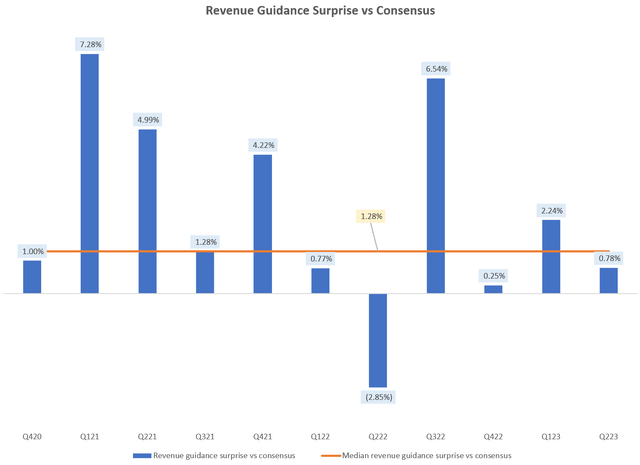

Management has a track record of beating expectations

A key part of my thesis relies on trusting management's commentary on revenues and margins. I believe this trust is well-earned as Palantir's management has a reliable track record of beating expectations. For example, they have only disappointed consensus revenue expectations in their guidance once in their entire history of 11 quarters:

Revenue Guidance Surprise vs Consensus (Company Filings, Author's Analysis)

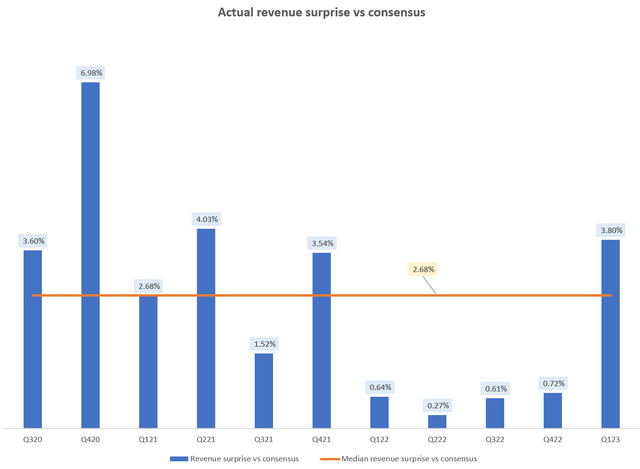

Their actual delivery is even more impressive as they have never had a revenue miss so far:

Actual Revenue Surprise vs Consensus (Company Filings, Capital IQ, Author's Analysis)

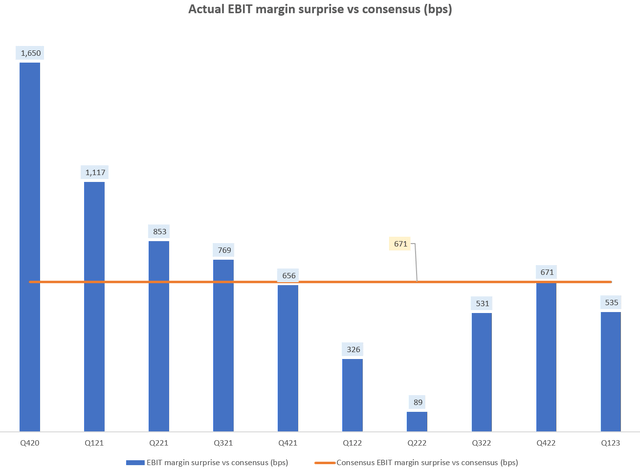

The same story applies for EBIT margins; no miss yet:

Actual EBIT Margin Surprise vs Consensus (bps) (Company Filings, Capital IQ, Author's Analysis)

Looking at these statistics, I gain confidence to take management's commentary as a key input into my views on the stock.

Valuation

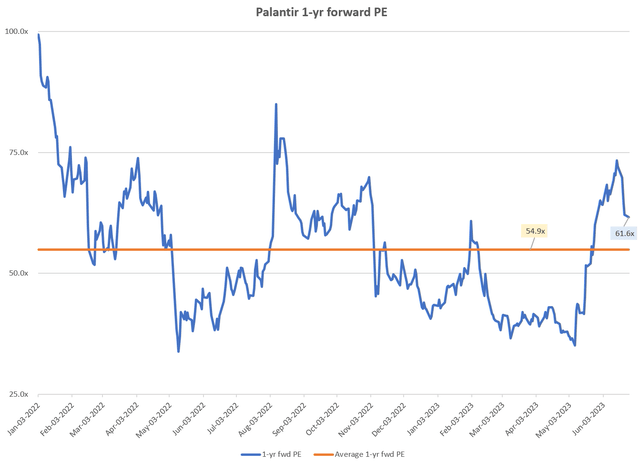

Palantir is currently trading at a 1-yr fwd PE of 61.6x, which corresponds to a 12.3% premium to the average 1-yr fwd PE of 54.9x since 2022:

Palantir 1-yr forward PE (Company Filings, Capital IQ, Author's Analysis)

Personally, I believe the positive business momentum trumps the slightly premium valuation. I think so long as Palantir surprises the street on its operating performance, the stock will continue to outperform the market.

Risks

I identify 3 key risks for the stock:

1. Delays and cancellations in project execution

This is likely to occur if the macroeconomic environment takes a turn for the worse, leading to a postponement or cancellation of spends by clients. We have seen this phenomena play out in IT Service companies such as EPAM Systems (EPAM), which has led to subsequent estimate downgrades (which I had anticipated in my last article on EPAM). As noted earlier, the commentary for Palantir is still very bullish so I think this reduces the chances of weaker project execution.

2. A faltering in the TTM GAAP net income's route to profitability

TTM GAAP net income to common stockholders (USD mn) (Company Filings, Author's Analysis)

Basis management commentary, TTM GAAP net income is expected to rise above the 0 mark by Q3 FY23. Any delays in this expected timeline are likely to lead to an earnings downgrade and a negative stock reaction.

3. S&P 500 index inclusion is not guaranteed

Even if Palantir meets all the necessary criteria for S&P500 index inclusion, it is not necessary that it will be included. Let's not forget that only 500 companies make the list. Retail investors seem to have high expectations as there is already talk of this positive catalyst in the earnings calls. But high expectations can also lead to unexpected disappointments so it is important to keep this risk in mind and moderate our expectations.

To continuously assess the key risks, I will keep a close eye on the quarterly result performance, especially the traction of leading indicators such as remaining performance obligations (which indicates the levels of non-cancellable contracted backlog) and billings growth.

Conclusion

I missed the initial run on Palantir as I had a 'neutral/hold' rating on the stock. This has led to an opportunity cost of a 61.4% alpha move on the stock. After reviewing the Q1 FY23 earnings call and the company's AIPCon, I gain a lot more confidence in the growth momentum for the company, particularly in the US commercial sector.

Furthermore, I think the end of FY23 is setting up a nice catalyst for the stock as the company would then become eligible for inclusion into the S&P500 index, which would attract greater institutional money and a lot of passive flows through instruments such as index funds such as the Vanguard S&P 500 ETF (VOO).

My thesis places some trust on management's commentary. However, the data shows that this trust is well-earned as management has consistently delivered positive surprises for more than 10 quarters now.

I recognize that valuation on a 1-yr forward PE basis is at a slight 12.3% premium since the start of 2022. However, I think so long as the company continues delivering and surprising the positive business momentum, the key risks of project cancellations and hiccups to TTM profitability will be kept at bay.

All things considered, I am changing my rating to a 'buy'.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.