TMX Group: Robust Free Cash Flows, Debt Refinancing Should Not Be An Issue

Summary

- The TMX Group is the owner and operator of the most important Canadian exchanges: The TSX and TSX Venture Exchange.

- The cash flows remain robust and we shouldn't expect a lot of volatility.

- As TMX has issued debentures when debt was cheap, I don't expect any aggressive increase in interest expenses.

- The thinly-traded debentures could offer excellent opportunities thanks to nervous sellers.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

Iryna Tolmachova/iStock Editorial via Getty Images

Introduction

The TMX Group (OTCPK:TMXXF) (TSX:X:CA) is the owner and operator of the Toronto Stock Exchange and the TSX Venture Exchange which are Canada's two main financial markets. TMX deals with equities and fixed income trading and clearing and the trading and clearing of financial derivatives. I like to invest in exchanges as a relatively "safe" investment proposition. Although there for sure are challenges and new, smaller exchanges are popping up left and right, those smaller exchanges don't appear to have what it takes to really take market share from the larger operators which have the "one-stop shop" as unique selling feature.

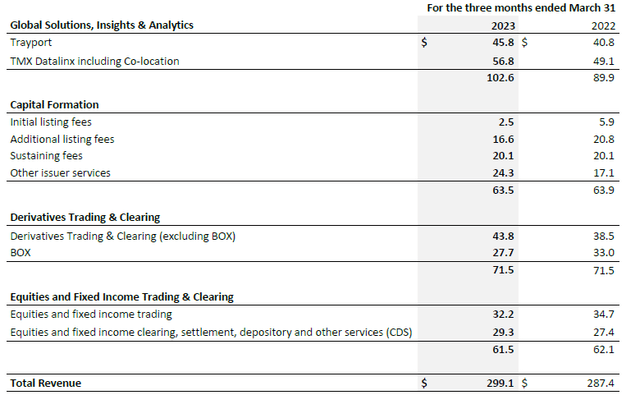

TMX is a cash flow machine

The very strong position in the Canadian financial markets also means the financial results of the TMX Group are pretty stable and predictable. Market volatility provides a boost to the financial results as there's a higher demand for trading and clearing solutions but unfortunately the weak financial markets also resulted in lower fees from IPOs and other listing fees. As you can see below, we see a strong increase in the derivatives trading and clearing and the insights and analytics division but this compensated for the lower listing fees. And while the total revenue increased from C$287M to C$299M, the entire revenue increase was generated by the global solutions, insights and analytics division.

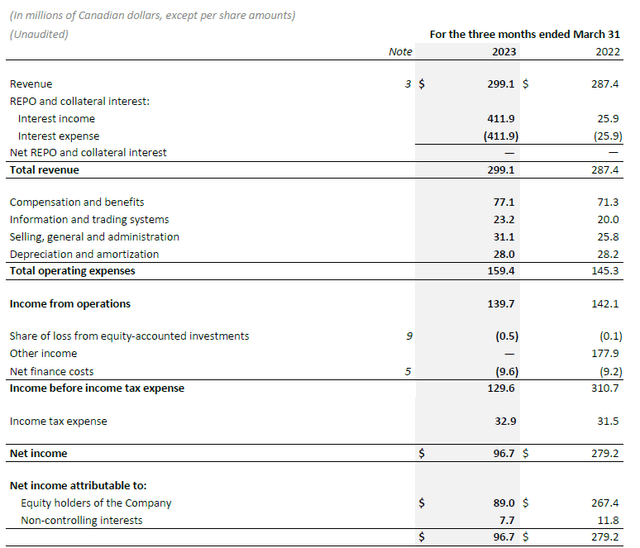

Unfortunately TMX also had to deal with higher operating expenses and unfortunately the entire C$12M revenue increase was needed to almost cover the C$14M increase in operating expenses. This indeed means the operating income decreased by approximately 2% compared to the first quarter of last year.

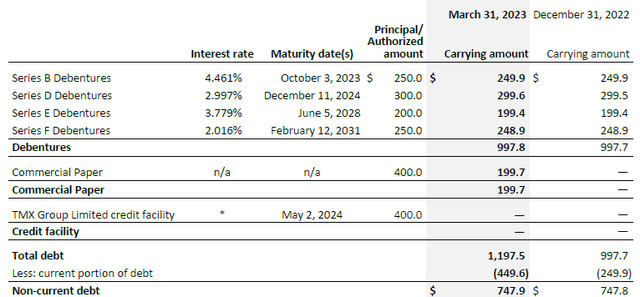

Fortunately, TMX Group has a very low cost of debt as it has locked in low interest rates by issuing long-term bonds. So while we can expect a gradual increase of the interest expenses as those bonds will have to be refinanced, it's not an issue that has to be dealt with right now.

The net income after making the C$33M tax payment was C$96.7M of which C$89M was attributable to the common shareholders of TMX Group. This represented an EPS of C$1.60 per share. Keep in mind the TMX Group has completed a 5:1 stock split subsequent to the end of the first quarter so adjusted for the new share count, the EPS is C$0.32.

That's nice but that definitely does not make the TMX Group cheap as the stock is trading at in excess of 20 times earnings. Fortunately, being an exchange operator is a pretty capital-light business and the required investments to keep the systems running are relatively low.

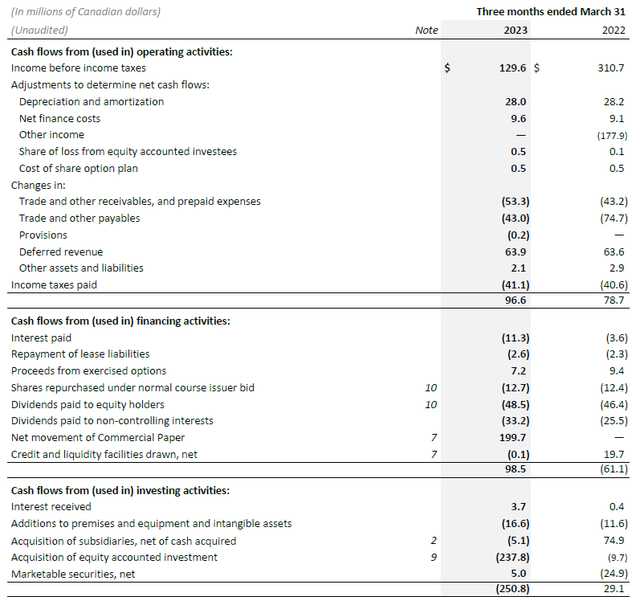

That's also clearly visible in the cash flow statement. As you can see below, TMX Group reported an operating cash flow of C$97M but this includes a net investment in the working capital position of approximately C$30M while it also includes about C$41M in cash taxes although only C$33M was due.

That being said, we still have to deduct the C$14M in interest and lease payments and I also will deduct the C$8M in net income attributable to the non-controlling shareholders.

While the cash flow statement above shows the total dividend paid to those non-controlling shareholders exceeded C$30M, keep in mind the vast majority of that dividend is paid in the first quarter and mainly covers the preceding year.

On an adjusted basis, the operating cash flow in the first quarter of the year was approximately C$113M and about C$117M after also adding the C$4M in net interest received. The total capex was just under C$17M which means the net free cash flow result was approximately C$100M. Divided over the 55.9M shares outstanding in Q1 the FCFPS was approximately C$1.79 and adjusted for the stock split the free cash flow per share exceeds C$0.35 per share.

As the TMX Group should be able to hike prices going forward, I don't really expect the earnings and free cash flow to come under too much pressure. And whereas other companies have to deal with increasing interest rates, TMX Group has taken advantage of the low interest rates and the gradual refinancing should be relatively painless.

As you can see above, the first debenture to mature is a C$250M debenture which matures in Q4 of this year but as the current coupon of 4.461% is already relatively high, I don't expect a substantial increase of the interest expenses. The Q4 2024 refinancing should be relatively fine as well but a 200 bp cost of debt increase will add about C$6M to the interest bill. The toughest nut to crack will be the 2.016% debenture but that one only matures in eight years from now so it for sure is not a pressing matter.

Investment thesis

I currently have no position in the TMX Group but I hope the recent stock split will improve the trading volumes and perhaps also improve the option pricing and volumes as the TMX Group would be a good example of a stock I would like to write put options on to take advantage of temporary weakness in the market. The stock is currently trading at about 20 times its underlying free cash flow and while that isn't cheap, it's clear quality has its price.

I do own a very substantial long position in the 2024 debentures. I noticed every once in a while sizable blocks are put up for sale and as there's hardly any volume in the debentures, it usually is a buyers' market rather than a sellers' market (earlier today, someone sold a block of the Series D debentures at 87 cents on the dollar for a double-digit yield to maturity which is a steal). Investors interested in fixed income should keep an eye on the TMX debentures on a daily basis to take advantage of a seller.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no position in TMX' common shares but I have a long position in the company's debentures maturing in 2024.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)