VCSH: A High-Yield Haven For Riding Out The Recession

Summary

- VCSH is a Buy due to its high yield and potential for capital appreciation, making it a good option for investors looking to ride out the coming recession.

- VCSH primarily invests in investment-grade corporate bonds that mature in 1-5 years.

- VCSH is a better choice than other ETFs for investors seeking high current yield and capital appreciation.

Nikada/iStock Unreleased via Getty Images

Vanguard Short-Term Corporate Bond Index Fund ETF (NASDAQ:NASDAQ:VCSH) invests in investment-grade short-term corporate bonds. With about $35B AUM, VCSH has a 30-day SEC yield of about 5.4%. Not only does VCSH offer a high yield, but it also offers more potential capital appreciation than other popular bond ETFs. As we head into a recession, I think now is the time to get rid of some equities and start buying bonds to ride out the recession, and VCSH is a great candidate to do so. I rate VCSH a Buy.

Holdings

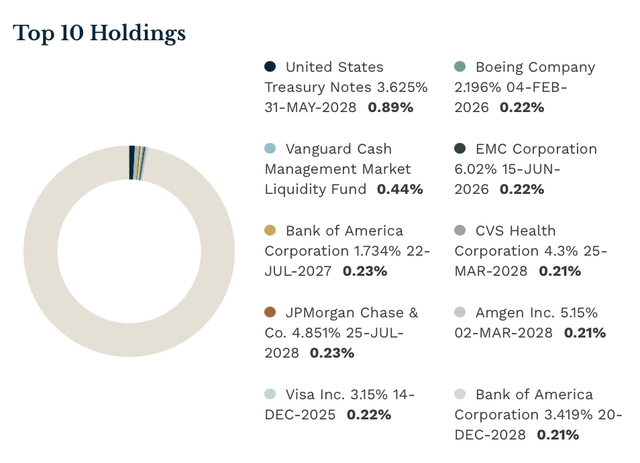

VCSH primarily holds investment-grade corporate bonds that mature in the next 1-5 years. This is a very diverse ETF, with 2456 holdings and the top 10 making up only a little over 3% of the AUM.

VCSH top 10 holdings (ETF.com)

VCSH invests in high-quality investment-grade bonds. Over 50% of the ETF is in A-rated bonds or better.

VCSH's holdings by credit rating (vanguard.com)

This ensures that default risk remains relatively low. Risk is also lowered due to the fact that VCSH holds short-term bonds, which usually carry less risk than longer-term bonds.

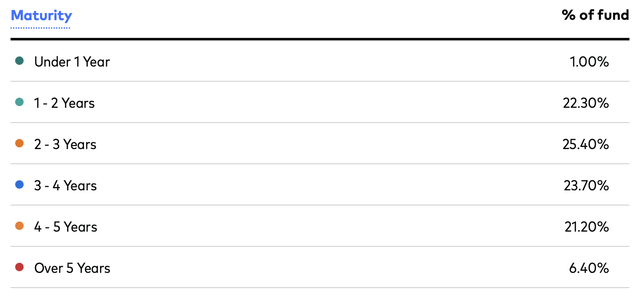

VCSH's holdings by maturity (vanguard.com)

The largest holding is bonds with maturity times between 2 and 3 years.

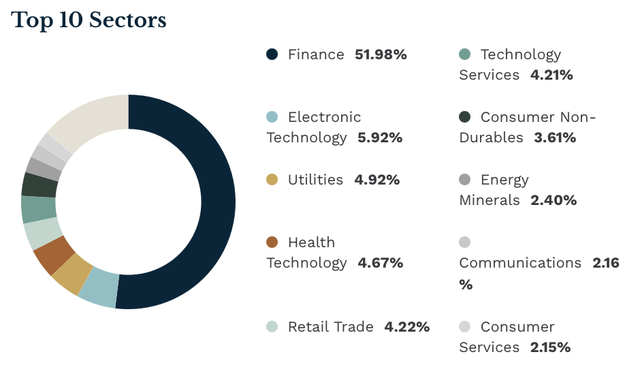

One final note about VCSH's holdings is that the bonds it holds are heavily concentrated in the financial sector.

VCSH's holdings by sector (vanguard.com)

If you are still concerned about the financial sector after the collapse of Silicon Valley Bank (OTCPK:SIVBQ) and First Republic Bank (OTCPK:FRCB) you may want to stay away from this ETF, considering over 50% of its AUM is in bonds issued by companies in the finance sector. I'm not too worried about this. Now that we know there are likely only a couple more rate hikes coming in 2023, I'm confident we aren’t heading into a banking crisis.

Why short-term corporate bonds

Short-term bonds tend to be less risky than longer-term bonds. Usually, this causes the yield for short-term bonds to be substantially lower than that of long-term bonds. However, this isn't the case at the moment because we are in a rare situation where we are experiencing an inverted yield curve.

| ETF | 30-day SEC yield |

| VCSH (Vanguard Short-Term Corporate Bond Index Fund ETF) | 5.35% |

| VCLT (Vanguard Long-Term Corporate Bond ETF) | 5.53% |

While the long-term equivalent to VCSH, VCLT, does have a higher yield, it's only by 0.18%. This means an investor would be taking on substantially more risk in order to receive a measly 0.18% more in yield. In my opinion, the risk-reward ratio of VCLT is not worth it.

Now look at the same comparison to VCIT, the intermediate-term equivalent of VCSH.

| ETF | 30-day SEC yield |

| VCSH (Vanguard Short-Term Corporate Bond Index Fund ETF) | 5.35% |

| VCIT (Vanguard Intermediate-Term Corporate Bond ETF) | 5.34% |

In this case, short-term bonds actually pay more than intermediate-term, although by a minuscule amount of 0.01%. Why would an investor buy an asset with more risk, in order to receive a lower or identical yield? The only reason is that bonds with more risk have more capital appreciation potential when rates go down. Although not as much as VCIT or VCLT, VCSH also makes sure to offer some capital appreciation potential. VCSH has a higher effective duration relative to most short-term corporate bond indexes, meaning it’s more sensitive to interest rates. Because of the added interest rate risk, there is more capital appreciation potential when rates fall.

Depending on your investing goals, VCIT or VCLT may be a better option for you. If you have a long-term outlook and want higher-risk, higher-yield, and higher-capital appreciation potential, VCIT or VCLT may be the better option. However, if you are looking for an asset with low risk, high-current yield, and some capital appreciation potential in order to ride out the coming recession, VCSH is the way to go.

Why now

We have started to see some slowdown in the booming US economy. We saw the Fed take a rate hike pause in June, suggesting that the end of rate hikes is near. Furthermore, we have been directed by Fed Chairman Powell to expect only 2 more rate hikes. This implies that there won't be much capital depreciation from future rate hikes because rates won't be raised much more. The Fed also said to expect no rate cuts for the next couple of years. This ensures that VCST holders will receive a high yield for at least a few of years.

Risks

Investment-grade corporate bonds carry some default risk. This risk is amplified during an economic downturn. Because of how quickly and how high interest rates have been raised, we are almost certainly headed into a recession. This will cause an increase in corporate bond defaults, potentially hurrying VCST. However, because VCST holds highly-rated bonds, I think this is a minor issue barring a very severe recession.

Another risk is interest rate uncertainty. As of now, Fed Chairman Powell has told investors to expect 2 more rate hikes in 2023. However, if inflation remains sticky and there isn't a sufficient slowdown in the economy, it's very likely that rates will have to be raised more. This will lead to capital depreciation. Although I feel confident there will only be at most 2 more rate hikes, nobody can know for certain right now.

VCSH vs SGOV

For most bond-related articles I write these days, I get comments saying SGOV (Ultra-short 0-3 month US treasury ETF) has practically zero risk and a high yield of about 5.1%, so I thought I would address that comment in relation to VCSH. While SGOV is a great ETF (currently has a Buy rating from me), it lacks capital appreciation potential. So if you are an investor who is hoping to profit from capital appreciation as well as yield, but still have a low-risk asset, VCSH is the better choice. Also, by no means are these two ETFs mutually exclusive; some investors may want to own both.

Conclusion

VCSH offers a low-risk, high-yield asset to ride out the recession. For investors looking for a high current yield, low risk, and some capital appreciation potential, short-term bonds are the best option in the corporate bond sector. Because of all this, I rate VCSH a Buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SGOV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.