3 Of My Favorite Dividend Growth Stocks

Summary

- Dividend growth stocks put the power of compounding into overdrive.

- All three companies generate strong free cash flows, allowing for safe and growing dividends.

- These three dividend growth stocks have strong management teams that are guiding the company in the right direction for continued growth.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Sakorn Sukkasemsakorn

Companies with strong cash flows that pay growing dividends are my favorite type of stocks to invest in. After all, dividend growth is what puts the power of compounding into overdrive.

Dividend growth is what has Warren Buffett earning a yield on cost of over 50% on his shares of Coca-Cola (KO) whereas anyone buying shares today earn only 3%.

So, today we are going to look at 3 of the best dividend growth stocks to consider for your portfolio.

- All 3 stocks are of the highest quality

- All 3 stocks have great balance sheets

- All 3 stocks have great management teams

- And All 3 stocks have strong dividend growth

3 of the best Dividend Growth Stocks

Dividend Growth Stock #1 - The Home Depot (HD)

Home Depot, as you are probably well aware, is the largest home improvement retailer in the US with a market cap of $302 billion and over the past 12 months, the stock is up 9%. Year-to-date, the stock is down 2.5%.

Home Depot is often tied to the real estate market, but they are strong enough to excel even if real estate is cooling. The real estate market has been a bit of a roller-coaster of late, high interest rates and a shortage of supply have made it difficult, especially for first time homebuyers. However, homebuilder stocks have been on the move higher, so there are plenty of mixed signals.

On the flip side, you have current homeowners sitting on loads of equity, given the price appreciation the real estate sector has seen over the past decade plus. In addition, you have many current homeowners sitting on low interest rates around 3% or lower, so the incentive to move and risk losing that low interest rate makes the prospects of selling low.

As such, homeowners are likely to stay in their current homes, keeping inventory levels low, but potentially increasing home projects again, which can positively impact the likes of Home Depot.

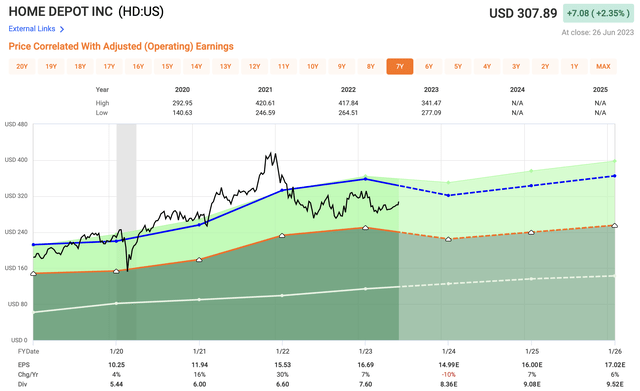

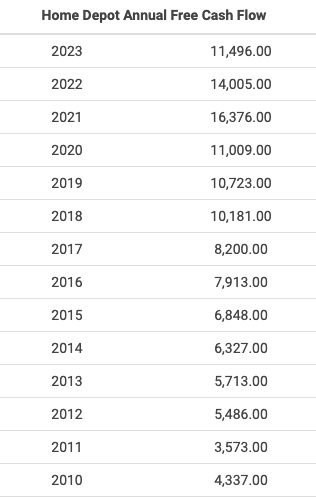

HD is a company that has been able to generate huge amounts of free cash flow over the years, especially the boom they saw during the pandemic. In 2010, the company generated $4.3 billion of FCF and fast forward to January 2023 (FY 2022), HD generated $11.5 billion, which is more in line with where the company was prior to the pandemic. HD saw a lot of pull forward in the midst of the pandemic seeing $16 billion of FCF.

Macrotrends

Looking at the company’s latest cash flow statement, the company paid dividends of $7.79 billion during the full 12 month period. This equates to a FCF payout ratio of 68%, which is actually quite high for Home Depot. The year prior the FCF dividend payout ratio was 50%, which is closer to normal. FCF levels are expected to rebound in the next 12 months, which would lower the payout ratio once again.

In terms of the dividend, HD currently pays an annual dividend of $8.36 per share which equates to nearly a 3% dividend yield. Looking at dividend growth, over the past five years, HD has a strong 5-year dividend growth rate of 15.2%, a dividend that has been increased for 14 consecutive years.

After the company’s recent earning release, which management said they now expect a decline in sales and net income, analysts have brought down their full-year estimates. Analysts are looking for EPS of roughly $15 flat in 2023, which equates to an earnings multiple of 20x compared to a 10-year average of 22x, so you are getting a slight discount at current levels.

Dividend Growth Stock #2 - Broadcom (AVGO)

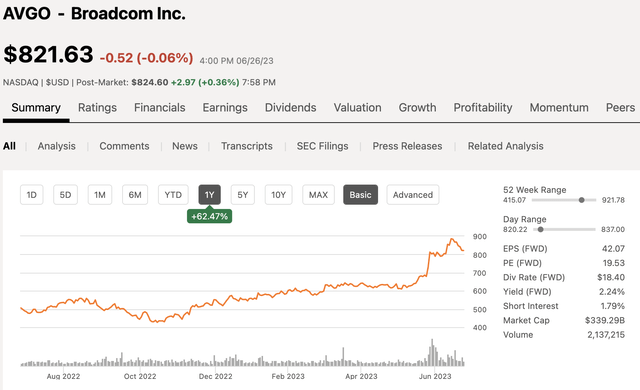

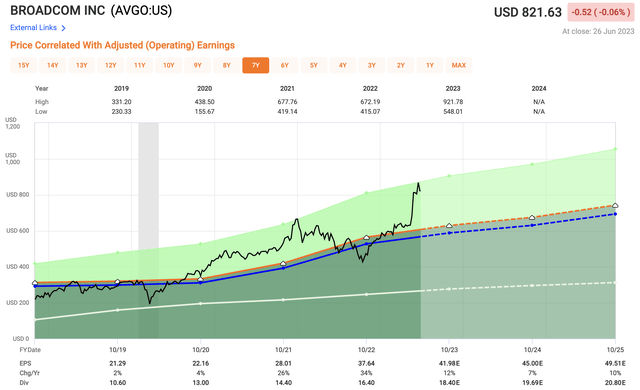

Broadcom is a stock that has been on a tear of late, being one of the latest to get a sizable bump from the AI craze. Broadcom currently has a market cap of $339 billion. Over the past 12 months, shares are up over 60% and year to date, shares are up nearly 50%.

Being that I own the stock, the move has been amazing, but part of me believes the move has been too far too fast.

Broadcom is a semiconductor company that specializes in various hardware components, such as processors and chips for various areas of technology from WiFi and data, to data centers, cybersecurity, and yes of course, AI.

Here are some of the customers Broadcom has:

All major companies, and all play some part in the world of artificial intelligence.

Broadcom CEO Hock Tan updated investors during the company’s recent earnings release and discussed the topic of AI, noting that AI will account for 15% of semiconductor revenues this fiscal year, which is up 10% from prior year. Moving out one year, Mr. Tan believes AI will account for 25% of semiconductor revenues, which is some major growth, and it means AI will account for nearly 20% of the company’s total revenues.

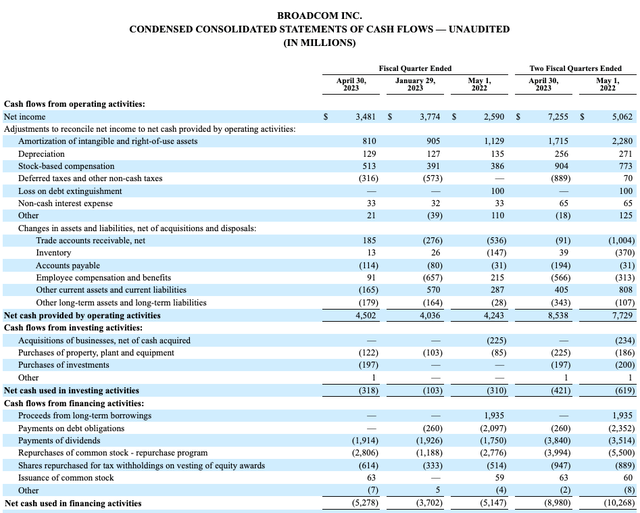

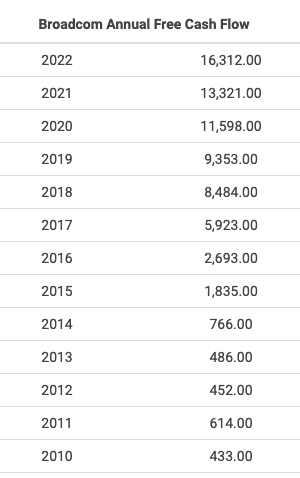

Broadcom is another company that generates strong amounts of free cash flow. In the most recent quarter, the company generated $4.4 billion in FCF, which was up 5.3% year over year.

Here is a look at the company’s free cash flow by year from 2010 through 2022 showing in 2010 they generated $433 Million compared to the $16.3 billion they generated in 2022. FCF is expected to increase as artificial intelligence continues to become a larger part of the business.

Macrotrends

Through the first half of the year, AVGO has already generated $8.3 billion and has paid dividends of $3.84 billion, which equates to an FCF payout ratio of 46%, making the dividend both plenty safe and having plenty of room to continue to grow moving forward.

The stock currently yields a dividend of 2.3% and they have a five year dividend growth rate of 21%. The board has increased the dividend for 12 consecutive years.

Dividend growth of 21% is insane, but also probably not something that is all that sustainable, so I would expect something more in the range of 15% for the foreseeable future.

Looking at valuation, you can see the spike in the share price of late, which have made shares much more expensive. Analysts are looking for EPS of $41.98 per share this fiscal year which equates to a 2023 earnings multiple of 19.6x. Over the past 10 years, shares have traded at a multiple closer to 15x, which makes the current valuation appear overvalued, yet still cheaper than many other AI related stocks.

Dividend Growth Stock #3 - Bank of America (BAC)

Bank of America is the second largest US bank in terms of total assets. JPMorgan (JPM) is the largest with $3.7 trillion, followed by Bank of America with $3.2 trillion.

Bank of America currently has a market cap of $221 billion and over the past 12 months, shares are down 13%, including being down 16% year to date.

The banking sector has been a bit of a roller coaster in 2023, but the quality always rises to the top, as the bank actually saw an influx of deposit inflows shortly after the mini banking crisis we saw a few months back. Deposits however are still down overall. In a few weeks, we will get an update from the banks, which will be great to see how deposit activity has been.

The other area where the bank has benefited is with Net Interest Income or NII, which Bank of America is benefiting due to higher interest rates. As rates go higher the bank is able to charge more for loans.

NII increased $2.9 billion in the prior quarter which was a 25% increase year over year. This has flowed through to the bottom lines as net income reached $8.2 billion in the most recent quarter.

Loan dollars continue to increase, but at the same time so does the bank's credit provisions, which is more an emergency fund if and when the economy falls on hard times and clients are unable to repay their loans.

Given that a potential recession is on the horizon, BAC could face a bumpy ride, but looking at valuation and estimates, it seems as if much of that is already priced in.

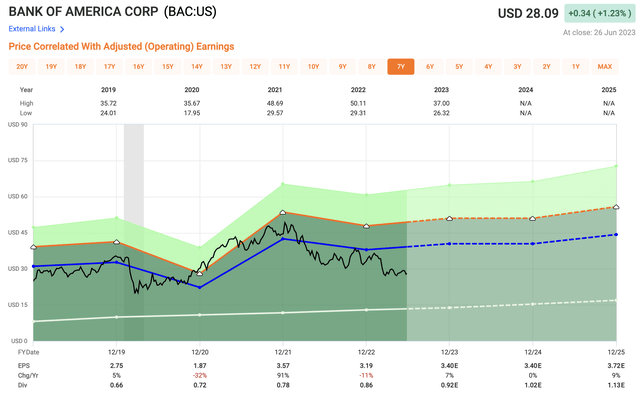

Analysts are looking for 2023 EPS of $3.40 which equates to an earnings multiple of just 8.3x, which is incredibly cheap.

To give you an idea of just how cheap BAC shares are, at the trough of 2009, shares of BAC dipped to 7.9x, not all that far away from where things stand today. Over the past five years, shares have traded closer to 12x and over the past decade closer to 14x.

In terms of the dividend, Bank of America shares currently yield a dividend of 3.1%, which is a dividend they have hiked for the past nine years. In terms of dividend growth, BAC has a five year dividend growth rate of 13%.

Investor Takeaway

All three of these dividend growth stocks have strong business models and operate at very efficient levels. Management has done a great job at generating strong free cash flows, which help pay a safe and growing dividend.

Dividend growth stocks are my favorite type of stock to invest in as I am not focused as much on yield as I am on dividend growth as it puts the power of compounding into overdrive.

Bank of America and Home Depot appear undervalued, but given the strong move of late from Broadcom, those shares do look a little pricey. Bank of America shares have dealt with a mini financial crisis in Q1 and Home Depot has dealt with volatile lumber prices and a slowing real estate sector. Broadcom on the other hand is just another AI related stock that has seen its shares shoot up of late, which is why I am choosing to be patient before adding to my position.

In the comment section below, let me know which of these dividend growth stocks you like best.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

No marketing to add

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Author of the weekly financial newsletter, "The Dividend Investor's Edge."

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, BAC, AAPL, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Don’t see the support for BAC, who I do own by the way. Thinking of moving to TD, TFC, or USB.