United Airlines: The Case For A Double

Summary

- United Airlines Holdings, Inc. continues to forecast a $10 to $12 EPS for 2023 while the stock trades at only $56.

- An airline analyst just made the case for a sector stock to double her just-increased price target.

- United Airlines stock is cheap at 5x '24 EPS targets while the industry stock regularly trade at triple the forward P/E multiple.

- Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Learn More »

Sakorn Sukkasemsakorn

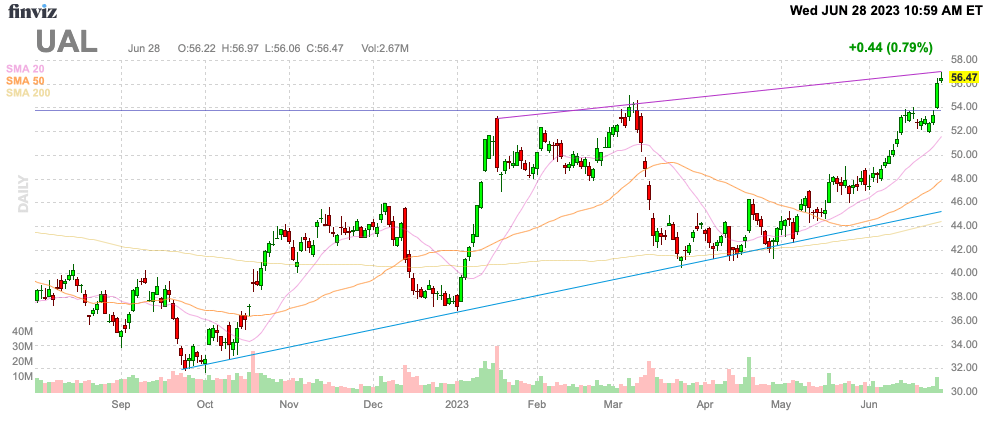

While United Airlines Holdings, Inc. (NASDAQ:UAL) has already seen a solid rally in the last couple of months, the stock still has the potential for substantial upside from here. The airlines have entered a period of strong profits and free cash flows while the market continues to exclude the sector from the standard industrial transportation valuations. My investment thesis remains ultra Bullish on the airline stock.

Source: Finviz

Topping 2019 Levels

While a lot of airlines racked up large debt levels during the Covid slowdowns back in 2020 and 2021, the companies are now generating massive profits and free cash flows with sights on topping 2019 levels. United Airlines actually continued to forecast a massive EPS of $10 to $12 for 2023, yet the stock only trades at $56 following a major breakout this week.

The airline, along with the sector, reported a small loss during Q1 completely throwing off the stock market. Somehow the losses in the seasonally weak quarter threw investors off track despite the persistent large yearly EPS target of $10+.

At the time of the Q1'23 earrings report, United Airlines targeted a $3.50 to $4.00 EPS for Q2'23 alone. The market initially ignored this number, but Delta Air Lines (DAL) hammered home the potential for a record Q2 EPS at their Investor Day on June 27.

The market was very positive on the airline stocks heading into the Delta meeting, but the guidance appears to have finally altered the mood on the stocks. Despite all the recent gains, a major disconnection remains on valuations.

Jefferies analyst Sheila Kahyaoglu went on CNBC after raising her price target on Delta to $50 from $45. The analyst made the following perplexing statement:

If you value Delta on its 2025 free cash flow target, it's trading at a 13% free cash flow yield. The market is at 5.5. We could see upside of up to $100 on Delta shares, if they hit their targets.

Despite a very bullish statement regarding the upside on Delta based on admitted conservative 2025 free cash flow targets of $4+ billion, Ms. Kahyaoglu has a price target just above the current stock price. In fact, the Jefferies price target on the stock would normally only warrant a Hold on the stock the analyst suggests could more than double to reach $100.

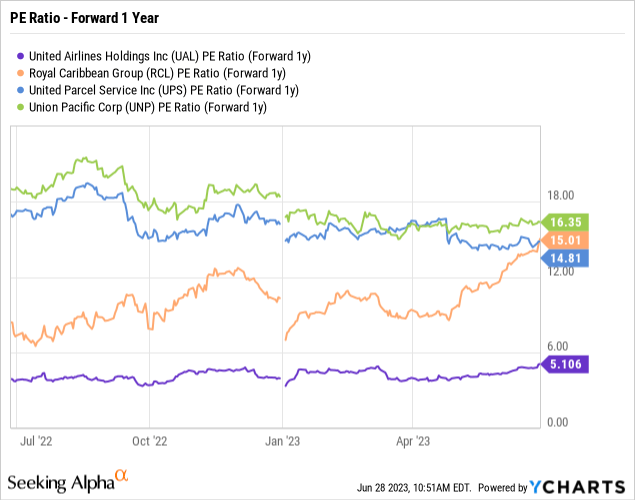

Industrial Transportation Comps

The industrial transportation industry is a diverse group from airlines to railroads to cruise lines to package delivery services. The sector currently has a common theme of related stocks trading around 15x forward earnings estimates outside of the airlines.

The amazing part is that Covid had varied impacts on the sector. The cruise lines were shut down until 2022 and are only now hitting full capacity in early 2023 while package delivery firms saw a big boost in demand leading to a current slowdown.

The airlines started reporting massive profits last year, yet a cruise line like Royal Caribbean Group (RCL) has already doubled this year prior to reporting forecasted large profits. In addition, United Parcel Service (UPS) and Union Pacific (UNP) have all returned to a 15x P/E multiple.

United Airlines could double to $112 and the stock would only hit a 10x froward P/E multiple. The airline stock would still trade at a massive discount to the other industrial transport stocks.

In addition, this forward P/E target is based on United Airlines earning an $11 EPS in 2024. The airline has already guided to hitting this level in 2023, suggesting the company could reach a $13 EPS in 2024 and the stock would have to hit $130 to reach a 10x forward P/E multiple.

United Airlines ended last quarter with a net debt total of only $13.5 billion due to generating positive cash flows from surging advance ticket sales up nearly 50% YoY to $10.2 billion, while the cruise line stocks have rallied despite similar or larger debt issues. Naturally, risks exist, but the other industrial transportation stocks face a lot of the same risks without the stocks being held back.

Takeaway

The key investor takeaway is that United Airlines stock remains an insanely cheap stock. The airline sector definitely isn't without risk, but the stock should be bought on this breakout due to the solid risk/reward scenario where United could still double from there.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

UAL has been cancelling a higher percentage of flights at the beginning if the day than other airlines for the summer. The thunderstorms in NYC this week have crippled airline operations but UAL has been posting far worse rates of cancellations and delays than any other airline across their system for days.

There is a very good chance that UAL will significantly miss its revenue and profit numbers in the 2nd quarter as hundreds of thousands of UAL passengers cannot get to where they are going or bail to other airlines. We have seen this over and over again; when one airline does much worse operationally than everyone else, other airlines gain at the poor performing airline's expense.And a big part of the reason that UAL cannot recover is not because of the FAA or weather - other airlines have to deal w/ the FAA and weather just like UAL does - but because United's pilots do not have a new pilot contract over a year and a half after UAL's CEO said he would lead the industry in getting a new contract to his pilots. DAL finally broke through w/ a massively expensive nearly $2 billion per year increase in pilot costs with its new contract, Delta passed along massive increases to all of its other employees as well, and Delta is now saying it will end up at the top end of very generous profit and cash flow guidance. DAL can clearly afford the labor cost increases it agreed to but it is doubtful that other airlines including UAL can do so near to the same extent.Scott Kirby, UAL's CEO has signed up for over $50 billion in new aircraft - more than 3X what DAL has on order - and DAL still has 300 new aircraft on order and many more on option - and even more than AAL, which has a younger and more fuel efficient fleet than UAL. Scott Kirby's focus is on growth and yet he is investing first in airplanes and doesn't have the money to spend on employees to anywhere near the same degree.Add in that the US air traffic system cannot handle the growth that Kirby says he will deliver and UAL is not even staffed for the schedule it has published this summer and UAL's revenue and profit numbers all summer long will be stretched and very well could be knocked from the lofty goals that have been published.

thank you.

look at this data for cancelled and delayed flights and compare UAL to the rest of the industry as far back as the site allows you on a day to day basis. I track it regularly and UAL's operation has deteriorated this summer far worse than other airlines.

They are simply pushing their system much further than other airlines, their operation is suffering just as other airlines have when similar things have happened in the past, and there is abundant history that this kind of stuff hurts the bottom line.

flightaware.com/...