Bayer: Easy Deep Value Pitch

Summary

- Bayer reported mixed Q1 2023 results, matching analyst consensus expectations with regard to profitability and earnings, but missing on topline and guidance.

- Long term, Bayer remains well-positioned for growth: Bayer's Crop Science Innovation Summit highlighted an ambitious innovation pipeline valued at approximately €30 billion.

- Anchored on adjusted EPS estimates through 2025, in line with analyst consensus, I see close to ~55% upside; and accordingly, I reiterate a "Strong Buy" recommendation.

brunocoelhopt

Following a disappointing outlook for Q2 and FY 2023, mostly due to fading pricing power in Glyphosate, Bayer (OTCPK:BAYRY) stock lost close to 10% post-Q1 2023 reporting, and the stock is now trading once again at dirt cheap valuation levels. For reference, Bayer stock is now priced at a 2024E P/E of ~11x, a P/B of ~1.2x and P/S of ~1x, all ratios suggesting a 50-60% discount to the respective median valuation for industry peers.

Personally, however, I do not complain that Bayer stock is cheap once again; but appreciate the opportunity to load up exposure on this long-term winner in key life science verticals such as consumer health, pharma, and agrar tech. Anchored on adjusted EPS estimates through 2025, I see close to ~55% upside based on a €78.86 implied target price. Reiterate "Strong Buy" recommendation.

(Note: For the purpose of this article, I reference the BAYN.DE Xetra listing, which is the most liquid equity paper for Bayer stock. The core takeaway, however, that Bayer is deeply undervalued is not influenced by the exchange listing of the underlying, and percentage upside/ downside estimates remain consistent across listings)

Bayer's Q1 Report

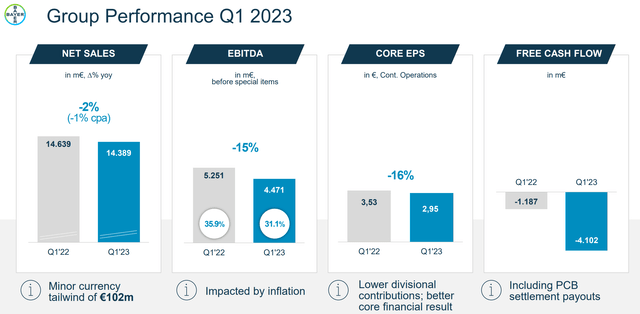

Bayer reported mixed Q1 2023 results, matching analyst consensus expectations with regard to profitability and earnings, but missing on topline. During the period from January to end of March, the German life science conglomerate generated total revenues of €14.4 billion, down about 1% YoY on a FX adjusted basis, and disappointing against analyst consensus at midpoint by approximately ∼€200 million.

With regard to profitability, Bayer's group EBITDA contracted by about 15% YoY, to €4.5 billion vs. €5.3 billion for the same period one year prior. Similarly, core earnings per share fell 16% YoY, to €2.95, as compared to €3.53 for the same period in 2022 respectively. While the profitability contraction is certainly disappointing, investors should consider, however, that the loss of profitability YoY vs. Q1 2022 has been broadly anticipated by analysts, given that the group faced a very tough comp in the crop science division.

Bayer closed Q1 with about ∼€34.5 billion of net debt, increasing leverage by about 12% QoQ, mostly as a function of PCB settlement payouts relating to the Monsanto litigation.

Segment View: Crop Science & Pharma Disappoint, Consumer Health Solid

The Crop Science division reported revenue around ∼€8.4 billion, down 1% YoY, and EBITDA of approximately ∼€3.3 billion, down 11% respectively. The segment suffered a notable decline in volume, which according to management is primarily attributed to the ongoing war in Ukraine. Prices increased by about 7%, but benefits were almost completely offset by inflationary cost pressures. Regarding Glyphosate-based products specifically, the company emphasized that prices are gradually returning to 2021 levels, which implies a sharp decline vs. FY 2022.

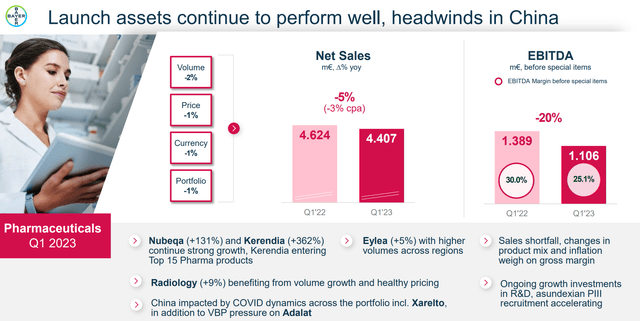

During the Q1 2023 period, the Pharmaceuticals unit's topline contracted by about 5% YoY, down to €4.4 billion; EBITDA fell 20% YoY, to €1.1 billion. In context of these financials, new drug launches (cancer drug Nubeqa, up 131%, and cardiovascular drug Kerendia, up 362%) partially offset weakness in legacy blockbuster products, as Xarelto sales declined 13% and Adalat declined 24% respectively.

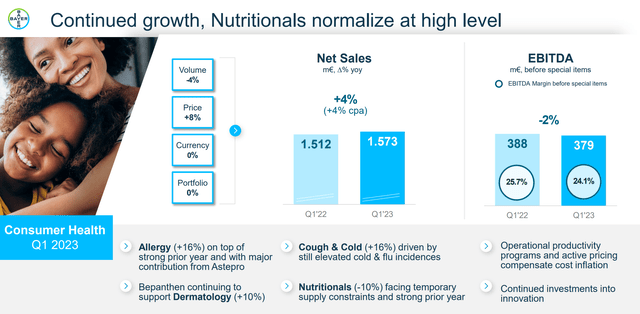

Bayer's Consumer Health unit recorded a 4% YoY expansion in net sales, growing to €1.6 billion, and EBITDA didn't move much versus Q1 2022 - reported at €380 million.

Outlook

Bayer slightly updated FY 2023 expectations, and disappointed investors with the commentary that management sees sales and earnings at "the lower end of (previous) guidance". Specifically, investors are advised to now price about €51.25 billion of group sales, and €7.25 of earnings per share.

While an earnings revision to the downside is never pleasant, needless to say, investors should not forget that Bayer's revised earnings estimate of ∼€7.25 is still an incredibly attractive value proposition for investors, considering that shares may currently be bought around ∼€50.5 (BAYN.DE reference, suggesting a ∼14% earnings yield).

A Note On Bayer's Crop Science Innovation Summit

Looking beyond quarterly revenue/ earnings fluctuations, I would like to point investors' attention to Bayer's long-term product strategy and business potential. Specifically, investors should be aware of the key takeaways relating to Bayer's Crop Science Innovation Summit (dated June 20th).

During the event's presentation, Bayer management provided an extensive overview of the company's current innovation pipeline, which the group estimates at approximately €30 billion peak sales potential (PSP). In that context, the Crop Science leadership team suggested that about 50% of the PSP is incremental to the current annual sales of around €25 billion, with 30% of the pipeline's PSP likely being realized by 2032, and approximately 80% by 2037.

For context, Bayer anticipates that the agriculture input market, which is valued at approximately €100 billion and divided between seeds/traits (40%) and agrochemicals (60%), will likely expand to around €200 billion by 2030. This growth will be facilitated by the emergence of digital platforms and precision farming techniques, carbon capture initiatives, and advancements in crop fertility -- all areas where Bayer is focusing R&D efforts.

A Note On The Never-Ending Monsanto Story

The Monsanto litigation seems to be a never-ending story, even as investors shift focus away from PCB settlement and pending (minor) risks. But the most recent news flow appears to skew favorably: Bayer recently issued an announcement highlighting a win in the Gordon trial, held in St. Louis, Missouri. This victory marks the third successful verdict for Bayer in cases adjudicated in St. Louis; and the verdict brings Bayer's overall trial record regarding Roundup/glyphosate cases to seven wins vs. three losses. In my opinion, the favorable verdict in the Gordon trial potentially opens the possibility of a partial write-back of Bayer's €6.4 billion provision, as of Q1 2023.

Valuation Update

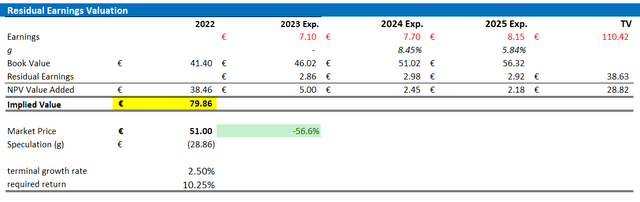

Reflecting on Bayer's Q1 2023 reporting, I update my EPS expectations for Bayer through 2025: I now estimate that Bayer's EPS in 2023 will likely fall somewhere between €7 and €7.2. Moreover, I also adjust my EPS expectations for 2024 and 2025, to €7.7 and €8.15, respectively -- in line with analyst consensus revisions.

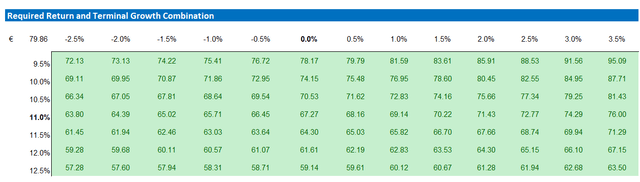

In addition, I anchor on a 2.5% terminal growth rate (about in line with estimated nominal global GDP growth, and thus quite conservative), as well as on a 10.25% cost of equity.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for the BAYN.DE listing equal to €79.86.

Company Financials & Analyst Consensus Estimates; Author's Calculations

Below is also the updated sensitivity table.

Company Financials & Analyst Consensus Estimates; Author's Calculations

Conclusion

Bayer's Q1 2023 results presented a mixed picture (slightly disappointing against optimistic comps.), with short-term weakness in the group's Crop Science division pressuring FY 2023 earnings. However, while the revised outlook for FY 2023 disappointed, the estimated ∼€7.25 EPS estimate still represents an attractive value proposition, comparing earnings to valuation (∼€50.50).

The favorable outcome in the Gordon trial adds to Bayer's track record of wins in glyphosate-related cases, potentially leading to a write-back of the provision set aside for such matters. Looking beyond short-term fluctuations, Bayer's long-term product strategy and innovation pipeline, particularly in the Crop Science segment, provide reasons for optimism. Considering these factors, I reiterate a "Strong Buy" recommendation for Bayer stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAYZF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.