SoFi: The Only Bank You Want To Bank On Right Now

Summary

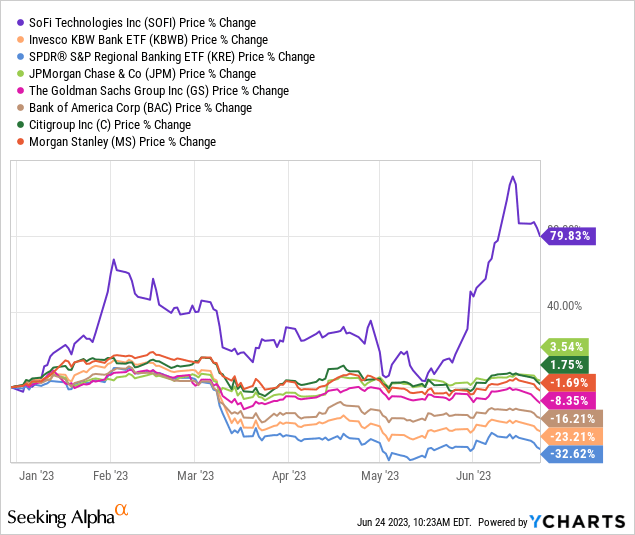

- Social Finance is an emerging force in the banking & financial services industry and an outlier in an ailing sector throughout 2023.

- Despite closing a valuation gap on its peers after a stunning 80% YTD rally, SoFi's stock remains undervalued on an absolute basis and continues to be an alpha generation opportunity.

- In this note, we shall revise our investment thesis and re-run SoFi through TQI's QA process, i.e., analyze its fundamental, quantitative, technical, and valuation data, to reach an informed decision.

- Without further ado, let's dive right into this discussion on a unique opportunity in banking.

- Looking for a portfolio of ideas like this one? Members of The Quantamental Investor get exclusive access to our subscriber-only portfolios. Learn More »

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Introduction

On the back of Fed's aggressive rate hike campaign last year, the banking sector has experienced intense pressure so far in 2023, with investors (and depositors) fleeing away from banks (especially regionals) after three massive bank failures earlier this year. However, SoFi's stock (NASDAQ:SOFI) is up ~80% year-to-date, outperforming its banking peers by a mile.

After receiving multiple Wall Street analyst downgrades in recent weeks, SoFi's stock has tanked by ~20% from its recent highs. In today's note, we shall briefly revise our investment thesis for SoFi, internalize two important catalysts, and re-run SoFi through TQI's Quantamental Analysis process to see if this pullback is a good buying opportunity for long-term investors.

Investment Thesis

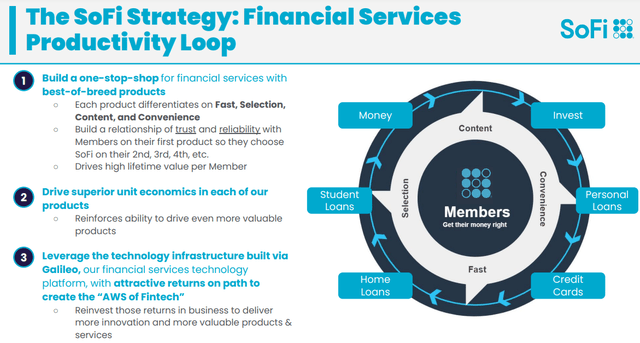

SoFi Technologies, Inc. is a member-centric, fully-digital, one-stop-shop for financial services that enables its (5.7M+) members to borrow, save, invest, spend, and protect their money. In addition to being a digital bank, SoFi provides Banking as a Service ("BaaS") solutions (via its technology platform [Galileo + Technisys]) to customers, including financial and non-financial businesses.

Despite facing several macroeconomic and political/regulatory headwinds in recent years (i.e., high inflation, rising interest rates, and the US Government essentially paralyzing SoFi's core student loan refinancing business by putting a freeze on student loan repayments during the pandemic and holding the freeze until this month), SoFi has managed to pull off a remarkable evolution from being a student loan refinancing company to an all-in-one consumer finance platform and digital bank. Given the dire situation with its core business, SoFi's evolution has been nothing short of incredible and proves the resilience of this emerging force in the banking industry.

Since Anthony Noto took over as SoFi's CEO in 2018, the company has undergone a complete cultural reset, which is now centered around rapid innovation and product-led growth. And in my view, Anthony's vision and meticulous execution from his team have led SoFi to the cusp of profitability and set forth a bright future for the company.

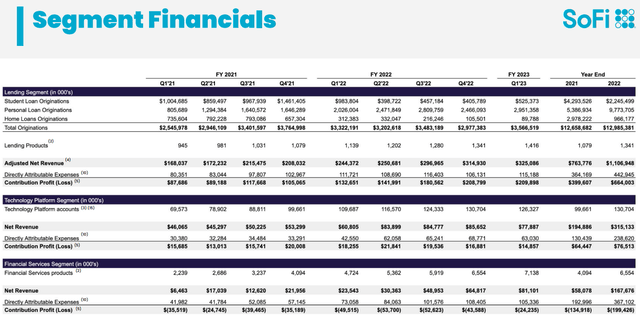

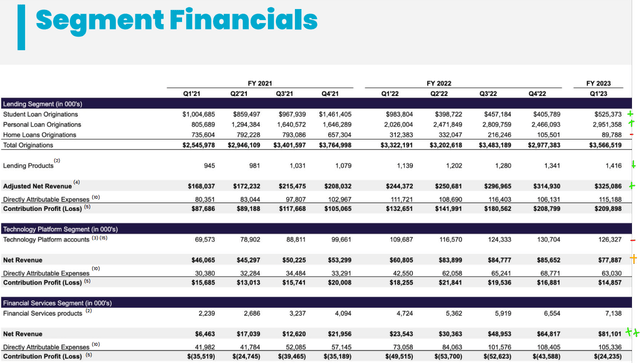

SoFi Q1 2023 Investor Presentation

Based on current revenues, SoFi is still primarily a lending business; however, SoFi's technology platform and financial services segment revenues are expected to grow faster over the coming years. Hence, I view SoFi as a well-diversified fintech company.

Now, the crux of SoFi's investment thesis is the cross-selling of financial products to a loyal member base from a singular digital substrate. At scale, SoFi should be able to generate better unit economics (and profit margins) as compared to traditional banks and other financial institutions.

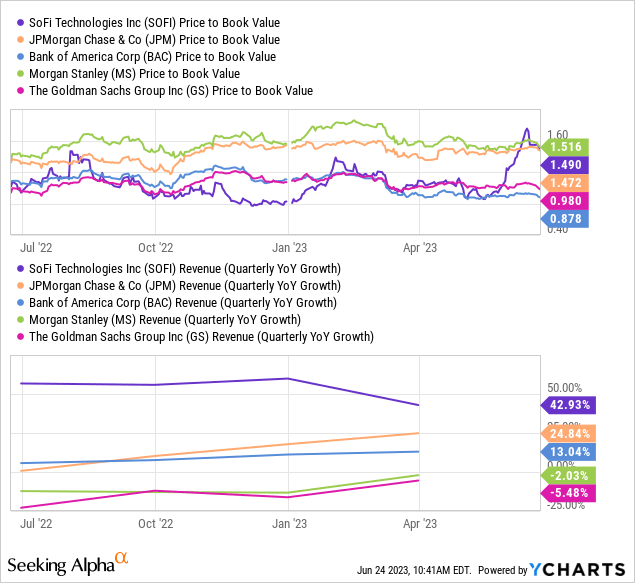

Despite showing robust revenue growth and rapidly improving margin performance, SoFi was trading like a legacy bank at a price-to-book ratio of 0.9x [with no value attached to its technology platform] back in early November 2022 when I highlighted SoFi as a "Strong Buy" in light of its Q3 2022 report due to asymmetric risk/reward on offer for long-term investors:

According to TQI's valuation model, SoFi is worth $11.40 per share (up from my previous estimate of $10.37 per share), i.e., it is still trading at a significant discount to its fair value. By 2027, SoFi's stock could be trading at $22.29 per share, which would imply a ~31% CAGR return from current levels. Since these projected returns are well above our investment hurdle rate of 20% for high-growth stocks, SoFi is a strong buy at $5.7 per share.

Source: SoFi Q3: Another Great Quarter In The Books, Buy Now For 2023 And Beyond

Since that call, SoFi's stock has rallied by more than 50%, with its valuation catching up to best-of-breed banking peers like JPMorgan (JPM) and Morgan Stanley (MS).

With SoFi stock now trading at a price-to-book ratio of ~1.50x, it is no longer undervalued on a relative basis. That said, I continue to believe that SoFi deserves a premium valuation compared to traditional banks due to a multitude of factors, including, but not limited to:

- Faster revenue growth

- Superior long-term margin profile due to far lower overhead expenses and no physical presence

- A diversified business model with multiple revenue streams (lending + financial services + technology [BaaS - Banking as a Service])

Now that we have revised our investment thesis for SoFi, let's re-run it through TQI's Quantamental Analysis process to see if it's a good buy at current levels. In the next section, we will analyze SoFi's recent business trends, quant factor grades, technical charts, and absolute valuation.

Running SoFi Through TQI's Quantamental Analysis Process

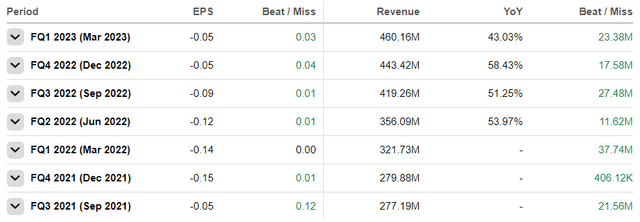

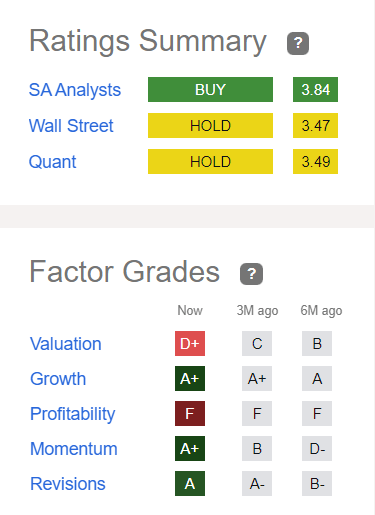

Since coming public at $10 per share via a SPAC in 2020, SoFi's stock has been on a wildly volatile ride. After rocketing up from $10 to $25 during the liquidity boom of 2020-21, SOFI crashed to roughly $4 by late-2022. And while investors have recouped some of those losses after a significant jump in the stock last month, SoFi is still trading below its SPAC price. While holding SoFi stock has been a painful experience for its shareholders (until recently), the good thing here is that the stock is not the business. Yes, SoFi's stock has underperformed the market for a large portion of its time as a public company, but SoFi's business is reaching new heights and exceeding consensus expectations quarter after quarter.

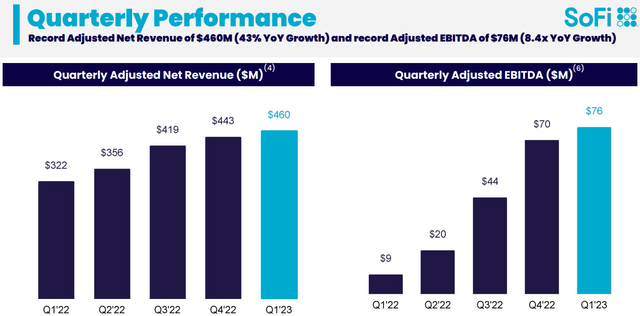

In Q1 2023, SoFi's adj. net revenue came in at a record $460M on the back of strong performance in its lending and financial services segments. With adj. EBITDA margin reaching 16% in Q1, SoFi's adj. EBITDA came in well ahead of expectations at $76M. And total contribution profit hit the $200M mark for the first time in SoFi's history!

SoFi Q1 2023 Investor Presentation

SoFi Q1 2023 Investor Presentation

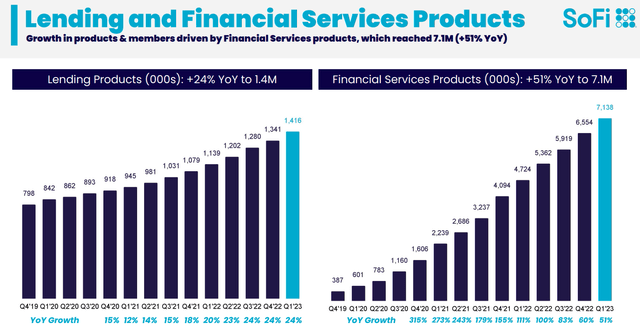

Despite a slump in Home loan originations, SoFi's lending business grew at a healthy clip in Q1 on the back of higher net interest income, robust growth in Personal loan originations, and a slight uptick in Student loan origination. As we have discussed in the past, the structural driver behind SoFi's strength is its national bank charter (received in Q1 2022), which has allowed the fintech company to turn into a digital bank that can raise deposits at low-interest rates (reducing capital costs for its lending activity). As of Q1 2023, SoFi's deposit base stood at $10B by the quarter end (up 37% or $2.7B from Q4 2022), and this rapidly-growing deposit base is providing SoFi the flexibility for holding loans on its balance sheet for a longer duration (as necessitated by a freeze-up in credit markets caused by rapid changes in interest rates). Overall, SoFi's lending business generated adj. revenue of $325M (+33% y/y), which is nearly 70% of its total adj. revenue.

SoFi Q1 2023 Investor Presentation

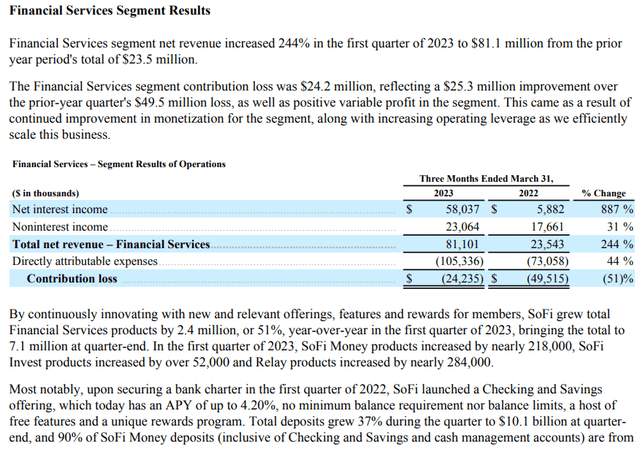

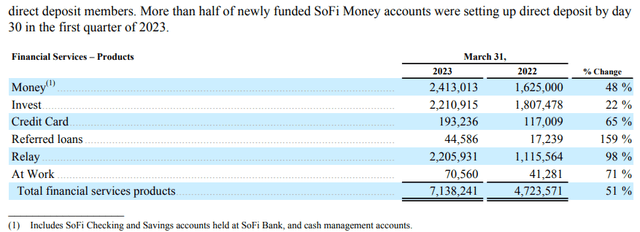

While SoFi is still primarily a lending business, the financial services segment (revenue up 244% y/y in Q1 2023) is growing much faster, and it looks on track to become SoFi's primary profit center over the long run with this business segment starting to deliver operating leverage as it scales up.

SoFi Q1 2023 Earnings Press Release SoFi Q1 2023 Earnings Press Release

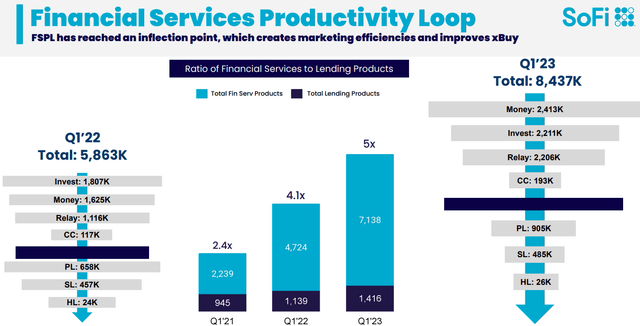

As we saw earlier, SoFi is a bet on cross-selling financial products & services from a single digital substrate to deliver best-in-class unit economics across the spectrum of consumer financial needs. With SoFi's financial services productivity loop hitting an inflection point, the company is seeing a rapid expansion in margins, and this is quite visible in Q1 2023 results and management's guidance for Q2 and 2023.

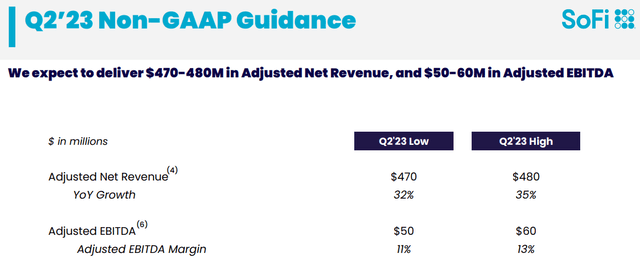

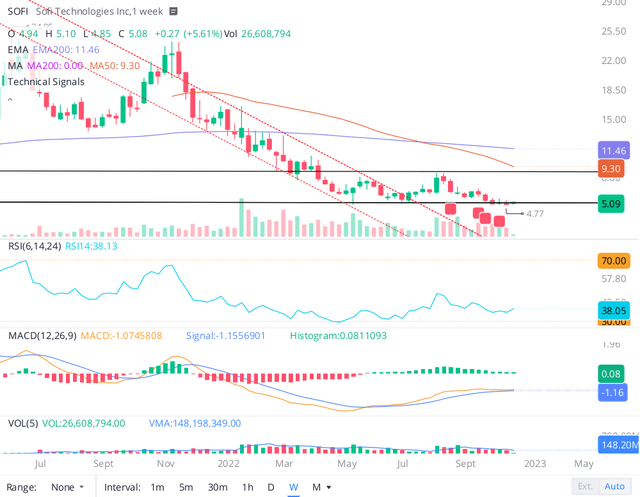

SoFi Q1 2023 Investor Presentation SoFi Q1 2023 Investor Presentation

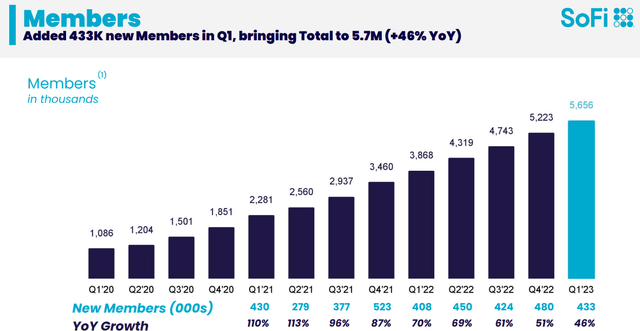

Given cross-selling financial products and services is the crux of our investment thesis, SoFi developing a loyal member base is of paramount importance. And so far, SoFi is doing an excellent job on this front. As of Q1 2023, SoFi had amassed 5.7M members (up 46% y/y, +433K q/q), and this count is likely to continue growing rapidly throughout 2023 and beyond.

SoFi Q1 2023 Investor Presentation

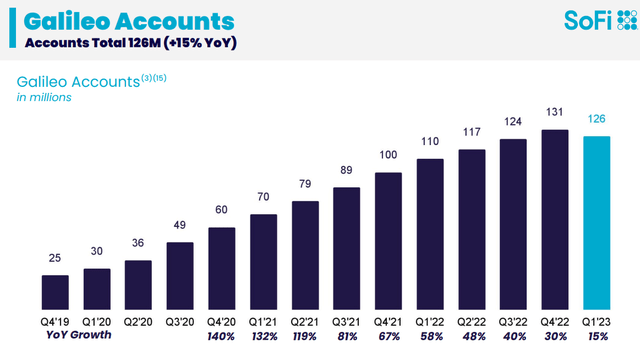

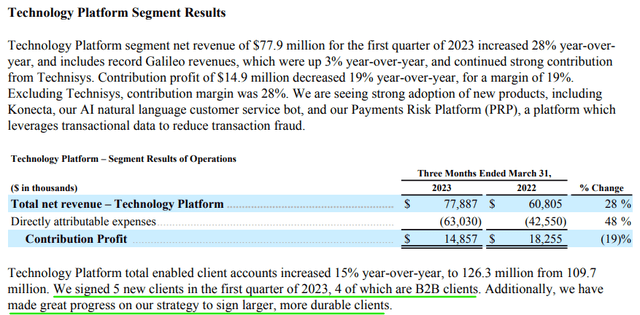

Currently, the one area of weakness in SoFi's business is its technology platform segment (Galileo + Technisys), wherein revenues rose 28% y/y in Q1, but Galileo accounts declined sequentially from 131M to 126M, and contribution profits fell 19% y/y.

SoFi Q1 2023 Investor Presentation

SoFi Q1 2023 Earnings Press Release

With its technology platform business, SoFi has set out to build the "AWS of Fintech". Now, many critics have taken issue with this comparison to AWS, but the central idea for SoFi is to build a cloud-native, BaaS infrastructure platform (akin to AWS's cloud offerings) to enable developers and businesses to implement core banking and financial services into their products with simple off-the-shelf product offerings. While this business segment is clearly not firing on all cylinders at this time, SoFi's management did provide some positive commentary here, with five new clients coming on board during Q1 and progress on SoFi's strategy to sign larger, more durable clients. The deterioration in the growth of SoFi's technology platform is concerning to an extent, but my investment thesis doesn't depend one bit on this segment, and I simply view it as a free embedded option in SoFi's stock!

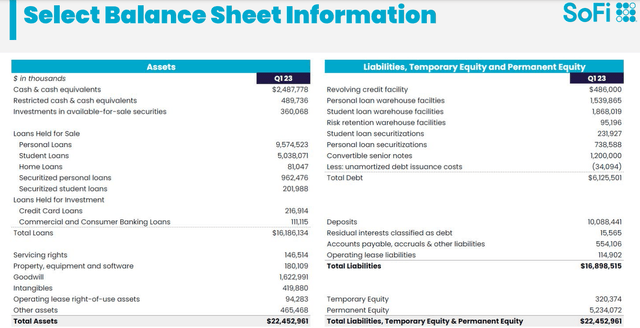

In addition to delivering robust product-led growth, SoFi has maintained a healthy balance sheet. As SoFi races towards profitability (expected to get there by Q4 2023), I see no major liquidity concerns for the business (despite the growing probability of a recession) due to SoFi's strict lending standards and a cash cushion of $2.5B.

SoFi Q1 2023 Investor Presentation

In my view, SoFi's loan book is as solid as they come. As of Q1 2023, SoFi's personal loan borrowers' weighted average income was $164,000, with a weighted average FICO score of 747. And SoFi's student loan borrowers' weighted average income was $173,000, with a weighted average FICO of 769. This focus on quality has led to strong credit performance, with on-balance sheet delinquency rates and charge-off rates remaining healthy and well below pre-pandemic levels. As I see it, SoFi's focus on serving HENWS (high-earning, not well-served) customers give it an edge over many of its fintech rivals, especially during a period of high macroeconomic uncertainty. Despite the rising likelihood of a global recession, I think SoFi can continue to deliver robust growth for many more years to come.

For FY-2023, SoFi increased its adj. revenue guidance from $1.925-2.000B to $1.955-2.020B and lifted the adj. EBITDA guide from $260-280M to $268-288M (~14% adj. EBITDA margin).

SoFi Q1 2023 Investor Presentation SoFi Q1 2023 Investor Presentation

Even in the face of a challenging macroeconomic environment, SoFi's guidance is probably too conservative, given these estimates haven't baked in the imminent end of the federal student loan moratorium. In my view, SoFi's business momentum is incredible, and financial performance in the rest of 2023 is going to get even better as the student loan moratorium is lifted and Net Interest Income from originations in late 2022 and early 2023 start hitting the income statement.

Overall, SoFi delivered record revenues of $460M (non-GAAP) (up 43% y/y) with a contribution profit of ~$200M in Q1 2023. While SoFi remains unprofitable on a net income basis, it is delivering rapid growth at scale and marching toward profitability. Fundamentally, SoFi is looking stronger than ever as a business. Now, we shall analyze SoFi's quant factor grades and technical chart to complete our QA process.

SoFi's Quant Factor Grades And Technical Charts

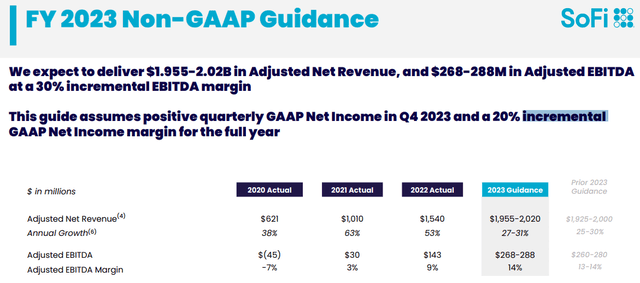

According to SA's quant rating system, SoFi still has a "Hold" rating with a score of 3.49/5 (up from 2.89/5 at our last update in November 2022). Over the last six months, SoFi's (sales) 'Growth' (A to A+), (technical) 'Momentum' (D- to A+), and (earnings) 'Revisions' (B- to A) grades have shown significant improvement on the back of robust business and stock performance.

SoFi Quant Rating (SeekingAlpha)

Since SoFi is still not profitable on a GAAP basis, I understand the "F" grade for 'Profitability'. However, SoFi is projected to turn GAAP profitable by Q4 2023, and with that in mind, I expect SoFi's 'Profitability' factor grade to improve gradually in upcoming quarters.

As we saw earlier in this article, SoFi is no longer undervalued on a relative basis. And this reality is being fairly represented in SoFi's 'Valuation' factor grade, which has deteriorated (from B to D+) after a stunning rally in its shares this year. Now, we will look at our valuation model for SoFi in just a bit; however, I want you to know that SoFi is still undervalued on an absolute valuation basis. Overall, SoFi's quant factor grades are neutral.

Before we make an investment decision, let's also analyze SoFi's technicals.

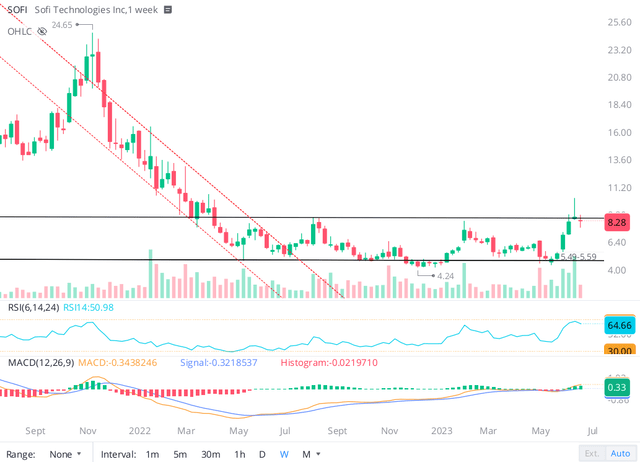

Here's what I said about SoFi's chart back in November 2022:

As you can see below, SoFi's stock chart is a disaster. After going public through a SPAC in late 2020, SoFi stock surged from $10 to $25, and has since crashed to $5 per share. While SoFi's technical chart history is not deep enough to suggest any floor on the stock, we can see a base formation in SoFi in the $5-9 range over the last few months.

SoFi's stock chart (1st November 2022) (WeBull Desktop)

Now, a breakdown of this base could send the stock plunging down to the $3.5-4 level, I think that buying in at the bottom end of this base formation is a fine idea for long-term investors.

In recent months, SoFi stock has been bouncing between the top and bottom end of its Stage-I base ($5-9), as you can see on the chart below:

After threatening an upside breakout in recent weeks, SoFi's stock has reversed back into the Stage-I base with a sharp pullback of ~20% from its recent highs of $10.23 per share, forming a topping tail in the process. With MACD rolling over and RSI just getting under the 'Overbought' territory on the daily chart, SoFi's stock chart appears to be losing momentum.

However, we could very well be experiencing a healthy technical correction before the next leg higher. And I say so because SoFi's business performance is going to get even better in the back half of 2023.

With the federal student loan moratorium coming to an end imminently as part of the US debt ceiling deal struck in early June, SoFi looks all set to benefit from a wave of student loan refinancing activity in the next couple of quarters. While the impending recovery in its core student loan refinancing business is a significant positive catalyst for SoFi, I see another equally important catalyst staying in play longer than expected. The FED's aggressive rate hiking campaign has seen deposits flow out of traditional financial institutions, and SoFi has been a big beneficiary of this dynamic due to its higher interest rates on Checking and Savings accounts.

A rapid expansion of its deposit base has enabled SoFi to grow its lending business at a brisk pace through the ongoing credit market freeze, and with the FED guiding for two more rate hikes this year, the outflux of deposits from traditional financial institutions can continue to benefit SoFi in the coming weeks and months.

Looking a little bit further into the future, I think the ongoing rate hike cycle is in its last innings, and interest rates should stabilize soon before heading back lower in 2024-25. If this happens, credit markets are more than likely to unfreeze in the next 6-24 months, which would allow SoFi to unlock greater new lending capacity through the sale of loans from its balance sheet.

Hence, I think SoFi can maintain robust growth in 2023, 2024, and beyond. With the business consistently exceeding management projections and consensus Wall Street expectations, SoFi's stock should eventually catch up to its fair value. Now, let's see where that fair value is right now.

SoFi's Fair Value And Expected Return

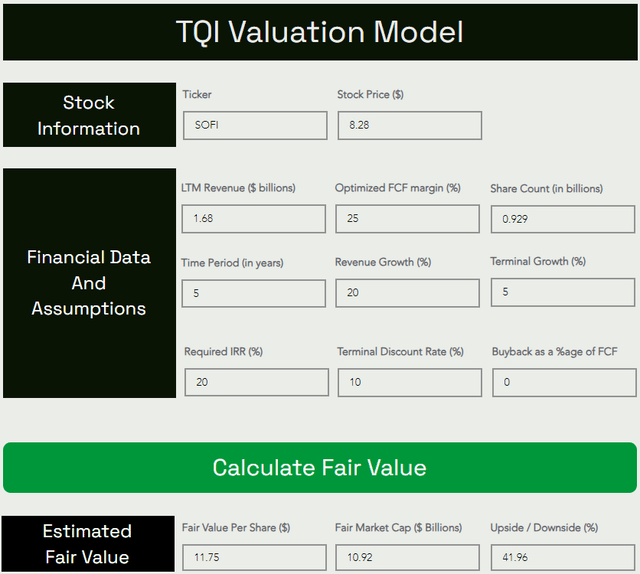

To determine the fair value and expected return of SoFi, we will use TQI's Valuation model with the following assumptions:

TQI Valuation Model (TQIG.org)

According to TQI's valuation model, SoFi is now worth $11.75 per share (up from my previous estimate of $11.40 per share). With SOFI trading at ~$8 per share, I see another 42% upside to fair value from current levels. Hence, investors buying here are getting a great discount.

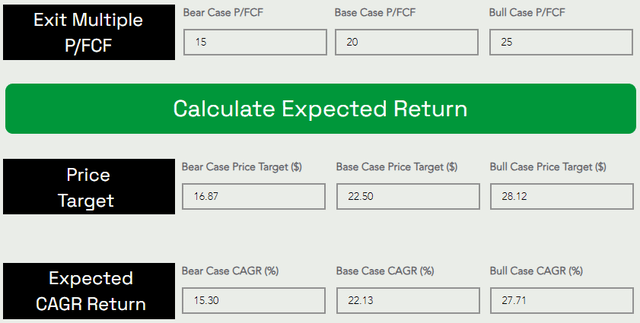

Now, let's consider the long-term reward potential by looking at a range of expected outcomes for SOFI assuming an exit multiple of 15-25x P/FCF:

TQI Valuation Model (TQIG.org)

In the base case scenario, SoFi's stock could be trading at $22.50 per share five years from now, which would imply a ~22.1% CAGR return from current levels. Since these projected returns are well above long-term equity market returns of ~10-12% and higher than our investment hurdle rate of 20% for high-growth stocks, SoFi remains an attractive buy at $8.28 per share.

Concluding Thoughts

Despite an 80% YTD rally in its stock, SoFi still qualifies as a "Buy" under our Quantamental Analysis process, which is a mix of fundamental, quantitative, technical, and valuation analysis. As of writing, SoFi's business fundamentals are robust, quant factor grades are improving, (medium-term) technical momentum looks strong, and the stock is still undervalued. Hence, I continue to remain bullish on SoFi stock at $8.28 per share.

Now, the risk/reward here is far less attractive than it was back in November 2022, with the expected 5-yr CAGR return for SOFI declining from 31% to 22% (primarily due to a run-up in its stock price). Hence, I am assigning a "Buy" rating here today [downgrade from "Strong Buy"].

Leading economic indicators and a deeply inverted yield curve have been flashing recessionary signals for months now. With the FED withdrawing financial market liquidity through Quantitative Tightening ($95B per month) and still looking to raise interest rates two more times this year, the likelihood of a recession is rising. The FED's aggressive rate hiking campaign has caused turbulence in the banking sector due to treasury bond portfolios turning upside down; however, the real credit default problems haven't even started yet. In 2023, bank stocks have come under tremendous pressure, and honestly, I see things getting worse before getting any better. In my view, SoFi is a unique opportunity in banking, and it is the only bank to bank on right now.

Key Takeaway: I rate SoFi a "Buy" at $8.28, with a preference for staggered accumulation using a 6-12 month DCA plan.

As always, thank you for reading, and happy investing. Please feel free to share any questions, concerns, or thoughts in the comments section below.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service - "The Quantamental Investor" - to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI's annual membership now costs only $480 (or $50 per month).

JOIN THE QUANTAMENTAL INVESTOR TODAY

This article was written by

I am the Author and Chief Financial Engineer at "The Quantamental Investor" - a community pursuing bold, active investing with proactive risk management. At TQI, our mission is to help retail investors build generational wealth in equity markets. To do so, we share robust model portfolios that cater to investor needs across different stages of the investor lifecycle. All of our investment ideas are thoroughly vetted through TQI's Quantamental Analysis process, which uses a mix of fundamental, quantitative, technical, and valuation analysis. If you're interested in learning more about our marketplace service, visit: The Quantamental Investor

If you're interested in reviewing my performance, feel free to view this tracker: Performance tracker for my SA research.

To learn more about our company and services, visit: The Quantamental Investment Group LLC's website - TQIG | Home

Prior to joining The Quantamental Investment Group LLC, I served as the Head of Equity Research at LASI's SA Marketplace service - Beating The Market, for two years. In the past, I have worked as an Associate Fellow with Jacmel Growth Partners, a middle-market private equity firm in New York. My resume also includes a stint at Capgemini as a software engineer. With regards to academia, I hold a Master of Quantitative Finance degree from Rutgers Business School and a Bachelor of Technology degree in Electronics and Communication Engineering, whilst I am also pursuing the CFA certification (Level 2 candidate).

If you would like to connect with me, please feel free to send me a direct message on SA or leave a comment on one of my articles!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Per recent WSJ article GS under current President has not gotten their consumer focus right.. Marcus is a financial disaster and changes in personnel and strategy at GS may change in the year ahead. SOFI turns profitable in the next 12 months and is well on its way to having 7+.million customers going into 2025. What do you think of the thesis that Goldman Sachs would buy SOFI for $30 per share, in GS stock, before end of 2024??