Snowflake: Accelerating Our Reality Upload Despite Macro Headwinds

Summary

- In 2020, I penned a note entitled, "Nvidia: Accelerating Our Reality Upload."

- As mankind further develops the ability to replicate our current reality, I believe the demand for unique configurations of compute and storage, and the underlying requisite hardware, will grow.

- To this end, businesses that facilitate the unique manipulation of compute and storage have been attractive to me.

- I believe Snowflake fits in this category, as well as, for instance, AWS or AMD or Nvidia, and, today, we will review the business of Snowflake; specifically its most recent quarter and context thereof.

- In short, while Snowflake is not exactly an exceptionally attractive value proposition quantitatively, I do believe it remains worth considering whereby we capitalize on the growing demand for compute/storage required to build virtual realities and AI. Should it decline further, alongside its gargantuan cash hoard of $5B+ alongside no debt, I believe it would become exceptionally attractive.

- Looking for a portfolio of ideas like this one? Members of Beating the Market get exclusive access to our subscriber-only portfolios. Learn More »

Sundry Photography Snowflake's Q1 2023 Investor Presentation

- Note: For the purposes of serving you/for your convenience, we will use Calendar Year and not Fiscal Year. I believe this simplifies understanding the business' performance, though it should be noted that Snowflake's FY ends on January 31st of each year.

Below, you will read a few quotes that illustrate the central thrust of this note: macroeconomic conditions continue to constrain demand for our businesses' products

- Of course, this non-linearity of growth is what gives us our "Fat Pitch" swings, such as those that we believe we're getting in a variety of names presently by virtue of persisting pessimism outside of a few supermajor tech companies and more "mid-major" tech companies.

We are, however, operating in an unsettled demand environment and we see this reflected in consumption patterns across the board. While enthusiasm for Snowflake is high, enterprises are preoccupied with cost in response to their own uncertainties. We proactively work with customers to optimize their environments. This may well continue near term, but cycles like this eventually run their course. Our conviction in the long-term opportunity remains unchanged.

Frank Slootman, CEO, Snowflake Q1 2023 Earnings Call

Brent Bracelin: Good afternoon. Frank, maybe for you. I totally get the current cost concerns and optimization efforts underway. I'd be more curious to hear what you think could get us out of the current slowdown? Are there products or workloads that you would flag as the key ones to watch that drives the reacceleration of the business? Just thinking through what's in your control? Or do you think we have to wait to further macro to improve? Thanks. Frank Slootman: I guess, the number one issue is sentiment out there, just the lack of visibility, the anxiety. Watching CNBC all day doesn't give you any hope. That's absolutely number one. And -- because what we're seeing is that when we're dealing with CTOs and the Chief Data Officers, these people are chomping at the bit, but they are now literally getting stomped.

As I said earlier, by the CFO being in the business and saying, well, I guess that's all good and well. But here's how much you're going to spend. You know you're going to get a new contract. You're going to live within the confines of the contract that you have. So really artificially constraining the demand because of the general anxiety that exists in the economy. So that really needs to start lifting. And that will happen. These things run their course. We've been through these episodes before. So I think that's really the requirement.

What We Hoped For

Heading into the recent Snowflake earnings print, I shared that I was hoping the stock would sell off whereby we could continue to more comfortably accumulate shares.

Candidly, I am hoping it sells off like Sea (SE) so that we can more comfortably accumulate.

Beating The Market Main Chat

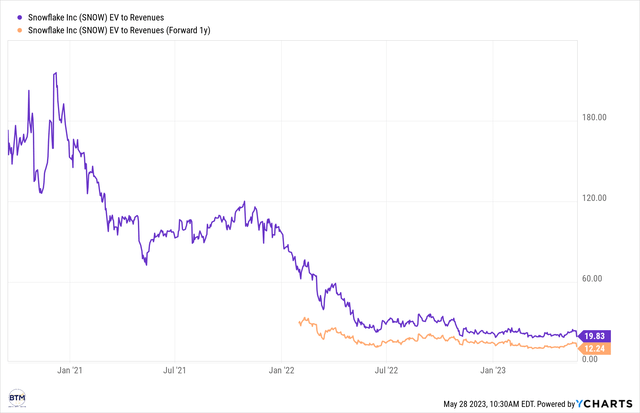

And we received our requested selloff, with Snowflake declining nearly 20% following the print. Snowflake, as well as Sea Ltd. (SE), as an aside, now trade at virtually their cheapest valuations in their corporate histories, while simultaneously operating from their great positions of business strength.

Snowflake's EV/Revenues TTM and Fwd. 12 Mo.

Forgive me. Snowflake, at $150/share, was almost definitively the cheapest it's ever been as a corporate entity, while simultaneously operating from its greatest position of strength.

[I've studied on the execution issues Snowflake faced in 2016-2019, which precipitated hiring Mr. Frank Slootman, and I've studied the valuation during its private rounds at that time. I am 99% sure Snowflake recently reached its most depressed valuation in its corporate history.]

We explored this interesting paradox via our TGI framework last year:

- The Greatest Irony 11 (NYSE:SNOW)

- This note was exclusively for Beating The Market, as I cannot share this more non-linear format under certain guidelines.

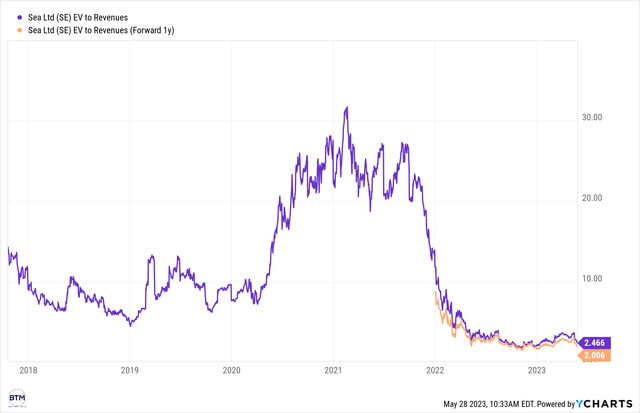

Similarly, and as a brief aside, Sea, as well, trades at virtually its cheapest valuation ever, while simultaneously operating from its greatest position of strength.

Sea's EV/Revenues TTM & Fwd. 12 Mo.

We explored this riveting paradox via our TGI framework last year:

- Learn More Here: The Greatest Irony 10 (SE)

Both businesses, Snowflake and Sea, now generate robust free cash flow, and both businesses, in my eyes, have multi-decade runways for very robust growth.

Lastly, I very much hope that Sea stops frivolously spending money on ecom in foreign regions (it mostly has) and begins spending money on building compute and storage for SE Asia. We will need a lot more of it, which is really the central thrust of this note to you today!

Taking us back to our brief introductory consideration of Snowflake...

To answer concisely why Snowflake sold off, and why a handful of our favorite companies continue to struggle, I believe listening to the Snowflake call would be of value to you. For your convenience, we will succinctly review the most germane ideas from the Snowflake call, and, at the end of this note, I will share a link through which you may listen to the Snowflake call.

In short, Snowflake's entire earnings call was an "ode to non-linearity begotten by exogenous factors."

Virtually every exchange consisted of, "Why aren't you doing better? Why aren't you growing faster?"

In essence, "Why isn't the business doing better, and, as a result, why isn't the stock doing better?"

In response to which, management replied with ideas such as,

It is challenging to identify a single cause of the consumption slowdown between Easter and today. A few of our largest customers have scrutinized Snowflake costs, as they face headwinds in their own businesses. For example, some organizations have re-evaluated their data retention policies to delete stale and less valuable data. This lowers their storage bill and reduces compute cost. We've worked with a few large customers more recently on these efforts and expect these trends to continue. History has shown that price performance benefits long-term consumption.

At another point in the call, Mr. Slootman remarked,

"One of the things that we've seen happen over the last couple of quarters is that the CFO is in the business. And this is sort of an expression that we use in enterprise that they're selling is that there is a level of oversight scrutiny that's normally not there. And this is not a frequent occurrence. You only see this happening in fairly severe episodes.

In the beginning it's like, "Hey, we do smaller contracts, short-term contracts," but then it's like, "Hey, you're going to live within your means. Here's the amount of money you're going to spend and you're going to make it work. And you can figure out where you're going to cut to fit into our box." So that's really dynamics that we've seen playing out there."

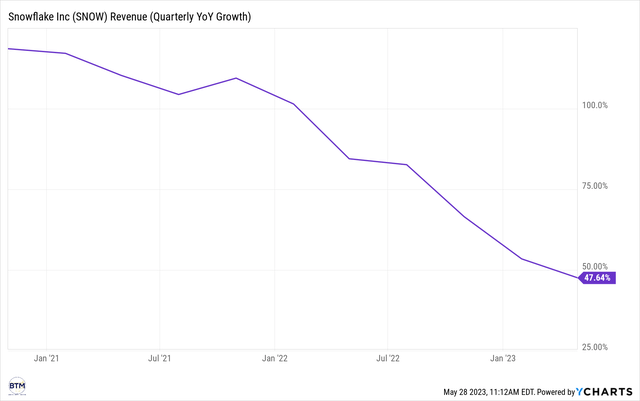

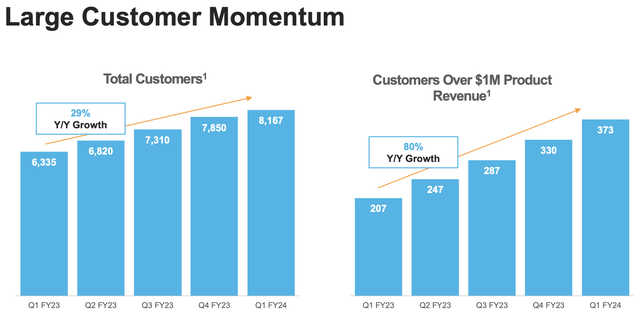

And we can see this non-linearity in both Snowflake's results and Snowflake's guidance:

Snowflake's Net Retention Rate

Snowflake's Q1 2023 Investor Presentation

- Note: NRR is arguably the most important metric in business. From Coupang (CPNG) to Snowflake to Amazon (AMZN), NRR is king in many senses.

While Snowflake's NRR remains "otherworldly," rivaled by few others companies, such as SentinelOne (S), within the entire public SaaS universe, it has been declining linearly on the heels of the fastest repricing of credit in U.S. history.

It should be noted that we just went through the fastest repricing of credit in the history of America. This is a factor that Snowflake, nor I, can control.

Snowflake's Sequential And Year Over Year Growth Continues To Slow

Snowflake's Q1 2023 Investor Presentation

Snowflake's Sequential And Year Over Year Growth Continues To Slow

And Snowflake's guidance indicates that growth will continue to materially slow:

Snowflake Guides For About 35% 2023 Growth (Accounting For Conservatism Baked Into The Guide)

Snowflake's Q1 2023 Investor Presentation

Of course, this doesn't scare us; in fact, it only energizes us to continue accumulating this world class enterprise at its cheapest valuation ever.

"Businesses do not meet expectations quarter after quarter & year after year. It just isn’t in the nature of running businesses. And, in our view, people that predict precisely what the future will be are either kidding investors, kidding themselves, or both."

-Mr. Warren Buffett

To close this section:

- Snowflake is currently experiencing a decline in its sales growth rate.

- This is creating a declining valuation.

- This creates an attractive entry point.

- It is likely that Snowflake reaccelerates sales growth rate in the decade head.

- We'd hoped for the company to sell off, and it did.

- We will continue to buy it as it declines as we have over the last 6-12 months or so.

Usage That Exceeds Revenue Generation

I found the following commentary insightful as it pertains to a couple of our other businesses within my coverage universe; namely, Marqeta (MQ) and Twilio (TWLO), both of which trade at "virtually great depression valuations," especially when we use long run free cash flow margins (I believe in no sense that this is an exaggeration).

The below quotes are from the Snowflake earnings call:

"And we do think that was driven a lot by some of these customers, that's when it happens, some of these big optimizations on storage retention policies. But in a consumption model, customers have the ability to dial it back and they can increase it as well too when they get more confidence in their business. And I can only guide based upon the data we have available to us."

As I remarked recently, "Twilio will get back up eventually. I do appreciate this period of exceptional scrutiny on the business. It is important."

Later on the call Mr. Scarpelli shared,

"So, in terms of what customers are doing actually the number of jobs -- the number of queries actually grew 57% year-over-year in the quarter, it's outpacing our revenue. The queries are just running more efficiently. And that is because of some of the optimizations, both -- if you reduce the amount of storage running queries on, they run faster. It's also the impact you're getting right now of the full Graviton 2 this year versus the quarter from last year. So the number of jobs is actually out -- growth is actually outpacing revenue and just we're becoming so much more efficient for our customers."

As we know, this is identical to Marqeta's experience, in which Marqeta has grown TPV rapidly (effectively usage of the platform); however, growth has slowed immensely, as has been the case for Snowflake.

That said, Snowflake is slightly more mature than Marqeta as of today; hence, it appears to be this shining castle on a hill that can do no wrong, and, to be sure, Marqeta has dealt with execution problems that pre-Mr. Slootman Snowflake as well struggled with.

Indeed, Snowflake was not always the impervious enterprise that investors think it is today. Snowflake, like Chipotle (CMG), like NVIDIA (NVDA) (it declined 93% in the early 2000s), experienced its katabasis along its journey (and Snowflake will likely experience more katabases in the future).

With these ideas in mind, I recently remarked,

Snowflake is a great template for Marqeta, as an aside.

Mr. Slootman had to step in to get the culture on the right track. The original founders did not have the desire/talent/destiny required to do this. We're witnessing the same for Marqeta presently.

At this juncture, we need Mr. Khalaf to drive discipline and efficiency within Marqeta, and I think we will be off to the races in the years ahead. We can see evidence that his leadership is succeeding by way of the bookings in Q1 which were larger than all bookings in the second half of 2022.

Further, both Snowflake and Marqeta are usage-based, and both are experiencing fairly dramatic revenue & gross profit headwinds presently, while also growing usage of their respective platforms.

It's a great gift to be able to study all of these businesses concurrently!

- Beating The Market chats

For those that want forensic evidence of what I shared above, I would invite you to review Snowflake's Glassdoor in the late 2010s and study the commentary:

Concluding Thoughts: Opportunity Abounds

The note is fairly long already; as such, I will make this portion brief.

As of today, we've gone from The Everything Bubble to "Mr. Market will force feed you 5x to 10x baggers that produce robust free cash flow atop incredible cultures, and you will like it."

From Snowflake to Tesla (TSLA), in 2021, we struggled to make sense of these companies from a valuation perspective, as Mr. Market positively adored them and traded their shares commensurately.

Today, as they operate from their greatest positions of strength, especially over the last 6-12 months, they now sit at approximately their cheapest valuations in their corporate histories.

Of course, using the TGI framework, we've called this "The Greatest Opportunity."

To these ends, within the Beating The Market community, I shared recently,

With all due respect to Mr. Market, I believe he is giving us a 97 mph fastball (5x to 10x next 10 years) in Sea (SE) and many others.

I'm actually excited for the malaises in many of our companies... Massive cash hoards for each business. Robust unit economics. Great cultures.

"Fat pitches," so to speak.

Again, with all due respect, Mr. Market truly adored these businesses for years... The VCs loved them. The public markets loved them. Today, they are operating from their greatest positions of strength in their corporate histories.

ZM, as another example, could be argued to be operating from its greatest position of strength as well... The consumer facing biz has taken a beating, but ZM can get back on track, and its enterprise business remains very heartening to the long term thesis.

What will ZM do with the $5.6B in cash and no long term debt? That's a lot of cash! $22B in market cap is good (as a currency for possible acquisitions). ZM could evolve in such a way that it could bolt on "growth accretive" businesses via its cash hoard... Eric isn't dead! He's alive!

Opportunity abounds!

As always, thank you for allowing Beating The Market to serve you in building your business of owning businesses!

This article was written by

https://www.tipranks.com/experts/bloggers/louis-stevens

Some credentials of mine: U.S. Army Officer in Reserve, Political Science Florida Atlantic, MBA University of Florida, inventor of the L.A. Stevens Valuation Model.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW, SE, MQ, TWLO, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.