Key Market Price Ratios Still Suggest Risk-On Bias Persists

Summary

- The US stock market has pulled back after briefly hitting a 14-month high on June 16.

- Looking at the stock market’s momentum bias via a pair of ETFs suggests that the bulls are still driving the trend.

- Looking at risk from a global asset allocation perspective also suggests that market sentiment remains bullish.

- Skeptics can rightfully point out that a number of threats could surprise markets with bearish news.

champpixs

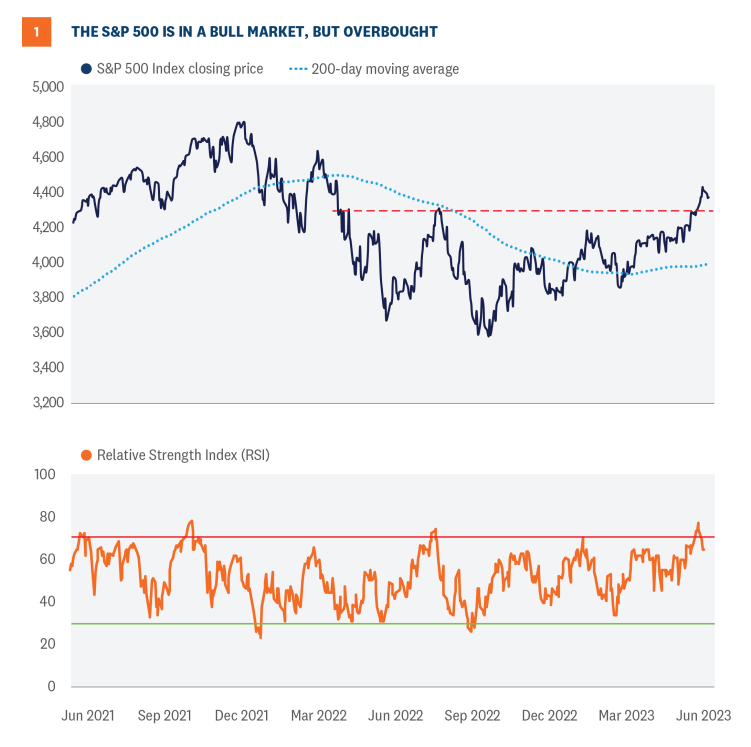

The US stock market has pulled back after briefly hitting a 14-month high on June 16, but there’s still a case for expecting the recent revival in risk-on sentiment to roll on and push markets higher in the near term.

“We know it’s old news at this point, but on June 8, 2023, the S&P 500 entered a new bull market,” write analysts at LPL Research. “After such a strong rally off the October lows, this young bull probably needs a breather.”

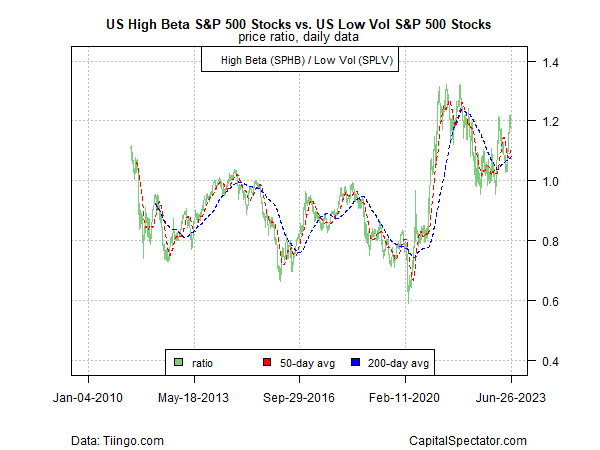

Looking at the stock market’s momentum bias via a pair of ETFs suggests that the bulls are still driving the trend. So-called high beta (i.e., high-risk) stocks (SPHB) vs. low-volatility (low risk) shares (SPLV) continue to point to more upside ahead.

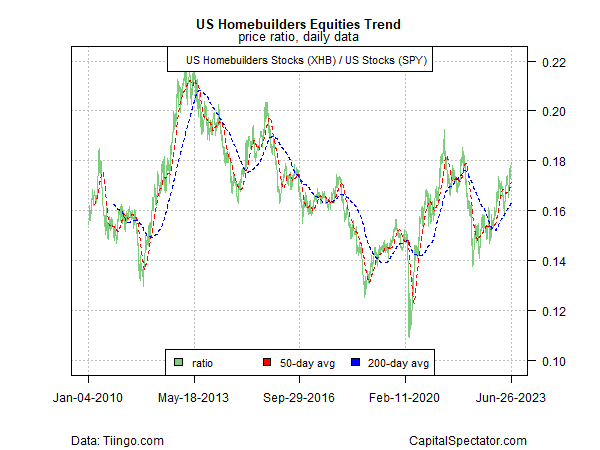

Digging into the market’s internals by way of industry trends highlights a number of strong technical profiles that are helping drive equities higher. Homebuilders (XHB), for example, continue to post strong performance vs. the overall market (SPY).

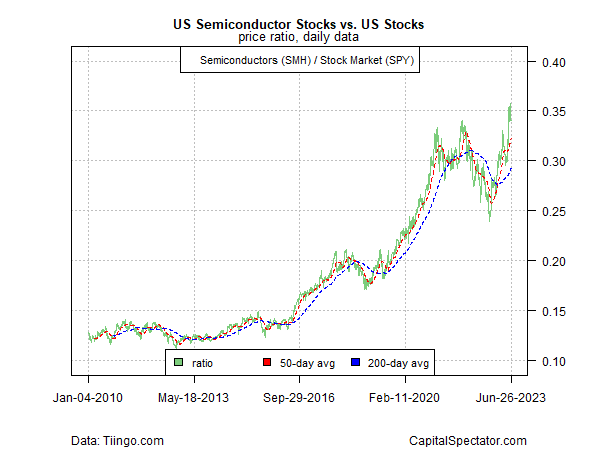

Semiconductor shares (SMH), which are considered a proxy for risk appetite, are also showing strength relative to equities generally (SPY).

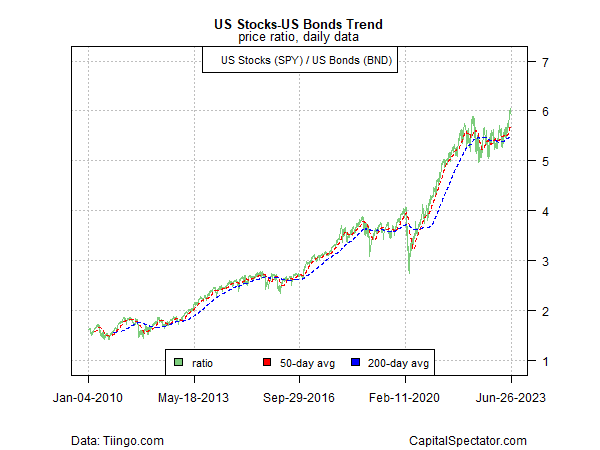

The price bias for stocks (SPY) vs. bonds (BND) is also firmly positioned in favor of risk-on lately.

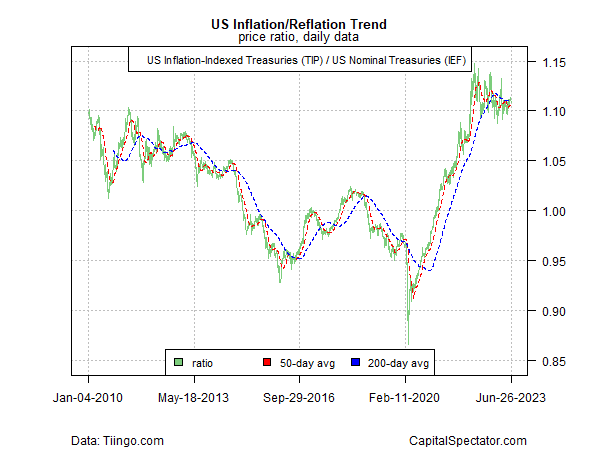

Part of the reason for the improvement in market sentiment is related to the growing conviction that inflation has peaked, which is reflected in the weaker price trend lately for inflation-indexed Treasuries (TIP) vs. conventional Treasuries (IEF).

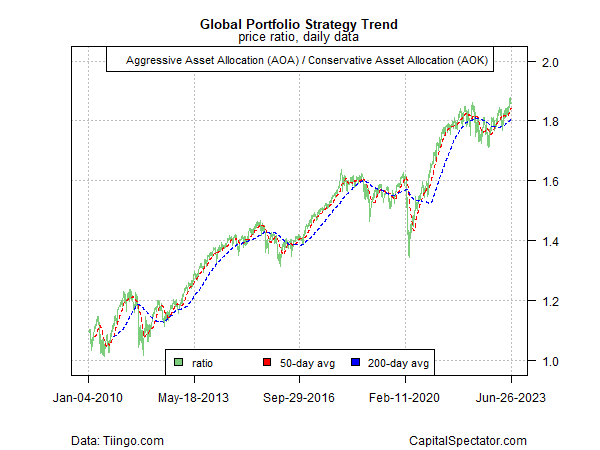

Looking at risk from a global asset allocation perspective also suggests that market sentiment remains bullish. The ratio of aggressive asset allocation (AOA) vs. conservative (AOK) remains in an uptrend and recently rose above its previous peak.

Skeptics can rightfully point out that a number of threats could surprise markets with bearish news. If inflation stays higher for longer than expected, for example, central banks may decide to keep interest rates elevated for an extended period, perhaps pushing rates higher in the months ahead.

“We also have to recognize that central banks have done quite a bit … But that said, we do think they should continue tightening, and importantly they should stay at a high level for a while,” says Gita Gopinath, first deputy managing director of the International Monetary Fund. “Now this is unlike, for instance, what several markets expect, which is that things are going to come down very quickly in terms of rates. I think they have to be on hold for much longer.”

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by