Blue Owl Capital: A Fast Growing 5% Dividend Yield And $114 Billion In Permanent Capital

Summary

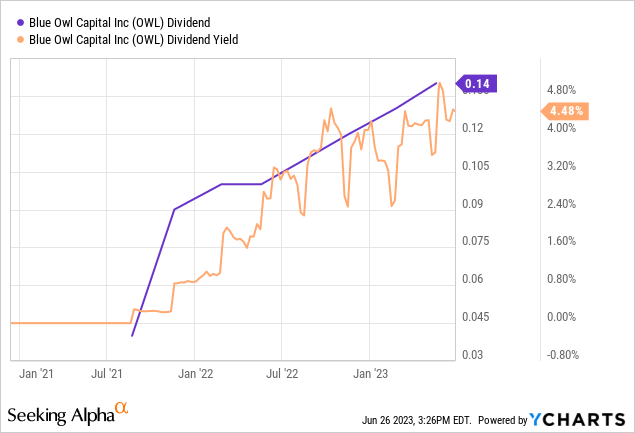

- Blue Owl Capital recently declared a quarterly cash dividend with a 7.7% increase and a 5% forward yield, driven by its rapid growth in assets under management.

- The company's focus on permanent capital in AUM reduces volatility and allows for steady growth, with 79.15% of total AUM being permanent capital as of the end of the first quarter.

- Bears have flagged a conflict between co-founders as a reason for caution even as the outlook for AUM growth is set to brighten.

peeterv/E+ via Getty Images

Blue Owl Capital (NYSE:OWL) last declared a quarterly cash dividend of $0.14 per share, a 7.7% increase from its prior quarter and for a 5% forward yield. The New York-based alternative asset manager only went public in the spring of 2021 when two previously independent entities; Owl Rock Capital and Dyal Capital, combined with a blank check company. The combined entity started trading with $52.5 billion in assets under management and has since grown this to $144.4 billion as of the end of its last reported fiscal 2023 first quarter. This rapid growth of AUM has front run a quarterly dividend payout that has been raised five times from a maiden dividend payout of just $0.04 per share.

The dividend isn't the sole prize here as the sustained growth of AUM drives the value of Blue Owl higher and heightens the possibilities of earning alpha on the back of total returns. However, the common shares of the FRE-centric, fee-related earnings, asset manager have stalled since it went public and is actually down around 1% over the last year. I'm considering a position here on the back of strong revenue growth, continued AUM expansion, and the prospects for future dividend growth without the volatility inherent in other asset managers.

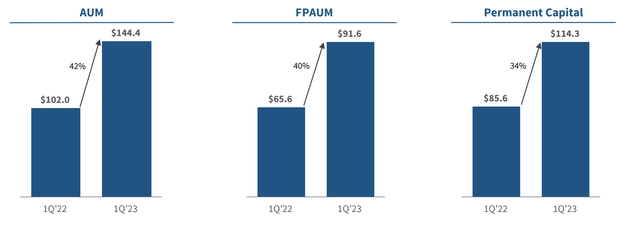

AUM Growth Drives Dramatic FRE Surge

Blue Owl is somewhat differentiated from other alternative asset managers by the concentration of permanent capital in AUM. This reduces the volatility of AUM and helps form an ever-growing base that the company charges management fees on. This is not an operational model that depends on the traditional 20% carried interest charged to returns over minimum hurdle rates. Permanent capital formed $114.3 billion of AUM as of the end of Blue Owl's first quarter, around 79.15% of its total AUM, and has allowed for steady AUM growth against several disruptive macroeconomic backdrops since it went public.

Blue Owl Capital Fiscal 2023 First Quarter Presentation

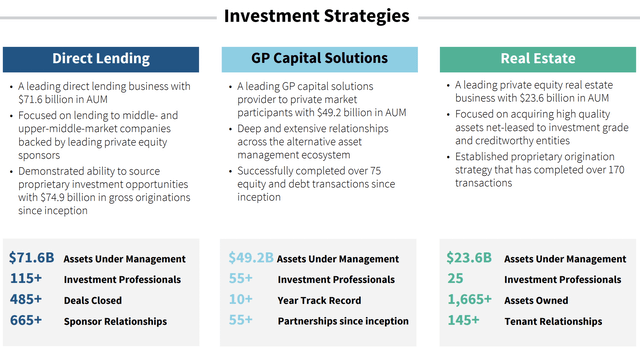

Blue Owl operates across three investment strategies; Direct Lending, GP Capital Solutions, and Real Estate. These all raise permanent funds from both institutional investors and private wealth clients. Direct Lending is the largest with 49.6% of AUM, then GP Capital Solutions at around 34.1%, and Real Estate at 16.4%. Revenue of $391 million during the first quarter was up 41.7% year-over-year and beat by $5.92 million on consensus estimates. Crucially, FRE of $225.9 million, around $0.16 per share, formed 58% of total revenue. This meant growth of $0.04 cents from around FRE per share of $0.12, around $171.4 million, in the year-ago comp.

This growth was set against a quarter that saw interest rates hiked close to their highest level since 2008 at 4.75% to 5%, the March banking panic, and angst around the US debt ceiling. Blue Owl has built its AUM around what its management has described as sticky and durable capital set against recurring management fees. This means a business model where the outlook for AUM drives most of the analysis for whether or not to start a position in the commons.

Blue Owl Capital Fiscal 2023 First Quarter Presentation

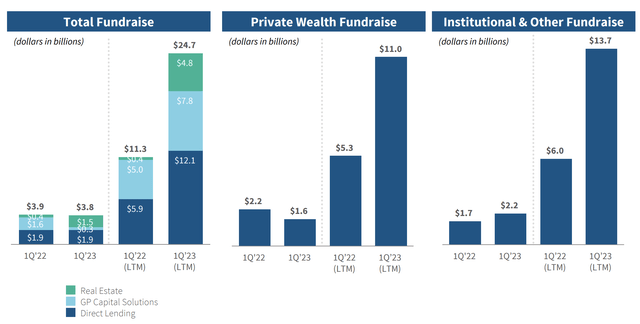

FPAUM grew by 40% over its year-ago comp to $91.6 million with permanent capital seeing a 34% uplift year-over-year to $114.3 million. This came as the asset manager fundraised $3.8 billion during the quarter driven by $1.9 billion in Direct Lending, $1.5 billion in Real Estate, and $300 million in GP Capital Solutions.

Outlook Should Brighten Further As Macroeconomic Turbulence Subsides

Critically, that Blue Owl only saw a $100 million reduction over its year-ago fundraising comp likely reflects a level of latent AUM growth building up for release on the back of a normalization of the current disruptive macroeconomic backdrop. This will be partially built on the current banking uncertainty getting a conclusive end following a positive second-quarter earnings season across currently shaky banks followed by another pause to the Fed funds rate at its current 5% to 5.25% during the July 26 FOMC meeting.

Blue Owl Capital Fiscal 2023 First Quarter Presentation

Comparative quarter-on-quarter growth for total fundraise over the last 12 months was 119% and the company expects this to move up over its second quarter. Distributable earnings of $209 million for the quarter was an increase of 34% over its year-ago comp to drive the 7.7% growth in dividends. I'm excited to see the direction of fundraising through 2023 with an incredibly turbulent yet positive first quarter set to be replaced by stronger year-over-year comps.

Bears, who form the 6.18% short interest, would be right to flag the potential risks lingering from the dispute between Blue Owl's co-founders. The internal leadership fight likely stemmed from a culture clash between Doug Ostrover and Marc Lipschultz, the founders of Owl Rock, with Dyal Capital's Michael Rees. Axios reports that both factions are at loggerheads and litigation is a possibility with Rees refusing to step down and the spinout of Dyal being a possibility. This conflict has already spilled out to the open with the asset manager moving to rebrand its managed BDC Owl Rock Capital Corp (ORCC) to Blue Owl Capital Corp. Despite it not being clear what impact this type of open conflict will have on fundraising, the market is likely to be somewhat muted on common shares until a resolution that does not result in a degradation of Blue Owl's operational footprint. A spinout of Dyal would be the worst-case scenario and a possibility that has caused me to rate OWL as a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)