Marine Money 2023: Latest Updates In Shipping

Summary

- Marine Money Week is the top shipping conference in the United States. The events were held this year in NYC from June 20-22.

- Our team attended the conference and we met with over 20 shipping firms and attended the key shipping sector panels.

- A lot of the insights from a conference like this are more qualitative than quantitative, but some high-level takeaways are worth sharing.

- Sentiment is still strong for tanker stocks, but no longer as crazy as last summer. Optimism is still in the air, but China's lackluster reopening and the slowing EU economy provide cause for concern.

- I am more bullish on tanker stocks than in previous months and mention International Seaways and Scorpio Tankers as interesting buys at this juncture.

- This idea was discussed in more depth with members of my private investing community, Value Investor's Edge. Learn More »

Maskot/DigitalVision via Getty Images

Notes from Marine Money 2023

It was a super busy week, but also incredibly enjoyable to meet so many Value Investor's Edge members, and the conference was also very fruitful for the qualitative side of our investment research. This was Michael Boyd's first Marine Money as well and he was able to meaningfully add to the discussion in a few selective energy/shipping overlap meetings such as with International Seaways (INSW) and Navigator Holdings (NVGS). Climent Molins and/or I met with virtually every firm at the conference including a few private firms (such as Atlas Corp and Seapeak) to garner more overall market impressions and commentary.

Marine Money Week is easily the most busy, yet fruitful, week of the year, but it is important to stress the qualitative nature of a lot of these interactions (i.e. how bullish is the sentiment, do companies seem overly promotional, can we trust projections, what do firms say about each other, etc.). Also keep in mind that there are a lot of impressions and discussions which will absolutely factor into the outputs of our research (e.g. fair value estimates, management ratings, model portfolio picks), but are not explicitly stated as a matter of professionalism. Obviously there is a lot of qualitative things (nothing financially material of course!) which are said in confidence and cannot be easily picked up in virtual interactions or by reading filings or news articles.

Finally, please keep in mind that these update notes are just my/our personal impressions and should NOT be construed as direct quotes or any sort of investment or trading advice. I am sharing these notes with the public audience since I know the majority of readers on Seeking Alpha were unable to attend this year. I hope to see you next year!

High Level Review and Takeaways

This was my fourth in-person Marine Money Week (2020 and 2021 were cancelled due to COVID), and this was the best one by far! Not so much because of the exact agenda (although the agenda was great), but this one was the best due to the level of corporate access, quality of meetings/discussions, and the ability to meet nearly 20 VIE members throughout the week. We have members from all over the world with diverse backgrounds and it was an honor to meet everyone!

I believe Marine Money is arguably the best shipping conference in the world, and it is by-far the best shipping conference in the United States. If you didn't attend this year, but are considering it in the future, I encourage you to reach out to a few VIE members who did attend and ask for their honest opinion on the value and/or takeaways of their own.

Sentiment Meter: Midcycle to Slightly Higher

One of the qualitative aspects/values of Marine Money is that it gives investors a great chance to gauge industry sentiment. If everyone in the room is bullish, then we should be very, very, afraid! Conversely, if there are zero investors at the conference and it feels like a funeral, then we need to go "all-in." Keep in mind that the room is populated with a very diverse smattering of all segments and all professions (lawyers, analysts, bankers, etc), so the sentiment is typically a derivative of deal flow, profits, etc.

This year felt very balanced/midcycle, perhaps slightly higher. On a scale of 1-to-100, I would summarize overall sentiment at roughly 60-65. There was a decent balance of optimism, mixed with concern about the future. Lots of folks are very concerned about China (primarily economically, but also some are concerned militarily), and there is still skepticism about the overall global economy and about interest rates. Overall, it felt just slightly less bullish than last summer, but a similar level of balance of optimism and caution.

Tanker Sentiment More Prudent

Last year the sentiment was uncontrollably bullish tankers and very bearish containers. The obnoxiously bullish tanker sentiment has definitely faded. Folks are still plastering the "tiny orderbook" chart in every slide deck, but there were many voices who expressed concern about asset valuations, bloated NAVs, and China's level of follow-through. This felt much more balanced than last summer where the level of sentiment was terrifying (it was punch-drunk bad last summer for tankers). The one exception was Tor Olav Troim who made some big headlines with his pronouncements. I personally also think that tanker stocks (not necessarily the assets) are a far better buy today than last summer! I am personally far more bullish this year. But apart from us and Tor Olav, it seems the overall room was a bit less euphoric than last summer.

There is an interesting sentiment gap between crude tankers and product tankers, with the latter being the favorite. Sentiment is hotter in products despite the larger orderbook and weaker historical performance. Crude was more muted, perhaps also because the panel performance was more flat and the executives were very conservative and professional and more focused on higher-level things than banging the drum on rates (Lois and Lars, of Seaways and Frontline, were next to each other and recent drama looms large). For what it's worth, I slightly favor crude tankers myself, but both sectors tend to correlate over time, so it's not worth getting bent around the axel too much as the tides will raise (or lower) all these boats.

Analyst Community Has Been Gutted

Marine Money used to always end with an analyst panel. No more. Omar Nokta of Jefferies (co-sponsor of the conference) was the only high profile US analyst in the room for the entire conference!

The difference between 2023 and 2018 (my first Marine Money appearance) is striking. We have gone from 6-7 high profile analysts with huge personalities to Omar Nokta virtually standing alone... Pretty crazy! Here is the analyst panel picture from 2018, which is even more striking when you consider that there were 3 other major analysts who were also watching from the galley.

More Investors... But the Bar is Low

There were more investors at this conference than in previous years, but the bar is incredibly low. Back in 2018, if I recall correctly, there were like five investors at the entire conference. The number was notably higher this year, but most of the net additions were either VIE members or a couple folks who joined on the last day to see some of the panels.

Tanker company executives all claim "there is huge investor interest," and "they are having more meetings than in over a decade," but I'm skeptical because we are not seeing it in the share prices. Either this "interest" is coming from hedge fund bag holders who are desperate for exit liquidity, or there are a lot of folks hovering on the sidelines. Again, this "huge investor interest" is not showing up in the charts!

Then again... the bar is quite low.

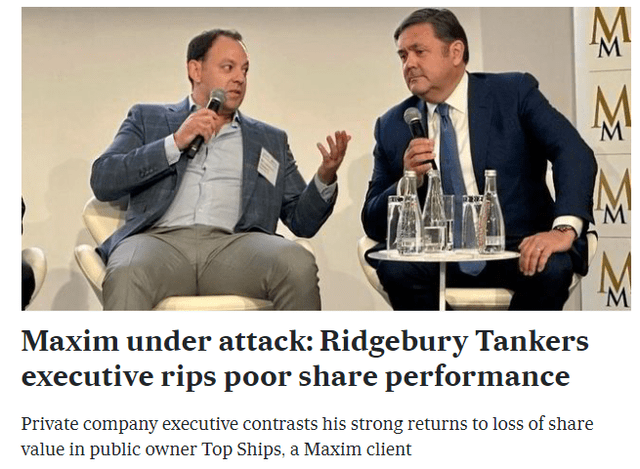

Maxim on Blast

Hew Crooks, CFO of Ridgebury Tankers, hewed down the crooks at Maxim in his panel and generated the biggest buzz of the conference. Unfortunately I was not in the room live (meetings on meetings), but this headline from Tradewinds is clear enough:

I've known the Ridgebury folks for years (CEO Bob Burke was on the final panel as well), and have high regard for their performance and integrity, so kudos to them for saying what needed to be said. Bonus points to the CEO of Gram Car Carriers, Georg Whist, for jumping on the pile on, with this direct quote:

The reason some companies are trading poorly is that they're s**t companies. The industry is not doing itself a favor by listing a lot of s**t!

Bravo, Georg! Stating the obvious, but still. Bravo!

Investment Takeaways: Buy INSW and STNG

I mentioned that the tanker sentiment is much more balanced at this juncture after enthusiasm boiled over into the 'terrifying' level last summer. I have also recently published a list of my three favorite shipping names, one of which is International Seaways. I would reiterate INSW as an excellent pick at this juncture and I am also more interested in Scorpio Tankers now that the chart looks like a bloodbath even after massive levels of share repurchases.

14x Return Over the Past 8 Years

Value Investor's Edge provides the world's best shipping research. Even during turbulent market conditions, our long-only models outperformed the S&P 500 by 75% in 2022 and our models have returned a further 24.2% YTD. Our research has driven an IRR of 43.2% over the past 8 years, which proves the ability of our team to outperform across all market conditions.

We also offer income-focused coverage, which prioritizes lower-risk firms with steady yields of 8-11%. Our income model has never had a dividend cut!

Don't believe it? Try a zero obligation free trial and audit for yourself!

This article was written by

Mintzmyer founded Value Investor's Edge, a top-ranked deep value research service in May 2015, with the goal of establishing a top-tier community of deep value investors and activists. Value Investor's Edge subscribers leverage exclusive in-depth analytic reports and community investment experience to discover disconnects in global shipping and a variety of other beaten down sectors.

As part of directing Value Investor's Edge, Mintzmyer works with a team of five analysts and data technicians to deliver quality research and analytics to over 500 members. He has interviewed numerous management teams at public maritime firms, and has worked with a multitude of investors. Mintzmyer's exclusive analysis has received frequent 'Top Idea,' 'Must Read,' and 'Small Cap Insight' awards at Seeking Alpha and he is commonly cited in industry news such as TradeWinds and Splash 24/7.

Pursuing a Doctorate in Public Policy (Intl Relations) from Harvard University. M.A. in Public Policy, with focus on International Security & Economic Policy from the University of Maryland. Distinguished Graduate of the United States Air Force Academy with a B.S. in Economics. Extensive background in financial analysis, equity research, accounting, portfolio management, and customized asset allocation through nearly a decade of formalized education, personal studies, and practical experience. Avid reader of business/investments and biographies.

Legal Disclaimer: Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Although I do my utmost to procure high quality information, investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INSW, STNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)