Inovio: Microcap Biotech Struggling To Find Traction

Summary

- Inovio faces an uphill battle in turning around its performance as it closes out its first full year under new management.

- The company has made progress with its INO-3107 therapy for recurrent respiratory papillomatosis, receiving positive feedback from the FDA and European Committee for Orphan Medicinal Products.

- Encouraging data has also been announced for INO-4201 as an Ebola booster, demonstrating the versatility of Inovio's platform and its potential to provide protective immune responses across multiple indications.

wildpixel

My most recent Inovio (NASDAQ:INO) article, 04/04/2023's "Inovio: Adrift At A Bargain Price But No Near-Term Catalyst" noted how Inovio has a paucity of near term catalysts. Since that time Inovio has come forward with the following:

- 05/10/2023 earnings call (the "Call");

- 05/16/2023 presentation (the "Presentation");

- 05/16/2023 RBC Capital Markets Global Healthcare Conference appearance (RBC Conference);

- 06/09/2023, Jefferies Healthcare Conference appearance (the Jefferies Conference)

This article will examine Inovio's latest investment merits with attention to any catalysts.

Joseph Kim had a long tenure with Inovio. He began his term as CEO following its 06/2009 merger with VGX Pharmaceuticals. Its ~$2.49 price at the close of Kim's last day was within pennies of its price when he started 13 years previously. Hardly a stellar run.

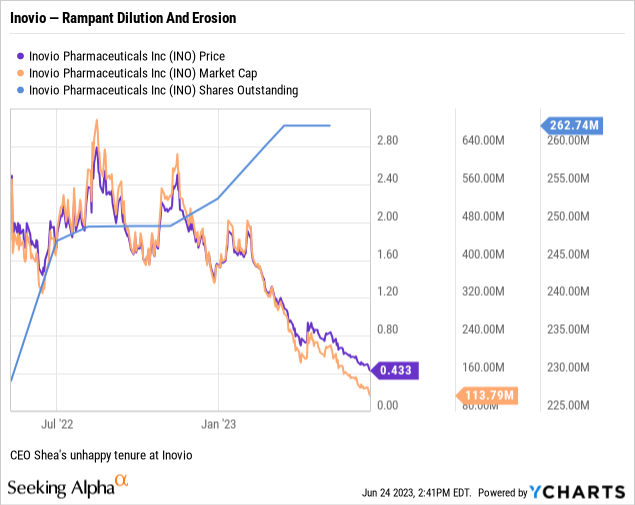

Current CEO Shea has had an even rougher road. She was appointed as CEO on 05/10/2022. At the outset of her term on 05/11/2022 Inovio opened at $1.95. It has only managed to close above $2.49 on a scant few days, never >$3.00 as shown by the chart below:

That is one ugly chart.

It last closed above $1.00 on 03/21/2023. Its closing prices following the Call have trended down to its most recent closing price of $0.43 as I write on 06/25/2023. When stocks get stuck in penny stock territory as has been the case for Inovio for the bulk of 2023, they suffer from devaluing of their share currency. In turn this leads to spiraling dilution.

Each new ATM financing for such companies dilutes shareholders ever more forcibly. What can break this vicious cycle? For development stage biotech's like Inovio the best chance is typically a pipeline breakthrough.

Inovio has shown a paucity of near term pipeline excitement.

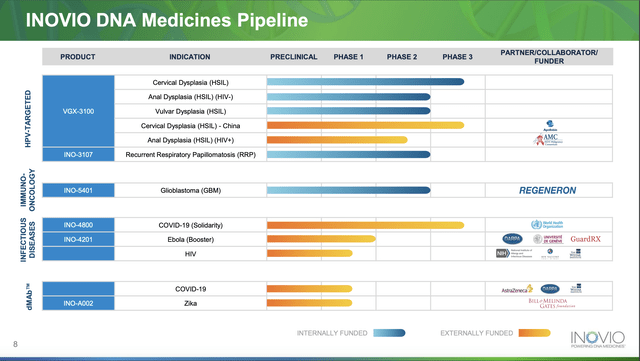

Inovio's pipeline from Presentation slide 8 is an important reference point for understanding Inovio's value proposition:

The highlights of Shea's introductory remarks during the Call were decidedly low key. They included: [A] three highlights on Inovio's phase 2 therapy INO-3107 as follows:

important headway in the development of INO-3107, a product candidate for recurrent respiratory papillomatosis or RRP, receipt of initial FDA feedback on proposed Phase 3 plans implying an achievable framework for a Phase 3 trial for INO-3107;

... the European Committee for Orphan Medicinal Products issued a positive opinion on Inovio's application for Orphan Drug Designation for INO-3107 with the European Commission's final decision received on 05/23/2023 coming on the heels of positive data from the second cohort of Phase 1/2 trial for INO-3107 ;

...data shows that INO-3107 has the ability to elicit a robust immune response and has the potential to provide clinical benefit to patients who otherwise face a lifetime of disruptive surgeries....

[B] Two highlights on its phase 1 Ebola booster INO-4201 as follows:

In the first quarter, we also announced encouraging data from our Phase 1 trial with INO-4201 as an Ebola booster for ERVEBO, which not only showed the potential of INO-4201 as an important tool in extending protection against the Ebola virus, but also demonstrated the versatility of our platform and the ability of DNA medicines to elicit potentially protective immune responses across multiple indications.

Additional safety and immunological data shared last month by lead investigator, Dr. Angela Huttner, at the 33rd European Congress of Clinical Microbiology and Infectious Diseases or ECCMID, provided more insight on the potential of INO-4201 to generate robust immune responses and extend protection against Ebola. Mike will also share more details on that data.

Shea had nothing new to say on Inovio's longtime lead Phase 3 therapy VGX-3100. As announced during its Q4, 2022 earnings release it had failed to achieve its primary endpoint on its recently completed phase 3 REVEAL2 trial. Inovio was nonetheless evaluating encouraging data from an ad hoc efficacy analysis of combined data from REVEAL1 and 2.

She did advise:

Our goal is to share the results of this analysis with you in the third quarter of 2023. We continue to believe that the data from REVEAL2, which showed VGX-3100's ability to provide viral clearance, highlights this drug candidate's potential to address the underlying course of the disease, the HPV virus, which could make it an effective treatment option for additional indications particularly in HSIL.

So nothing during the Call to suggest a near term catalyst. Shea also mentioned Inovio's INO-5401 in phase 2 treatment of Glioblastoma [GBM] being developed with Regeneron (REGN). She stated:

...we wrapped up the Phase 2 study for this product candidate in glioblastoma, we still have patients from the study that we are continuing to provide drug for and we are evaluating next steps for this candidate which we believe is worth a further evaluation.

So the Call offered a laundry list of pipeline highlights, none of which truly alerts to near term developments.

Switcheroo — in terms of emphasis Inovio is moving its INO-3107 to lead therapy status.

When I step in the way-back machine, I find Inovio's developing VGX 3100 discussed at length in Seeking Alpha's earliest Inovio article back in 2012. INO-3107 on the other hand was not even on Inovio's pipeline until much later. For example it is not on Inovio's pipeline graphic in my 2017 Inovio article, "Inovio: The Dilution Solution".

I find its sole INO-3107 trial on clincaltrials.gov, CT04398433, is a phase 1/2 trial with a start date in 2021. It receives hardly any attention in Inovio articles on Seeking Alpha. The first mention I find is analyst William Meyers touching on it in an 06/2021 article. In other words INO-3107 as potentially a major component of Inovio's value proposition is a decidedly recent development.

The Call gives it nice attention as referenced above. Beyond the Call, both the RBC Conference and the Jefferies Conference address INO-3107 at length. During the RBC Conference CEO Shea emphasized INO-3107's target disease RRP as being particularly nasty.

She described how it attacks its victims with wart-like papillomas in the throat and in the airway. It is particularly nasty when these growths advance to impact breathing. Such an impact is most common in children because of the small size of their airways.

The current standard of care for treatment of RRP is surgery to remove the growths. Often recurrent surgeries are necessary; in some cases, over a patient's life, many dozens of such surgeries. They devastate patients' quality of life as they go through cycles dominated by preparation for, endurance of, and recovery from repeated surgeries.

During the Jefferies Conference CMO Sumner described Inovio's INO-3107 trial and its results as follows:

- a small trial with 32 participants;

- 26 experienced a reduction in surgery comparing the number of surgeries after the commencement of treatment to the previous year;

- of those 26 patients that saw a reduction, the overall population had a median number of surgeries of four and saw a median reduction of three surgeries;

- 9 patients required no surgical intervention following the start of treatment.

Now these are the type of results which could reignite Inovio's share price. They have not done so as I write on 06/25/2023. I submit that the market is leery about the small size of the sample and the perceived difficulty of achieving FDA approval on a slippery endpoint of reduced surgeries.

Conclusion

Inovio's pipeline invites a variety of approaches to valuing the company. I favor a simplistic take. I am most drawn to INO-3107 as controlling the company's value. Accordingly, I value the balance of its pipeline as nil.

In order for Inovio to harvest an FDA approval for INO-3107 it will need to:

- design a pivotal trial that effectively demonstrates INO-3107's ability to achieve an acceptable endpoint;

- receive FDA approval for the trial as designed;

- obtain clinical sites willing and able to conduct the trial;

- enroll the required number of patients;

- assemble and present data from the trial in approvable form to the FDA.

Can Inovio manage this? How long will it take? If you judge solely by Inovio's ever declining share price you might say there is little hope. One ought not dismiss the significance of Inovio's market cap of ~$113 million. The market assigns some value to the company.

However, it is assigning a heavy discount when one considers that Presentation slide lists its liquidity as of close of Q1, 2023 at $223.8 million. A sizable stake for sure, but slide 3 only projects it as taking Inovio into Q1, 2025.

This shows that Inovio will likely have to do a major financing before it can hope to realize any benefit from INO-3107. Is Inovio a Buy, Hold or Sell? I submit it is at best a hold. If you already own shares, that is a decision you made. If you don't already own shares steer clear, unless you are feeling both daring and lucky and you can afford to take a loss.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of REGN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may buy or sell interests in any company mentioned over the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.