Discover Financial: Steady Growth With Some Risks

Summary

- Rising interest rates have led to a higher net interest margin and a decent earnings spurt.

- Discover Financial is growing strongly in deposits and loans, while the net charge-off ratio does not show much risk.

- Consumer behavior can change during a recession. However, there is still no visible slowdown in consumer spending and no sign of a recession yet.

naphtalina/iStock via Getty Images

Introduction

Discover Financial (NYSE:DFS) is benefiting greatly from increased interest rates, but with the Fed's strong rate increases also comes risk. Consumers may struggle to make payments, increasing the net credit write-off ratio.

In my article on industry peer American Express (AXP), we saw that the growth outlook is strong and that the net credit write-off ratio did not increase significantly to 1.4%. At Discover Financial, we also see an increase in the net credit write-off ratio to 3.7% currently. Discover Financial's customer base is riskier than American Express'. In my view that risk is already embedded in the stock's valuation because it is a lot cheaper.

I see many positives to investing in Discover Financial. Rising interest rates have led to a higher net interest margin and a decent profit spurt. Discover Financial is growing strongly in deposits and loans, while the net charge-off ratio does not show much risk. Management is shareholder-friendly by both paying dividends and repurchasing shares. However, along with these positive characteristics, there are also risks lurking.

First Quarter 2023 Results

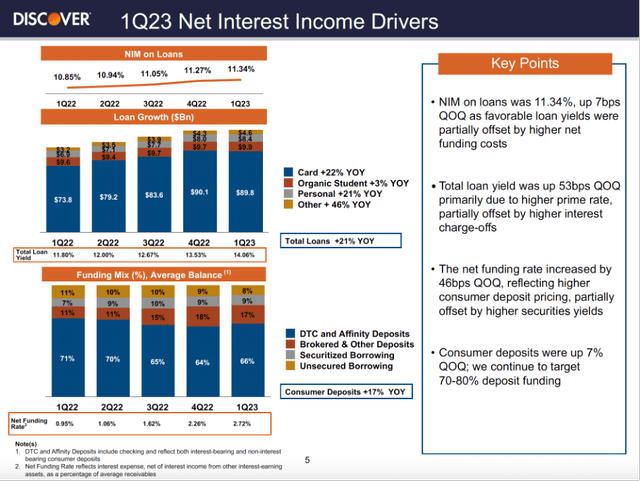

First Quarter 2023 Results (DFS Investor Relations)

The increased interest rates are beneficial to Discover Financial, pushing the NIM up to 11.34%. Net interest income increased to $3.132 million in the first quarter of this year from $2.479 million in the same period last year. Nevertheless, EPS fell as the provision for loan losses increased sharply. It rose significantly to $1,102 million, compared to just $154 million in early 2022. A sharply increased provision for credit losses caused EPS to fall from $4.22 to $3.58 over the same period. Deposits grew strongly at 17% year-on-year and credit growth was also strong at 21%. Everything points to a strong recovery in consumer spending after the COVID-19 crisis.

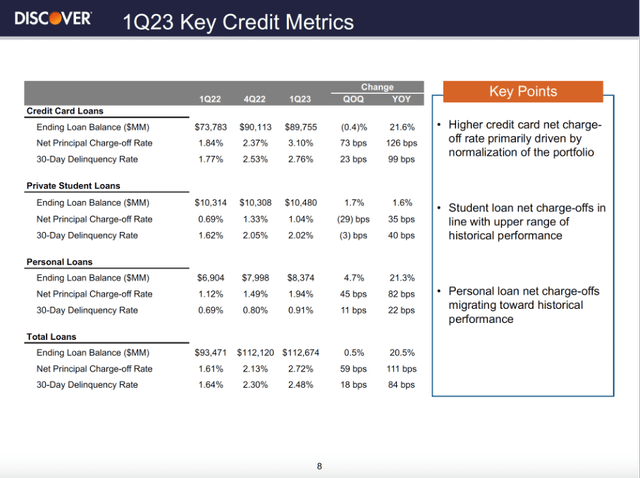

If we look at the write-off percentages, we see that credit card loans in particular are performing worse. The net charge-off rate has almost doubled compared to the same period a year earlier. The net charge-off rate of personal loans also increased year over year to 1.94%. Overall, the net principal charge-off rate was 2.72% and the 30-day delinquency rate was only 2.48%. For now, I don't find these numbers alarming. They look fine.

1Q23 Key Credit Metrics (DFS Investor Relations)

Risks To Mention

Discover Financial benefits from rising interest rates because it expands the net interest margin, but the downside is that the net credit write-off rate may increase which could lead to losses.

The uncertain macroeconomic conditions is a risk for Discover Financial. The Federal Reserve has raised interest rates sharply, inverting the treasury yield curve. There is a correlation that a recession is imminent within a year of the yield curve inverting. However, the depth of a possible recession is unknown.

The Federal Reserve will cut interest rates during the recession, causing Discovery Financials’ NIM to fall. Consumer spending can also fall during a recession, and the combination of the two could have a significant impact on Discover Financial's bottom line.

Consumer behavior changes during a recession. However, there is still no visible slowdown in consumer spending and no sign of a recession yet. Consumers have spend heavily after COVID-19 and credit card debt reaches an all-time high of $930 billion, young adults in particular have a high rate of credit card delinquencies. Investors should be aware that a possible recession is a major risk for credit card companies such as Discover Financial and American Express.

Dividends and Share Repurchases

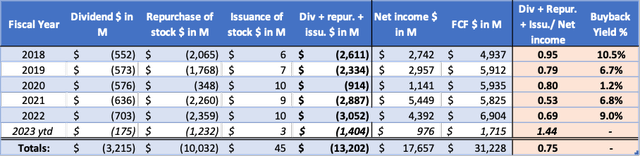

What I find very attractive are Discover Financial's consistent dividend payments. The dividend per share has risen on average by about 12% per year over the past 5 years. The dividend has held up even during the difficult times of the 2007-2008 financial crisis.

Therefore, I expect that management will also try to maintain the dividend in the next recession. Discover Financial is therefore a perfect stock for income investors.

In addition to a decent dividend (dividend yield = 2.4%), Discover Financial also repurchases shares for an amount that far exceeds the dividend payment. We see that the buyback yield is significantly high, reaching as high as 9% in 2022. A high buyback yield is beneficial because it increases the dividend per share, and there is also a chance that the share price will go up due to the reduction of shares outstanding and increased demand.

Discover Financial's cash flow highlights (Annual reports and calculations)

Cheap Valuation

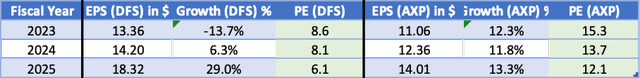

We cannot properly compare Discover Financial to peer American Express due to differences in net credit write-off rates. What I do want to show is the differences in growth expectations between these two companies. On the left side of the table we see Discover Financial's earnings outlook, growth and forward P/E ratio, and on the right side we see the same values for American Express.

We see a big difference in the forward P/E ratio, perhaps because of the possible differences in business risks. We also see that analysts expecting more earnings volatility for Discover Financial while American Express earnings are expected to grow steadily. Looking at earnings estimates alone, I find American Express a safer choice to invest in.

DFS and AXP' EPS expectations (Seeking Alpha ticker pages and calculations)

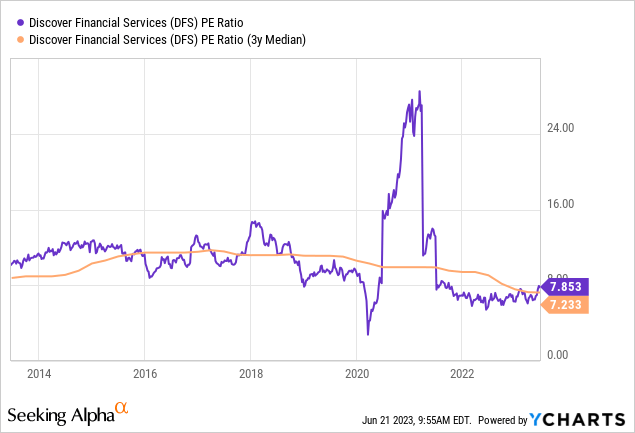

Discover Financials' average P/E ratio was much higher years ago than it is now. This is notable because the profits are higher due to the improvement of NIM. Investors are not yet convinced that Discover Financial is an attractive investment.

Discovery Financials’ forward P/E ratio for 2025 is 6.1, representing an undervaluation of 18% compared to the average 3-year P/E ratio. This equates to an expected return of approximately 10% per annum including dividends. I do assume that the potential recession is not severe and that consumer spending will not fall substantially. For the time being, these are risks that must be taken into account.

Conclusion

Discover Financial, like American Express, is a credit card company that has benefited greatly from increased consumer spending and rising interest rates. However, the rise in interest rates is accompanied by an increase in net credit write-offs and delinquency rates but these ratios do not look worrisome (yet). One risk is an upcoming recession; the yield curve has inverted due to the strongly increased interest rates. Historically, we can expect an economic recession within a year. What consumer spending will be during a possible recession is still unknown, for now it looks good with consumer spending at the highest level ever. During a recession, the net charge-off rate can rise while interest rates are decreased. This is not a favorable combination for Discover Financial, and investors will have to take this risk into account. A positive point to mention is that the dividends have been distributed for a very long time. I therefore do expect that the dividend will be maintained during a recession. The stock valuation is also attractive and I believe low double-digit annual returns can be expected.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DFS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.