KBC Group: Trading At Just 9x Recurring Earnings With A 17% CET1 Ratio

Summary

- KBC Group is focusing on Belgium and CEE countries.

- The Q1 results were exceptionally strong thanks to a non-recurring gain.

- Even without that gain, KBC is performing as expected, and the full-year EPS will likely come in around 6.5-7 EUR per share.

- I expect the bank to keep the dividend of 4 EUR per share at least stable. This would result in a 6.5% dividend yield.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

Cineberg

Introduction

I have been following KBC Group (OTCPK:KBCSY) (OTCPK:KBCSF) for several years now as I liked the bank’s strong capital ratios and generous dividend policy. This allows the Belgian bank to take advantage of M&A opportunities to further strengthen its position on the core markets (Belgium and the CEE), and back in 2017, the bank signed an agreement with the National Bank of Greece (NBG) to acquire the fourth largest bank in Bulgaria. The total value of the transaction was just 610M EUR (at 1.1 times the tangible book value) which gives you a good idea of KBC’s deal size and its plan to slowly grow in its core markets without jeopardizing the balance sheet on pursuing mega-deals.

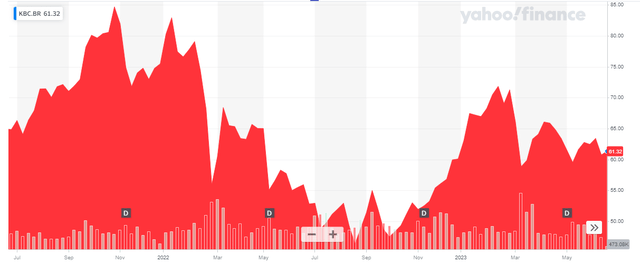

Yahoo Finance

KBC Group has its primary listing in Belgium where the company is trading with KBC as its ticker symbol. The Brussels listing has an average daily volume of 625,000 shares, making it the most liquid listing and I would strongly recommend to use KBC's Brussels listing to trade. As KBC reports in Euro and has its primary listing in the same currency, I will use the EUR as base currency throughout this article unless indicated otherwise.

Strong results, despite the market turmoil

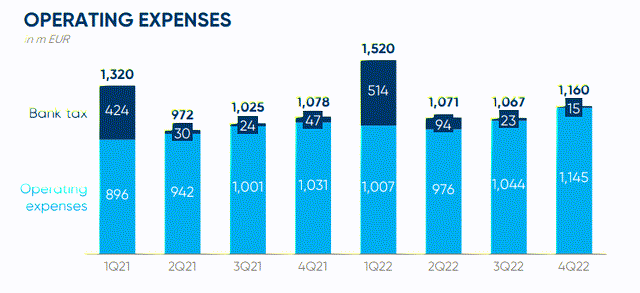

The bank’s first quarter was surprisingly strong. Traditionally, Q1 is the weakest as the bank is on the hook for the annual bank taxes in the jurisdictions it is active in. Last year, the total amount of bank tax was 514M EUR in Q1, and Q1 2023 wasn’t any different: the total amount of bank and insurance taxes increased to 571M EUR.

KBC Investor Relations

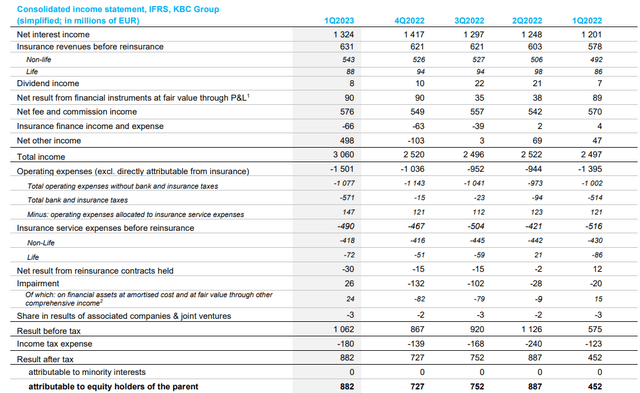

While you would (and should) expect the first quarter’s bottom line result to be relatively weak, KBC surprisingly posted a net income that was almost twice as high as in the first quarter of last year despite a lower net interest income, as you can see below.

KBC Investor Relations

The main reason for the surprisingly strong result is the 498M EUR in "net other income" and this is entirely related to the completion of the sale of the KBC Bank Ireland. KBC confirmed the normal run rate of the "net other income" is approximately 50M EUR per quarter, and it’s definitely important to understand the vast majority of that net other income is non-recurring in nature.

So while the net income was a very impressive 882M EUR or 2.08 EUR per share, about 40% of the pre-tax income was generated from the sale of the Irish assets so the normalized earnings were slightly lower at just over 1 EUR per share.

That’s still fine. Keep in mind Q1 traditionally is the weakest quarter of the year and if we look back at FY 2022 wherein the bank reported a total EPS of 6.75 EUR, only 1.07 EUR was generated in the first quarter of the year.

This means there is no need for the bank to change its generous dividend policy. KBC continues to earmark at least 50% of its consolidated net profit for dividends KBC paid 4.00 EUR per share in dividends based on its FY 2022 results and thanks to the non-recurring gain in Q1 of this year, odds are KBC will keep the dividend at least stable this year.

The capital ratios remain strong, and this paves the way for more outsized dividends

One of the main reasons why I was attracted to KBC (other than having exposure to Eastern Europe) is the bank’s strong capital ratio. KBC has a leading CET1 capital ratio in Europe and should be well equipped to deal with the current volatility and nervosity on the financial markets.

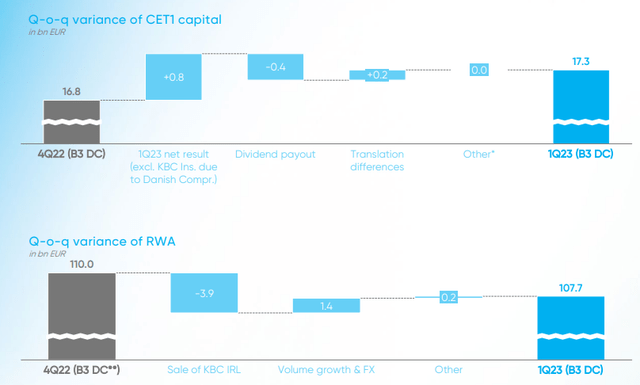

KBC was actually able to further boost its capital ratios thanks to a strong earnings report. As you can see below, the Q1 earnings added about 800M EUR of CET1 capital and more than compensated for the 400M EUR provision for the dividend. As of the end of Q1, the total CET1 capital came in at 17.3B EUR compared to "just" 16.8B EUR as of the end of the financial year 2022.

KBC Investor Relations

Additionally, the total amount of risk-weighted assets decreased in the first quarter mainly due to the sale of the Irish assets which had a positive impact of 3.9B EUR. This was partially mitigated by the 1.4B EUR related to FX changes and volume growth but at the end of the quarter, the RWA decreased to 107.7B EUR. And that combination of a higher CET1 capital vs. a lower amount of risk-weighted assets boosted the CET1 ratio to 16.1%.

This means KBC already has fully digested the impact of a higher required CET1 ratio. The annual review of the European Central Bank in December of last year revealed an increased CET1 requirement of 11.43% compared to 10.81% one year ago. But with a CET1 capital ratio of 16.1%, the bank is exceeding the minimum requirement with almost 500 bp. Expressed in Euros, there’s about 5B EUR in "excess" capital on the balance sheet.

Investment thesis

I have an indirect long position in KBC Group through a mono-holding (which is trading at a double digit discount to NAV) and although I will have to monitor the quarterly results more closely while the financial system is dealing with the fallout of higher interest rates, I see no reason to change my bullish position. The bank and insurance company has learned its lesson during the global financial crisis in 2008 when it had to be bailed out and has now converted itself to be one of the most robust banks in Europe.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no direct position in KBC but I have an indirect long position via a monoholding with almost 100% of its assets invested in KBC.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)