Origin Materials Rallies On Plant Startup News, Shares Remain A Buy

Summary

- Origin Materials, Inc. has started commercial operations at its chloromethyl furfural plant, the first in the world to develop the chemical building block at a commercial scale.

- The firm expects to generate significant revenue soon, with its Origin 1 plant and substantial revenue and earnings from its Origin 2+ plants in later years.

- Despite a bearish technical outlook, the growth potential for Origin Materials remains compelling, with strategic partnerships, offtake agreements, and licensing revenue expected to generate better cash flow in the future.

- I outline key price levels to watch ahead of its July shareholders meeting and August earnings report.

pcess609

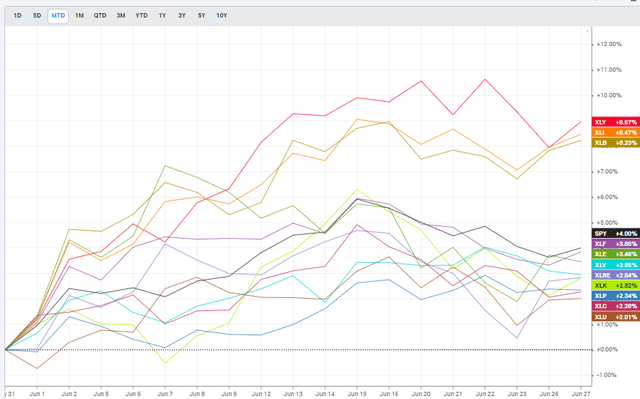

The Materials sector has been among a trio of areas leading the S&P 500 (SP500) higher this month. Along with Discretionary and Industrials, the cyclical space has finally attracted buyers after a prolonged tough stretch relative to the growth-heavy S&P 500.

One small name, Origin Materials, Inc. (NASDAQ:ORGN) has struggled, however. But bullish news this morning is lifting shares. I reiterate my buy rating but recognize emerging bearish risks on the chart.

Materials Helping To Lift Stocks In June

According to Bank of America Global Research, ORGN is a novel materials company developing cellulose-based solutions for the plastics industry. Its CMF and HTC products can be used to produce PET, paraxylene, and carbon black and activated carbon substitutes. The company expects to generate meaningful revenue starting in 2023 from its Origin 1 plant and substantial revenue and earnings from its Origin 2+ plants in later years.

The California-based $591 million market cap Chemicals industry stock within the Materials sector trades at a low 7.2 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. ORGN has a somewhat high 7.7% short interest, perhaps helping to lift the stock today.

Bullish news crossed the wires this morning when it was announced that Origin was starting up commercial operations of its chloromethyl furfural plant, which it said is the first in the world to develop the chemical building block at commercial scale. According to the report

"the plant substantially scales up our revolutionary core technology platform. We expect the power of our platform intermediates, CMF and HTC, to be transformative for the chemical industry and how the world generally makes things."

I look forward to seeing what this news means to earnings accretion - we might get that detail in its Q2 report due out in August.

Back in May, ORGN reported an EPS beat while revenue topped estimates considerably. Cash of $263.9 million would have been higher had it not invested liquidity into the completion of Origin 1. The firm expects 2023 revenue of $40 million to $60 million while adjusted EBITDA is seen in the loss range of $50 million to $60 million.

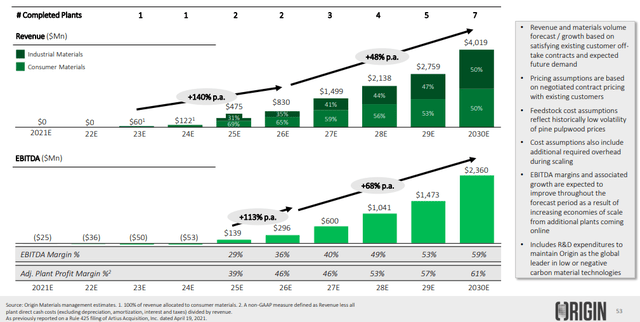

EBITDA is expected to turn positive by 2025 with further gains through the end of the decade, so the growth potential is compelling. Still, it's a speculative non-profitable company this year and next that must weather a tough funding market and the inherent uncertainty that comes with fast expansion.

Adjusted EBITDA Seen Rising Big Later This Decade

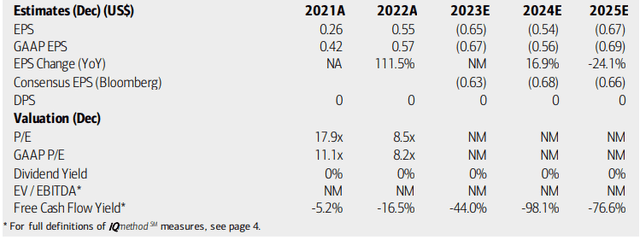

On valuation, analysts at BofA see earnings falling sharply into the red this year before recovering just modestly in the out year. But EPS does not budge to the good side much through 2025. The Bloomberg consensus forecast is about on par with what BofA projects.

Of course, these figures are before today's announcement of the world's first commercial CMF plant, so I expect upward earnings revisions in the coming weeks ahead of its August earnings date. No dividends are expected to be paid on the stock and we must look beyond the usual earnings-based valuation ratios to arrive at a reasonable fair value for the company.

Origin: Earnings, Valuation, Free Cash Flow Forecasts

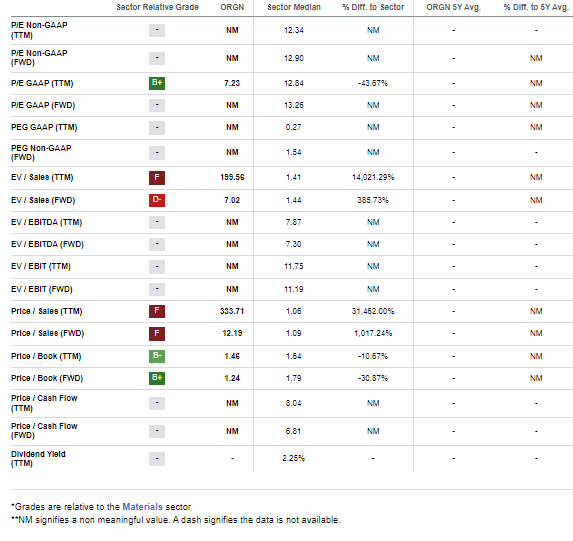

While not profitable in the coming quarters, ORGN is seen as producing free cash flow in later years. For now, the Chemicals company trades at just 1.24 times book on a forward basis - that is a 31% discount compared to the Materials sector median. Its strategic partnerships, offtake agreements, and licensing revenue should generate better cash flow before long. Overall, I continue to like ORGN's market position and growth outlook despite the lack of earnings growth visibility currently.

ORGN: Modest P/B, But A Lack of Profitability Casts Shade On Valuation Confidence

Seeking Alpha

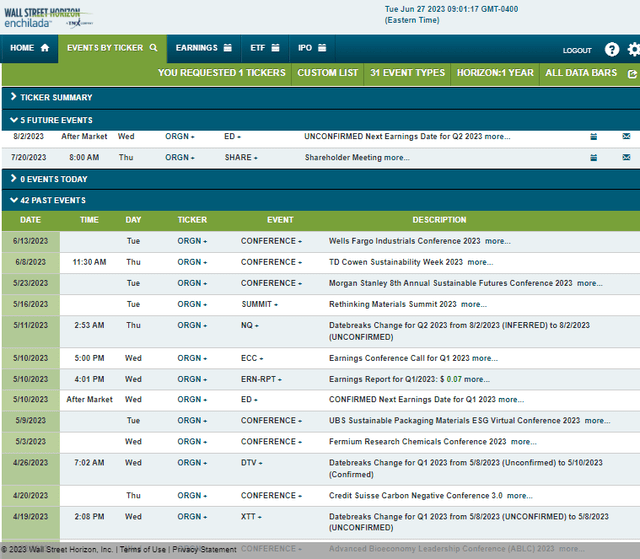

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Wednesday, August 2 AMC. Before that, shares could be on the move around its July 20 shareholders' meeting.

Corporate Event Risk Calendar

The Technical Take

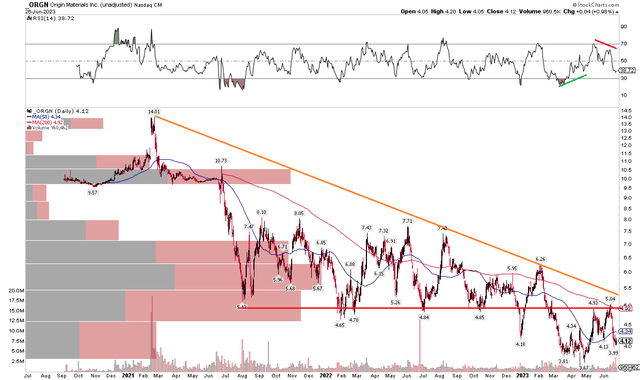

While I like the growth story and Origin's potential to become a global leader in producing carbon-free materials, the chart has turned bearish. Back in October, I noted key support around $4.50. That level held temporarily, but a late-year drop penetrated through the support zone.

Despite a spike recovery to the downtrend resistance line, new lows were notched in Q1 and Q2 this year. Just recently, ORGN encountered selling pressure at the falling 200-day moving average on negative RSI momentum divergence. I now see resistance in the $4.60 to $5 range, but a breakout above $5.50 would help support a renewed uptrend.

Overall, the technical situation is negative even after this morning's bounce.

ORGN: Bearish Breakdown Under $4.50, Resistance Into the Low $5s

The Bottom Line

While the Origin Materials, Inc. technicals have turned less sanguine, the growth outlook improved with today's news. I reiterate my buy rating but will be watching price action closely this summer. If trends do not improve, risk management must be applied.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.