Corporacion America Airports: Riding Favorable Travel Trends

Summary

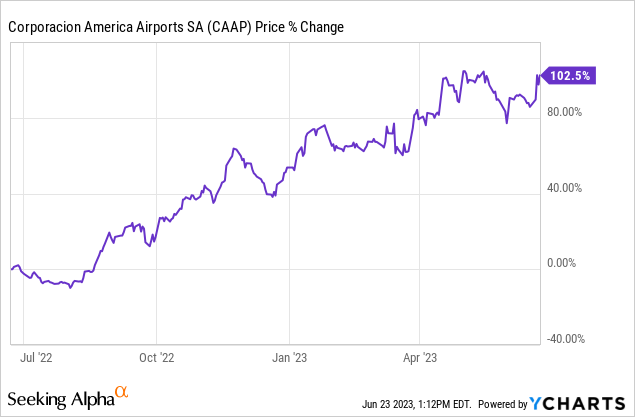

- Corporación América Airports is up 100% from its 52-week low as global travel volume continues to rebound.

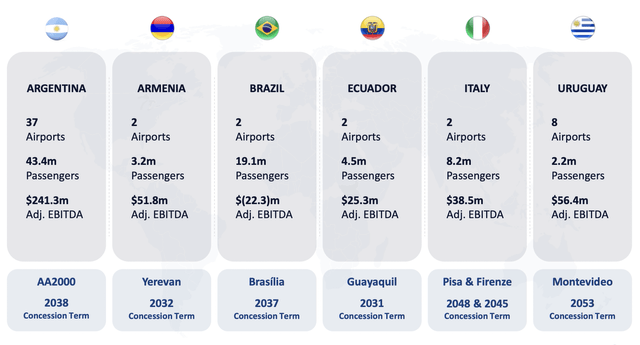

- The company operates 53 airports in 6 countries, with Argentina being its primary focus, generating over 60% of total revenue.

- Most of its airports are located in popular destinations and are well-positioned to benefit from the favorable travel trends.

- The latest earnings were extremely strong, while valuation remains discounted compared to peers.

Sean Gallup/Getty Images News

Investment Thesis

Corporación América Airports (NYSE:CAAP) has rallied over 100% from its 52-week low, as global air traffic continues to rebound. The company operates multiple high-quality airports located in prime positions and should benefit meaningfully from the ongoing expansion of the travel industry, especially in the near term. Thanks to the strong traveling momentum, the latest earnings were extremely strong. Despite the massive increase in share price, its valuation remains discounted from peers. I believe the company should have more room to run.

Quality Airports In Prime Locations

Corporación América Airports is a Luxembourg-based airport operator managing 53 airports in 6 countries, including Argentina, Uruguay, Italy, Brazil, Ecuador, and Armenia. These airports combined serve over 80 million passengers annually. Most of the traffic comes from Argentina, which has 37 airports generating over 60% of total revenue. Most of the company's airports are high-quality assets located in prime positions.

For instance, Ezeiza Airport is Argentina's most important airport, accounting for 79% of the country's total international passenger volume. It is located in Buenos Aires, one of the world's most popular travel destinations. It also owns Florence Airport and Pisa Airport in Italy. They are both leading airports located in Tuscany, a major tourism spot with 8 world heritage sites, including the renowned Leaning Tower of Pisa. Other notable airports include Carrasco Airport, the largest airport in Uruguay located in Montevideo.

The location of an airport dictates its value and the company's high-quality airport should offer strong competitive advantages. The availability of land in prime locations is often limited, therefore it is hard for other companies to compete in the same cities. There are also extremely high regulatory barriers and capital requirements that fend off new entrants.

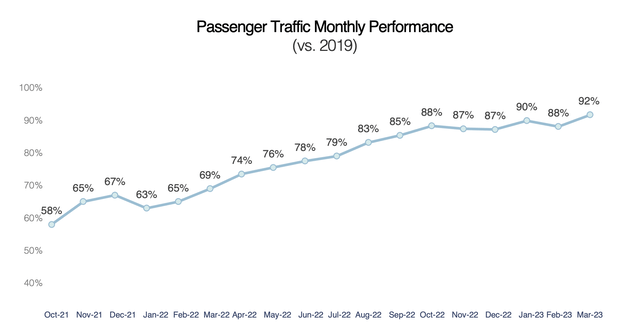

Rebounding Travel Industry

Thanks to the pent-up demand and government stimulus across the world, the global travel industry has been rebounding rapidly. As shown in the chart below, the company's passenger traffic has already recovered 92% compared to the first quarter of 2019. In countries such as Armenia and Ecuador, traffic levels are now even higher than pre-pandemic levels.

Besides the near-term rebound, the company's long-term opportunity also looks promising. Argentina, its largest market, is forecasted to grow its travel industry from $6.71 billion in 2023 to $8.62 billion in 2027, representing a solid CAGR (compounded annual growth rate) of 6.4%. The travel industry of Uruguay, its second-largest market, is also expected to grow at a 5.1% CAGR. Corporación América Airports should continue to benefit from both trends as most of its airports are located in popular travel destinations.

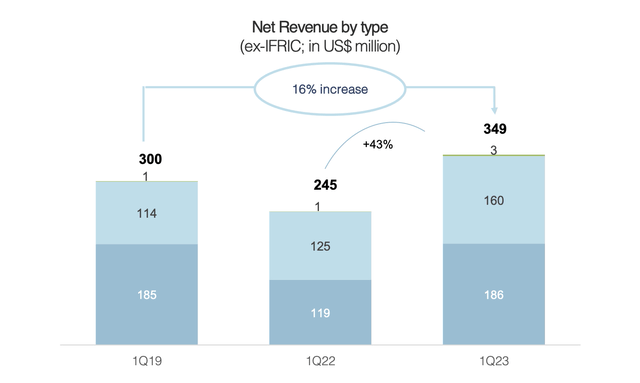

Strong Earnings

Corporación América Airports announced its first-quarter earnings last month and the results are extremely strong in my opinion, especially when considering the current macro backdrop. The company reported revenue of $382.1 million, up 48% YoY (year over year) compared to $258.1 million. Aeronautical revenue grew 55.5% from $119.4 million to $185.6 million, while non-aeronautical revenue grew 41.6% from $138.8 million to $196.5 million. The growth is driven by higher passenger traffic, which was up 37.3% YoY from 13.5 million to 18.5 million. The traffic was particularly strong in Italy and Armenia, which increased by 61.5% and 83.1% respectively

The bottom line was also very impressive. The operating income grew 96.8% YoY from $51.8 million to $102 million, as the operating leverage improved amid higher traffic volume. The operating margin also expanded 660 basis points from 20.1% to 26.7%. The adjusted EBITDA increased 57.6% YoY from $89.2 million to $140.6 million, or 36.8% of total revenue. The EPS was $0.20 compared to $0.16, up 22.1% YoY. Thanks to increased earnings, the net debt/adjusted EBITDA ratio declined from 5.1x in the prior year to 2.1x.

Cheap Valuation

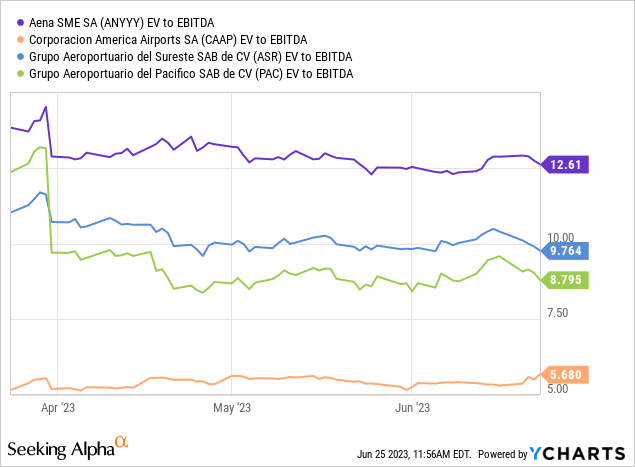

Despite the massive rally, Corporación América Airports still look cheap in my opinion. The company is currently trading at an EV/EBITDA ratio of just 5.7x (I am using EV/EBITDA as it can take the debt into account), which is much cheaper than other major airport operators such as Aena S.M.E. (OTCPK:ANYYY) and Grupo Aeroportuario del Sureste (ASR). As shown in the first chart below, the peer group has an average EV/EBITDA ratio of 10.4x, which represents a significant premium of 82.5% over the company.

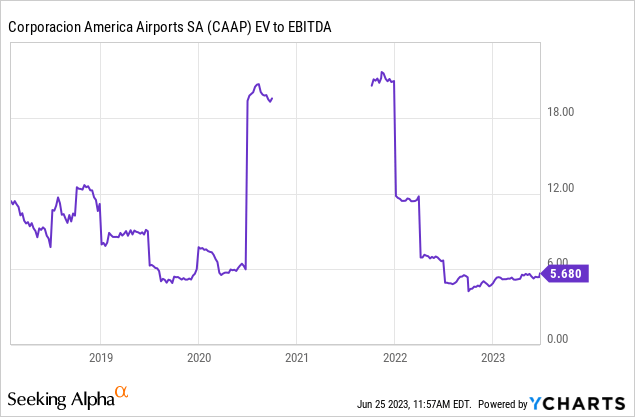

The company is also discounted on a historical basis. As shown in the second chart below, it has been trading at an EV/EBITDA ratio of around 10x prior to the pandemic, which is also substantially higher than the current multiple.

Risks

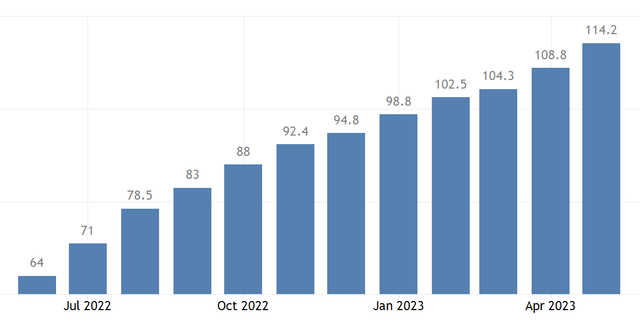

The major risks regarding Corporación América Airports are Argentina and macro headwinds. Given the company's heavy presence in Argentina, its outlook also highly depends on the state of the country. Argentina's political landscape has been quite unstable and its economy continues to deteriorate. For instance, its inflation rate continues to rise and recently reached 114% YoY in May. The country's volatility will likely impact outbound travel while inbound travel may get dragged down as well, which is worth keeping an eye on.

Economic slowdown is another notable risk. While the US economy has been holding up relatively well, many other countries are starting to see a slowdown. Due to the company's large presence in less-developed countries, it will likely be more exposed to macro headwinds.

Argentina's Inflation Rate (Trading Economics)

Investors Takeaway

I believe Corporación América Airports is a compelling bet on the rebounding travel & tourism industry. Most of the company's airports are located in prime positions that are poised to benefit from the increasing travel volume. As shown in the latest earnings, both the top and the bottom line continue to see upbeat momentum. Despite the massive rally, the valuation remains cheap compared to peers. The company should have more room to run and I rate it as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.