Core Molding Technologies: Strategic Acquisitions Fostering Stable Growth

Summary

- Core Molding Technologies demonstrates financial strength with a market capitalization of $183.98 million and a 12% return on invested capital.

- The company has experienced significant growth in earnings and revenues, outperforming the S&P 500 over the past three years.

- Despite being currently overvalued, Core Molding is well-positioned for long-term growth through strategic acquisitions and a robust balance sheet.

- I believe the company's acquisition strategy will stabilize revenues and expand margins in the long term.

TongTa

Core Molding Technologies (NYSE:CMT) has exemplified rapid share price growth over the past few years. I believe that the company is currently a hold because even though the company has a strong ROIC, solid earnings and guidance, and a resilient balance sheet, Core Molding is currently overvalued when assuming my DCF figures which further account for macroeconomic risks and volume declines.

Business Overview

Core Molding Technologies, Inc. and its subsidiaries specialize in molding thermoplastic and thermoset structural products. The business uses a wide variety of manufacturing techniques, including compression molding of the sheet molding compound, resin transfer molding, liquid molding of dicyclopentadiene, spray-up, and hand-lay-up, direct long-fiber thermoplastics, structural foam, and structural web injection molding. In the United States, Mexico, Canada, and other countries, Core Molding Technologies serves a broad range of markets, including those for medium and heavy-duty trucks, automobiles, power sports, construction, agriculture, building materials, and various commercial sectors.

Core Molding Overview (Core Molding Technologies)

Financials

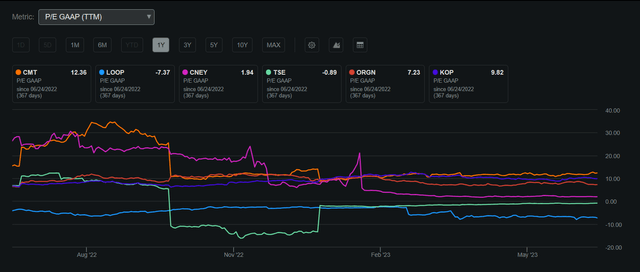

With a market capitalization of $183.98 million and a commendable return on invested capital of 12%, Core Molding demonstrates its financial strength. Trading at $20.41, the stock price is in proximity to its 52-week high of $21.23. However, it's important to consider that Core Molding's GAAP price-to-earnings ratio is 12.36, indicating a relatively higher valuation compared to its industry counterparts.

Core Molding P/E GAAP Compared to Industry Peers 1Y (Seeking Alpha)

Even though Core Molding does not pay a dividend, the company is able to capitalize on its FCF by utilizing its strong ROIC to foster growth and strengthen its core business model. This enables Core Molding to have multiple avenues of growth either from synergies or diversification which would improve and stabilize cash flows from cost and risk reductions.

Share Performance (Seeking Alpha)

Earnings

With remarkable Q1 2023 earnings, Core Molding has witnessed a surge in its share price, reaching unprecedented levels. This exceptional performance underscores Core Molding's resilience in the face of challenging macroeconomic conditions characterized by price volatility and high rates. The company exceeded earnings expectations by $0.29 per share, reporting an impressive $0.66, while surpassing revenue projections by $5.75 million, with total revenues amounting to $99.5 million, representing a significant 9.8% year-over-year growth. This outstanding achievement showcases Core Molding's ability to outperform during periods of profitability, fortifying its position to withstand cyclical downturns and fostering long-term business growth.

The company also has decent guidance moving into the end of 2023 and 2024 with continued growth of EPS and revenues displaying Core Molding's ability to maintain growth and build upon it.

Earnings Estimates (Seeking Alpha)

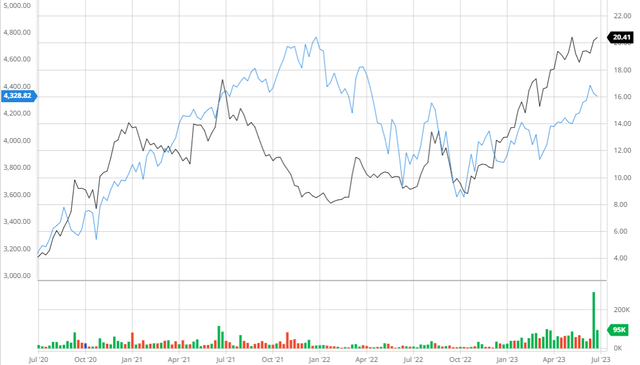

Outperforming the Broader Market

Over the past 3 years, Core Molding has been able to outperform the S&P 500 demonstrating the company's ability to recover from the 2020 recession.

Core Molding Compared to the S&P 500 3Y (Created by author using Bar Charts)

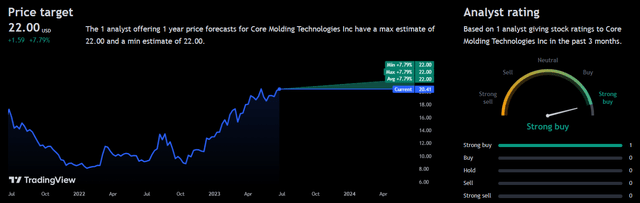

Analyst Consensus

Core Molding is currently highly regarded by analysts, who have assigned it a strong buy rating. The average one-year price target for the company stands at $22, indicating a potential upside of 7.79%. This optimistic assessment reflects analysts' positive outlook on Core Molding's long-term strategy and growth prospects.

Analyst Consensus (TradingView)

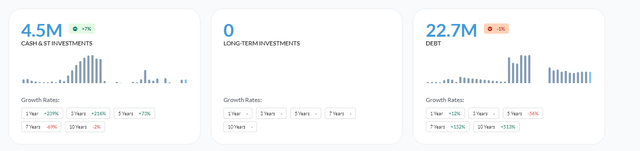

Balance Sheet

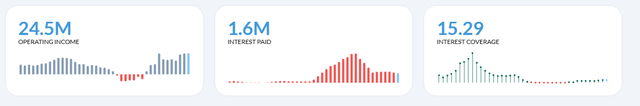

Core Molding has established a robust balance sheet that enables it to weather cyclical declines and recessionary environments with resilience. The company boasts an interest coverage ratio of 15.29, indicating its ability to comfortably meet interest obligations. Additionally, Core Molding maintains a current ratio of 1.71, which signifies its strong liquidity position. These factors place Core Molding in an advantageous position, allowing it to pursue expansionary spending initiatives and safeguard its core business in the long term.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Valuation

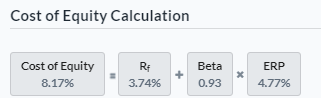

In order to ensure a comprehensive analysis, I considered it crucial to calculate Core Molding's Cost of Equity and Weighted Average Cost of Capital using the Capital Asset Pricing Model. Incorporating a risk-free rate of 3.74% derived from the 10-year treasury yield, my calculations revealed that Core Molding's Cost of Equity stands at 8.17%. This value signifies the expected return that investors require to compensate for the risks associated with holding Core Molding's equity.

Cost of Equity (Created by author using Alpha Spread)

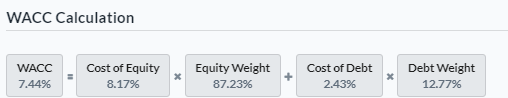

Using the above calculations, I calculated Core Molding's WACC to be 7.44% which is below the industry average of 9.89%.

WACC Calculation (Created by author using Alpha Spread)

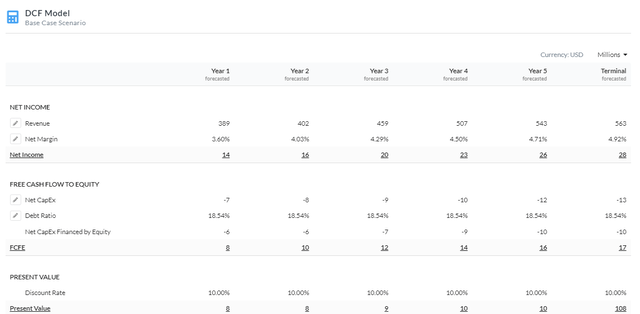

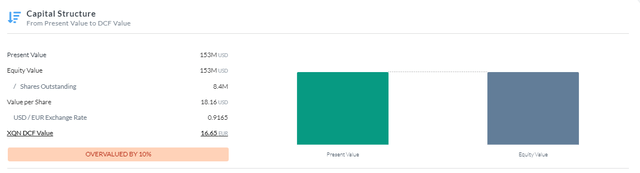

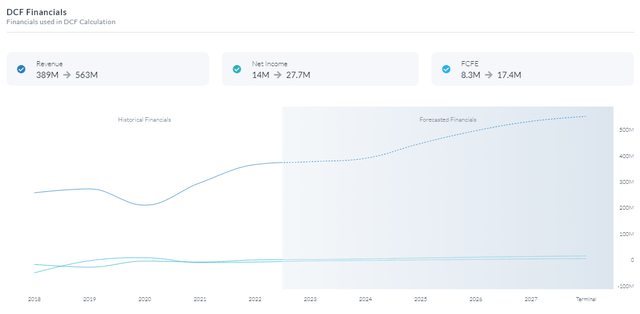

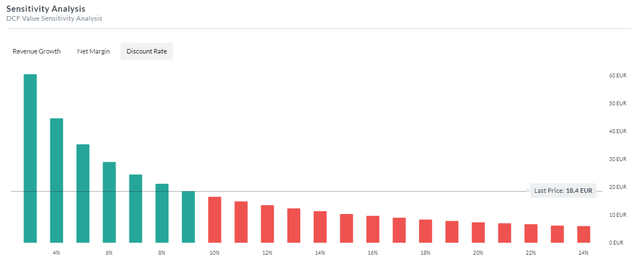

After conducting a thorough analysis utilizing an Equity Model DCF approach, with a specific focus on Free Cash Flow to Equity, it has been determined that Core Molding is presently overvalued by approximately 10%. This assessment takes into consideration a fair value estimate of approximately €16.65 EUR or $18.16 USD. The valuation was conducted using a discount rate of 10% over a 5-year period. This discount rate incorporates a risk premium of 1.83% to account for the macroeconomic challenges and the cyclical nature of Core Molding's operations, as evidenced by the price volatility experienced in 2020. In addition, the analysis assumes steady revenue and margin growth, attributing to diversification that stabilizes revenues, and anticipates that acquisitions will enhance operational excellence, thus expanding margins.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Some promising results from this valuation for Core Molding would be that if I were to not factor a risk premium to account for excess risk, the company would be undervalued by 14% presenting a long-term growth opportunity. I believe that once macroeconomic headwinds subside, Core Molding would be an attractive investment opportunity for the long term.

Sensitivity Analysis (Created by author using Alpha Spread)

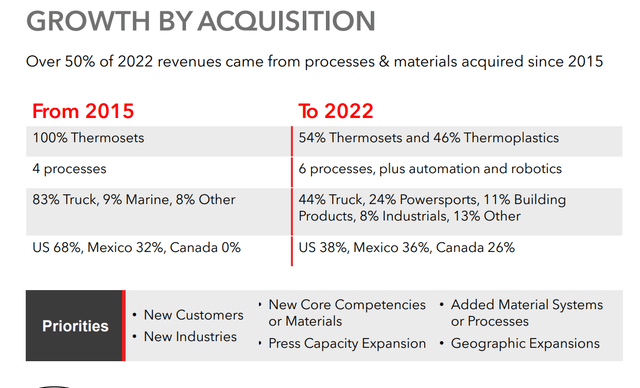

Strategic Acquisitions And Growth

In order to grow its company and strengthen its position in the market, Core Molding Technologies uses a strategic acquisition approach. The corporation looks for chances to buy complementary businesses that fit its strengths and strategic goals. Core Molding Technologies can expand its product line through these acquisitions, open up new markets, and take advantage of synergies to spur growth.

One example of a strategic acquisition made by Core Molding Technologies is the 2015 acquisition of CPI Binani Inc., a producer of thermoset molded components. The automotive and electrical sectors saw a significant presence from CPI Binani, which produced parts for HVAC systems, engine covers, and electrical enclosures.

Core Molding Technologies improved its position as an industry supplier of molded components by acquiring CPI Binani, increasing its footprint in the automotive sector. With the help of this acquisition, Core Molding Technologies gained access to new automotive clients and expanded the range of products they could deliver to their current clientele. This allowed the company to outperform competitors and utilize its core business model to penetrate the market within this new industry.

Additionally, Core Molding Technologies was able to take advantage of synergies in production processes and capabilities as a result of the acquisition of CPI Binani. Operational improvements and greater cost competitiveness were made possible by the combined knowledge and resources of the two businesses. Additionally, the acquisition offered chances to cross-sell and upsell products to clients of both businesses.

Core Molding Technologies increased its market diversity by entering the automotive and electrical sectors through the strategic acquisition of CPI Binani. The company was better positioned for continued expansion and market success as a result of the acquisition, which increased its product portfolio, client base, and manufacturing capabilities. This is due to margin expansion from vertically integrated acquisitions to improve cash flows and stability in revenues from diversification to improve resiliency.

Core Molding Growth Through Acquisitions (Investor Presentation)

Risks

Raw material price fluctuations: The activities of Core Molding are reliant on a variety of raw materials, including thermoplastics and thermosets. The profitability of the business and its total cost structure may be impacted by changes in these materials' costs.

Supply chain disruptions: Any delays in material deliveries or interruptions from suppliers that occur in Core Molding's supply chain could have an effect on its production schedules, client obligations, and overall operations.

Conclusion

To summarize, I believe that Core Molding is currently a hold because even though the company has a strong ROIC, solid earnings and guidance, and a resilient balance sheet, Core Molding is currently overvalued when assuming my DCF figures which further account for macroeconomic risks and volume declines.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.