EWZ ETF: Brazil's Valuation Is Downright Compelling

Summary

- You can't possibly be diversified unless you have a portion of your portfolio that you hate.

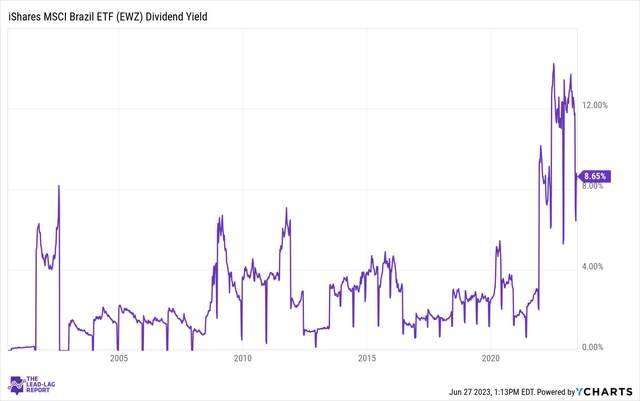

- One of the most enticing aspects of iShares MSCI Brazil ETF is its dividend yield.

- As of the end of 2022, EWZ's holdings had an average price-to-earnings (P/E) ratio of just 5.7, and is even lower now at just 5.09.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

FG Trade

When Brazil take part in any competition they must always play to win. - Zico.

As an investor, you're constantly on the lookout for opportunities to diversify your portfolio and optimize returns. And you can't possibly be diversified unless you have a portion of your portfolio that you hate, i.e., an investment that's NOT working against other parts of a portfolio (meaning non-correlation).

One such opportunity might be investing in Brazil, a market that has seen its fair share of ups and downs over the years. Let's face it - investors largely hate Brazil because of that. The iShares MSCI Brazil ETF (NYSEARCA:EWZ) offers a convenient way to gain exposure to this emerging market. However, as with any investment, it's crucial to understand the risk/reward profile.

EWZ: A Snapshot

First, let's get a clear picture of what EWZ is. The exchange-traded fund, or "ETF," tracks the performance of the MSCI Brazil Index, containing around 50 companies and charging an expense fee of 0.58%. Its holdings are heavily skewed towards commodities, with Materials and Oil & Gas sectors making up a significant portion of the index. The performance of the ETF is influenced by global commodity prices and currency performance, among other factors.

It should make sense how poorly investing in Brazil has fared relative to the S&P 500 (SP500) via the SPDR® S&P 500 ETF Trust (SPY) given commodities for the most part being left behind from a sustained risk-on cycle post GFC. It also may finally be stabilizing and showing signs of relative strength in recent weeks.

The Alluring Dividend Yield

One of the most enticing aspects of EWZ is its dividend yield. Sporting a yield of over 8%, EWZ's return significantly outpaces inflation rates, treasury note yields, and the average yield for the S&P 500. This high dividend yield provides a substantial passive income stream and a noteworthy safety margin when investing. Current yield is much higher than it has been historically.

Attractive Valuations

Besides the impressive dividend yield, EWZ's holdings are trading at compelling valuations. As of the end of 2022, EWZ's holdings had an average price-to-earnings (P/E) ratio of just 5.7, and is even lower now at just 5.09. This is substantially lower than the average P/E ratio for the S&P 500 and even the average P/E ratio for the iShares MSCI Emerging Markets ETF (EEM). Put simply - that's incredible, and should make you seriously look at Brazil for a contrarian investment precisely because valuations are so low.

The Fear and Greed Paradigm

Investors are often guided by the famous Warren Buffett adage, "Be fearful when others are greedy and greedy when others are fearful." Brazil's market is a perfect example of this. The election of President Luis Inacio Lula da Silva (known as "Lula") sparked fears about potential anti-market policies. Yet, historical data shows that the Brazilian stock market performed well during Lula's first term from 2003 to 2010. To think that Lula alone is a reason to bearish is just not true historically.

The Strength of Brazil's Economy and Market

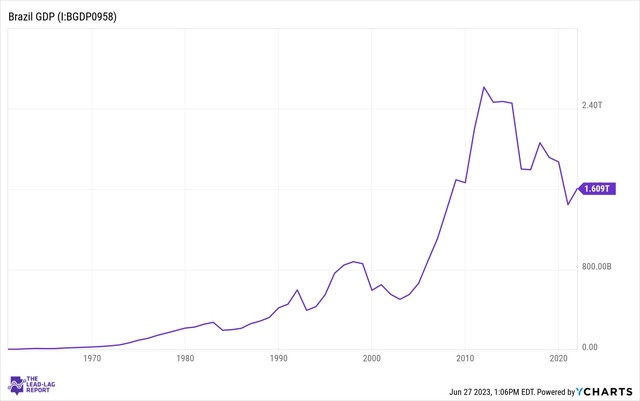

Brazil's economy is the 10th largest in the world. The country is one of the few globally that are self-sufficient in oil. It is also a leading producer of alternative energy sources and is the second-largest producer of iron ore globally.

According to YCharts, "Brazil GDP is at a current level of 1.609T, up from 1.449T one year ago. This is a change of 11.07% from one year ago." Yes, GDP has been trending lower, but the biggest returns tend to come at the turn of a trend, not in the middle of it.

Conclusion

While Brazil's market has faced challenges, the potential rewards of investing in EWZ seem to outweigh the risks. With a historically high dividend yield and valuations at rock-bottom levels, EWZ might be a compelling buy. Personally, I do believe we are in a cycle that favors commodities and value investing, which would finally be tailwinds for Brazil's stock market relative to the tech-driven momentum everyone is clamoring for in QQQ.

Poucos entendem isso ("Few understand this").

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.