MercadoLibre: The More It Falls, The More I Buy

Summary

- MELI is a fast-growing e-commerce and fintech company.

- There are plenty of further growth opportunities for the business, and profitability is increasing.

- MELI should be worth at least 20% more, if not double what it is worth today.

- This idea was discussed in more depth with members of my private investing community, The Pragmatic Investor. Learn More »

Robert Way/iStock Editorial via Getty Images

This article was first published on The Pragmatic Investor IG on 6/19/23

Thesis Summary

MercadoLibre (NASDAQ:MELI) is an eCommerce and Fintech giant in Latin America. This company is still growing at a very fast rate, and is just scratching the surface of what it can do in terms of both growth and profitability.

Furthermore, this company offers great exposure to fast-growing international markets and is a great way to diversify your investments away from the dollar.

At the very least, this company is 25% undervalued, but I plan to hold this one for the very long-term.

Company Overview

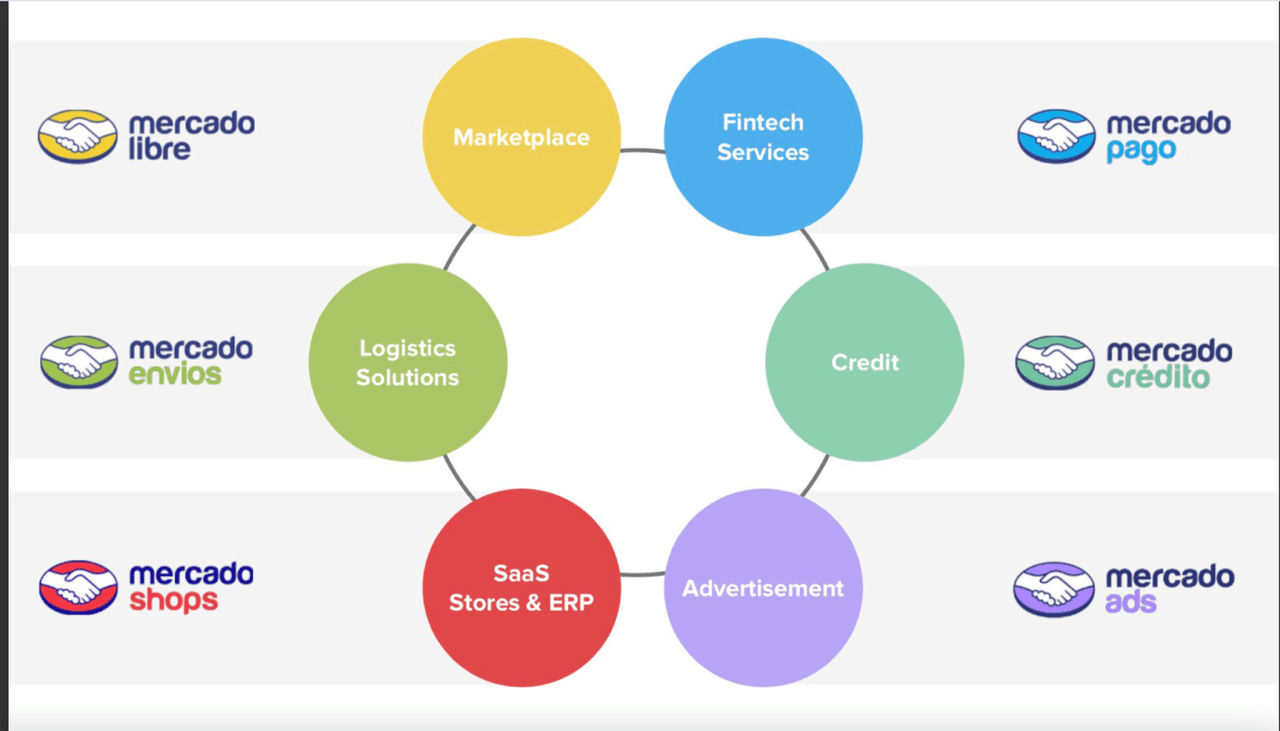

MercadoLibre is mostly known for its eCommerce business, though in reality it is a highly diversified company with a lot of different segments.

MELI businesses (Investor Presentation)

Mercado envios is the logistical arm of the company, facilitating timely deliveries for MELI around the continent.

Mercado shops is a software that allows sellers to create their own store fronts and manage their eCommerce easily.

Mercado pago is a fully integrated payment system for merchants. This has now extended to other financial services, like loans, which is what Mercado credito encompasses.

Lastly, we also have Mercado ads, which is a way for merchants to advertise on the MELI platform.

Let’s view how these segments performed in the last quarter:

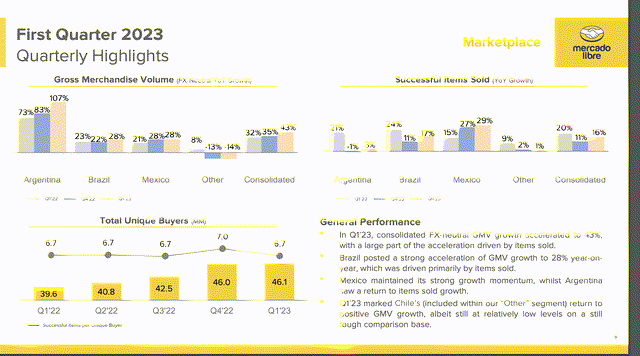

Q1 Highlights (Investor Presentation)

Marketplace GMV grew 43% YoY. We saw significant growth in all of the company’s key geographies except Argentina, which is struggling with inflation. Total unique buyers remained steady at 46.1 million.

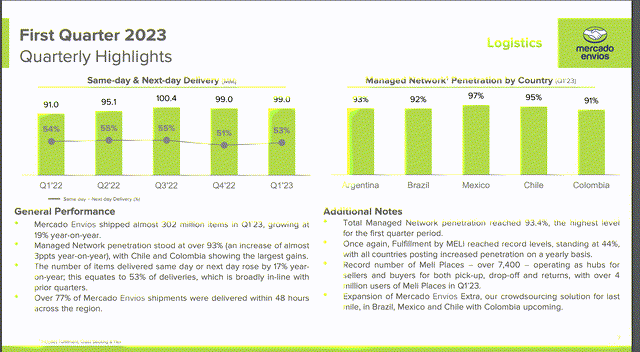

Q1 Highlights (Investor Presentation)

Mercado envios grew 19% YoY. We can see that over 77% of deliveries were done within two days, and this has been achieved in part thanks to the expansion of Mercado Envios Extra. As we can see from the +90% penetration rates, MELI dominates the logistics market.

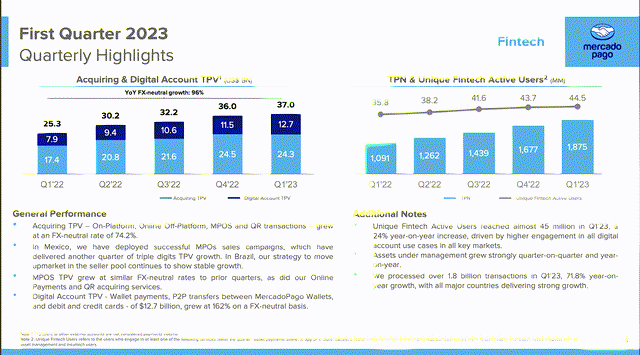

Q1 Highlights (Investor Presentation)

The fintech segment can be further subdivided into Acquiring and Digital Account. Acquiring grew 72.4% YoY, while Digital Accounts hit 162% YoY growth. However, it’s worth mentioning that QoQ growth was 10% for digital accounts negative for Acquiring.

Lastly, we have MELI’s loan portfolio:

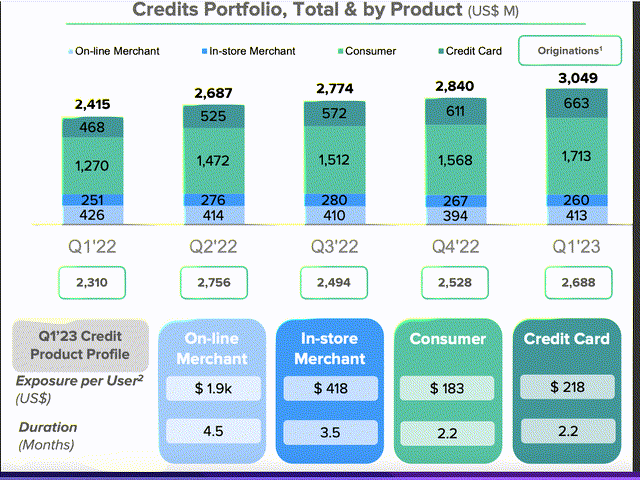

Loan Portfolio (Investor Presentation)

The portfolio is growing at a steady rate, with the bulk of the leans attributable to consumers and credit cards.

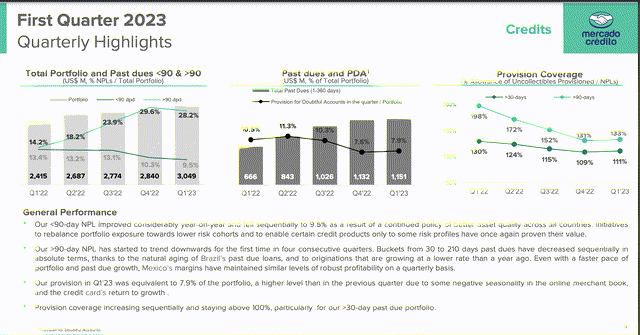

Q1 Highlights (Investor presentation)

We can see some encouraging trends here, as the 1-90 day non-performing loan ratio fell towards 9.5% and Past dues remained almost flat.

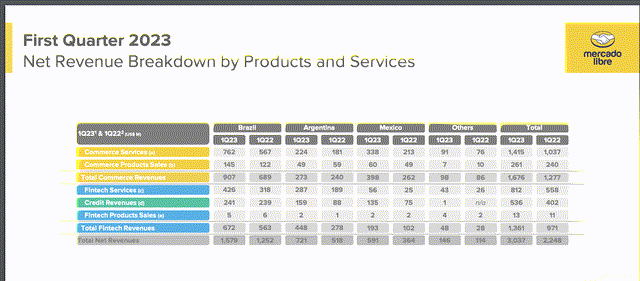

Now, let’s look at the consolidated revenues and earnings. MELI breaks these down into commerce and Fintech.

Revenue breakdown (Investor Presentation)

Within Commerce, we have services and products. Commerce revenues were 54% and reached almost $1.7 billion. Brazil and Mexico were the highest areas of growth.

Then we have Fintech services, where growth slowed down to 64% YoY, and reached $1.3 billion.

But how does this translate into earnings?

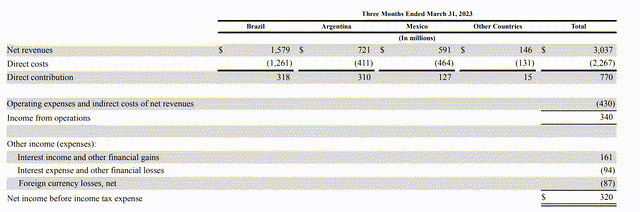

Operating income (SEC filing)

After direct costs, the company nets around $770 million, which ends up being 340 in Income from operations. For the first quarter of 2023, MELI achieved EPS of $3.97.

MELI is a very exciting company operating in, what I perceive, could be one of the fastest-growing areas of the next decade. There’s a lot of potential here, and the stock is not cheap, but there’s still plenty of upside.

Going forward, there’s still so much more the company can do to leverage revenues and increase profitability.

What I Like About MELI

With a company like Mercado Libre, the question on a lot of investors' minds is, how profitable can the company get? In the latest quarter, MercadoLibre has shown some encouraging trends in its profitability, which make me even more bullish:

Over the last quarter, we have seen an expansion in Gross margins, Operating margins and cash flow generation:

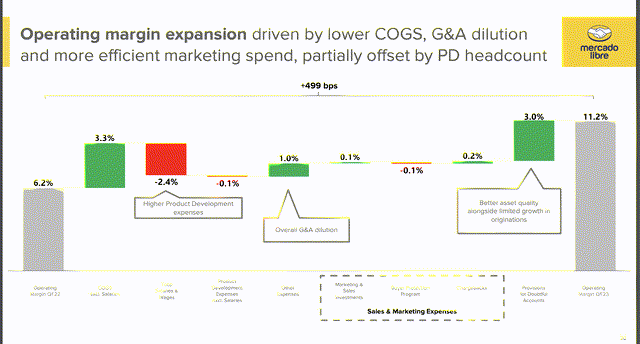

Operating Margin (Investor slides)

Thanks to a reduction in COGs, a reduction in G&A compared to revenue growth, and better asset quality, the company increased its operating margin by 5%. This is a remarkable improvement, and there’s room for this to continue.

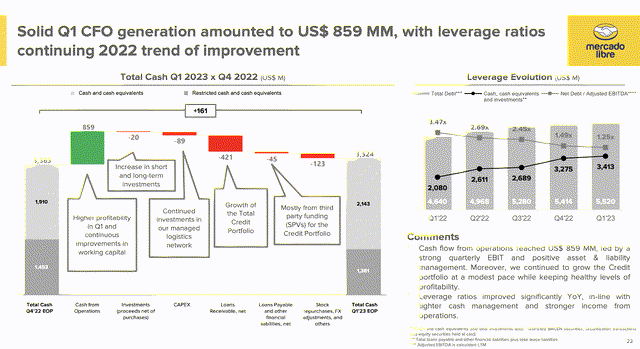

With the company producing $859 million in cash, MELI has been able to continue investing heavily while improving its financial position. Debt/ EBITDA is now at its lowest level, 1.25x, while cash and cash equivalents are at their highest.

CFO (Investor Presentation)

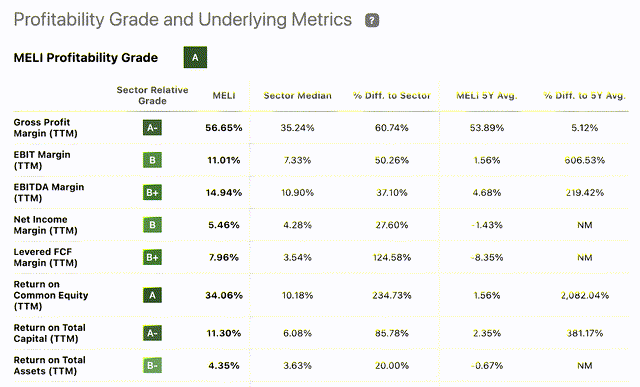

MELI actually get an A rating in terms of profitability, and we can see from the 5 year average just how far the company has come:

We have covered profitability, but what about growth? Stocks like MELI get high valuations because they are growing fast, but eventually, when growth falls, so do these multiples.

MELI Profitability (SA)

I am not concerned about this, since MELI still has multiple avenues to pursue growth, and even further profitability.

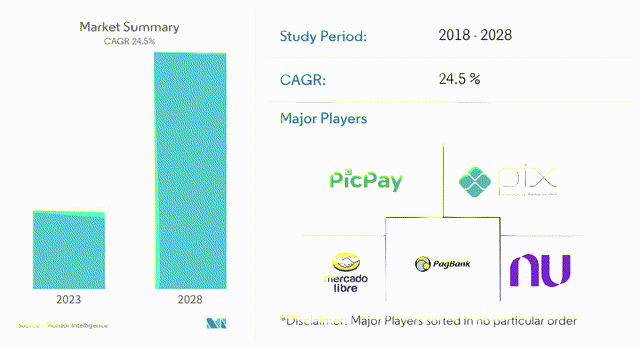

The fintech space, no doubt, is one of the most exciting, especially in Latin America. According to Mordor Intelligence, mobile payments will grow at a CAGR of 24.5% in the next five years. MELI is already a key player, and so is Nu Holdings (NU), a stock I have talked about before, which is doing quite well.

Mobile Payment Forecast (Mordor Intelligence)

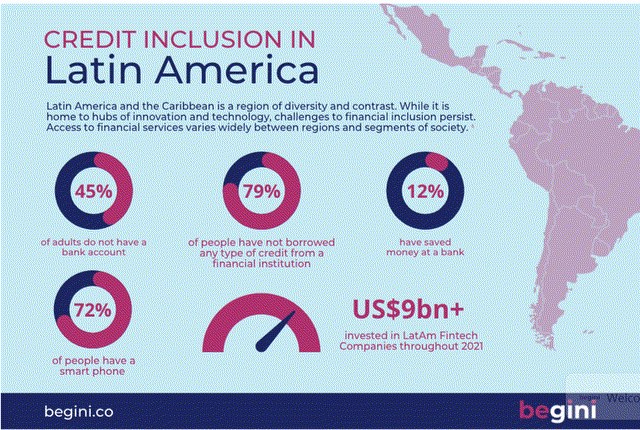

Overall, the opportunity in the banking/finance segment is huge in LatAm, where 45% of adults do not have a bank account, yet 72% of them own a smartphone.

MELI would be well advised to expand into this aggressively. Thanks to its already highly successful commerce business, MELI has the most important piece of the puzzle, a customer base.

The other great growth opportunity I see with MELI is in the logistics space. MELI has built out an impressive delivery network, which could become the foundation for two further sources of revenue.

Credit Inclusion (Begini)

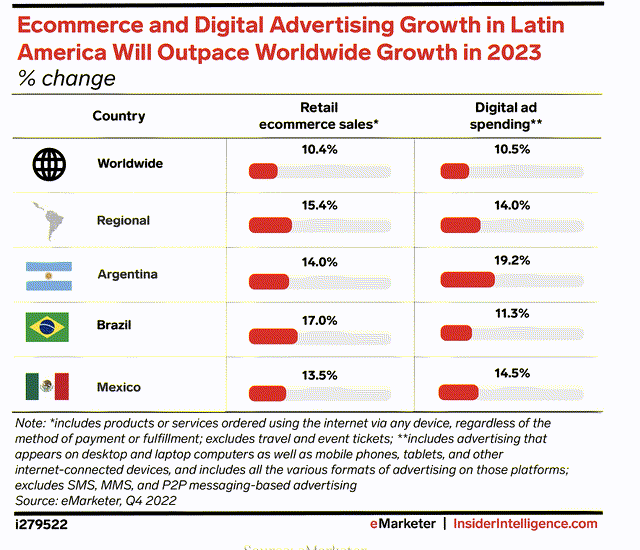

Firstly, third-party fulfilment, something that MELI already does but could do even more off. e-Commerce is a fast-growing segment worldwide, and even more so in Latin America.

Ecommerce (Digital Advertising)

Beyond that, MELI could also use its logistic network to expand into other areas, such as groceries and more general forms of transportation.

Underpinning this whole investment thesis is the fact that MELI is operating in Latin America, which I like. The region has had problems, but I think we will see this change in the coming decade. Countries like Brazil and Mexico are doing very well and will continue to do so.

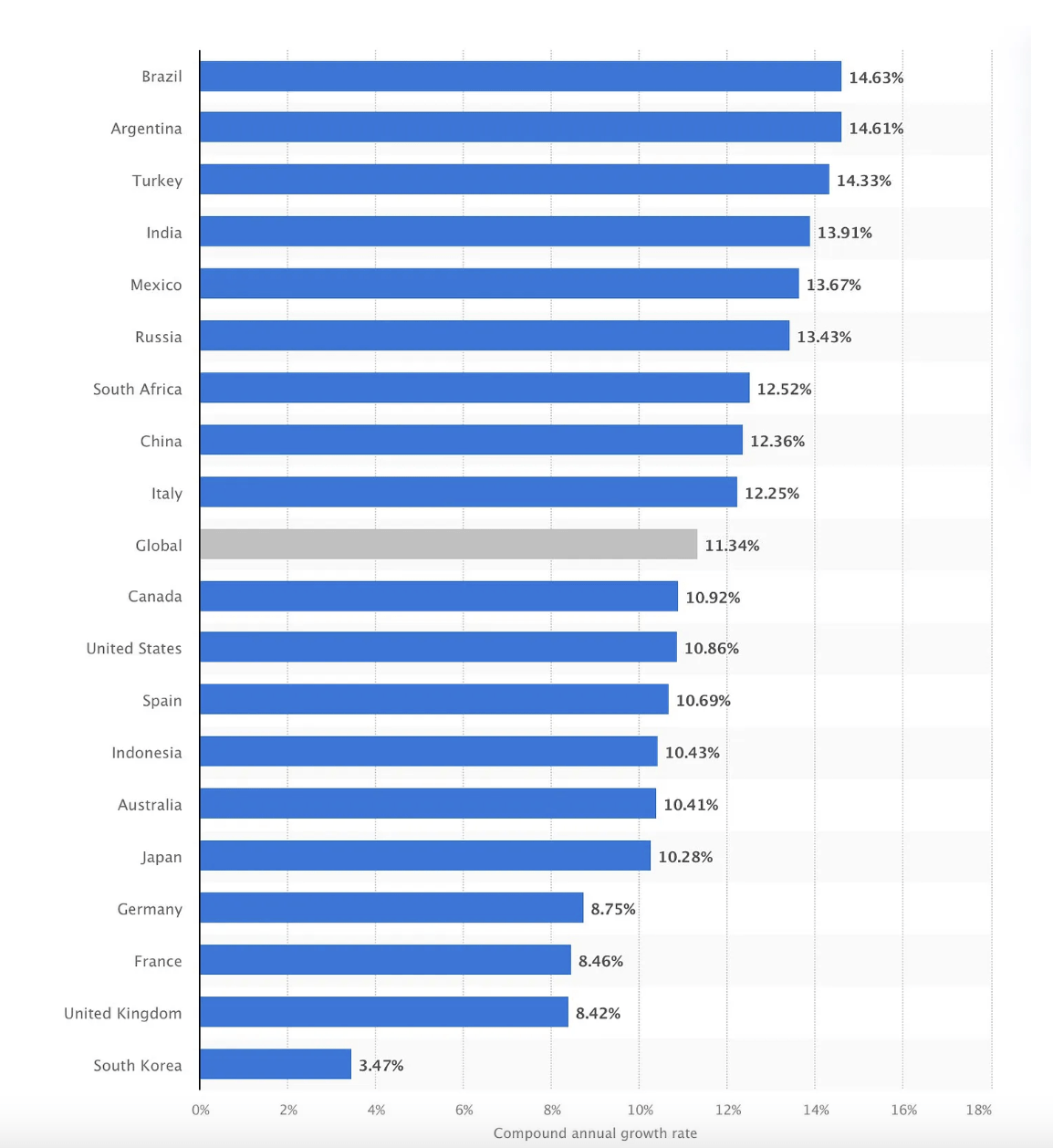

Again, if we look at the expected growth in e-commerce sales, the LatAm area is well above the global average:

Growth in Ecomm by country (Statista)

Investors are not yet pricing in just how much growth potential there is in the area, which is why I think MELI is undervalued here.

Competition, Threats and Other Risks

MercadoLibre does face some stiff competition in both e-Commerce and Finance. MELI is up against the likes of Amazon.com (AMZN), Americanas, in Brazil and even Shopee, which is owned by Sea Limited (SE), another great company.

As we can see in the table above, MELI does have a very dominant position, with plenty more visits than its competitors combined. The fintech space is also getting crowded. Nubank (NU) is doing very well and where there is money to be made, plenty of companies are trying to take market share.

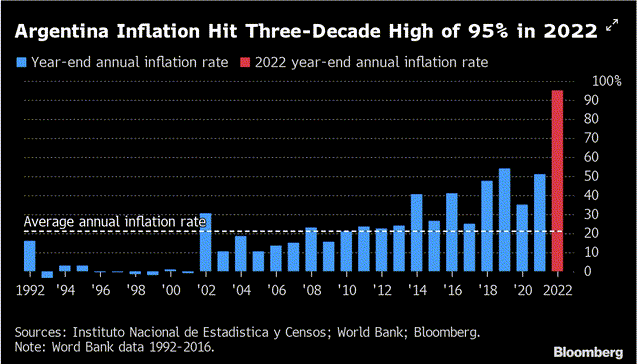

The other main risk with MELI is geopolitical. Case in point: Argentina.

This is a country with a lot of potential to become a large demographic for MELI, but it is struggling with record inflation. Latin American countries have had issues with this in the past, though I see encouraging signs from other regions like Brazil and even Mexico.

Argentina inflation (Bloomberg)

All in all, MELI is still well positioned to perform very well in the coming year and even decade. If you are concerned about competition, feel free to buy up some stock in NU and SE, as I have.

Valuation

MELI trades just below $1200, as I write this, but my expectation is that we could go much higher.

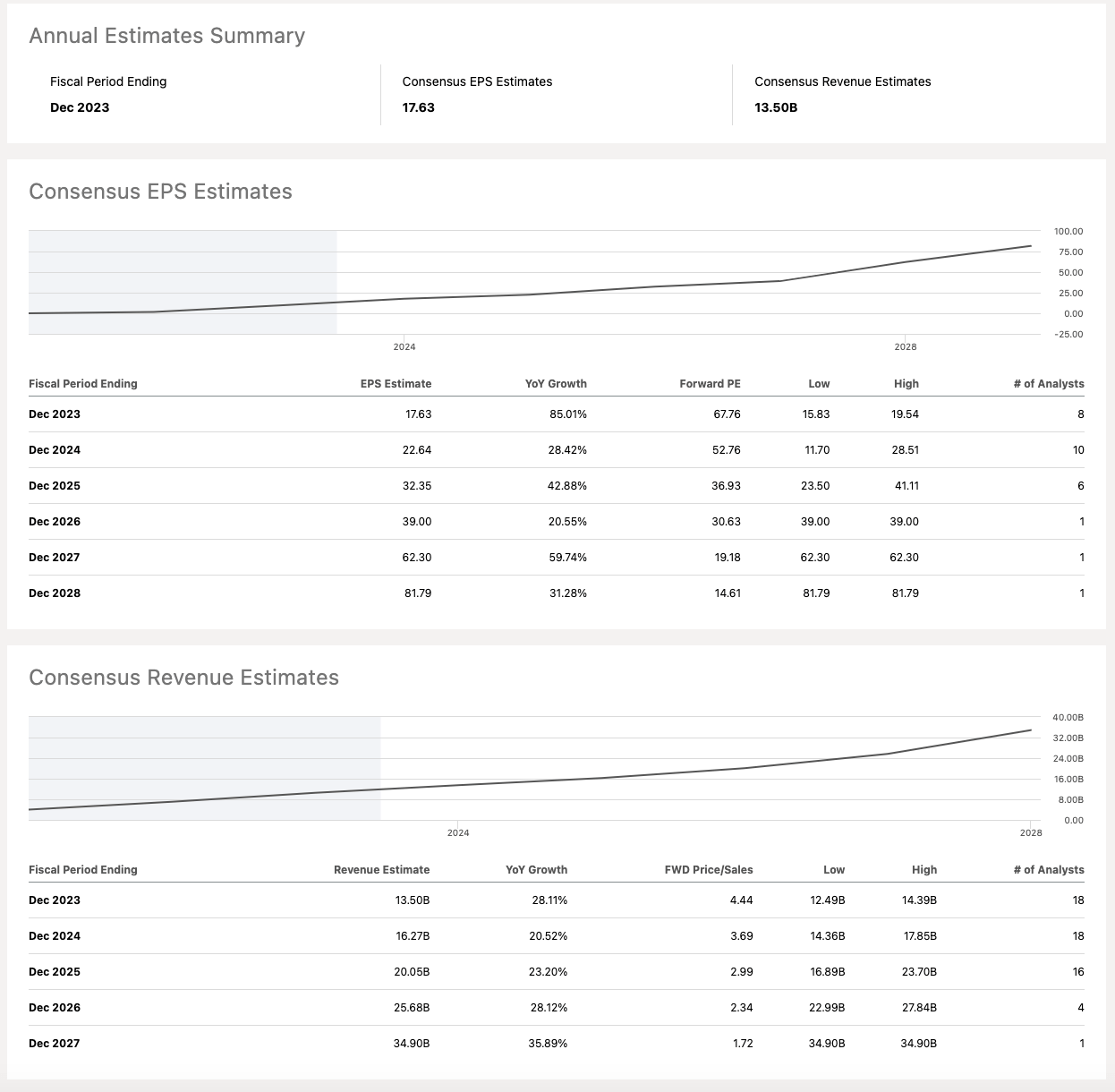

EPS and revenue estimates (SA)

First off, if we look at the earnings and revenue estimates on Seeking Alpha, we can see that most analysts also see growth and profitability trending upwards. +20% CAGR over the next few years seems more than reasonable, especially given the forecasts shown in the previous sections on e-Commerce and fintech growth.

This would put MELI at a P/S of 3 by 2025, with revenues of between $16.9-$23.7 billion.

However, my preferred method of valuation for this company would be PE, or better yet, PEG:

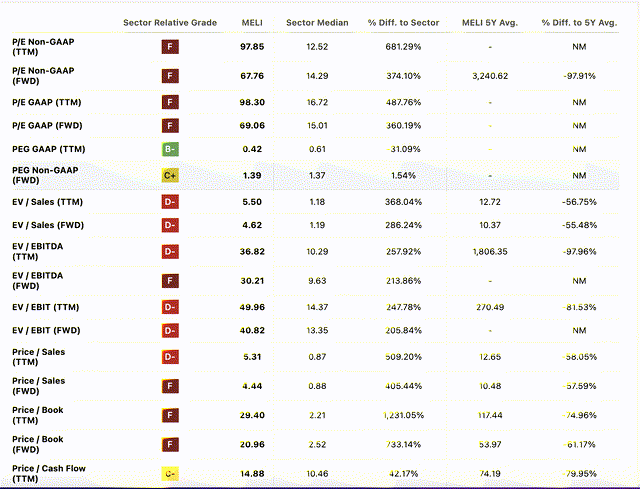

MELI valuation metrics (SA)

In fact, if we look at TTM PEG, MELI is significantly undervalued. This is lower than the sector median and well below what I’d consider an “equilibrium PEG” of 1. This implies MELI stock price could double from here, which would put it at over $2000/share.

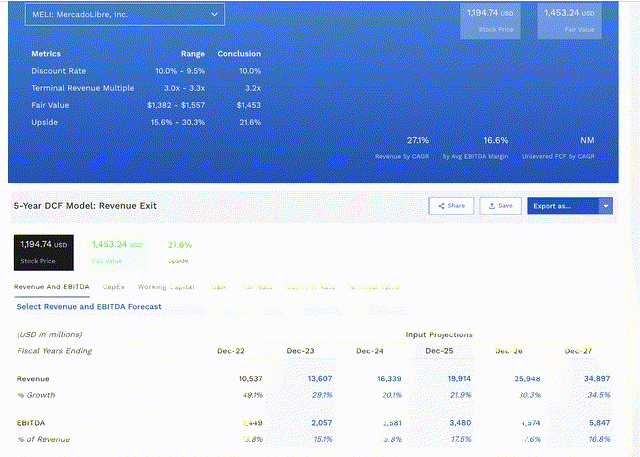

Using a 5-year DCF model, we can find a slightly less bullish estimate, which we could use as the bottom of our price range:

5-year DCF (Finbox)

Assuming a 27% revenue 5-year CAGR and a modest increase in EBITDA margins, and using a 10% discount rate, we get a price target of $1453, which is about a 21% upside.

So, I think that $1450-$2000 is a reasonable price target for MELI over the next few years.

Technical Analysis

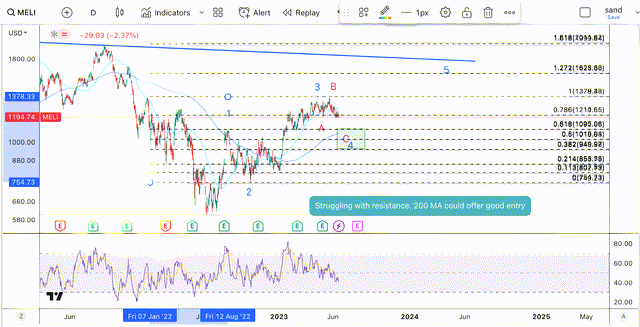

Looking at the Technical Chart, I believe we could sell off a bit more in the coming weeks, giving us a perfect opportunity to buy the dip.

MELI TA (Author's work)

After bottoming back in June 2022, MELI has given us what looks to be like the first three waves of an impulse. The third wave reached the 1 ext of wave 1, meaning they are the same length, which is the minimum requirement.

That means we are now in a wave 4 retracement, which could take us down into the $10000 region. We have support from the 200-day MA down here, so this would be an ideal place to buy. Following this, I think we could finish this initial impulse at around $1628, which is the next fib level and an area of resistance from the upper trendline.

For now, I will look to add more MELI if we touch the 50% retracement at $1018

Final Thoughts

In conclusion, MELI is one of my highest conviction picks and a great way to gain exposure to the growing economies of Latin America. Even though the stock has run up significantly from its bottom, I think there’s a lot more juice left to squeeze.

This is just one of many exciting international equities you can buy right now! The current environment is ripe for outsized gains in this asset class.

Join The Pragmatic Investor to stay ahead of the latest news and trends in the space and gain:

- Access to our Stock Portfolio; commodities, international equities, crypto, etc.

- Deep dive reports on select stocks

- Weekly macro-focused newsletter.

This article was written by

I am an economist and financial writer specialising in building robust and truly diversified portfolios that will preserve and increase wealth in the long term.

Having been born in Spain, to an English family, with extensive work experience in the US, and now living and travelling across Latin America and Asia, I believe this gives me a unique understanding of the global economy.

Only by investing in multiple assets around the globe can investors be truly diversified and protected from the ever-present risks posed by economic cycles and geopolitics.

My Links:

Investing Group: https://seekingalpha.com/checkout?service_id=mp_1401

Youtube: https://www.youtube.com/channel/UCUNZ28Ydsumo0P8FZ9OtquA

Podcast: https://open.spotify.com/show/7JVmqZUVhe1vvgDCstNBBJ

Substack: https://jamesfoord.substack.com/

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)